1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Scooter and Bike Rentals?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electric Scooter and Bike Rentals

Electric Scooter and Bike RentalsElectric Scooter and Bike Rentals by Type (Short-term Lease, Long-term Lease), by Application (Street, Community, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

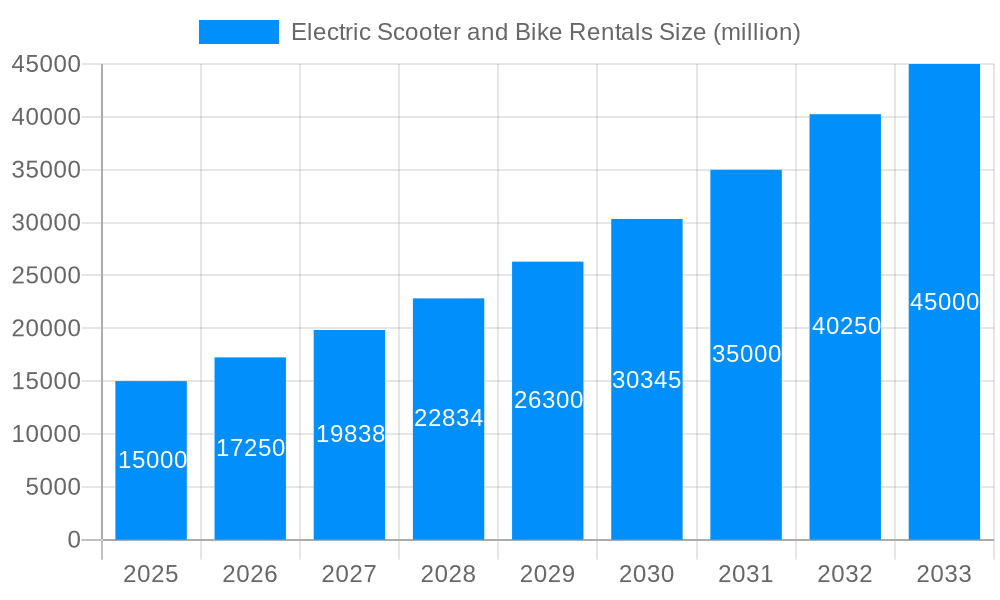

The global electric scooter and bike rental market is experiencing robust growth, driven by increasing urbanization, rising environmental concerns, and the convenience offered by these shared mobility solutions. The market, estimated at $15 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching an estimated $45 billion by 2033. This growth is fueled by several key factors. Firstly, the increasing adoption of sustainable transportation options, driven by government regulations and public awareness of climate change, is significantly boosting demand. Secondly, the ease of use and affordability of these rentals, particularly through smartphone apps, are attracting a wide user base, ranging from commuters to tourists. Finally, technological advancements, such as improved battery technology and smart locking systems, are enhancing the user experience and operational efficiency of rental fleets. The market is segmented by lease type (short-term and long-term) and application (street, community, and other), with short-term street rentals currently dominating the market share.

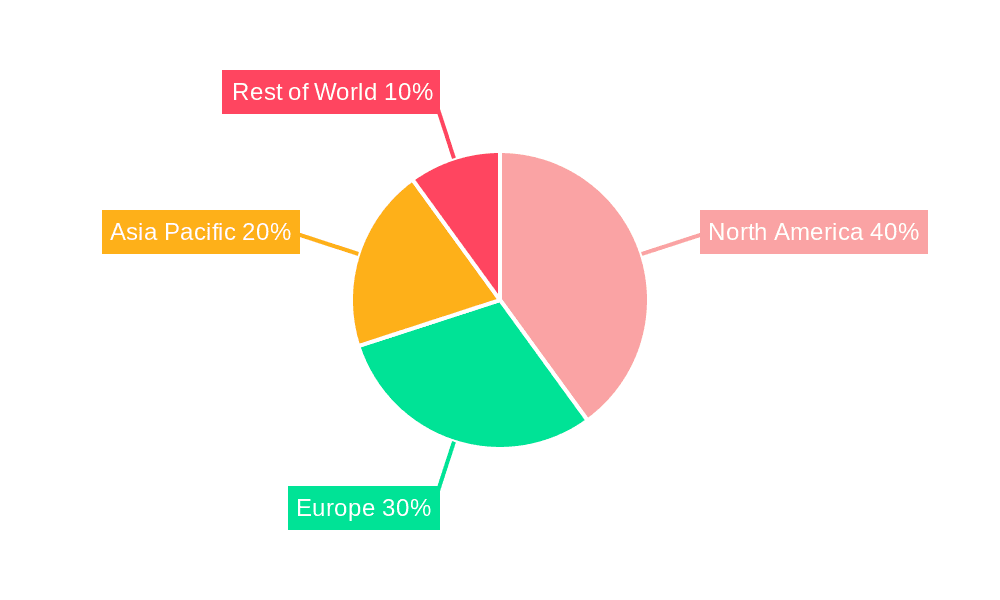

Despite the positive outlook, the market faces certain challenges. Competition among numerous players, including established companies like Lime and Bird, as well as smaller regional operators, is intense. Regulatory hurdles, including licensing requirements and parking restrictions in urban areas, pose operational complexities. Furthermore, the seasonality of demand, particularly in regions with harsh winters, and the need for robust infrastructure for charging and maintenance of the rental vehicles, represent potential constraints on market growth. Geographical expansion, however, presents considerable opportunities. While North America and Europe currently hold significant market shares, the Asia-Pacific region, particularly China and India, is expected to witness substantial growth in the coming years due to rapidly increasing urbanization and rising disposable incomes. The continued innovation in technology, along with favorable government policies and expanding infrastructure, will play a pivotal role in shaping the future of this dynamic market.

The electric scooter and bike rental market experienced explosive growth between 2019 and 2024, driven by increasing urbanization, rising fuel costs, and a growing preference for eco-friendly transportation options. The market, valued at several million units in 2024, shows a clear trajectory towards significant expansion. The introduction of dockless rental systems, facilitated by smartphone apps, revolutionized accessibility and convenience, allowing users spontaneous rentals within designated areas. This ease of use, coupled with competitive pricing strategies employed by leading players like Lime, Bird, and Spin, fueled mass adoption, particularly among younger demographics. However, the initial rapid expansion wasn't without its challenges. Issues surrounding safety regulations, vandalism, and the efficient management of large fleets in urban environments presented hurdles. The historical period (2019-2024) saw a significant learning curve for operators, with many adjusting their business models to optimize operational efficiency and address regulatory concerns. The base year of 2025 marks a pivotal point, where the market is consolidating, with a focus on sustainability, improved safety features, and data-driven operational strategies. This consolidation is expected to lead to sustained, albeit potentially less explosive, growth in the forecast period (2025-2033). The market is projected to reach tens of millions of units by 2033, driven by technological advancements, improved infrastructure, and a greater acceptance of micromobility solutions as a viable part of integrated urban transportation systems. The shift towards longer-term lease options also presents an interesting new revenue stream, supplementing the traditional short-term rental model. This evolution reflects a move beyond impulsive rentals towards a more considered adoption of e-scooters and e-bikes as a regular mode of transport.

Several factors are fueling the growth of the electric scooter and bike rental market. Firstly, the increasing congestion in urban areas is driving the need for efficient and agile transportation solutions. Electric scooters and bikes offer a quick and convenient alternative to cars, especially for shorter distances. Secondly, environmental concerns are leading to a global shift towards sustainable transportation, with electric vehicles becoming increasingly popular. E-scooters and e-bikes are perceived as environmentally friendly, contributing to reduced carbon emissions in urban environments. Thirdly, the technological advancements in battery technology and scooter design are improving the overall user experience, making them more reliable, durable, and user-friendly. This improved technology has addressed earlier concerns about range anxiety and performance limitations. Fourthly, the rise of smartphone technology and mobile applications has streamlined the rental process, making it incredibly easy to access and utilize these vehicles. The convenience factor is a significant driver of adoption. Finally, favorable government policies and initiatives in many cities and countries are encouraging the adoption of micromobility solutions by promoting dedicated bike lanes, offering subsidies, and introducing regulations that facilitate their operation. This supportive regulatory environment is vital for the continued growth and sustainability of the industry.

Despite the significant growth potential, the electric scooter and bike rental market faces various challenges. One key challenge is ensuring rider safety. Accidents involving e-scooters and e-bikes have raised concerns about the need for better safety regulations, rider education, and improved vehicle design. Another challenge is the management and maintenance of large fleets of vehicles, which requires significant operational efficiency and substantial investment in logistics and repair infrastructure. Vandalism and theft are also significant problems for operators, leading to increased costs and impacting the availability of vehicles. Furthermore, the market is subject to fluctuating demand, influenced by factors such as weather conditions and seasonal variations. This unpredictability requires sophisticated demand forecasting and fleet management strategies to optimize resource allocation. Regulatory hurdles, including differing regulations across different cities and countries, create complexities for operators in scaling their businesses across wider geographical areas. Competition is also fierce, with many companies vying for market share, leading to price wars and pressure on profit margins. Finally, public perception and acceptance of e-scooters and e-bikes as a legitimate mode of transport still need to be fully addressed in some communities to ensure long-term market stability and expansion.

The short-term lease segment within the street application category is poised to dominate the market in major metropolitan areas globally.

Dominant Segment: Short-term leases for street use account for the bulk of rentals due to their inherent convenience. Users can easily rent a scooter or bike for a short trip without the commitment of a long-term contract. This is especially appealing in densely populated urban environments where short-distance travel is common.

Key Regions: North America (specifically the US) and major European cities (like Paris, London, Berlin, Amsterdam) will continue to be leading markets. The high population density, developed infrastructure (in some areas), and technological advancements in these regions create a conducive environment for short-term e-scooter and e-bike rental services. Furthermore, these regions show high adoption rates of smartphone technology, which is fundamental to the success of dockless rental systems.

Market Dynamics: The rapid expansion of ride-sharing services, a parallel trend, has created a market acceptance of on-demand transportation, fostering the success of short-term scooter and bike rentals. Cities are also increasingly recognizing the potential of micromobility solutions for easing traffic congestion and promoting greener transportation, leading to more favorable regulations and dedicated infrastructure. However, certain cities may face challenges with integrating e-scooters seamlessly into existing infrastructure, leading to varying levels of adoption across different urban landscapes.

Future Growth: The continued focus on urban planning that incorporates micromobility, technological advancements (like improved battery technology and safety features), and the ever-increasing demand for efficient urban transportation options all point toward exponential growth in this dominant segment. However, regulatory developments and public perception will play key roles in shaping the market's trajectory, and companies will need to adapt their strategies to address safety concerns and operational challenges to maintain dominance.

The industry is fueled by several key catalysts: increasing urbanization leading to traffic congestion; rising environmental concerns driving the need for sustainable transport; technological advancements, improving vehicle performance and battery life; the convenience offered by smartphone apps and dockless rental systems; and supportive government policies promoting micromobility. These factors collectively contribute to heightened demand and market expansion.

This report provides a comprehensive analysis of the electric scooter and bike rental market, covering historical trends (2019-2024), the current market landscape (2025), and future projections (2025-2033). It examines key market drivers, challenges, and growth opportunities, including a detailed segmentation analysis and profiles of leading market players. The report also explores significant industry developments and provides valuable insights for businesses operating in or considering entry into this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Lime, JUMP, Bird, Spin, Skip, Rent Electric, Provincetown Bike Rentals, LA BICICLETA, City Rider, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Electric Scooter and Bike Rentals," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electric Scooter and Bike Rentals, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.