1. What is the projected Compound Annual Growth Rate (CAGR) of the e-grocery Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

e-grocery Service

e-grocery Servicee-grocery Service by Type (Packaged Foods, Fresh Foods), by Application (Personal Shoppers, Business Customers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

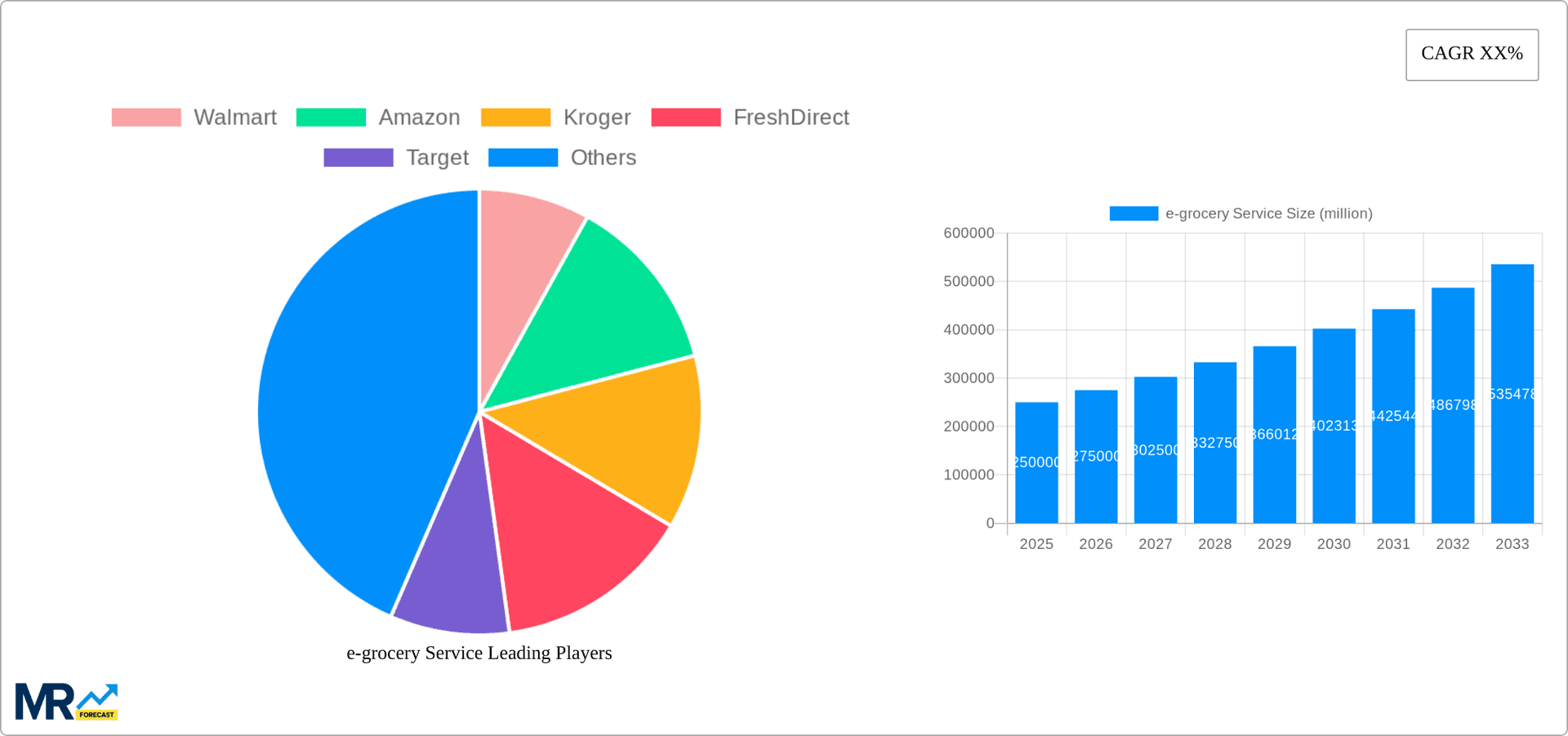

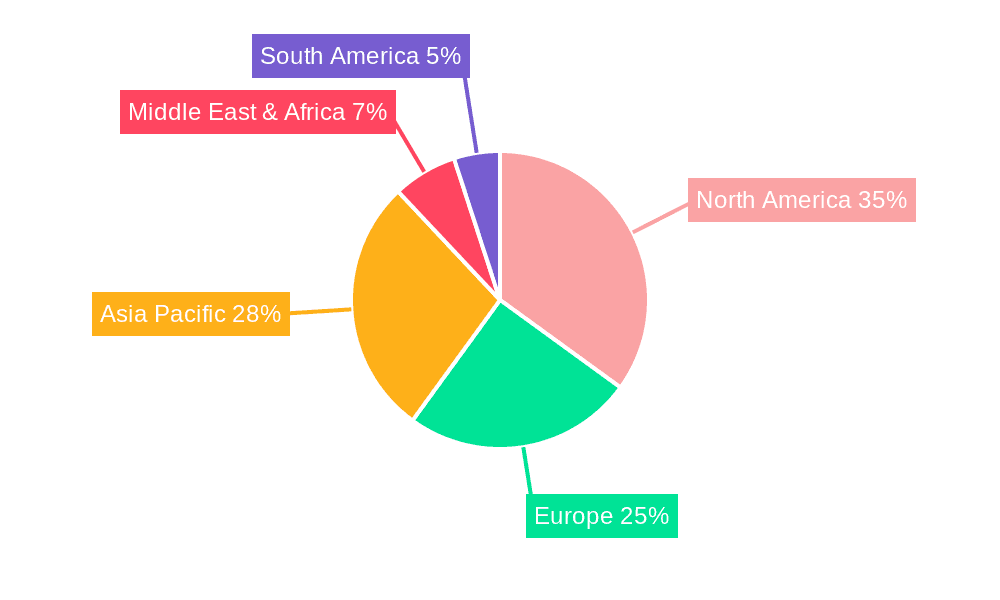

The global e-grocery market is experiencing robust growth, driven by the increasing adoption of online shopping, particularly among younger demographics and busy professionals. Convenience, wider product selection compared to physical stores, and the ability to compare prices easily are major factors fueling this expansion. The market is segmented by food type (packaged and fresh) and customer type (personal shoppers and businesses), with significant variation in growth rates across these segments. Fresh food e-grocery is exhibiting faster growth than packaged foods, reflecting a consumer shift towards healthier eating habits and a willingness to pay a premium for convenience in this sector. Similarly, business customers are increasingly leveraging e-grocery services for efficient catering and staff provision, adding a significant revenue stream. Major players like Walmart, Amazon, and Kroger dominate the market, leveraging their existing infrastructure and customer bases to establish a strong online presence. However, smaller, specialized e-grocery providers are also thriving, focusing on niche markets such as organic produce or hyperlocal delivery. Geographic distribution shows North America and Europe as leading regions, but Asia-Pacific is demonstrating the highest growth potential due to increasing internet penetration and rising disposable incomes. While supply chain challenges and maintaining product freshness remain significant hurdles, technological advancements in areas like automated warehouses and drone delivery are addressing these concerns, further propelling market growth.

Looking ahead, the e-grocery market is poised for sustained expansion over the next decade. Continued improvements in technology, particularly in last-mile delivery solutions, will be crucial for maintaining profitability and enhancing customer experience. The increasing integration of e-grocery services with other online platforms, such as meal kit services and recipe apps, offers significant opportunities for growth. The competitive landscape will continue to evolve, with mergers and acquisitions likely as established players seek to consolidate their market share. The focus will likely shift towards personalization and customization, with e-grocery services offering tailored recommendations and targeted promotions to individual consumers. Finally, the sustainability aspects of e-grocery, including reducing packaging waste and optimizing delivery routes, will become increasingly important factors influencing consumer choices and industry practices. We estimate a significant increase in market value over the forecast period, reflecting these dynamic market forces.

The e-grocery service market experienced phenomenal growth throughout the historical period (2019-2024), fueled by the increasing adoption of online shopping and the expansion of e-commerce infrastructure. The market's value surged into the tens of billions, with key players like Amazon, Walmart, and Kroger dominating the landscape. However, the COVID-19 pandemic acted as a significant catalyst, accelerating the shift towards online grocery shopping as consumers prioritized safety and convenience. This trend continues to drive market expansion, with projections indicating sustained growth throughout the forecast period (2025-2033). The estimated market value in 2025 is projected to reach hundreds of millions of dollars, showcasing the sector's substantial potential. While packaged foods initially led the market, fresh foods are rapidly gaining traction, driven by improvements in cold-chain logistics and the increasing demand for high-quality, convenient produce. The emergence of innovative services, such as personalized shopping experiences and subscription boxes, further enhances customer appeal. Technological advancements, including advanced delivery systems, AI-powered personalization, and improved online platforms, are continuously transforming the e-grocery landscape, enhancing operational efficiency and customer satisfaction. This competitive landscape, characterized by mergers, acquisitions, and continuous innovation, is expected to drive further market consolidation and specialization in the coming years, creating an environment where both large multinational corporations and nimble, specialized companies can thrive. The focus is shifting from mere online ordering to a more comprehensive, personalized, and integrated shopping experience.

Several key factors are propelling the growth of the e-grocery service market. The increasing adoption of smartphones and internet penetration, particularly in developing economies, allows a larger consumer base access to online shopping. The convenience factor is undeniable; e-grocery services eliminate the need for physical shopping trips, saving valuable time and effort. This is particularly attractive to busy professionals and families. Furthermore, the pandemic significantly accelerated the adoption of online grocery shopping, highlighting its crucial role during periods of uncertainty and health concerns. The rise of subscription models offers customers recurring deliveries of their favorite products, fostering brand loyalty and predictable revenue streams for providers. Improved delivery infrastructure, including faster delivery options, wider coverage areas, and sophisticated logistics networks, contributes to enhanced customer experience. Finally, the increasing availability of a wider selection of products online, often surpassing the variety found in physical stores, further entices consumers to embrace e-grocery services. The continuous development of user-friendly mobile applications and improved website interfaces simplifies the ordering process and enhances user satisfaction.

Despite its immense potential, the e-grocery sector faces several challenges. Maintaining the freshness and quality of perishable goods like fresh produce and meat remains a significant hurdle. Efficient cold-chain management and last-mile delivery are crucial but costly investments. High delivery costs, often a significant portion of the overall purchase price, can deter customers, especially those purchasing smaller quantities of groceries. Competition in the sector is fierce, with established retailers and new entrants vying for market share, creating pressure on pricing and profitability. Security concerns related to online payments and data privacy can deter some consumers from embracing online grocery shopping. Furthermore, the need to accurately predict demand and manage inventory effectively to minimize waste and maximize efficiency poses a continuous operational challenge. Addressing these concerns requires significant investment in technology, infrastructure, and operational strategies. Building and maintaining trust with customers, ensuring consistent delivery experiences, and managing customer expectations in terms of product quality and availability are paramount.

The e-grocery market is experiencing significant growth across various regions, with North America and Europe currently holding a dominant position, driven largely by high internet penetration and established e-commerce infrastructure. However, Asia-Pacific is poised for rapid expansion, fueled by increasing smartphone usage and a large and growing middle class. Within the segments, fresh foods are experiencing particularly strong growth. Consumers are increasingly willing to pay a premium for convenience and high-quality fresh produce delivered directly to their homes. This shift reflects a change in lifestyle, with consumers prioritizing convenience and healthy eating habits. Furthermore, the personal shoppers segment is expanding rapidly, offering bespoke grocery shopping experiences and personalized product recommendations. Companies are leveraging advanced technologies such as AI to enhance the shopper’s experience and optimize efficiency. This personalized service is becoming a key differentiator in a crowded market.

The convergence of these trends creates substantial growth opportunities for businesses capable of adapting to the evolving consumer demands and leveraging technology to improve efficiency and enhance the customer experience.

Several factors contribute to the continued growth of the e-grocery service industry. Technological innovations, such as improved delivery systems, AI-powered inventory management, and personalized recommendations, are enhancing operational efficiency and customer satisfaction. The increasing demand for convenience and time-saving solutions continues to fuel the adoption of online grocery services among busy consumers. The expansion of e-commerce infrastructure and greater internet access in developing economies opens up vast new markets. Lastly, strategic partnerships between e-grocery platforms and local retailers offer expanded product selection and enhanced delivery networks, strengthening the overall industry.

This report provides a comprehensive analysis of the e-grocery service market, offering valuable insights into market trends, growth drivers, challenges, and key players. It covers the historical period (2019-2024), the base year (2025), and provides detailed forecasts for the future (2025-2033). The report also segments the market by type (packaged foods, fresh foods), application (personal shoppers, business customers), and key regions, providing a granular understanding of the market dynamics. The extensive research methodology used ensures the accuracy and reliability of the data presented, making this report an invaluable resource for businesses operating in or considering entering the e-grocery market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Walmart, Amazon, Kroger, FreshDirect, Target, Tesco, Alibaba, Carrefour, ALDI, Coles Online, BigBasket, Longo, Schwan Food, Honestbee, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "e-grocery Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the e-grocery Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.