1. What is the projected Compound Annual Growth Rate (CAGR) of the Drone Camera?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Drone Camera

Drone CameraDrone Camera by Type (SD Drone Camera, HD Drone Camera, FHD Drone Camera, QHD Drone Camera, UHD Drone Camera, World Drone Camera Production ), by Application (Aerial Photography, Environmental Monitoring and Conservation, Geographic Mapping, Search and Rescue, Law Enforcement, Shipping and Delivery, Agricultural, Power Inspection, Research and Education, Wildlife Monitoring, World Drone Camera Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

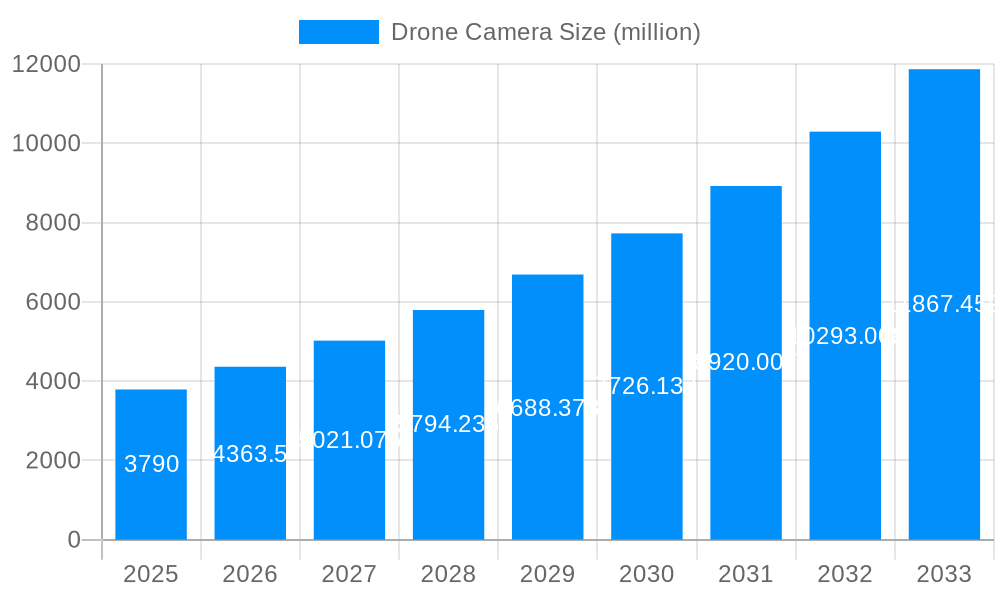

The global drone camera market, valued at $3.79 billion in 2025, is poised for substantial growth over the next decade. Driven by increasing adoption across diverse sectors – including aerial photography, environmental monitoring, precision agriculture, and infrastructure inspection – the market is projected to experience a significant Compound Annual Growth Rate (CAGR). Considering the rapid technological advancements in drone technology and the expanding applications, a conservative estimate for the CAGR would be in the range of 15-20% annually. This growth is fueled by several key factors: the decreasing cost of drones and cameras, improved image quality and resolution (with higher demand for UHD cameras), enhanced drone autonomy and ease of use, and the increasing availability of user-friendly data analysis software. Major players like DJI, GoPro, and Autel Robotics are constantly innovating, leading to a competitive landscape driving further advancements. The market segmentation by camera type (SD, HD, FHD, QHD, UHD) reflects the evolving needs of various applications, with a clear trend toward higher-resolution cameras. Geographical distribution shows strong growth potential in regions like Asia-Pacific, driven by burgeoning infrastructure development and agricultural activities. However, regulatory hurdles and privacy concerns remain potential restraints to market expansion, requiring careful navigation by industry stakeholders.

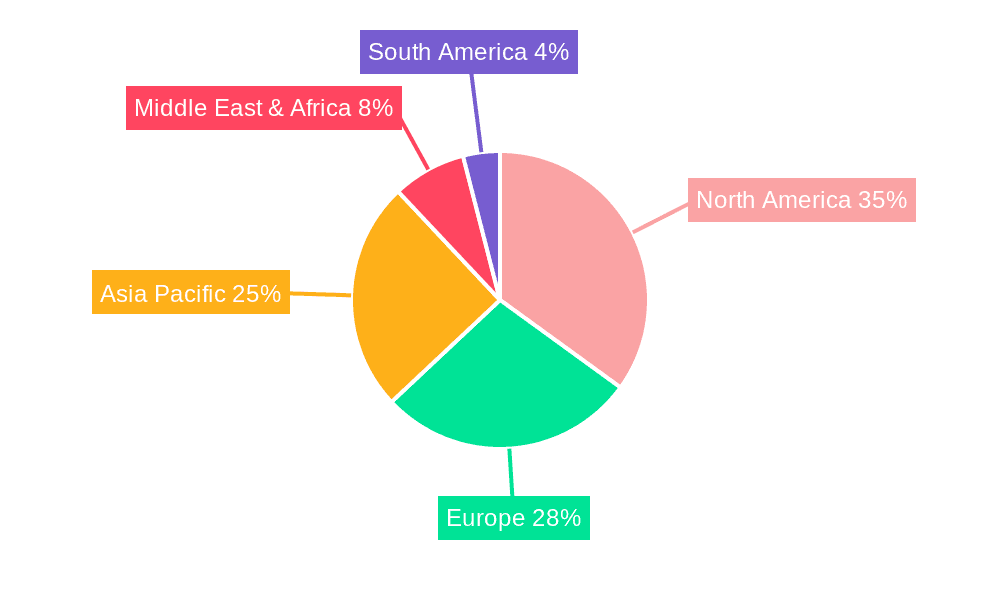

The market's segmentation by application highlights its versatility. Aerial photography remains a major driver, while the increasing focus on environmental sustainability is boosting the demand for drone cameras in monitoring and conservation efforts. Similarly, the precision agriculture sector is witnessing rapid adoption as farmers leverage drone technology for crop monitoring and optimized resource management. The law enforcement and search and rescue sectors also represent significant growth opportunities, emphasizing the diverse applications of drone cameras in various safety and security contexts. While North America and Europe currently hold substantial market shares, the rapid economic growth and technological adoption in Asia-Pacific suggest a significant shift in regional market share in the coming years, requiring strategic investments and adaptation by companies operating within this dynamic market.

The global drone camera market, valued at several million units in 2024, is experiencing explosive growth, projected to reach tens of millions of units by 2033. This expansion is driven by technological advancements, increasing affordability, and the proliferation of drone applications across diverse sectors. The historical period (2019-2024) witnessed a steady increase in market size, fueled by early adoption in professional fields like aerial photography and surveying. However, the forecast period (2025-2033) anticipates a significantly steeper growth trajectory, propelled by the expansion into consumer markets and the integration of advanced features like AI-powered image processing and improved stabilization systems. The base year for this report is 2025, allowing for a detailed analysis of current market dynamics and future projections. This surge is not uniform across all camera types; higher-resolution cameras (FHD, QHD, and UHD) are experiencing faster growth compared to SD and HD counterparts due to increasing demand for high-quality imagery in various applications. Furthermore, market trends indicate a shift towards modular and customizable drone camera systems, providing users greater flexibility in tailoring their equipment to specific needs. The ongoing development of compact yet powerful drone cameras with longer battery life and enhanced features continues to fuel the market's upward momentum. The integration of thermal imaging capabilities is also gaining traction, widening the applicability of drone cameras in sectors like search and rescue, environmental monitoring, and infrastructure inspection. The market is becoming increasingly competitive, with established players continuously innovating and new entrants entering the market, all vying for a share of this rapidly expanding landscape.

Several factors are fueling the remarkable growth of the drone camera market. Firstly, the continuous improvement in image sensor technology, coupled with the miniaturization of components, has resulted in increasingly affordable and high-performance drone cameras. The availability of readily accessible, user-friendly drones with integrated camera systems has broadened the market's appeal to both professional and hobbyist users. Secondly, the expanding range of applications across various industries, from agriculture and construction to filmmaking and journalism, is driving demand. Drone cameras offer a unique perspective and efficiency gains previously unattainable, leading to significant cost savings and improved operational efficiency in various sectors. Thirdly, government regulations are progressively becoming more streamlined and supportive of drone usage, facilitating market expansion and encouraging wider adoption. This simplification of licensing and operational procedures has further boosted the market's growth potential. Moreover, the declining cost of data storage and the advancement of cloud-based image processing and analysis technologies have contributed to this surge. These technological advancements streamline workflow, making drone photography and videography more convenient and accessible. Lastly, the growing popularity of drone photography and videography amongst consumers, along with the rise of social media platforms where such content is easily shared, have fuelled market demand.

Despite the significant growth potential, several challenges and restraints impede the drone camera market's expansion. Firstly, concerns surrounding privacy and data security remain a considerable obstacle. The widespread use of drones equipped with cameras raises ethical and legal questions related to unauthorized surveillance and data breaches. Addressing these concerns requires careful consideration of regulatory frameworks and the implementation of appropriate security measures. Secondly, battery life and flight time remain limitations for many drone cameras. Longer flight times are crucial for efficient operation in various applications, and technological breakthroughs are needed to address this constraint effectively. Thirdly, the integration of advanced features like AI-powered image processing and autonomous flight capabilities increases the cost of drone cameras, making them less accessible to budget-conscious consumers and smaller businesses. This price point can be a barrier to entry for many. Fourthly, weather conditions can significantly affect drone operations, limiting their use in certain environments and hindering their overall applicability. Lastly, the potential for accidents and malfunctions associated with drone operation raises concerns regarding safety and liability, requiring the development of more robust safety standards and protocols.

The North American and Asia-Pacific regions are projected to dominate the drone camera market during the forecast period (2025-2033). North America's robust technological infrastructure, high disposable incomes, and early adoption of drone technology contribute to its market leadership. The Asia-Pacific region, on the other hand, is experiencing rapid growth due to increasing government support for drone technology, a burgeoning consumer market, and the expanding application of drones in agriculture and infrastructure development. Within the segments, the UHD drone camera market is expected to exhibit substantial growth due to its superior image quality and increasing demand for high-resolution imagery across various applications. Furthermore, the aerial photography segment will continue to be a major driver of market growth, followed by applications in agricultural monitoring, environmental conservation, and infrastructure inspection.

Paragraph Expansion: The dominance of North America stems from early technological advancements in drone technology, coupled with substantial investments in R&D and strong regulatory support promoting commercial drone integration across various sectors. The Asia-Pacific region demonstrates rapid growth as its rapidly developing economies encourage drone adoption across industries. Agriculture, particularly in large countries like India and China, provides a major driver for this, benefiting from drone-based precision farming. In the camera segment, UHD cameras lead due to the increasing need for high-quality imagery—particularly in professional applications like film production and mapping. Aerial photography's prominence is a direct consequence of its versatile applicability across diverse industries, ranging from real estate to construction.

The drone camera industry's growth is further fueled by continuous technological innovation, declining prices, expanding regulatory support, and the integration of advanced features like AI and thermal imaging. These factors collectively broaden the market's accessibility and applicability, driving increased demand across numerous sectors.

This report provides a comprehensive overview of the drone camera market, analyzing historical trends, current market dynamics, and future growth prospects. It offers detailed insights into key market segments, leading players, and significant technological developments, providing valuable information for businesses, investors, and researchers in this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

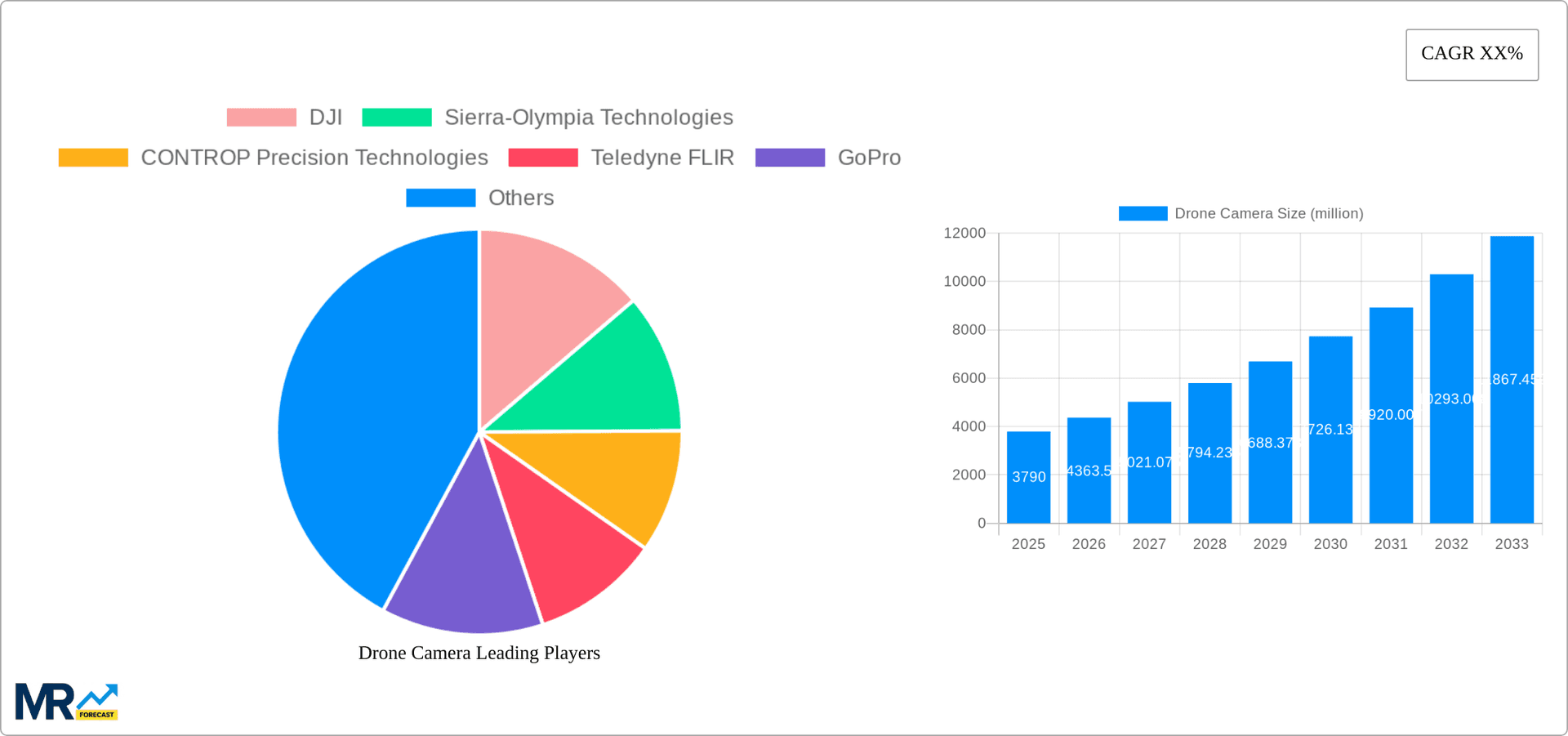

Key companies in the market include DJI, Sierra-Olympia Technologies, CONTROP Precision Technologies, Teledyne FLIR, GoPro, Autel Robotics, Parrot, NextVision, DST Control, GDU Technology, Aerialtronics, Canon, AgEagle Aerial Systems, Huixinghai Technology, Sony, SwellPro, .

The market segments include Type, Application.

The market size is estimated to be USD 3790 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Drone Camera," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Drone Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.