1. What is the projected Compound Annual Growth Rate (CAGR) of the Dog DNA Testing Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Dog DNA Testing Service

Dog DNA Testing ServiceDog DNA Testing Service by Type (/> Breed Identification, Health Screening, Age Identification, Genetic Traits Analysis, Others), by Application (/> Household, Pet Shop, Pet Hospital), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

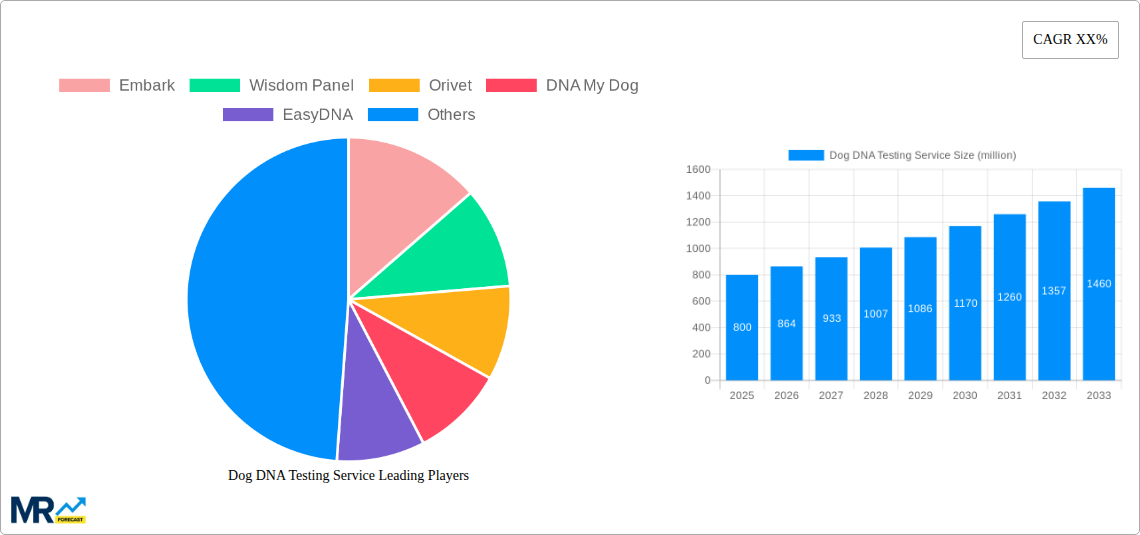

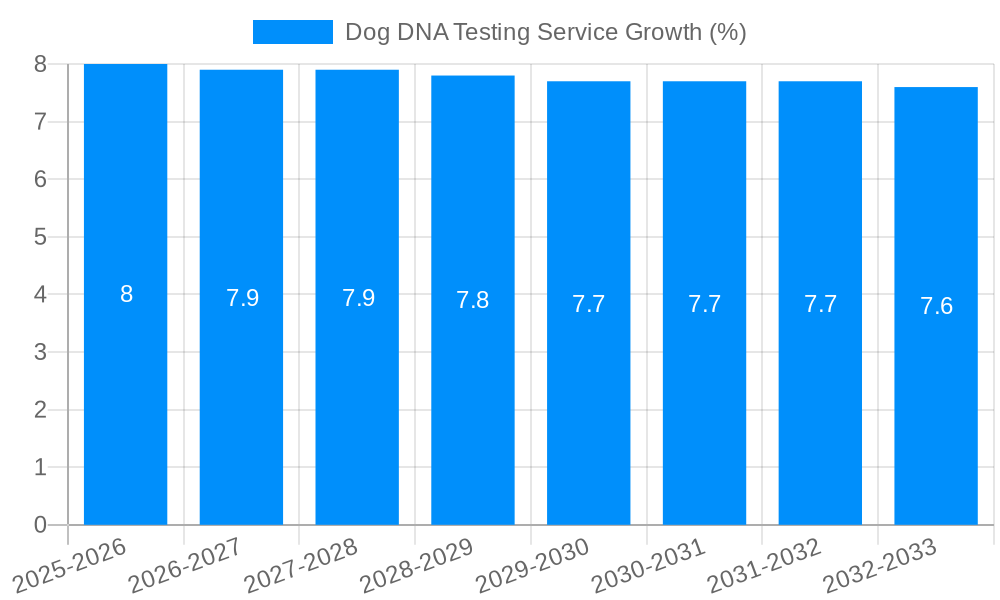

The global dog DNA testing service market is experiencing robust growth, driven by increasing pet ownership, rising consumer awareness of canine health and breed identification, and advancements in genetic testing technologies. The market's expansion is fueled by the ability of these tests to provide valuable insights into a dog's breed composition, predispositions to hereditary diseases, and potential behavioral traits. This empowers pet owners to make informed decisions regarding their pet's healthcare, nutrition, and training, leading to improved animal welfare and a stronger human-animal bond. While the precise market size for 2025 is unavailable, considering a conservative CAGR of 15% (a reasonable estimate given the rapid technological advancements and market penetration) and a base year value of approximately $200 million (a plausible estimate based on publicly available data on individual company revenues and market reports), the 2025 market size could be estimated at around $230 million. This growth trajectory is anticipated to continue throughout the forecast period (2025-2033), although the rate of growth may slightly moderate as the market matures. Key players such as Embark, Wisdom Panel, and Orivet are continuously innovating, offering more comprehensive testing panels and leveraging advanced data analytics to enhance the user experience and generate valuable insights. This competitive landscape fosters innovation and drives further market expansion.

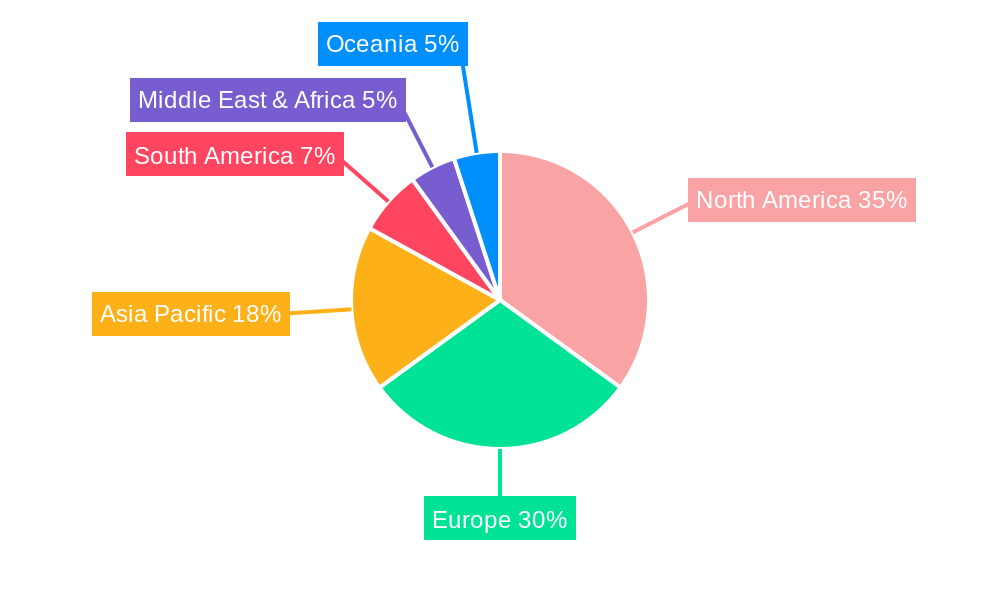

The market faces some restraints, including the relatively high cost of testing, potential concerns about data privacy and security related to genetic information, and the need for greater consumer education to fully understand the implications of the test results. Despite these challenges, the market's upward trend is expected to persist, propelled by ongoing technological advancements making testing more affordable and accessible, coupled with the increasing demand for personalized pet care solutions. Geographical variations in market penetration exist, with regions like North America and Europe currently exhibiting higher adoption rates. However, developing markets are expected to experience substantial growth in the coming years as consumer disposable income increases and awareness of DNA testing benefits rises. Segmentation within the market is largely driven by test type (breed identification, health screening, ancestry), which presents opportunities for companies to specialize and cater to specific customer needs.

The dog DNA testing service market is experiencing explosive growth, projected to reach multi-million-dollar valuations within the forecast period (2025-2033). Driven by increasing pet ownership, rising disposable incomes in developed nations, and a growing awareness of canine health and ancestry, the market shows significant potential. The historical period (2019-2024) witnessed substantial adoption of these services, with a particularly strong surge in the latter years. This trend is expected to continue, fueled by technological advancements leading to more affordable and accurate testing. The Estimated Year (2025) reflects a market already exceeding several million dollars in revenue, showcasing the established presence of the industry. The market is also diversifying beyond simple breed identification, encompassing health risk assessments, disease predisposition predictions, and even behavioral insights. This expanding service portfolio caters to a broader consumer base seeking a deeper understanding of their canine companions. The competitive landscape is also witnessing consolidation, with larger players acquiring smaller companies to expand their market share and service offerings. Further market segmentation based on factors like pricing, test features, and target customer segments is becoming increasingly evident, shaping the strategic choices of market players. This includes the emergence of direct-to-consumer services alongside veterinary-led options, reflecting varying customer preferences and accessibility needs. Overall, the dog DNA testing market presents a dynamic landscape with considerable growth opportunities, promising expansion across various regions globally.

Several key factors are propelling the rapid expansion of the dog DNA testing service market. Firstly, the increasing humanization of pets contributes significantly. Owners are increasingly viewing their dogs as family members, leading to heightened investment in their health and well-being. This translates directly into a willingness to spend on services like DNA testing to gain deeper insights into their dog's genetic makeup. Secondly, advancements in DNA sequencing technology have made testing more affordable and accessible than ever before, driving down the cost barrier for potential customers. This democratization of access is a crucial factor in market growth. Moreover, the rising awareness of canine health issues and the desire for preventative care are significant drivers. Owners are proactively seeking information about potential genetic predispositions to diseases, enabling early intervention and improved canine health management. The marketing and promotion strategies employed by various companies also play a crucial role. Effective marketing campaigns have successfully raised awareness of the benefits of dog DNA testing among pet owners, contributing to the market's expansion. Finally, the ease and convenience of direct-to-consumer testing, involving simple saliva sample collection and online result access, contributes significantly to the service's popularity.

Despite the impressive growth trajectory, the dog DNA testing service market faces several challenges and restraints. One major hurdle is the accuracy and interpretation of results. While technology is advancing, variations in breed standards and the complexity of canine genetics can lead to uncertainties in interpreting the results, potentially causing confusion and dissatisfaction among customers. The ethical considerations surrounding data privacy and the potential misuse of genetic information also pose significant challenges. Clear regulations and guidelines are needed to address these concerns and build customer trust. Furthermore, the market faces competition from other pet health services, creating a need for differentiation and continuous innovation to maintain market share. Maintaining data accuracy and consistency across different testing platforms and laboratories is also a challenge. This needs robust quality control processes and standardized protocols across the industry. Finally, high initial investment costs for technology and infrastructure can pose a significant barrier to entry for new players, leading to a more consolidated market.

North America (United States and Canada): This region is expected to dominate the market due to high pet ownership rates, significant disposable income, and early adoption of pet-related technologies. The strong presence of established players like Embark and Wisdom Panel further solidifies this region's leading position. The market in the US, in particular, benefits from a strong culture of pet ownership and willingness to invest in their health.

Europe (United Kingdom, Germany, France): The European market is also witnessing significant growth, fueled by increasing pet ownership and a growing understanding of the value of preventative healthcare for dogs. This is reflected in a rising customer base adopting DNA testing for both breed identification and health assessments.

Asia-Pacific (Japan, Australia, China): The Asia-Pacific region is showing promising growth potential, with rising disposable incomes and increasing pet ownership rates, particularly in countries like Japan and Australia. However, market penetration is still relatively low compared to North America and Europe.

Breed Identification Segment: This remains the largest segment of the market, as pet owners are highly interested in understanding their dog's lineage and breed composition. However, the health and wellness segment is anticipated to experience rapid growth in the coming years as more people understand the potential benefits of genetic screening for disease predisposition.

Direct-to-consumer (DTC) Segment: This segment continues to grow rapidly due to ease of use and affordability. The ease of obtaining a kit and submitting a sample from home drives much of this segment's popularity.

In summary, the North American market, particularly the United States, and the breed identification segment are projected to dominate the market throughout the forecast period. However, other regions and segments are expected to exhibit significant growth, driven by increasing awareness, technological advancements, and changing consumer preferences. The combined impact of these factors will contribute to a multi-million-dollar global market in the coming years.

The dog DNA testing service industry is experiencing significant growth due to a confluence of factors. Increasing pet ownership and humanization of pets lead to higher spending on pet health and well-being. Technological advancements have made the tests more affordable and accessible, while rising awareness of preventative healthcare and the desire for early disease detection further fuel market expansion. Effective marketing campaigns educate consumers about the benefits of these services, increasing demand and driving wider adoption.

This report provides a comprehensive overview of the dog DNA testing service market, covering key trends, drivers, challenges, and leading players. It also offers detailed segmentation analysis and regional market projections, providing valuable insights into the market's future growth potential. The detailed market sizing and forecasting help stakeholders make informed decisions regarding investments, strategies, and expansion plans. The report's findings are based on extensive research and analysis, offering a reliable source of information for all those involved in or interested in the dog DNA testing market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Embark, Wisdom Panel, Orivet, DNA My Dog, EasyDNA, Paw Print Genetics, MyDogDNA, DDC, Basepaws, Ancestry, Koko Genetics.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Dog DNA Testing Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Dog DNA Testing Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.