1. What is the projected Compound Annual Growth Rate (CAGR) of the Disposable Introducer Sheath?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Disposable Introducer Sheath

Disposable Introducer SheathDisposable Introducer Sheath by Type (Cardiovascular Catheter Sheath, Peripheral Vascular Catheter Sheath, World Disposable Introducer Sheath Production ), by Application (Hospital, Clinic, World Disposable Introducer Sheath Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

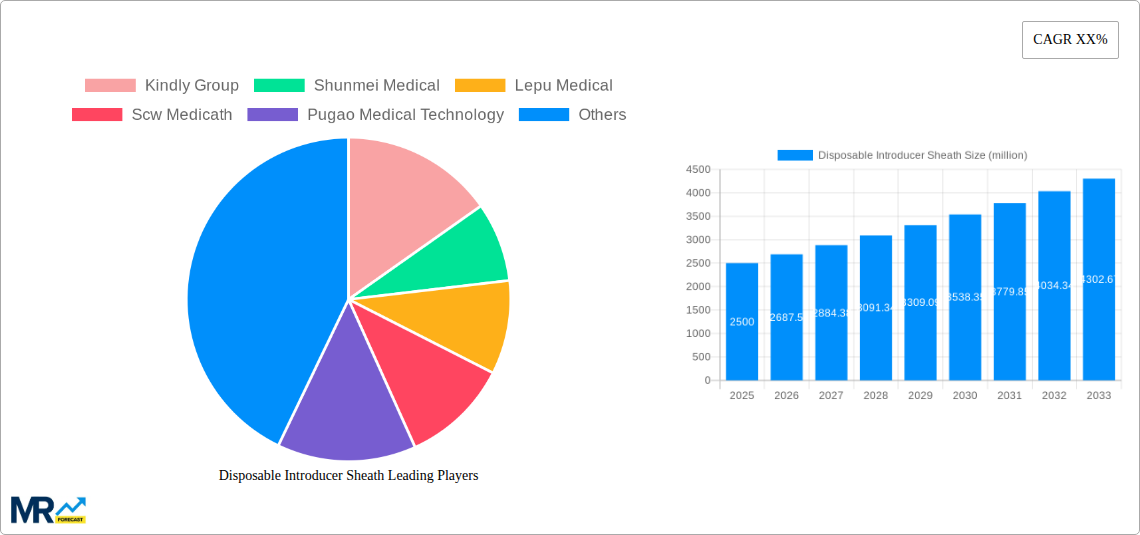

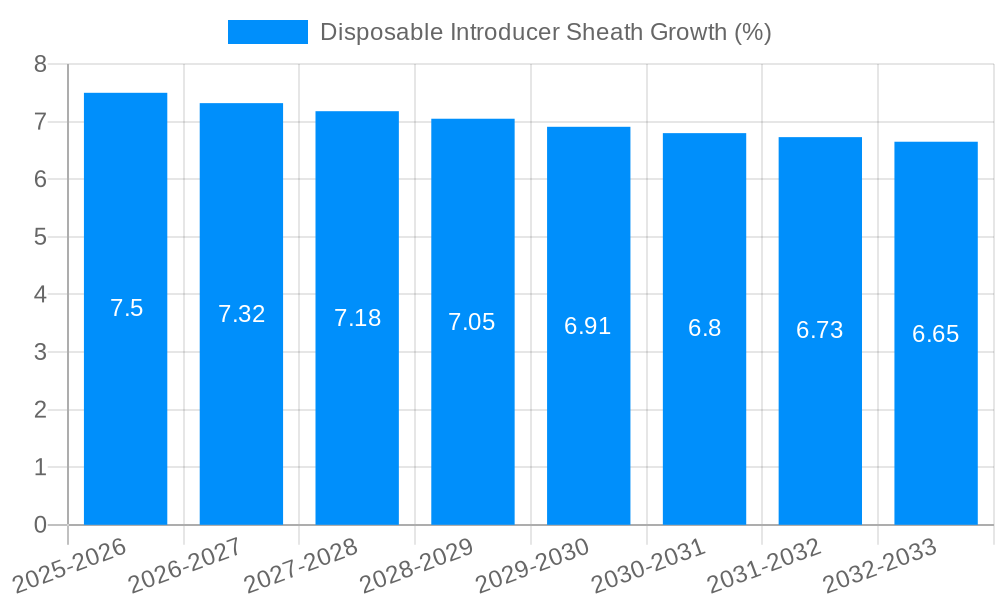

The global Disposable Introducer Sheath market is poised for significant expansion, projected to reach approximately USD 2,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 7.5% from 2019-2033. This robust growth is fueled by several key drivers, including the escalating prevalence of cardiovascular diseases and peripheral vascular conditions worldwide. An aging global population further amplifies the demand for minimally invasive procedures, where introducer sheaths are critical components for delivering therapeutic devices and diagnostic tools. Advancements in catheter technology, leading to smaller and more sophisticated sheaths with enhanced guidewire compatibility and kink resistance, are also a major impetus. The increasing adoption of interventional cardiology and radiology procedures, especially in emerging economies undergoing healthcare infrastructure development, is contributing significantly to market penetration. Furthermore, the inherent benefits of disposable introducer sheaths, such as reduced risk of cross-contamination and improved workflow efficiency in healthcare settings, continue to drive their preference over reusable alternatives.

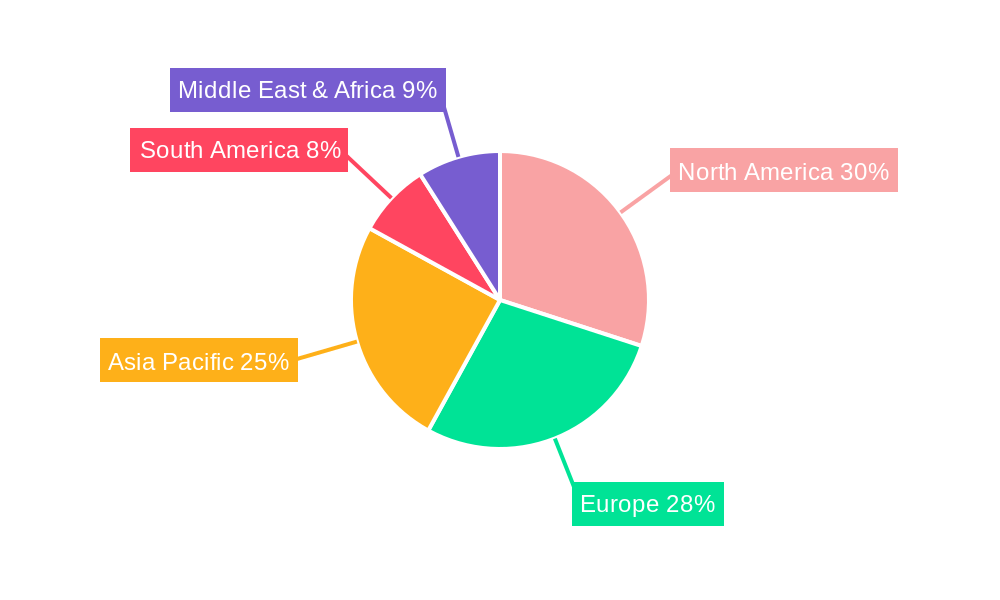

The market is segmented into Cardiovascular Catheter Sheath and Peripheral Vascular Catheter Sheath, with the former likely holding a larger share due to the higher incidence and treatment rates of cardiac conditions. Application-wise, hospitals represent the dominant segment, followed by clinics, reflecting the primary settings for these medical devices. Geographically, North America and Europe are expected to maintain substantial market share, driven by advanced healthcare systems and high per capita healthcare spending. However, the Asia Pacific region, particularly China and India, is anticipated to exhibit the fastest growth due to a large patient pool, increasing disposable incomes, and growing investments in healthcare infrastructure. Key market restraints include stringent regulatory approvals and the cost sensitivity in certain emerging markets, which might influence adoption rates. Nevertheless, the overall trajectory points towards sustained demand and market expansion in the foreseeable future.

This report delves into the dynamic global market for Disposable Introducer Sheaths, a critical component in minimally invasive medical procedures. The study encompasses a comprehensive analysis from the historical period of 2019-2024, with a base year of 2025, and projects growth through the forecast period of 2025-2033. We aim to provide stakeholders with actionable insights into market trends, growth drivers, challenges, and the competitive landscape, informing strategic decision-making in this vital segment of the medical device industry.

The global Disposable Introducer Sheath market is poised for significant expansion, driven by an escalating demand for minimally invasive surgical techniques and a burgeoning geriatric population worldwide. The World Disposable Introducer Sheath Production is projected to witness substantial growth, with an estimated production volume reaching over 50 million units by the base year of 2025, and further climbing to an impressive 75 million units by the end of the forecast period in 2033. This upward trajectory is underpinned by the inherent advantages of introducer sheaths, including reduced patient trauma, shorter hospital stays, and faster recovery times, all of which contribute to their increasing adoption across various medical specialties.

The Cardiovascular Catheter Sheath segment, in particular, is expected to remain a dominant force, fueled by the persistent and growing prevalence of cardiovascular diseases. Procedures like angioplasty, stenting, and pacemaker implantation, which rely heavily on these sheaths, are becoming more sophisticated and widespread. Similarly, the Peripheral Vascular Catheter Sheath segment is experiencing robust growth, mirroring the rise in conditions such as peripheral artery disease and deep vein thrombosis, demanding advanced interventional treatments. The Application sector also reflects this trend, with Hospitals accounting for the lion's share of consumption due to their comprehensive infrastructure and high volume of surgical procedures. However, the increasing integration of specialized interventional services into Clinics is also a notable trend, indicating a diversification in the end-user landscape. Innovation in material science, focusing on enhanced lubricity and reduced thrombogenicity, along with the development of sheaths with improved kink resistance and flexibility, are key technological advancements shaping the market. Furthermore, the growing emphasis on single-use medical devices to mitigate the risk of healthcare-associated infections is a secular trend that directly benefits the disposable introducer sheath market. The market's evolution is also being shaped by increasing healthcare expenditure in emerging economies and a growing awareness among healthcare professionals about the benefits of minimally invasive approaches. The intricate interplay of these factors is creating a fertile ground for sustained market expansion and innovation.

The disposable introducer sheath market is propelled by a confluence of powerful driving forces, primarily centered around the escalating global burden of chronic diseases and the resultant surge in demand for minimally invasive surgical interventions. The increasing prevalence of cardiovascular diseases, such as coronary artery disease and heart failure, directly translates into a higher volume of cardiac catheterization procedures, angioplasties, and stent placements – all of which are heavily reliant on introducer sheaths. Similarly, the growing incidence of peripheral vascular diseases, including peripheral artery disease (PAD) and deep vein thrombosis (DVT), necessitates a greater number of endovascular procedures, further bolstering the demand for peripheral vascular introducer sheaths.

Beyond disease prevalence, advancements in medical technology play a crucial role. The development of more sophisticated catheters, guidewires, and imaging modalities has enabled clinicians to perform increasingly complex procedures with greater precision and safety, thereby expanding the scope of minimally invasive treatments. This technological evolution necessitates the use of introducer sheaths that are compatible with these advanced devices and offer enhanced performance characteristics. Furthermore, the inherent advantages of minimally invasive surgery, such as reduced patient trauma, shorter hospital stays, quicker recovery times, and lower overall healthcare costs, are increasingly recognized by both healthcare providers and patients, leading to a widespread preference for these approaches. This shift in treatment paradigm directly fuels the demand for disposable introducer sheaths, which are integral to the execution of these procedures. The expanding healthcare infrastructure, particularly in emerging economies, coupled with increasing disposable incomes, is also contributing to greater access to advanced medical treatments, further accelerating market growth.

Despite the robust growth trajectory, the disposable introducer sheath market is not without its challenges and restraints. A significant concern revolves around the increasing stringency of regulatory frameworks globally. Manufacturers must navigate complex approval processes and adhere to evolving quality standards, which can lead to increased development costs and longer time-to-market for new products. The potential for product recalls due to manufacturing defects or adverse event reporting can also pose a significant financial and reputational risk to companies.

Furthermore, the cost-effectiveness of disposable introducer sheaths, particularly in resource-limited settings, remains a key consideration. While disposable devices offer clear advantages in terms of infection control, their per-procedure cost can be a barrier to adoption in some markets, prompting a search for more economical alternatives or reusable options in certain scenarios. Price sensitivity among healthcare providers, especially in the face of declining reimbursement rates for certain procedures, can also exert downward pressure on pricing, impacting profit margins for manufacturers. The intense competition within the market, with numerous players vying for market share, further exacerbates pricing pressures. Moreover, the susceptibility of these devices to mechanical failures, such as kinking or breakage during insertion, although less frequent with advancements, can lead to procedure complications and patient dissatisfaction, posing a reputational challenge and potentially leading to litigation. Finally, the increasing awareness and focus on environmental sustainability in the healthcare sector may eventually lead to pressures for more eco-friendly disposal methods or alternative materials, requiring manufacturers to invest in sustainable practices.

The global Disposable Introducer Sheath market is characterized by a dynamic interplay of regional dominance and segment leadership. While the market is geographically diverse, North America and Europe have historically been major contributors due to their well-established healthcare infrastructures, high per capita healthcare spending, and the early adoption of advanced medical technologies. However, the Asia-Pacific region is emerging as a dominant force, particularly driven by countries like China and India. This surge is attributed to several factors, including a rapidly growing and aging population, a significant increase in the prevalence of cardiovascular and peripheral vascular diseases, expanding healthcare expenditure, and government initiatives aimed at improving healthcare access and outcomes.

Within this burgeoning market, the Cardiovascular Catheter Sheath segment is expected to remain the most significant contributor to overall market value and volume. The relentless rise in the incidence of cardiovascular diseases globally, coupled with the increasing preference for minimally invasive cardiac interventions like percutaneous coronary interventions (PCI), transcatheter aortic valve replacements (TAVR), and pacemaker implantations, directly fuels the demand for cardiovascular introducer sheaths. These procedures are increasingly becoming the standard of care for many cardiac conditions, driving substantial consumption. For instance, the estimated World Disposable Introducer Sheath Production for cardiovascular applications alone is anticipated to exceed 30 million units by the base year of 2025, with a projected increase to over 45 million units by 2033.

The Hospital segment, as an application, will continue to dominate the market landscape. Hospitals are the primary centers for complex surgical procedures, including cardiovascular and peripheral interventions, and are equipped with the necessary infrastructure, specialized medical personnel, and a higher volume of patient flow. The concentration of interventional cardiology and radiology departments within hospitals makes them the largest consumers of disposable introducer sheaths. By 2025, it is estimated that hospitals will account for over 70% of the total market consumption, with this share remaining substantial throughout the forecast period. The growth in the clinic segment, while present, will be more incremental in comparison to the established dominance of hospitals in terms of sheer volume. The sheer scale of procedures performed in hospital settings, coupled with the need for a diverse range of introducer sheath sizes and configurations to cater to various anatomical challenges and procedural requirements, solidifies the hospital segment's leading position. The continuous development of novel and improved introducer sheaths designed for specific cardiovascular and peripheral vascular applications will further reinforce the dominance of these segments and regions.

The Disposable Introducer Sheath industry is experiencing robust growth, largely catalyzed by the escalating global prevalence of chronic diseases, particularly cardiovascular and peripheral vascular conditions. This demographic shift necessitates an increasing number of minimally invasive procedures, which are directly reliant on introducer sheaths. Furthermore, continuous advancements in medical technology, leading to the development of more sophisticated and user-friendly introducer sheath designs with enhanced lubricity and kink resistance, are expanding the procedural indications and improving patient outcomes. The growing acceptance and preference for minimally invasive surgery over traditional open procedures, owing to benefits like reduced trauma and faster recovery, further acts as a significant growth catalyst.

This report offers an in-depth and comprehensive analysis of the global Disposable Introducer Sheath market, providing stakeholders with actionable intelligence for strategic planning and decision-making. The study meticulously examines market dynamics, including historical trends, current scenarios, and future projections, covering a study period from 2019 to 2033 with a base year of 2025. We delve into the key drivers propelling market growth, such as the rising prevalence of chronic diseases and the adoption of minimally invasive techniques. Simultaneously, the report scrutinizes the challenges and restraints that could impede market expansion, including regulatory hurdles and cost sensitivities. A detailed regional analysis highlights dominant markets and emerging opportunities, while segment-wise analysis provides insights into the performance of Cardiovascular Catheter Sheaths and Peripheral Vascular Catheter Sheaths. Furthermore, the report identifies key industry developments, leading players, and offers a robust outlook on the future trajectory of this vital medical device sector. The estimated World Disposable Introducer Sheath Production is projected to reach over 75 million units by 2033, underscoring the significant growth potential within this market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Kindly Group, Shunmei Medical, Lepu Medical, Scw Medicath, Pugao Medical Technology, Baihe Medical Technology, Demax Medical Technology, Teleflex, B. Braun, Medtronic, Merit Medical, Biotronik.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Disposable Introducer Sheath," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Disposable Introducer Sheath, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.