1. What is the projected Compound Annual Growth Rate (CAGR) of the Drill Pipe Safety Valve?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Drill Pipe Safety Valve

Drill Pipe Safety ValveDrill Pipe Safety Valve by Type (Upper Type, Lower Type), by Application (Oil Industry, Natural Gas Industry), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

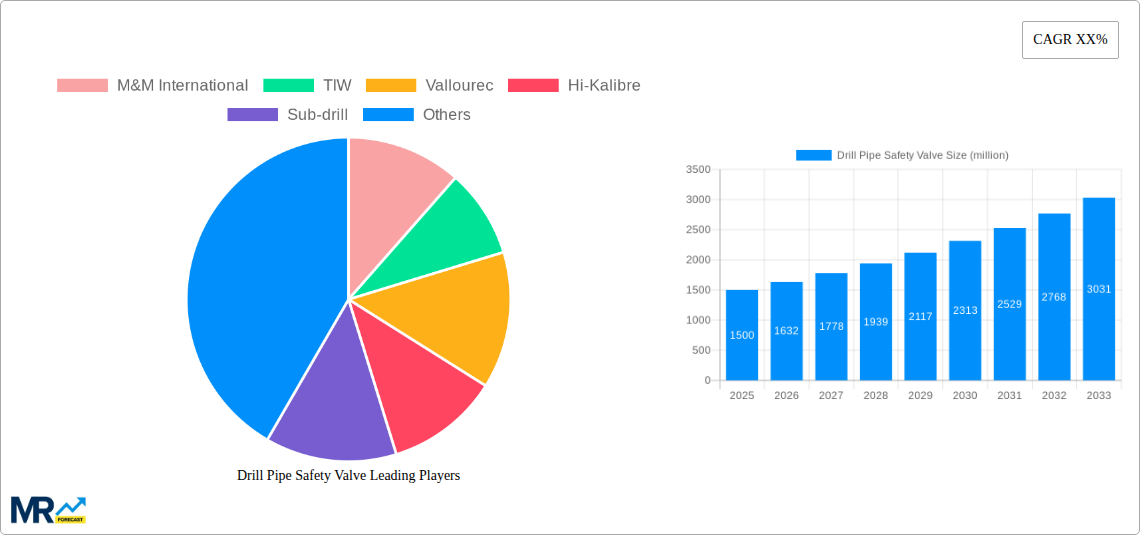

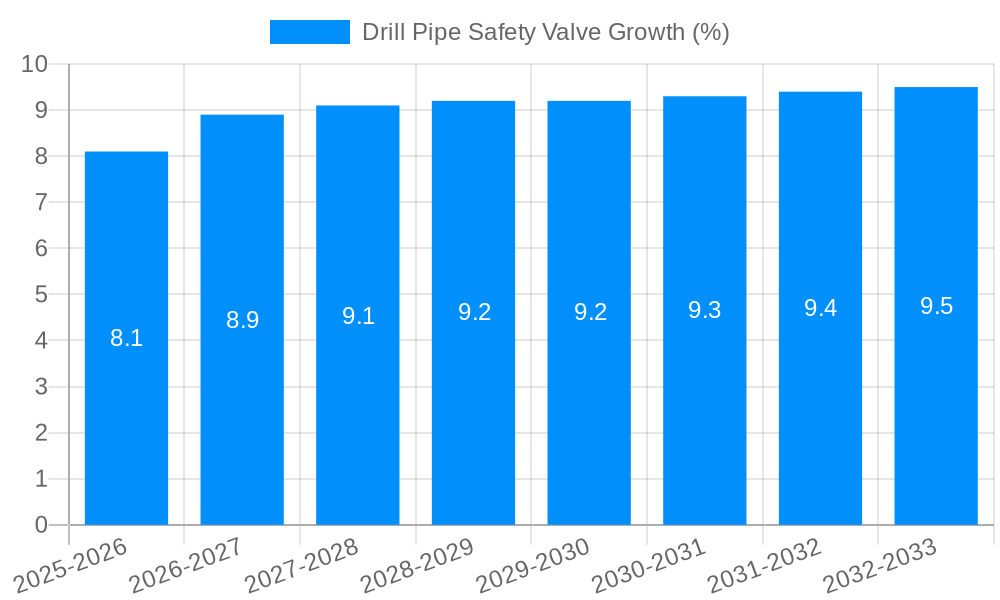

The global Drill Pipe Safety Valve market is poised for substantial growth, projected to reach an estimated USD 1,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 8.5% anticipated over the forecast period from 2025 to 2033. This robust expansion is primarily driven by the escalating demand for oil and natural gas globally, necessitating increased exploration and production activities. As energy companies intensify their drilling operations, the imperative for robust safety mechanisms like drill pipe safety valves becomes paramount. These valves are crucial for preventing uncontrolled releases of oil and gas, mitigating environmental hazards, and ensuring the safety of personnel, thus underpinning their market relevance. The market's segmentation into Upper Type and Lower Type valves, catering to specific operational needs, alongside their application in both the Oil Industry and Natural Gas Industry, highlights the diverse utility and widespread adoption across the energy sector. Key players are actively investing in technological advancements to enhance valve performance, durability, and ease of maintenance, further fueling market dynamism.

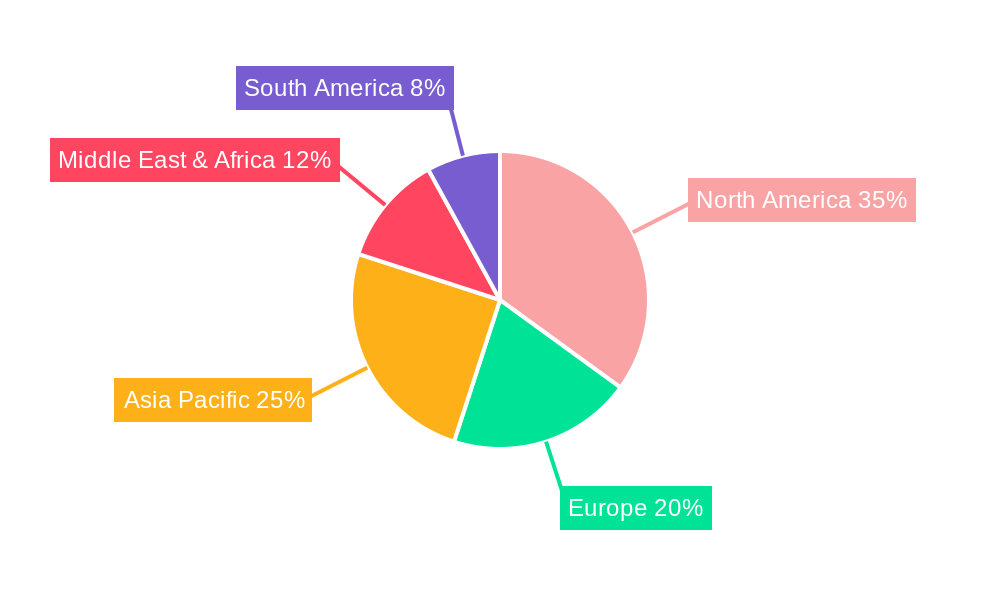

Geographically, North America is expected to maintain a dominant market share, fueled by extensive shale gas and oil extraction activities, particularly in the United States. The Asia Pacific region is emerging as a significant growth engine, driven by substantial investments in upstream oil and gas infrastructure in countries like China and India. Europe and the Middle East & Africa are also projected to witness steady growth, influenced by ongoing exploration projects and the continuous need for enhanced safety protocols. However, the market faces certain restraints, including stringent regulatory compliance costs and the inherent volatility of oil prices, which can impact capital expenditure by exploration companies. Despite these challenges, the unwavering global energy demand and the increasing emphasis on operational safety and environmental protection are expected to propel the Drill Pipe Safety Valve market towards sustained and significant expansion in the coming years.

Here is a unique report description on Drill Pipe Safety Valves, incorporating your specified elements:

XXX, a leading market research firm, presents a comprehensive analysis of the global Drill Pipe Safety Valve market, forecasting a substantial expansion driven by critical safety imperatives in the oil and gas sector. The study, covering the Study Period: 2019-2033, with Base Year: 2025 and an Estimated Year: 2025, reveals that the market is projected to witness robust growth throughout the Forecast Period: 2025-2033, building upon solid performance in the Historical Period: 2019-2024. In 2025, the global Drill Pipe Safety Valve market is estimated to be valued at approximately $650 million, with projections indicating a significant rise to over $1,200 million by 2033. This upward trajectory is fundamentally underpinned by the escalating demand for enhanced wellbore integrity and the prevention of uncontrolled hydrocarbon releases, particularly as exploration and production activities venture into more challenging and deeper environments. The increasing stringency of regulatory frameworks worldwide, coupled with a heightened industry focus on minimizing operational risks and environmental impact, are key drivers behind this market dynamism. Furthermore, advancements in material science and manufacturing technologies are enabling the production of more durable, reliable, and cost-effective drill pipe safety valves, further stimulating adoption. The report delves into the nuanced performance of various valve types, including Upper Type and Lower Type configurations, analyzing their respective market shares and growth potentials. The dominant application remains firmly within the Oil Industry, accounting for an estimated 75% of the market value in 2025, followed closely by the Natural Gas Industry, which represents approximately 20%. Emerging niche applications and aftermarket services are expected to contribute to the remaining market share, showcasing a diverse and evolving landscape. The research meticulously examines the strategic initiatives and product innovations introduced by key players such as M&M International, TIW, and Vallourec, highlighting their contributions to market expansion and technological evolution. The increasing complexity of offshore and unconventional resource extraction necessitates sophisticated safety solutions, positioning drill pipe safety valves as indispensable components of modern drilling operations and creating a fertile ground for sustained market growth.

The global Drill Pipe Safety Valve market is experiencing a significant upswing, propelled by a confluence of powerful forces that are reshaping the oil and gas exploration and production landscape. Foremost among these is the unwavering commitment to enhanced safety standards and the imperative to mitigate risks associated with deepwater and high-pressure drilling operations. As exploration pushes into previously inaccessible frontiers, the likelihood of encountering hazardous conditions increases, making the deployment of robust safety valves a non-negotiable requirement. Regulatory bodies worldwide are increasingly enforcing stricter safety protocols, mandating the use of advanced well control equipment, which directly benefits the drill pipe safety valve sector. Furthermore, the oil and gas industry is facing intense scrutiny regarding its environmental footprint. The prevention of well blowouts and uncontrolled releases is paramount in minimizing environmental damage and ensuring sustainable operations. This has spurred significant investment in technologies that enhance wellbore integrity, with drill pipe safety valves playing a crucial role. Technological advancements in material science, such as the development of corrosion-resistant alloys and high-strength steels, are enabling the creation of valves that can withstand extreme temperatures, pressures, and corrosive environments, thereby improving their reliability and lifespan. The growing adoption of digitalization and smart technologies in the oilfield is also influencing the market, with the potential for integrated safety systems and real-time monitoring of valve performance. The continued demand for oil and natural gas, despite the global energy transition, ensures ongoing drilling activities, which directly translate into sustained demand for essential safety equipment like drill pipe safety valves, thus forming a solid foundation for market expansion.

Despite the promising growth trajectory, the Drill Pipe Safety Valve market is not without its hurdles. One of the primary challenges lies in the inherent cyclical nature of the oil and gas industry. Fluctuations in crude oil and natural gas prices can lead to significant shifts in exploration and production budgets, directly impacting capital expenditure on drilling equipment, including safety valves. Periods of low commodity prices often result in reduced drilling activity, thereby constraining market growth. Another significant restraint is the high initial cost associated with advanced drill pipe safety valves. While their long-term benefits in terms of safety and risk mitigation are undeniable, the upfront investment can be a deterrent for smaller exploration companies or in regions with limited financial resources. Moreover, the complexity of these specialized valves necessitates skilled personnel for installation, maintenance, and repair, which can be a challenge in remote drilling locations. The development and implementation of sophisticated testing and certification procedures also add to the cost and lead times for product development and deployment. Furthermore, the increasing competition from manufacturers, while beneficial for consumers, can lead to price wars and margin pressures for established players. The ongoing global energy transition, with a shift towards renewable energy sources, could also pose a long-term restraint as fossil fuel exploration might see a gradual decline, though this is expected to be offset by continued demand in the Forecast Period: 2025-2033. Ensuring standardization across different operational environments and compatibility with various drilling systems can also be a technical challenge, requiring continuous innovation and collaboration within the industry.

The global Drill Pipe Safety Valve market is poised for significant growth across various regions and segments, with a clear dominance anticipated in specific areas. The Oil Industry segment is expected to remain the largest revenue generator, projected to account for approximately 75% of the total market value by 2025. This dominance stems from the sheer scale of global oil exploration and production activities, which require a vast array of specialized drilling tools, including safety valves, to ensure operational integrity and prevent catastrophic failures. The continuous demand for oil as a primary energy source, coupled with ongoing efforts to tap into complex and challenging reserves, fuels this segment's robust performance. Within the applications, the Oil Industry is further segmented by the type of operations, including onshore and offshore drilling. Offshore operations, particularly in deepwater and ultra-deepwater environments, necessitate highly sophisticated and reliable safety valves due to the inherent risks and logistical complexities involved.

Geographically, North America, particularly the United States, is expected to continue its leadership in the Drill Pipe Safety Valve market. This dominance is driven by several factors:

Another significant region poised for substantial growth is Asia Pacific, driven by the burgeoning energy demands of countries like China and India. While their current market share is smaller than North America, the rapid pace of industrialization and infrastructure development in these nations necessitates increased energy production, leading to a surge in drilling activities. Companies like Heilongjiang North Shuangjia Drilling Tools and Jiangsu Zhaoyou Petrochemical Machinery are key players in this region, catering to the growing local demand.

In terms of valve types, the Upper Type drill pipe safety valves are expected to hold a larger market share, due to their common application as a primary safety barrier located at the top of the drill string, offering immediate protection during tripping operations and in case of blowouts. However, Lower Type safety valves, strategically positioned deeper within the drill string, are gaining traction for their ability to provide localized protection in specific downhole conditions and are crucial for multi-stage fracturing and other complex well interventions.

The overall market will witness a gradual shift towards more advanced, digitally integrated, and remotely operable safety valve systems, driven by the industry's pursuit of enhanced operational efficiency and proactive risk management.

Several key factors are acting as potent growth catalysts for the Drill Pipe Safety Valve industry. The relentless pursuit of enhanced operational safety and the imperative to prevent environmental disasters are paramount. As exploration ventures into deeper and more challenging offshore and unconventional reservoirs, the demand for highly reliable safety valves escalates. Furthermore, tightening global regulations surrounding well control and environmental protection are mandating the use of advanced safety equipment, directly boosting market demand. Technological advancements, including the development of more durable materials and innovative valve designs, are enhancing performance and reliability, making these valves more attractive investments for oil and gas operators. The ongoing need for oil and natural gas, despite the energy transition, ensures continued drilling activities, a fundamental driver for safety valve consumption.

This comprehensive report provides an in-depth analysis of the global Drill Pipe Safety Valve market, offering critical insights for stakeholders across the oil and gas value chain. It meticulously examines market segmentation by Type (Upper Type, Lower Type) and Application (Oil Industry, Natural Gas Industry), providing detailed market size and forecast data for each segment. The report delves into the intricate workings of Industry Developments, highlighting emerging trends and technological advancements. Furthermore, it provides a thorough evaluation of key market drivers, restraints, and opportunities, offering a strategic outlook for the Study Period: 2019-2033. The report includes detailed regional analysis, identifying dominant markets and growth pockets, and features profiles of leading industry players such as M&M International, TIW, and Vallourec, along with their strategic initiatives. With a Base Year: 2025 and Estimated Year: 2025, and a detailed Forecast Period: 2025-2033, this report is an indispensable resource for understanding the current landscape and future trajectory of the Drill Pipe Safety Valve market, enabling informed decision-making and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include M&M International, TIW, Vallourec, Hi-Kalibre, Sub-drill, D‑Valves, Unionlever International Group, Heilongjiang North Shuangjia Drilling Tools, Jiangsu Zhaoyou Petrochemical Machinery, Mudanjiang Zhongyuan Drilling, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Drill Pipe Safety Valve," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Drill Pipe Safety Valve, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.