1. What is the projected Compound Annual Growth Rate (CAGR) of the E-grocery?

The projected CAGR is approximately 2.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

E-grocery

E-groceryE-grocery by Type (/> Food Products, Non-Food Products), by Application (/> Onlinegrocery Store, Household Supplies), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

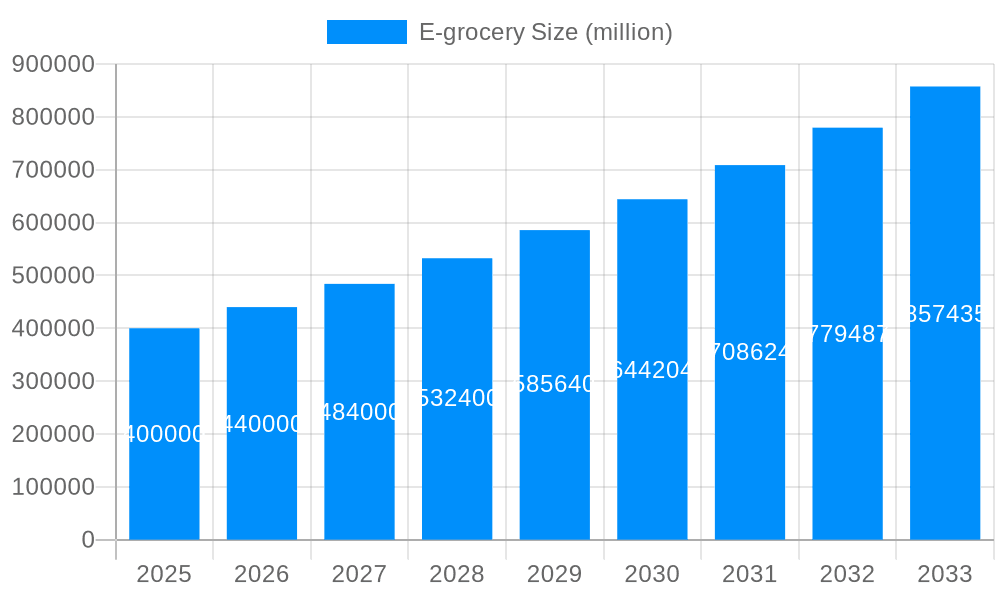

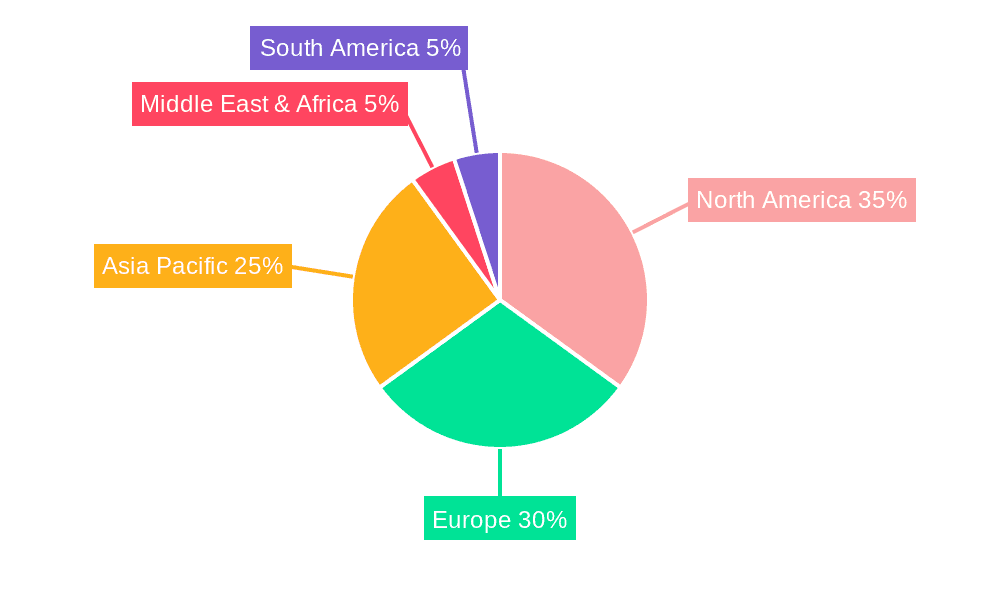

The global e-grocery market is projected for significant expansion, propelled by escalating online shopping adoption, especially among younger demographics. Key drivers include enhanced convenience, broader product availability, and competitive pricing. The market size is estimated at $166.3 billion in the base year 2025, with a Compound Annual Growth Rate (CAGR) of 2.3%. Major global e-commerce giants and established retail chains are actively participating, indicating a highly competitive environment. The market is strategically segmented by product category (food and non-food) and application (online grocery platforms and direct-to-consumer models), offering distinct avenues for market penetration and investment. While North America and Europe currently lead in market share, the Asia-Pacific region, particularly emerging economies, presents substantial growth potential fueled by increasing internet access and rising consumer spending power.

Market challenges encompass infrastructure deficits in specific locales, consumer concerns regarding product freshness, and complex last-mile delivery logistics. However, innovations in delivery technology, sophisticated supply chain management, and personalized customer experiences are actively addressing these constraints. Further market insights can be derived from granular segmentation based on consumer demographics, purchasing frequency, and preferred payment methods. The forecast period, spanning from 2025 to 2033, anticipates sustained growth, driven by expanding digital infrastructure, widespread smartphone usage, and evolving consumer purchasing habits. Collaborations between online retailers and physical stores are expected to intensify, reshaping market dynamics and fostering continued expansion. This evolving landscape underscores a dynamic and promising future for the e-grocery sector.

The e-grocery sector experienced explosive growth during the study period (2019-2024), driven initially by the pandemic and sustained by evolving consumer preferences. The market, valued at XXX million units in 2024, is projected to reach XXX million units by 2025 (estimated year) and continue its upward trajectory to reach XXX million units by 2033. This substantial growth reflects a significant shift in consumer behavior, with online grocery shopping becoming increasingly integrated into daily life. Key market insights reveal a growing preference for convenient, contactless delivery options, particularly among younger demographics. The rise of quick-commerce models, offering ultra-fast delivery within minutes or hours, has further accelerated market expansion. Simultaneously, the expansion of e-grocery offerings beyond simple food staples to encompass a wider range of non-food products, including household supplies and personal care items, has broadened the market's appeal. Competition within the sector remains fierce, with both established brick-and-mortar retailers and tech giants vying for market share. This competitive landscape is driving innovation in areas such as personalized recommendations, advanced inventory management, and sustainable delivery practices. The increasing adoption of omnichannel strategies, blending online and offline shopping experiences, signifies another significant trend. This enables retailers to cater to a broader range of consumer needs and preferences. The future of the e-grocery market appears bright, with continued growth anticipated throughout the forecast period (2025-2033), driven by technological advancements, evolving consumer expectations and strategic investments.

Several factors are propelling the remarkable growth of the e-grocery sector. The convenience factor is paramount, allowing consumers to shop from the comfort of their homes, saving time and effort. This is particularly appealing to busy individuals and families. The increasing availability of diverse product selections, comparable to or exceeding those of traditional supermarkets, is another significant driver. The rise of subscription services and loyalty programs further incentivizes online grocery shopping, offering consumers price discounts and exclusive benefits. Technological advancements, such as improved mobile applications, user-friendly websites, and sophisticated delivery logistics, have enhanced the overall shopping experience and reduced friction. Furthermore, the expansion of delivery networks, including same-day and next-day options, has broadened accessibility and increased consumer adoption. The COVID-19 pandemic played a crucial role in accelerating the adoption of online grocery shopping, prompting many consumers to switch from traditional methods due to lockdowns and social distancing measures. This shift is likely to be sustained, even as pandemic restrictions ease. Finally, the increasing penetration of smartphones and internet access, particularly in developing markets, is opening up new opportunities for e-grocery expansion globally.

Despite the impressive growth, the e-grocery sector faces considerable challenges. Maintaining freshness and quality of perishable goods remains a critical concern, particularly during longer delivery times. High delivery costs, often a significant deterrent for consumers, need to be addressed by optimizing logistics and potentially through subscription models. The complexity of managing inventory across multiple locations, along with dealing with returns and damaged goods, adds another layer of operational complexity. Competition is intense, requiring e-grocery players to constantly innovate and adapt to maintain competitiveness. Ensuring a seamless and secure online payment experience is essential for building consumer trust and driving adoption. Furthermore, concerns about data privacy and security, along with the need to manage large volumes of customer data responsibly, are important considerations. Lastly, the environmental impact of last-mile delivery, particularly in terms of carbon emissions, presents both a challenge and an opportunity for e-grocery companies to adopt more sustainable practices.

The e-grocery market is experiencing significant growth across various regions, but specific segments and geographic locations stand out as key drivers. While a comprehensive analysis across all regions and countries is beyond this summary, we can highlight some prominent trends:

North America (US and Canada): This region has consistently been a dominant player, with established players like Walmart, Amazon, Kroger, and Target leading the charge. The high internet penetration, sophisticated logistics infrastructure, and high disposable incomes contribute to this market’s strength.

Europe (UK, Germany, France): European countries demonstrate considerable growth driven by the presence of major players such as Tesco, Carrefour, Aldi, and EDEKA. The market is characterized by a mix of established brick-and-mortar retailers adapting to online sales and specialized e-grocery platforms.

Asia-Pacific (China, India): This region is experiencing explosive growth, driven by the increasing adoption of online shopping, particularly in rapidly developing economies. Alibaba, Amazon, and various regional players are shaping this market landscape.

Dominant Segment: Food Products: The majority of e-grocery sales are still focused on food products, although the non-food category is experiencing substantial growth. Within the food segment, fresh produce and grocery staples remain the most popular items. This dominance is primarily due to convenience and the ability to have everyday essentials delivered directly to one's home.

In summary, while different regions showcase unique market dynamics, the overall trend points toward substantial growth globally. The combination of evolving consumer behavior, advanced technologies, and aggressive competition across these key regions and the predominant "Food Products" segment will dictate the continued expansion of the e-grocery market.

Several factors are acting as powerful growth catalysts in the e-grocery industry. The continued rise in smartphone penetration and internet connectivity globally is significantly expanding the potential customer base. Technological advancements in areas such as AI-powered personalization and drone delivery are streamlining operations and enhancing the customer experience. Increased investment in logistics infrastructure and supply chain optimization is making e-grocery more efficient and cost-effective. The growing popularity of quick-commerce models, emphasizing ultra-fast delivery, is attracting a new segment of time-conscious consumers.

This report provides a comprehensive overview of the e-grocery market, encompassing historical data (2019-2024), current estimates (2025), and future projections (2025-2033). It delves into key market trends, driving forces, challenges, and growth catalysts, providing a detailed analysis of leading players and significant sector developments. The report offers valuable insights for businesses operating in or considering entering the dynamic e-grocery sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.3%.

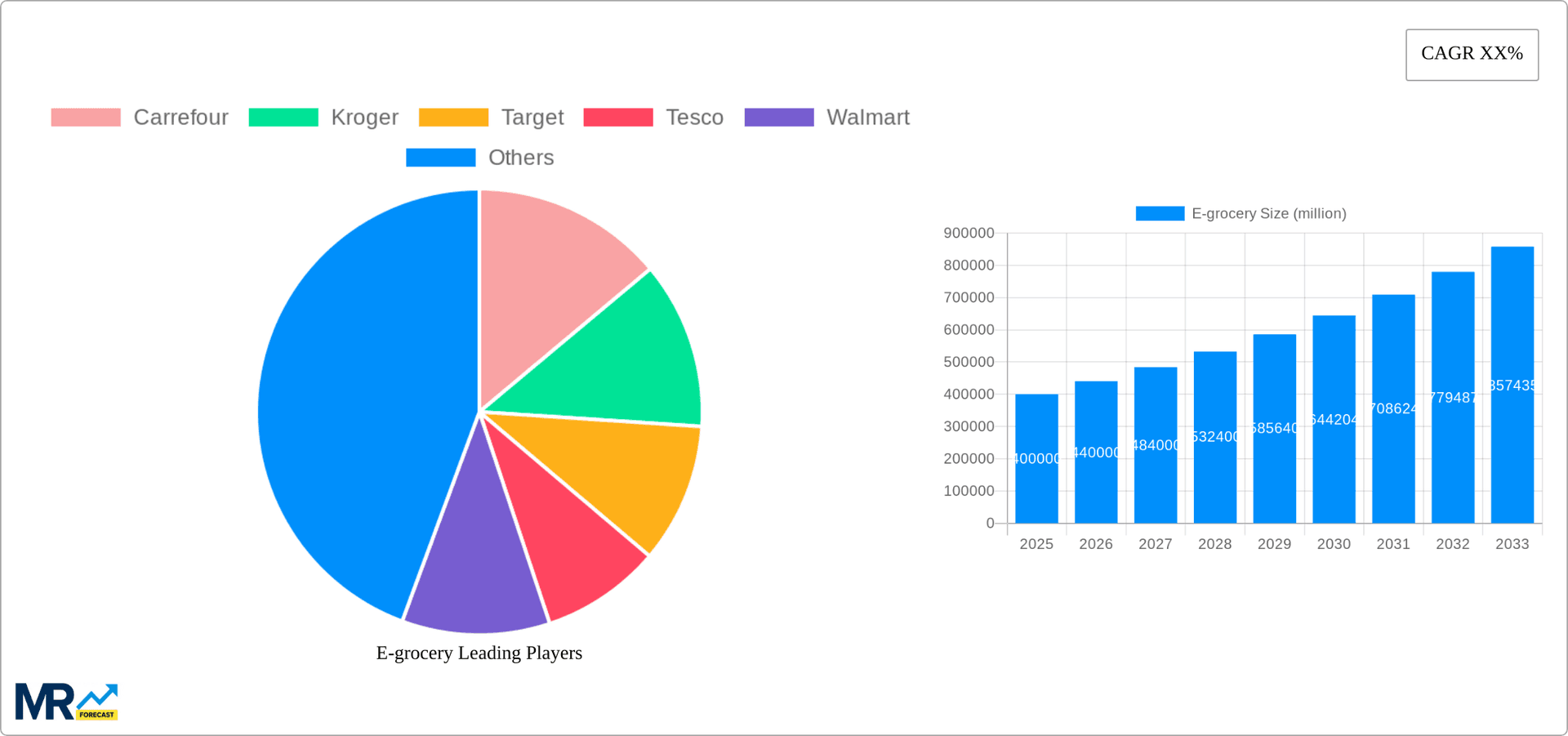

Key companies in the market include Carrefour, Kroger, Target, Tesco, Walmart, ÆON, Aldi, Alibaba, Amazon, big basket, BigBazaar, Coles Supermarkets, Costco Wholesale, EDEKA, METRO AG, more, REWE, Safeway, Schwarz, Tengelmann.

The market segments include Type, Application.

The market size is estimated to be USD 166.3 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "E-grocery," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the E-grocery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.