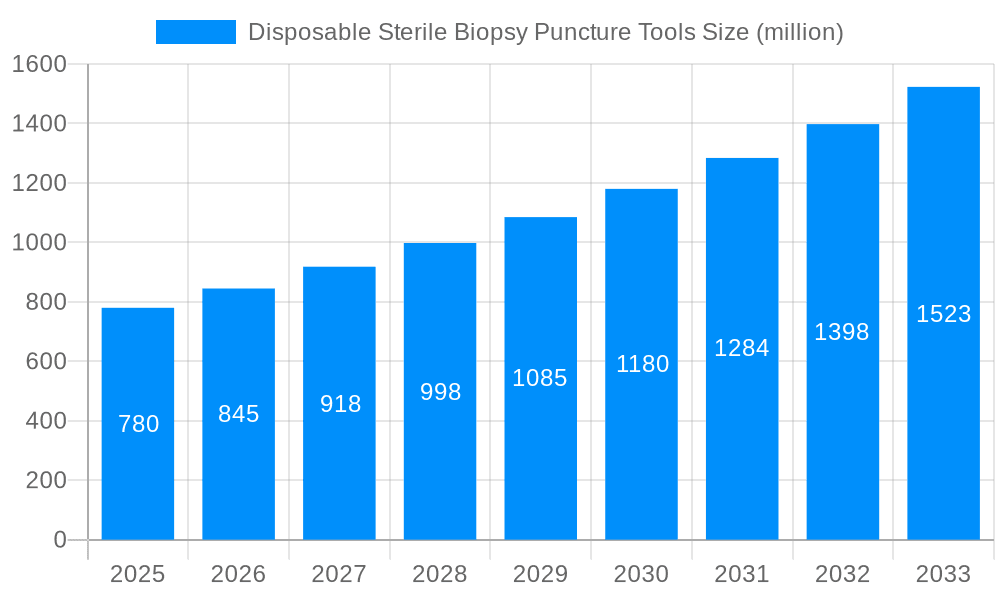

1. What is the projected Compound Annual Growth Rate (CAGR) of the Disposable Sterile Biopsy Puncture Tools?

The projected CAGR is approximately 11.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Disposable Sterile Biopsy Puncture Tools

Disposable Sterile Biopsy Puncture ToolsDisposable Sterile Biopsy Puncture Tools by Type (Below 3 mm, 3-6 mm, Above 6 mm), by Application (Dermatology, Cosmetic Procedures, Lab, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Disposable Sterile Biopsy Puncture Tools market is poised for substantial growth, projected to reach an estimated USD 13.22 billion by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 11.6% throughout the forecast period of 2025-2033. This significant expansion is primarily driven by the increasing prevalence of chronic diseases requiring accurate and early diagnosis, alongside a growing demand for minimally invasive procedures across various medical specialties. The rising healthcare expenditure globally, coupled with advancements in diagnostic technologies, further fuels the adoption of these sterile biopsy tools. Key applications include dermatology, cosmetic procedures, and laboratory diagnostics, where precision and sterility are paramount. The market is segmented by tool type, with the "Below 3 mm" and "3-6 mm" segments expected to witness considerable traction due to their suitability for a wide range of diagnostic needs in sensitive areas.

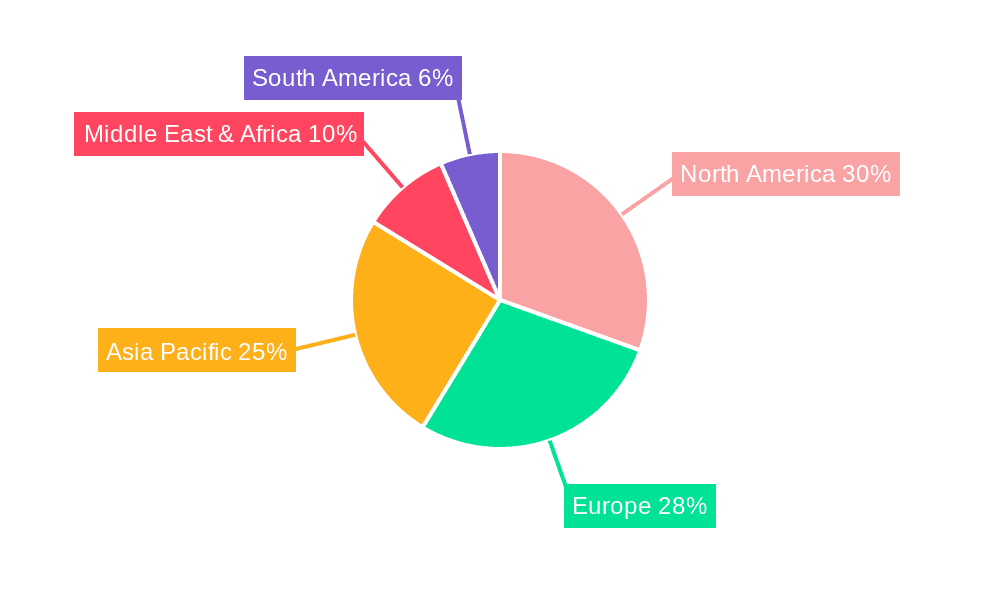

The market's trajectory is further shaped by emerging trends such as the development of enhanced needle designs for improved patient comfort and sample quality, and the increasing focus on single-use sterile instruments to mitigate the risk of healthcare-associated infections. Regions like North America and Europe are anticipated to lead the market, owing to established healthcare infrastructures, higher patient awareness, and significant R&D investments. However, the Asia Pacific region presents a high-growth potential due to its expanding healthcare sector, increasing disposable incomes, and growing adoption of advanced medical devices. While the market exhibits strong growth potential, potential restraints could include stringent regulatory approvals for new products and the initial cost of advanced sterile biopsy tools, though these are likely to be offset by the long-term benefits of improved patient outcomes and reduced infection rates.

This comprehensive report offers an in-depth analysis of the global Disposable Sterile Biopsy Puncture Tools market, providing critical insights into its current trajectory and future potential. Covering a study period from 2019 to 2033, with the base and estimated year set at 2025 and a forecast period from 2025 to 2033, the report leverages historical data from 2019-2024 to present a robust market evaluation. The market is segmented by Type (Below 3 mm, 3-6 mm, Above 6 mm) and Application (Dermatology, Cosmetic Procedures, Lab, Others). Furthermore, it meticulously examines key industry developments influencing market dynamics. The report highlights the significant market size, projected to reach multi-billion dollar valuations, driven by increasing healthcare expenditures and advancements in minimally invasive procedures.

The global market for Disposable Sterile Biopsy Puncture Tools is experiencing a significant upward trajectory, driven by an escalating demand for minimally invasive diagnostic and therapeutic procedures across various healthcare disciplines. The market, valued in the billions of dollars, is poised for substantial growth throughout the forecast period (2025-2033), building upon a strong historical performance from 2019-2024. Key trends shaping this landscape include the increasing adoption of these sterile tools in dermatology for accurate lesion sampling and early disease detection, as well as their growing application in cosmetic procedures for aesthetic enhancements and targeted treatments. The precision and sterility offered by these single-use instruments are paramount in minimizing infection risks and ensuring patient safety, thus fostering higher adoption rates. Furthermore, advancements in material science and manufacturing technologies are leading to the development of more ergonomic, sharper, and cost-effective biopsy puncture tools, expanding their accessibility and utility. The trend towards point-of-care diagnostics also plays a crucial role, with these tools facilitating rapid sample collection in diverse settings, including clinics and even remote healthcare facilities. The growing awareness among healthcare professionals and patients regarding the benefits of early and accurate diagnosis through biopsy further propels the market forward. The segmentation analysis reveals distinct growth patterns within different size categories, with tools below and between 3-6 mm witnessing particularly strong demand due to their applicability in a wide range of dermatological and cosmetic interventions. The emphasis on infection control and the inherent limitations of reusable instruments in sterile environments underscore the consistent demand for disposable options.

Several powerful forces are propelling the growth of the Disposable Sterile Biopsy Puncture Tools market. Foremost among these is the escalating global prevalence of skin conditions and cancers, which directly translates into a higher demand for diagnostic biopsies. As healthcare systems worldwide prioritize early detection and intervention for better patient outcomes, the role of accurate and sterile biopsy tools becomes indispensable. The increasing popularity of cosmetic procedures, ranging from mole removal to minor skin enhancements, also significantly contributes to market expansion. These procedures, often performed in outpatient settings, necessitate the use of safe, sterile, and readily available biopsy instruments. Technological advancements in the manufacturing of these tools are another critical driver. Innovations in metallurgy have led to the development of sharper, more durable, and precisely engineered needles, improving patient comfort and sample quality. Furthermore, the inherent advantage of disposability in preventing cross-contamination and hospital-acquired infections aligns perfectly with the stringent hygiene standards in modern healthcare, making them the preferred choice for medical practitioners. The growing emphasis on value-based healthcare and the need for cost-effectiveness in healthcare delivery also favor disposable tools, as they eliminate the expenses associated with sterilization, maintenance, and replacement of reusable instruments over time.

Despite the robust growth, the Disposable Sterile Biopsy Puncture Tools market is not without its challenges and restraints. A significant hurdle is the increasing scrutiny and evolving regulatory landscape surrounding medical devices. Manufacturers must continually adapt to new standards and compliance requirements, which can involve substantial investment in research, development, and quality control. The disposal of medical waste, including these single-use biopsy tools, presents an environmental concern and can lead to increased waste management costs for healthcare facilities. This necessitates the development of more sustainable disposal methods or biodegradable materials, which are still in nascent stages of widespread adoption. Price sensitivity among certain healthcare providers, particularly in developing economies, can also pose a restraint. While the overall cost-effectiveness of disposable tools is established, the upfront purchase price can be a deterrent in budget-constrained environments, leading some to opt for cheaper, less sterile alternatives where possible. Furthermore, the market can experience intense competition, with numerous players vying for market share. This can lead to price wars and pressure on profit margins, requiring companies to focus on innovation and value-added services to maintain their competitive edge. The limited awareness or accessibility of advanced biopsy techniques in certain underserved regions also restricts the full market potential.

The North America region is anticipated to dominate the global Disposable Sterile Biopsy Puncture Tools market, driven by several synergistic factors. The region boasts a highly developed healthcare infrastructure, characterized by a high density of specialized clinics, hospitals, and aesthetic centers. This robust ecosystem fosters a consistent demand for advanced medical consumables, including sterile biopsy tools. The strong emphasis on preventative healthcare and early disease detection in countries like the United States and Canada further fuels the market. This includes widespread screening programs for various cancers, where precise and sterile biopsy procedures are integral. Furthermore, North America is a leading hub for dermatological advancements and cosmetic procedures. The high disposable income and strong consumer interest in aesthetic treatments contribute to a significant market for biopsy tools in cosmetic dermatology. The presence of major research institutions and medical device manufacturers in the region also drives innovation and the adoption of new technologies, such as advanced needle designs and ergonomic handling features.

In terms of Application, Dermatology is poised to be the dominant segment within the Disposable Sterile Biopsy Puncture Tools market. This dominance is underpinned by several critical factors:

While Cosmetic Procedures and Lab applications are significant growth areas, the sheer volume of routine dermatological diagnoses and treatments positions Dermatology as the primary driver of demand for Disposable Sterile Biopsy Puncture Tools in the foreseeable future.

Several key growth catalysts are fueling the expansion of the Disposable Sterile Biopsy Puncture Tools industry. The increasing global burden of chronic diseases, particularly non-communicable diseases like skin cancers, directly escalates the need for diagnostic tools. Furthermore, the growing acceptance and demand for minimally invasive surgical procedures across various medical specialties are significant contributors. Technological advancements leading to the development of sharper, more precise, and user-friendly biopsy tools enhance their utility and adoption rates. The persistent emphasis on infection control in healthcare settings also strongly favors disposable sterile instruments, minimizing the risk of hospital-acquired infections.

This report provides a comprehensive overview of the global Disposable Sterile Biopsy Puncture Tools market, offering invaluable insights for stakeholders. It meticulously analyzes market size and growth projections, segmented by product type and application, with detailed examination of the historical, base, and forecast periods (2019-2033). The report delves into the critical driving forces, challenges, and restraints impacting market dynamics. It identifies key regions and dominant segments, offering strategic perspectives for market penetration and expansion. Furthermore, it highlights significant industry developments, growth catalysts, and profiles leading market players, ensuring a complete understanding of the competitive landscape. This comprehensive coverage equips businesses with the necessary intelligence to make informed strategic decisions and capitalize on emerging opportunities within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.6%.

Key companies in the market include Kai Industries, Integra LifeSciences, CooperSurgical, Stiefel, KRUUSE, Feather, Aesthetic, DTR Medical, Acuderm, Accutec Blades, MedBlades, Paramount Surgimed, Razormed, Ribbel, Plasti Med, Acti-Med, Basco, SOMATEX, Bright Shine, Medgyn Products, Robinson Healthcare, .

The market segments include Type, Application.

The market size is estimated to be USD 13.22 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Disposable Sterile Biopsy Puncture Tools," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Disposable Sterile Biopsy Puncture Tools, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.