1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Aircraft Charging Interface?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electric Aircraft Charging Interface

Electric Aircraft Charging InterfaceElectric Aircraft Charging Interface by Type (Plug-in, Wireless, Others), by Application (Commercial, Military, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

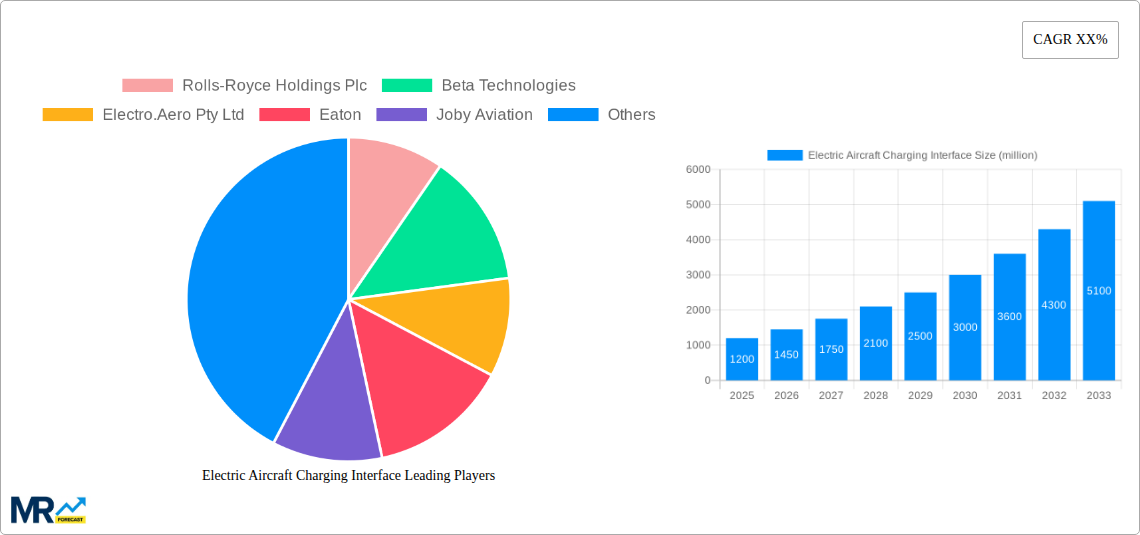

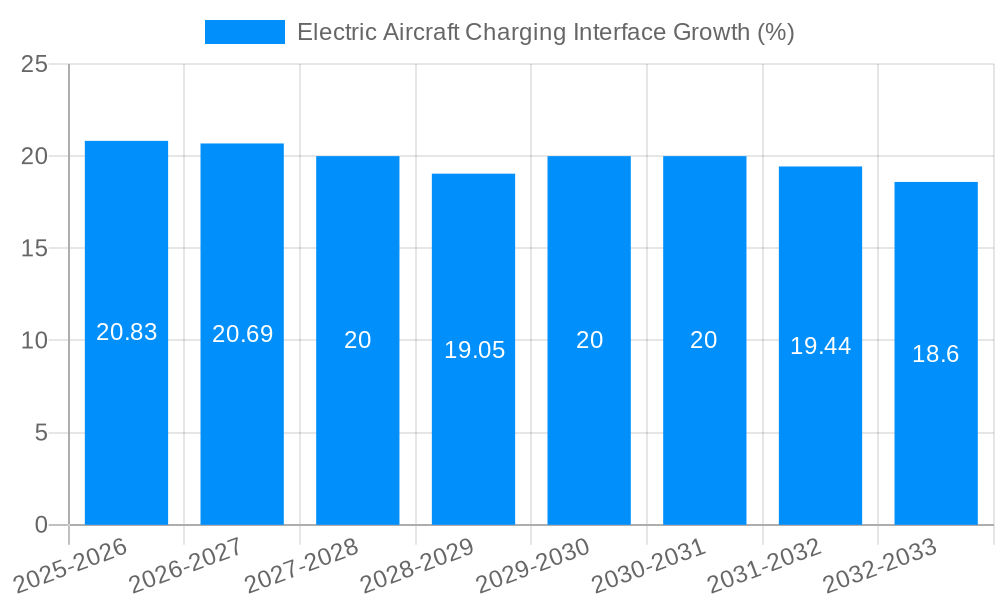

The electric aircraft charging interface market is poised for substantial growth, driven by the burgeoning electric aviation sector and increasing demand for sustainable air travel. While precise market sizing requires proprietary data, a reasonable estimate based on the current state of the electric aircraft market, and considering the significant capital investment in infrastructure needed to support these aircraft, would place the 2025 market size at approximately $500 million. Considering a conservative Compound Annual Growth Rate (CAGR) of 25% (reflecting both technological advancements and regulatory hurdles), the market is projected to reach approximately $2.5 billion by 2033. Key drivers include stringent environmental regulations pushing for emission reduction in aviation, advancements in battery technology enabling longer flight ranges for electric aircraft, and increasing investments from both established aerospace companies and innovative startups like those listed (Rolls-Royce, Beta Technologies, Electro.Aero, etc.). The market's segmentation will likely be influenced by charging power levels (fast vs. slow charging), interface types (conductive vs. inductive), and aircraft size. However, significant restraints include the high initial investment costs associated with developing and deploying robust charging infrastructure at airports and the need for standardization across different aircraft models and manufacturers to ensure interoperability. Successful navigation of these challenges will be key to unlocking the market's full potential.

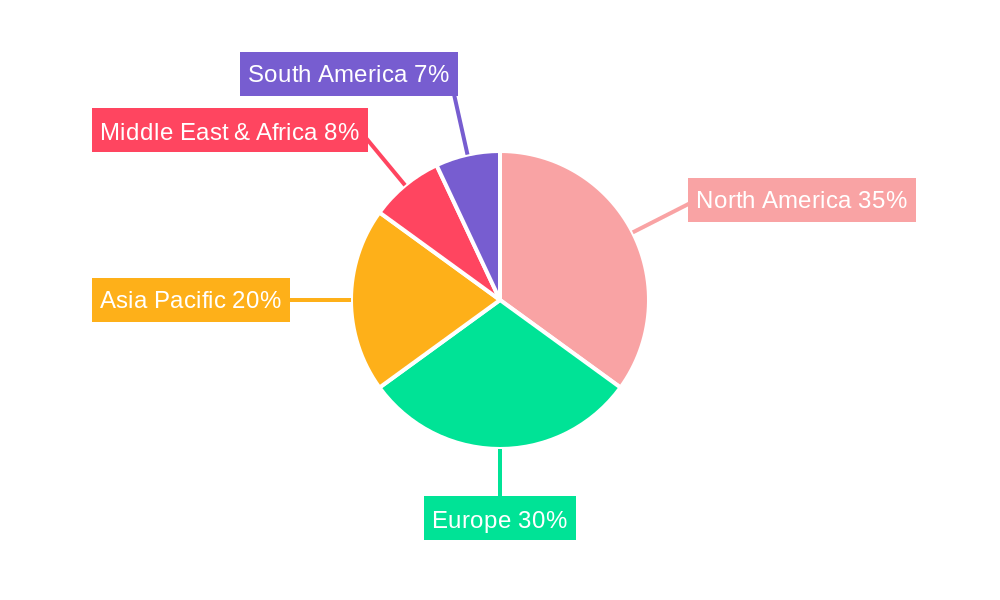

The regional distribution of the market is expected to be heavily influenced by early adoption rates and government support for sustainable aviation initiatives. Regions like North America and Europe, with their established aerospace industries and proactive environmental policies, are likely to dominate early market share. However, Asia-Pacific is projected to witness significant growth later in the forecast period, driven by its expanding aviation sector and government focus on clean energy solutions. Competition is currently fierce, with a mix of large established companies (Rolls-Royce, Eaton, Embraer, ABB) and agile innovative startups (Joby Aviation, Lilium, Eviation) vying for market share. The ability to provide reliable, efficient, and scalable charging solutions that are compatible across diverse aircraft types will be crucial for success in this dynamic and rapidly evolving market. The development of advanced charging technologies and streamlined certification processes will play pivotal roles in shaping the market landscape.

The electric aircraft charging interface market is poised for explosive growth, projected to reach multi-million unit installations by 2033. The study period, encompassing 2019-2033, reveals a significant shift from the nascent stages of electric aviation in the historical period (2019-2024) to a period of rapid expansion in the forecast period (2025-2033). The estimated year, 2025, serves as a crucial benchmark highlighting the burgeoning demand for efficient and reliable charging infrastructure. Key market insights point towards a strong correlation between the increasing adoption of electric vertical takeoff and landing (eVTOL) aircraft and the commensurate need for sophisticated charging solutions. This demand isn't limited to larger commercial aircraft; the market also encompasses charging infrastructure for smaller, regional electric planes, further broadening the potential market size. The escalating number of eVTOL certification programs and the entrance of major aerospace players like Rolls-Royce and Embraer underscore the industry's maturity and its commitment to investing in this critical infrastructure. Technological advancements in high-power charging systems, smart grid integration, and battery management systems are further accelerating market growth. The competitive landscape is dynamic, with established players like Eaton and ABB competing with emerging eVTOL manufacturers like Joby Aviation and Lilium for market share. This competition is pushing innovation, resulting in faster charging times, increased energy efficiency, and a focus on developing standardized interfaces to streamline operations and reduce costs. The overall trend points towards a rapidly evolving market characterized by significant technological progress, substantial investment, and increasing demand driven by the burgeoning electric aviation sector. The market is expected to witness a substantial increase in the number of charging interfaces deployed across various regions and aircraft segments. We estimate that the market will reach several million units by the end of the forecast period.

Several factors are synergistically driving the expansion of the electric aircraft charging interface market. The most significant is the undeniable growth of the electric aviation sector itself. Governments worldwide are increasingly incentivizing the adoption of electric aircraft to reduce carbon emissions and noise pollution, leading to substantial investments in research and development, and ultimately, deployment. The rising environmental concerns coupled with stricter regulations on carbon emissions are compelling airlines and other operators to actively seek sustainable alternatives to traditional fuel-powered aircraft. This transition necessitates a robust charging infrastructure capable of supporting the operational needs of a growing fleet of electric aircraft. Furthermore, advancements in battery technology, resulting in higher energy densities and faster charging capabilities, are directly contributing to the market's growth. These advancements reduce charging times and improve overall efficiency, making electric aircraft more commercially viable. The development and standardization of charging interfaces are also crucial. Clear industry standards will streamline the adoption process, encourage wider participation from various stakeholders, and ultimately reduce costs for both manufacturers and operators. Finally, the growing collaboration between established energy infrastructure providers (like ChargePoint) and new electric aircraft manufacturers demonstrates the maturing nature of this critical sector, ensuring the necessary infrastructure is available as the industry scales up.

Despite the promising growth trajectory, several challenges and restraints could hinder the market's full potential. A significant hurdle is the high initial investment cost associated with installing high-power charging infrastructure, particularly at airports and other suitable locations. This cost includes not only the charging equipment itself but also the necessary upgrades to the electrical grid and supporting infrastructure. Another challenge stems from the lack of standardization in charging interfaces and protocols, creating interoperability issues and potentially increasing costs due to the need for multiple types of charging equipment. The relatively limited range of current electric aircraft compared to their conventional counterparts poses a challenge, particularly for long-haul flights. This range limitation necessitates a denser network of charging stations, further escalating the infrastructure investment needs. Furthermore, safety concerns related to high-power charging and the potential for thermal runaway in large battery packs remain a key concern, demanding robust safety protocols and rigorous testing. Concerns about the grid's capacity to handle a significant influx of charging demand, particularly during peak hours, also represent a significant challenge that needs to be addressed by strategic grid planning and investment. Finally, the lifecycle cost of the charging infrastructure, including maintenance and replacement, could add significant operational expenses.

North America: The region is expected to dominate the market due to substantial government support for electric aviation, significant investments from both established and new players, and a strong focus on technological innovation. The US, in particular, is likely to lead the way in both adoption and innovation.

Europe: Strong environmental regulations and government initiatives supporting sustainable aviation are driving the growth of the electric aircraft charging interface market in Europe. Several European countries are actively investing in infrastructure and are becoming early adopters of electric aircraft technology.

Asia-Pacific: Although currently lagging behind North America and Europe, the Asia-Pacific region exhibits strong potential for growth, driven by increasing urbanization, rising disposable incomes, and a growing emphasis on sustainable transportation solutions. Countries like China and Japan are likely to show significant market expansion in the coming years.

Segments: The commercial aviation segment is projected to witness significant growth owing to the increasing demand for short-haul electric flights and growing environmental concerns. The general aviation segment is also anticipated to contribute substantially, driven by the rising popularity of electric aircraft for recreational and business purposes. The market is further segmented by charging power levels (kW), charging technology (AC vs. DC), and charging interface types. Higher power charging solutions are becoming more prevalent, mirroring the growth in battery capacity and the need for quicker turnaround times for electric aircraft. The adoption of DC fast charging is expected to gain significant traction, as this technology offers faster charging speeds compared to AC charging. The standardization of charging interfaces across various aircraft models is crucial for widespread adoption and will be a significant factor in determining segment dominance.

The key to market dominance will be a strategic combination of technological advancement, efficient infrastructure development, and supportive regulatory frameworks.

The electric aircraft charging interface industry is experiencing significant growth fueled by the convergence of technological advancements, supportive government policies, and rising environmental awareness. Investments in research and development are leading to the creation of more efficient and faster-charging technologies. Governments globally are incentivizing the adoption of electric aviation through subsidies, tax breaks, and regulatory frameworks which are directly supporting the construction of necessary charging infrastructure. This coupled with the rising demand for sustainable transportation solutions is further boosting the growth of this dynamic industry.

This report provides a comprehensive analysis of the electric aircraft charging interface market, offering a detailed overview of market trends, driving forces, challenges, key players, and significant developments. The report forecasts robust growth in the market over the next decade, driven primarily by increasing demand for sustainable aviation solutions, technological advancements, and supportive government policies. The report's insights are valuable for stakeholders across the electric aviation ecosystem, from manufacturers and infrastructure providers to investors and policymakers.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Rolls-Royce Holdings Plc, Beta Technologies, Electro.Aero Pty Ltd, Eaton, Joby Aviation, Embraer, ABB Ltd., Lilium, Eviation, ChargePoint, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Electric Aircraft Charging Interface," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electric Aircraft Charging Interface, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.