1. What is the projected Compound Annual Growth Rate (CAGR) of the Drive-through COVID-19 Testing?

The projected CAGR is approximately XX%.

Drive-through COVID-19 Testing

Drive-through COVID-19 TestingDrive-through COVID-19 Testing by Application (/> Personal, Group), by Type (/> Throat Swab Testing, Nose Swab Testing), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

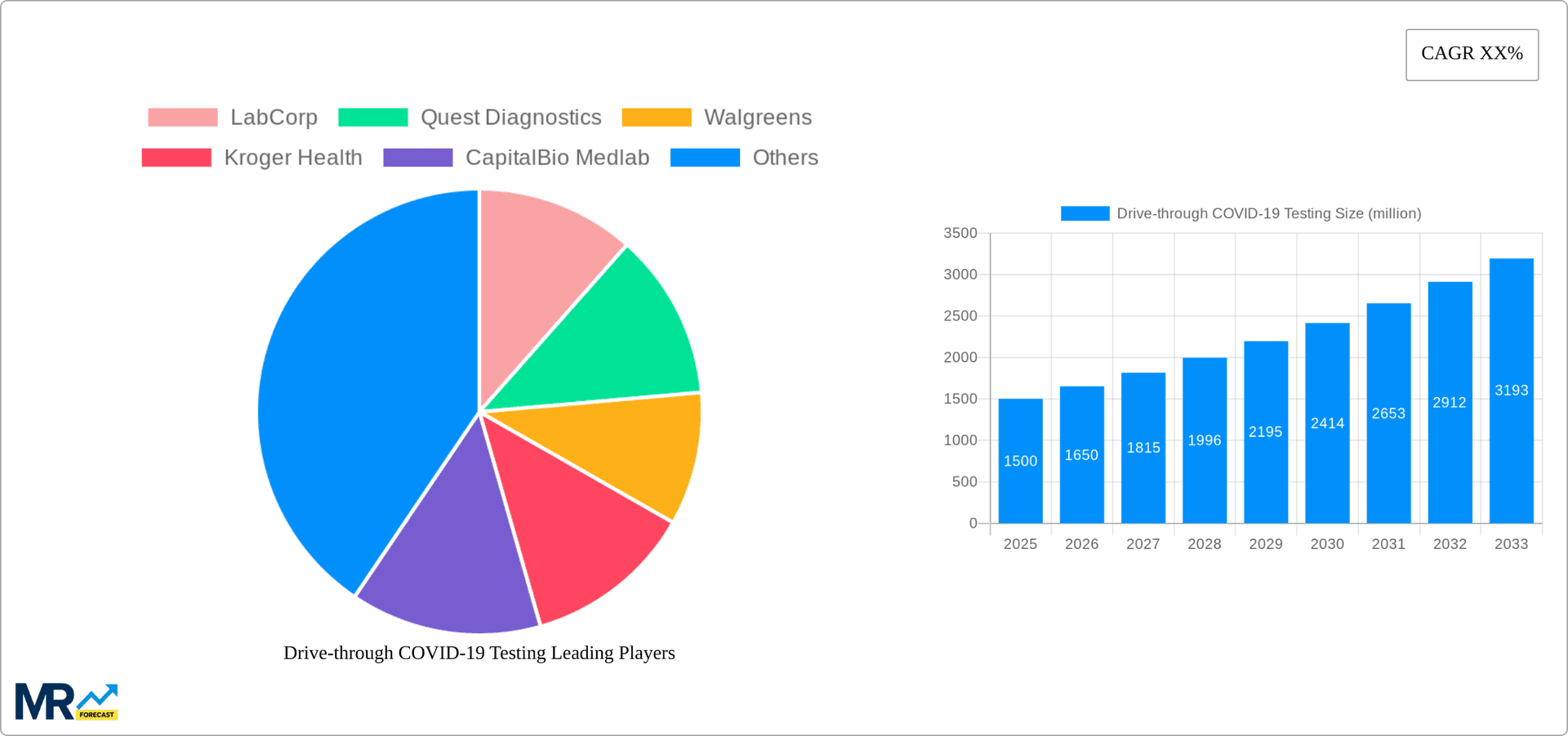

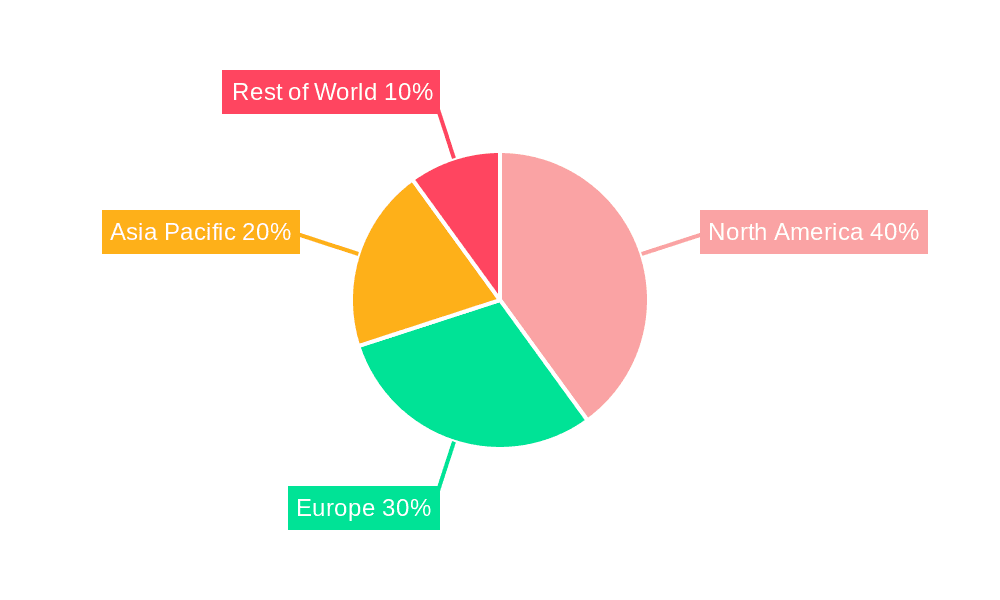

The drive-through COVID-19 testing market experienced significant growth during the pandemic, driven by the need for convenient, accessible, and large-scale testing solutions. While the initial surge has subsided, the market remains robust due to ongoing concerns about new variants and the potential for future outbreaks. The convenience factor, minimizing contact and infection risk for both patients and healthcare workers, continues to be a major driver. Market segmentation reveals a preference for nose swab testing over throat swab testing due to ease of administration and higher accuracy. The personal testing segment holds a larger market share compared to the group testing segment, reflecting individual preferences for privacy and quicker result turnaround. Key players like LabCorp, Quest Diagnostics, and Walgreens capitalized on this demand, establishing extensive networks of drive-through testing sites. However, the market is becoming increasingly competitive with smaller regional labs and international players vying for a share. The market's future growth will depend on factors such as the prevalence of new COVID-19 variants, government policies regarding testing mandates, and the development of more advanced testing technologies. Geographic variations exist, with North America and Europe initially dominating the market due to early pandemic impact and higher testing rates, though Asia-Pacific is projected to witness considerable growth in the coming years as economies recover and testing infrastructure improves. Pricing strategies and insurance coverage will also play a crucial role in shaping the future landscape of the drive-through COVID-19 testing market.

The market is predicted to witness a period of stabilization, with a slower but consistent growth trajectory compared to the pandemic peak. This reflects a shift from emergency response to a more integrated approach within routine healthcare. Factors like the development of at-home testing kits, and the integration of drive-through testing into broader healthcare networks, will influence market evolution. Furthermore, ongoing research into rapid and more accurate diagnostic methods will also affect market size and competitiveness. Long-term growth will likely depend on the preparedness for future pandemic scenarios and the emergence of new infectious diseases, with drive-through testing potentially playing a vital role in public health preparedness strategies. Sustained investment in testing infrastructure, particularly in emerging markets, is crucial for maximizing global access and resilience against future outbreaks. A focus on improving operational efficiency and leveraging technological advancements within drive-through facilities will be critical for maintaining profitability and securing a sustainable position in the evolving healthcare landscape.

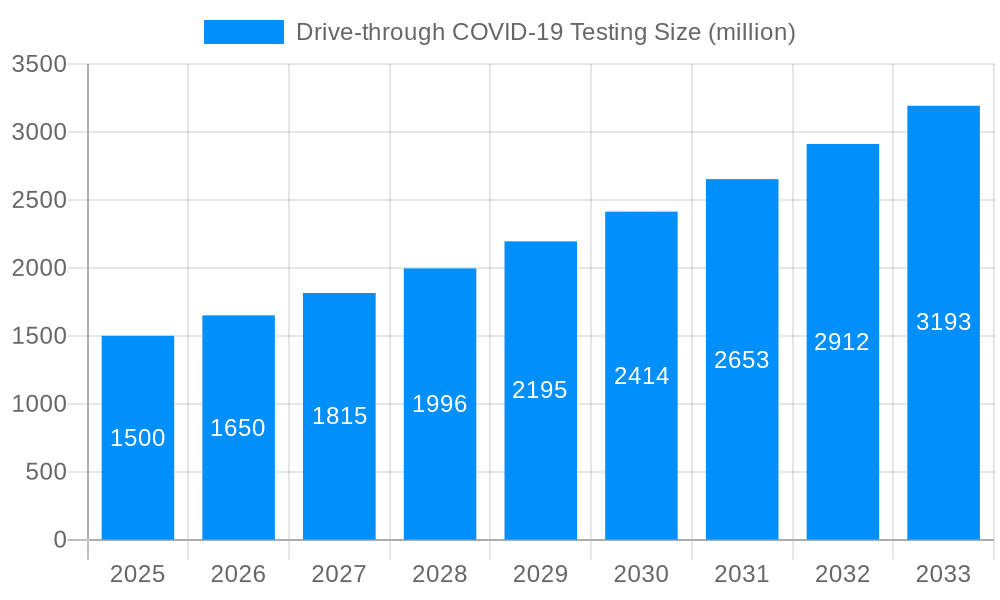

The drive-through COVID-19 testing market experienced explosive growth during the initial phases of the pandemic (2019-2024), driven by the urgent need for widespread, convenient testing to curb the virus's spread. This innovative approach offered a safe and efficient alternative to traditional clinic settings, minimizing exposure risks for both healthcare workers and the public. The market's value soared into the multi-million-dollar range, with millions of tests administered globally. While the initial surge has subsided as the pandemic transitioned to an endemic phase, the market continues to hold relevance. The convenience and speed of drive-through testing remain valuable assets in managing outbreaks, seasonal surges, and future pandemic preparedness. This convenience factor contributes to higher testing rates, enabling quicker identification of positive cases and facilitating timely interventions. The historical period (2019-2024) showcases a steep upward trajectory, with the base year (2025) marking a leveling off but still representing a substantial market size in the millions. The forecast period (2025-2033) anticipates continued albeit more moderate growth, primarily driven by ongoing public health concerns, emerging variants, and the potential need for rapid testing during future outbreaks. The market's size, measured in millions of tests, reflects a significant and enduring impact of the drive-through testing model on global healthcare infrastructure.

Several factors propelled the rapid growth of drive-through COVID-19 testing. The paramount driver was the pandemic's unprecedented scale, demanding quick, large-scale testing solutions. Drive-through centers addressed this need by providing a high-throughput, contactless testing method, minimizing the risk of infection transmission compared to traditional clinic settings. This accessibility significantly improved testing rates, particularly in communities with limited access to healthcare resources. The convenience factor was also key, attracting individuals who might otherwise avoid testing due to time constraints or fears of exposure. Furthermore, government initiatives and public health campaigns played a crucial role, promoting widespread testing and allocating funds to establish and maintain drive-through facilities. The simplicity and relative affordability of the drive-through model, compared to more complex testing methods, made it particularly appealing to both healthcare providers and policymakers. Finally, the relatively quick turnaround time for results, often within 24-48 hours for many providers, facilitated prompt isolation and contact tracing, contributing to effective containment strategies. These factors together created a powerful synergy that propelled the market's phenomenal growth during the early stages of the pandemic.

Despite its successes, the drive-through COVID-19 testing model faced several challenges. Weather conditions, particularly extreme temperatures or inclement weather, could significantly impact testing capacity and accessibility. Logistics and operational hurdles, including staffing shortages, supply chain disruptions (especially for testing kits and personal protective equipment), and managing large volumes of samples efficiently, posed considerable difficulties. Maintaining the quality and accuracy of test results across numerous testing sites required robust quality control measures, adding complexity to the operational aspects. The initial high demand often led to long waiting times, potentially discouraging some individuals from getting tested. Furthermore, the fluctuating demand, which surged during peak infection periods and tapered off during calmer times, presented operational challenges in managing staffing and resource allocation effectively. Finally, the need for continuous adaptation to evolving testing methodologies and variants of the virus presented an ongoing challenge, requiring providers to maintain up-to-date protocols and technologies.

The drive-through COVID-19 testing market saw significant adoption across various regions globally, though certain areas experienced more rapid growth. The United States, with its extensive healthcare infrastructure and initial high infection rates, witnessed a particularly substantial expansion of drive-through testing facilities. Similarly, several European countries, such as the UK and Germany, adopted this model widely, driven by comparable factors.

Regarding market segmentation, the Personal application segment dominated the market, owing to individual's need to assess their own health status and take preventive measures. This segment's dominance highlights the individual-focused nature of pandemic response strategies in numerous regions.

In terms of test Type, both Nose Swab Testing and Throat Swab Testing had significant market shares, with the preference for one over the other potentially varying based on the testing facility's protocols and the availability of resources. Both methods were widely implemented throughout the drive-through testing model.

The drive-through COVID-19 testing industry's future growth will be fueled by several factors. Firstly, the ongoing need for efficient and rapid testing during seasonal surges and potential future pandemics will guarantee sustained demand. Secondly, technological advancements in testing methodologies, such as the development of quicker and more accurate tests, will further enhance the drive-through model's appeal. Finally, improved infrastructure and the experience gained during the pandemic will help refine operational processes and enhance the overall effectiveness and efficiency of this model.

This report provides a comprehensive analysis of the drive-through COVID-19 testing market, offering insights into historical trends, current market dynamics, and future growth prospects. It examines key driving forces, challenges, and influential players, along with a detailed segmentation analysis. The report is crucial for stakeholders seeking to understand the evolution and future trajectory of this vital component of pandemic preparedness and response. The extensive data, covering a period from 2019 to 2033, allows for in-depth analysis and informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include LabCorp, Quest Diagnostics, Walgreens, Kroger Health, CapitalBio Medlab, BEIJING IPE CENTER FOR CLINICAL LABORATORY, KingMed Diagnostics, Kaipu, Medical Laborary, Pony Testing International Group.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Drive-through COVID-19 Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Drive-through COVID-19 Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.