1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Garbage Transfer Vehicle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electric Garbage Transfer Vehicle

Electric Garbage Transfer VehicleElectric Garbage Transfer Vehicle by Type (Swing Arm Garbage Truck, Sealed Tipper Garbage Truck, Hanging Bucket Self-loading Garbage Truck, Compression Garbage Truck, Pull Arm Garbage Truck, Other), by Application (Government, Non-Governmental Organization, World Electric Garbage Transfer Vehicle Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

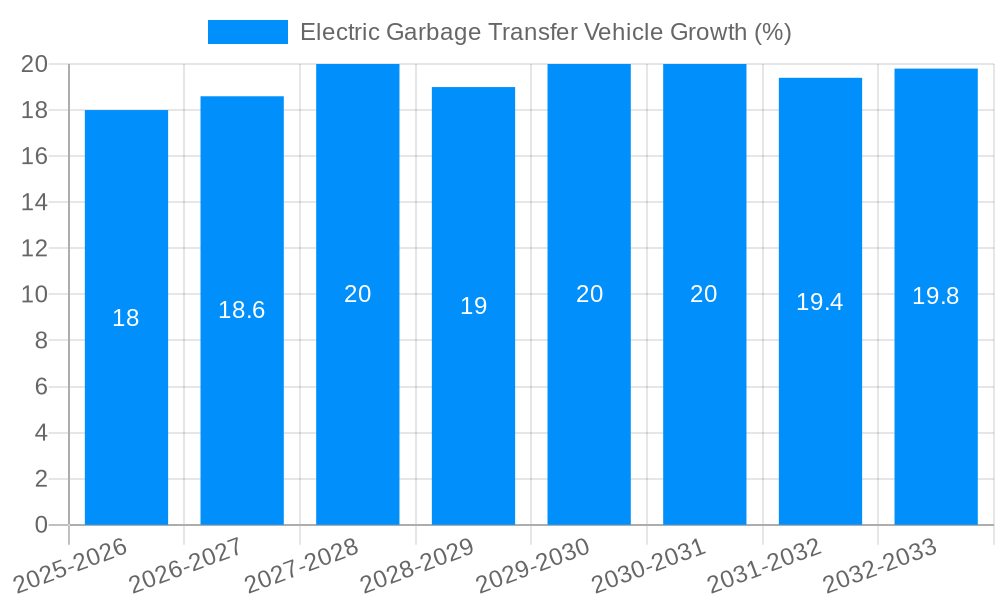

The global Electric Garbage Transfer Vehicle market is poised for substantial expansion, projected to reach a significant market size by 2033. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of approximately 15-20%, reflecting the increasing adoption of sustainable waste management solutions. Key drivers fueling this market surge include stringent environmental regulations mandating cleaner fleets, growing public awareness and demand for eco-friendly urban environments, and advancements in battery technology leading to improved range and efficiency of electric vehicles. Governments worldwide are actively promoting the transition to electric fleets through incentives and mandates, further accelerating market penetration. Additionally, the rising operational cost savings associated with electric vehicles, such as lower fuel and maintenance expenses compared to their internal combustion engine counterparts, are making them an increasingly attractive investment for both public and private waste management entities.

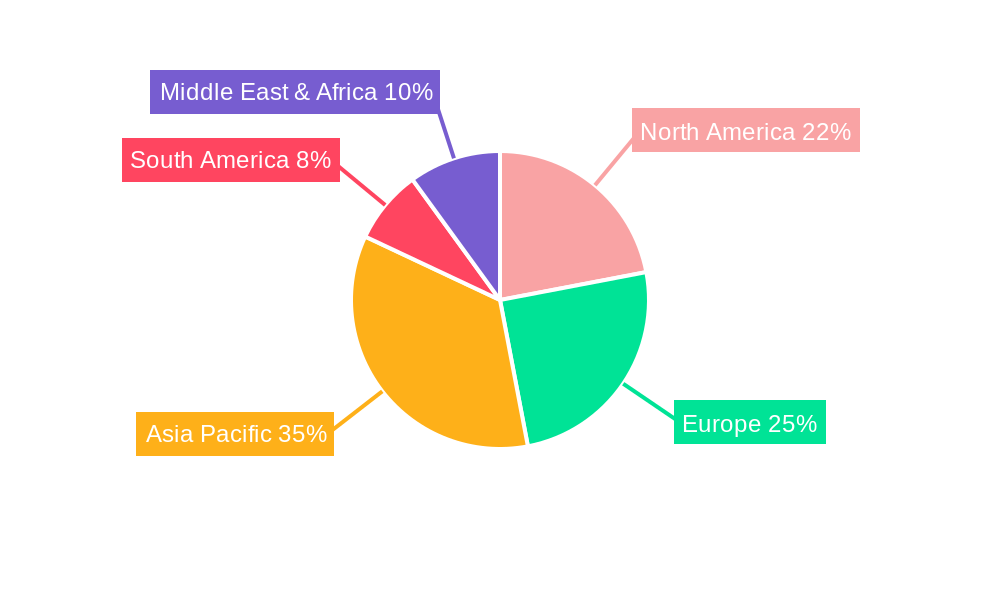

The market is segmented across various vehicle types, with Compression Garbage Trucks and Sealed Tipper Garbage Trucks expected to dominate due to their efficiency in waste collection and transport. Applications span across governmental municipalities and non-governmental organizations, highlighting the widespread need for cleaner waste management infrastructure. Geographically, Asia Pacific, particularly China and India, is anticipated to lead the market growth due to rapid urbanization, increasing waste generation, and supportive government policies for electric vehicle adoption. North America and Europe are also significant markets, driven by advanced technological adoption and strong regulatory frameworks. Despite the promising outlook, challenges such as the higher initial cost of electric vehicles and the need for robust charging infrastructure in certain regions may pose temporary restraints. However, ongoing technological innovation and supportive policies are expected to mitigate these challenges, paving the way for a sustainable and electrified future in waste management.

Here is a comprehensive report description for Electric Garbage Transfer Vehicles, incorporating the provided information, values, and structure:

This in-depth report provides a thorough analysis of the global Electric Garbage Transfer Vehicle (E-GTV) market, charting its trajectory from a historical perspective through to future projections. With a Study Period spanning 2019-2033, the report leverages a Base Year of 2025 for detailed estimations and an Estimated Year also set as 2025, followed by a robust Forecast Period of 2025-2033. It meticulously examines the Historical Period from 2019-2024, laying the groundwork for understanding current trends and future potential. The report delves into the evolving landscape of waste management technology, focusing on the significant shift towards electrification and its implications for municipal and private waste collection services. It quantifies market opportunities, analyzes competitive strategies, and identifies key drivers and challenges shaping this rapidly advancing sector. The global E-GTV market is projected to reach USD 15.5 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 12.8%, reaching an estimated market value of USD 38.2 million by 2033.

XXX, the global Electric Garbage Transfer Vehicle market is undergoing a transformative phase, driven by a confluence of environmental regulations, technological advancements, and increasing urban populations. The market's robust growth is underpinned by a fundamental shift in municipal and private waste management strategies, prioritizing sustainability and operational efficiency. In the Base Year of 2025, the market is estimated to be valued at USD 15.5 million, a figure poised for substantial expansion. The Study Period of 2019-2033 encompasses a critical period of development, from nascent adoption to widespread implementation. Key trends include the increasing demand for zero-emission vehicles to combat urban air pollution, coupled with governmental incentives and stricter emissions standards that are compelling fleet operators to transition away from traditional diesel-powered garbage trucks. Furthermore, advancements in battery technology, leading to longer ranges and faster charging times, are alleviating early adoption concerns. The development of smarter charging infrastructure and vehicle-to-grid (V2G) capabilities are also emerging as significant trends, enhancing the overall utility and economic viability of E-GTVs. The report highlights that the World Electric Garbage Transfer Vehicle Production is expected to witness a significant surge, moving from approximately 1,500 units in 2025 to over 4,000 units by 2033, reflecting the escalating demand and manufacturing capacity. The integration of IoT and advanced telematics for route optimization, predictive maintenance, and real-time monitoring is also becoming a standard feature, further enhancing operational efficiency and cost-effectiveness. As cities worldwide grapple with growing waste volumes and the imperative to reduce their carbon footprint, the E-GTV market is set to become a crucial component of sustainable urban development. The historical performance from 2019-2024 shows a steady upward climb, establishing a strong foundation for the projected exponential growth in the Forecast Period of 2025-2033.

The burgeoning Electric Garbage Transfer Vehicle market is propelled by a potent combination of governmental mandates, economic incentives, and a growing societal consciousness towards environmental preservation. Stricter emissions regulations enacted by governments worldwide are compelling municipalities and private waste management companies to adopt cleaner transportation solutions. Initiatives such as subsidies, tax credits, and preferential procurement policies for electric vehicles are significantly lowering the total cost of ownership, making E-GTVs a more attractive investment. For instance, the growing emphasis on reducing urban air pollution and greenhouse gas emissions is directly translating into increased adoption of these zero-emission vehicles. Moreover, the rising operational costs associated with traditional diesel trucks, including fluctuating fuel prices and escalating maintenance expenses, are pushing fleet operators to explore more cost-effective alternatives. Electric vehicles, with their simpler mechanical components and lower energy costs, offer substantial long-term savings. The technological advancements in battery technology, leading to improved range, faster charging, and extended battery life, have also addressed previous limitations, making E-GTVs more practical for daily operations. The expanding charging infrastructure and the development of specialized charging solutions for heavy-duty vehicles further bolster the confidence of fleet managers. Ultimately, the drive towards creating more sustainable and livable cities, coupled with the tangible economic benefits, forms the bedrock of the rapid growth witnessed in the E-GTV sector.

Despite the promising growth trajectory, the Electric Garbage Transfer Vehicle market faces several significant challenges and restraints that could impede its full potential. One of the primary hurdles is the high upfront cost of E-GTVs compared to their conventional diesel counterparts. While operational costs are lower over time, the initial capital investment can be a deterrent for many organizations, particularly smaller waste management firms. The limited charging infrastructure, especially in rural or less developed regions, presents another substantial barrier. The need for specialized, high-power charging stations capable of handling the demanding operational cycles of garbage trucks requires significant investment and planning. Range anxiety and charging times, although improving, can still be a concern for ensuring uninterrupted waste collection services, especially in extensive urban areas or during extended shifts. The availability of suitable battery technology that can withstand the rigors of daily waste collection, including heavy payloads and varied operating conditions, is also crucial. Furthermore, the establishment of a robust and efficient maintenance and repair network for electric heavy-duty vehicles, including a skilled workforce and readily available spare parts, is still in its nascent stages in many regions. The reliance on electricity grids for charging also raises questions about grid capacity and the environmental impact of electricity generation if it's not sourced from renewable energy. Finally, the perception and acceptance of electric technology among fleet operators and drivers, who may be accustomed to traditional diesel vehicles, can also contribute to slower adoption rates.

The global Electric Garbage Transfer Vehicle market is characterized by the dominant influence of specific regions and segments, driven by a combination of favorable policies, technological adoption rates, and urban development needs.

Dominant Regions/Countries:

North America: The United States and Canada are at the forefront of E-GTV adoption. This leadership is attributed to stringent environmental regulations, significant government incentives at federal and state levels, and a proactive approach to adopting new technologies in urban waste management. Major cities are setting ambitious emission reduction targets, directly fueling the demand for electric waste collection vehicles. The presence of key manufacturers and a growing ecosystem of charging infrastructure providers further solidify North America's dominance. The market in North America is projected to account for approximately 30% of the global E-GTV market by 2025, with an estimated value of USD 4.65 million.

Europe: European nations, particularly Germany, the United Kingdom, France, and the Nordic countries, are major drivers of the E-GTV market. The European Union's aggressive climate change policies, including the "Fit for 55" package, are pushing member states to decarbonize their transportation sectors, including municipal services. Strong government support, coupled with a high degree of environmental awareness among the populace, fosters a conducive market environment. Investment in electric mobility and smart city initiatives further accelerates E-GTV adoption. The European market is expected to represent around 28% of the global market by 2025, valued at approximately USD 4.34 million.

Asia-Pacific: While currently a developing market for E-GTVs, the Asia-Pacific region, led by China, is poised for significant growth. China's ambitious goals for electric vehicle production and adoption, coupled with its massive urban populations and increasing focus on environmental improvement, make it a critical market. The government's strong push for new energy vehicles and the presence of large-scale domestic manufacturers are key accelerators. As urbanization continues and environmental concerns rise, the demand for cleaner waste management solutions is expected to surge. The Asia-Pacific market is projected to hold around 25% of the global market by 2025, with an estimated value of USD 3.88 million.

Dominant Segments:

Type: Compression Garbage Truck: This segment is expected to dominate the E-GTV market due to its widespread application in efficient waste collection. Compression garbage trucks are designed to compact waste on-site, increasing carrying capacity and reducing the number of trips required. The electric versions offer all the benefits of electric powertrains—zero emissions, lower noise pollution, and reduced operational costs—making them highly desirable for urban environments. Their ability to handle large volumes of waste efficiently aligns perfectly with the needs of modern waste management. The Compression Garbage Truck segment is estimated to capture 35% of the E-GTV market share in 2025, valued at approximately USD 5.43 million.

Application: Government: Governmental bodies are the primary end-users and often the initiators of E-GTV adoption. Municipalities and government agencies are responsible for public waste management services and are under increasing pressure to meet environmental targets and improve urban living conditions. Their procurement decisions significantly influence market trends, and their commitment to electrifying municipal fleets drives demand for E-GTVs. Government procurement also provides the scale necessary for manufacturers to invest in production and technology. The Government application segment is anticipated to hold a substantial 60% market share in 2025, with an estimated value of USD 9.3 million.

World Electric Garbage Transfer Vehicle Production: The increasing World Electric Garbage Transfer Vehicle Production is a segment in itself, reflecting the manufacturing capacity and output of the industry. As demand grows, production volumes are expected to rise significantly. In 2025, estimated production stands at 1,500 units, with the forecast predicting a rise to over 4,000 units by 2033. This growth in production is essential to meet the escalating demand across various regions and segments, indicating a healthy and expanding industrial base.

The Electric Garbage Transfer Vehicle industry is experiencing robust growth fueled by several key catalysts. Foremost among these is the accelerating pace of urbanization worldwide, leading to increased waste generation and a greater need for efficient and sustainable waste management solutions. Stringent environmental regulations and government mandates promoting zero-emission vehicles are compelling fleet operators to transition to electric alternatives. Financial incentives, including subsidies and tax credits for electric vehicle purchases, are significantly reducing the upfront cost barrier. Advancements in battery technology, leading to improved range and faster charging capabilities, are addressing operational concerns. Furthermore, the rising awareness of the health and environmental benefits of reduced air and noise pollution in urban areas is creating a strong social demand for cleaner waste collection methods.

The competitive landscape of the Electric Garbage Transfer Vehicle market is characterized by the presence of established automotive manufacturers, specialized electric vehicle companies, and emerging players. These companies are actively engaged in research and development, strategic partnerships, and expanding their product portfolios to cater to the evolving demands of the waste management sector.

The Electric Garbage Transfer Vehicle sector has witnessed a series of pivotal developments that are shaping its present and future. These advancements range from new product launches and strategic collaborations to significant investments in technology and infrastructure.

This comprehensive report offers unparalleled insights into the global Electric Garbage Transfer Vehicle market. It provides detailed market size estimations for 2025 (USD 15.5 million) and forecasts a significant growth to USD 38.2 million by 2033, with a robust CAGR of 12.8% during the 2025-2033 Forecast Period. The analysis covers the entire Study Period of 2019-2033, drawing valuable lessons from the Historical Period of 2019-2024. It dissects key trends, driving forces such as environmental regulations and technological advancements, and identifies critical challenges like upfront costs and infrastructure limitations. Furthermore, the report highlights dominant regions and segments, including the influential Government application and the efficient Compression Garbage Truck type, and projects the overall growth in World Electric Garbage Transfer Vehicle Production. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the dynamic opportunities within the E-GTV industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Lion Electric, Mack Trucks (Volvo), Battle Motors, Spruce Power, Daimler (Mercedes-Benz Group), Peterbilt (PACCAR), Oshkosh Corporation, Renault Trucks, Dennis Eagle, E-Trucks Europe, Motiv Power Systems, Mitsubishi Fuso, Nikola, Zhengzhou YUTONG Heavy Industries, Infore Environment Technology Group, Skywell New Energy Vehicles Group, BYD, Beijing HUA-LIN SPECIAL VEHICLE, Fujian Longma Environmental Sanitation Equipment, Anhui Airuite New Energy Special Purpose Vehicle, Beiqi Foton Motor, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Electric Garbage Transfer Vehicle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electric Garbage Transfer Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.