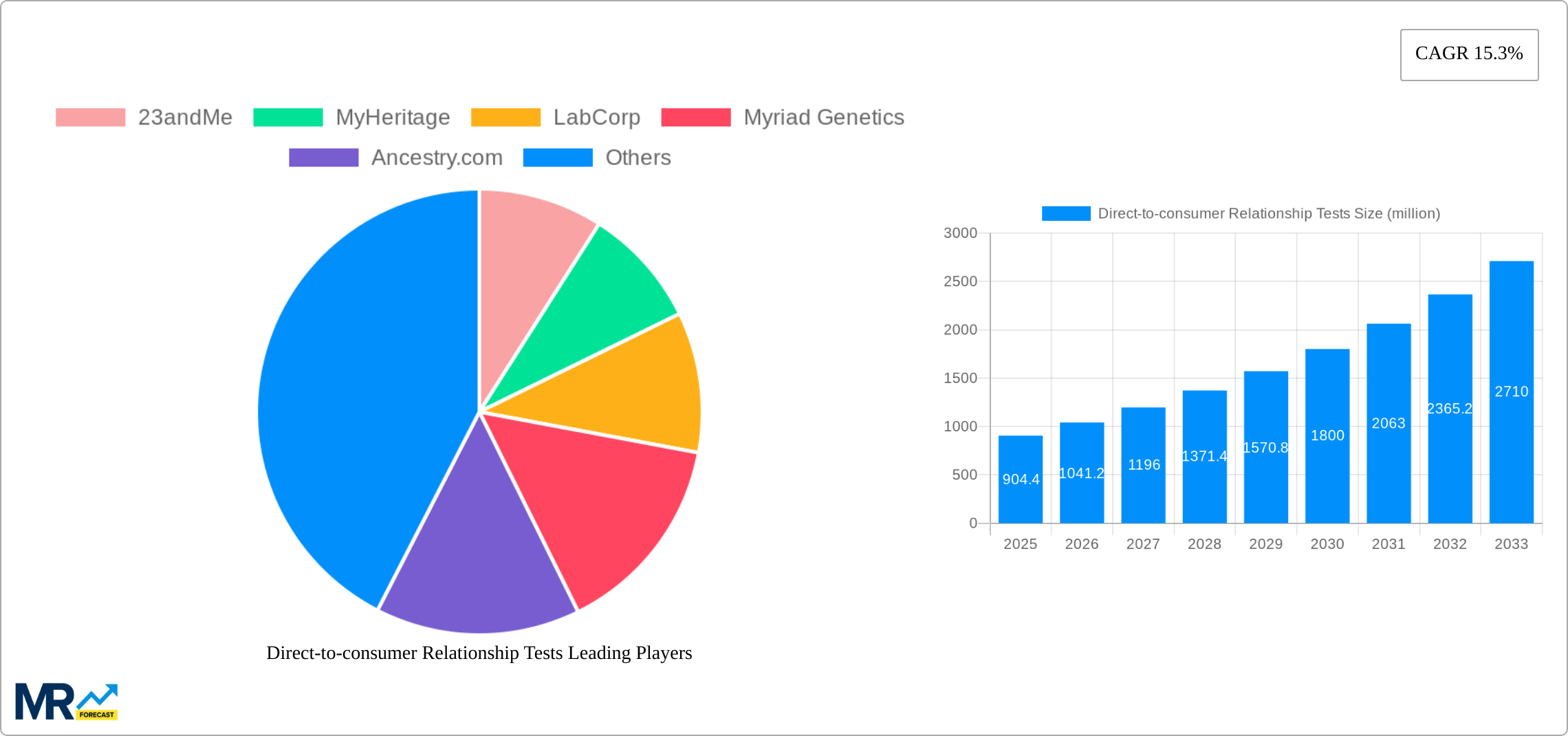

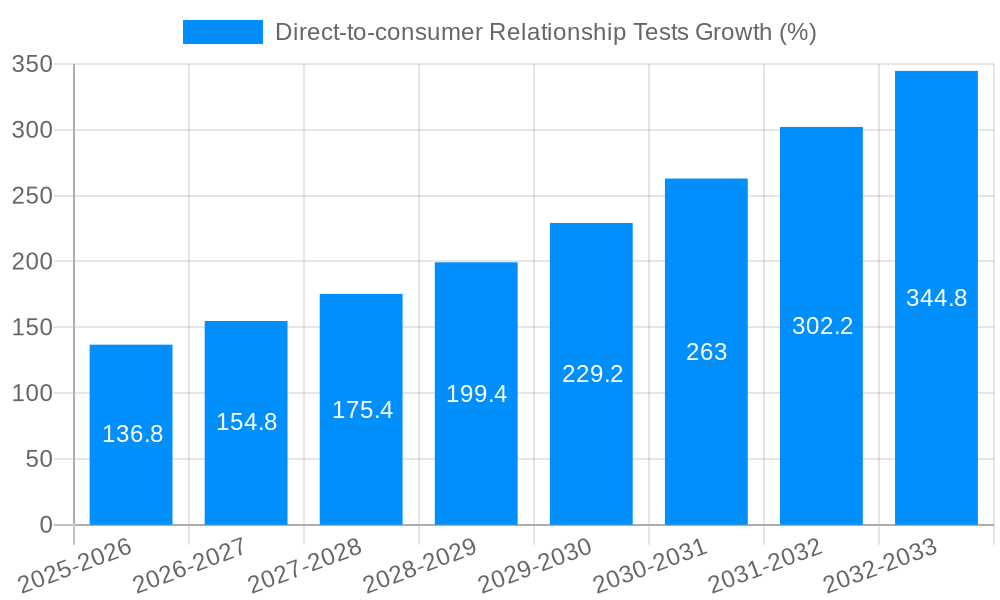

1. What is the projected Compound Annual Growth Rate (CAGR) of the Direct-to-consumer Relationship Tests?

The projected CAGR is approximately 15.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Direct-to-consumer Relationship Tests

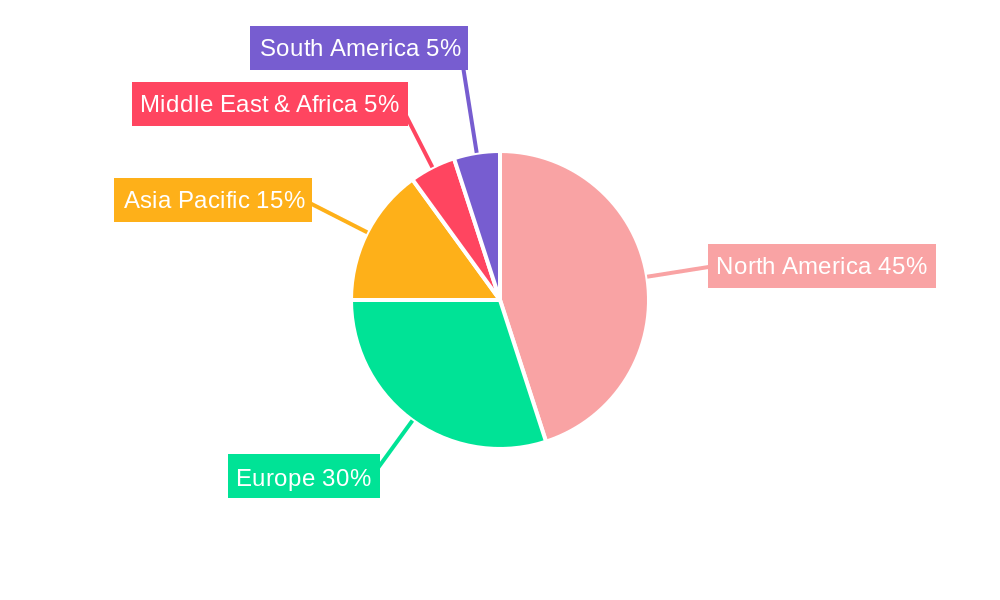

Direct-to-consumer Relationship TestsDirect-to-consumer Relationship Tests by Type (Siblings DNA Test, Grandparentage Test, Genetic Reconstruction Test, Other), by Application (Online, Offline), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The direct-to-consumer (DTC) relationship testing market, encompassing sibling DNA tests, grandparentage tests, and genetic reconstruction tests, is experiencing robust growth, projected at a 15.3% CAGR from 2019 to 2033. The 2025 market size of $904.4 million underscores significant consumer interest in exploring family history and resolving paternity or kinship questions without intermediaries. Several factors fuel this expansion. Increased accessibility and affordability of genetic testing technologies are making these tests appealing to a broader audience. Enhanced marketing and advertising campaigns by DTC genetic testing companies, emphasizing ease of use and the speed of results, have significantly boosted awareness and adoption. Furthermore, the growing curiosity regarding ancestry and family heritage, fueled by readily available online resources and genealogy platforms, strongly contributes to market demand. The market's segmentation by test type and application (online vs. offline) reveals opportunities for customized services and targeted marketing strategies. While online platforms offer convenience, offline services cater to those seeking more personalized support and interpretation of results.

The market's geographical distribution reveals a significant presence in North America, driven largely by the high adoption rate in the United States and Canada. Europe follows with a substantial market share, fueled by increasing consumer awareness and the growing popularity of ancestry research. Asia-Pacific is also a region of substantial potential, with rising disposable incomes and increasing interest in genetic testing driving future growth. However, regulatory hurdles in certain regions, concerns about data privacy and security, and the cost of testing remain potential constraints. Future growth will likely depend on continued technological advancements, innovative service offerings, and a strong emphasis on ethical considerations and data protection to ensure consumer trust and build a sustainable market.

The direct-to-consumer (DTC) relationship testing market, encompassing sibling DNA tests, grandparentage tests, genetic reconstruction tests, and other relationship verification services, is experiencing robust growth. Driven by increasing affordability, accessibility, and consumer awareness, the market is projected to reach several billion units by 2033. The historical period (2019-2024) saw significant adoption of online testing platforms, facilitated by user-friendly interfaces and rapid turnaround times. The base year (2025) reveals a market already exceeding expectations, with online applications dominating the sales landscape. The forecast period (2025-2033) anticipates continued expansion, fueled by technological advancements improving accuracy and reducing costs. This growth is not uniform across all segments; for example, while sibling DNA tests have consistently high demand due to their relatively low cost and straightforward applications, genetic reconstruction tests are witnessing a slower, yet steady, rise as their complexity and associated costs gradually decrease. The emergence of sophisticated algorithms and improved genetic analysis techniques is contributing to increased market penetration across all relationship test types. Furthermore, a rising interest in genealogy and ancestry research is broadening the customer base, extending beyond immediate family concerns to encompass broader historical lineage investigations. This trend suggests a considerable untapped market potential for innovative DTC relationship testing solutions. The increasing availability of these tests in both online and offline settings reflects a strategic approach by market players to cater to diverse customer preferences and enhance market accessibility.

Several key factors are fueling the growth of the DTC relationship testing market. Firstly, the decreasing cost of genetic sequencing and analysis has made these tests significantly more affordable and accessible to a broader population. Secondly, the rise of online platforms and e-commerce has simplified the ordering and receiving processes, eliminating geographical barriers and improving convenience. The user-friendly interfaces of many DTC testing companies have made the process easy to understand and execute, even for individuals with limited scientific knowledge. Thirdly, increased public awareness of genetic testing and its applications, driven by media coverage and educational initiatives, has significantly boosted demand. People are increasingly recognizing the benefits of resolving relationship uncertainties or establishing familial connections, driving the need for accessible and reliable testing solutions. Furthermore, the growing adoption of advanced technologies like next-generation sequencing (NGS) is leading to improved accuracy and faster turnaround times, enhancing the overall customer experience. Finally, the expanding legal applications of DTC relationship tests, for example, in immigration cases or inheritance disputes, contribute to the market's expansion, creating a steady demand beyond purely personal motivations.

Despite the rapid growth, the DTC relationship testing market faces several challenges. Accuracy concerns remain a significant issue, particularly with complex tests like genetic reconstruction. While technology is improving, the potential for errors, especially in interpreting ambiguous results, requires careful consideration and transparent communication with clients. Data privacy and security are paramount; concerns about the handling and potential misuse of sensitive genetic information represent a considerable hurdle. Stringent regulations and data protection laws necessitate robust security measures and ethical considerations in data management. The potential for misinterpretation of results, leading to emotional distress or family conflict, is a serious consideration. Clear, readily-understandable reporting and adequate counseling are essential to mitigate this risk. Furthermore, the market is becoming increasingly competitive, with new players entering frequently. This competitive environment requires continuous innovation and cost-effective strategies to maintain market share. Lastly, the lack of standardized testing protocols and regulatory oversight across different regions may lead to inconsistencies in test quality and reliability. Greater harmonization and standardization are crucial to build consumer confidence and establish a robust, reliable market.

The North American market, encompassing the United States and Canada, is currently the dominant region in the DTC relationship testing market, driven by higher disposable income, increased awareness, and readily available technology. However, the European market is showing significant growth potential, with rising adoption rates in countries like the UK and Germany. Within the segment types, sibling DNA tests currently hold the largest market share due to affordability and high demand. This is followed by grandparentage tests and other relationship verification services. Genetic reconstruction tests, while representing a smaller segment, demonstrate considerable growth potential as technological advancements enhance accuracy and reduce the cost, making them more accessible.

The paragraph below further explains these points:

The online application segment is currently dominating the DTC relationship testing landscape due to the ease and speed of access it offers. The convenience of ordering tests from home and receiving results digitally eliminates geographical barriers and time constraints for customers. This convenience is a key driver for its market leadership. While the offline segment also plays a crucial role, particularly for clients who may prefer in-person consultations or require more personalized support, the trend towards online testing is expected to continue due to the inherent advantages of digital platforms. The North American market's dominance reflects several factors, including high disposable incomes, significant consumer awareness of genetic testing's possibilities, and a robust infrastructure supporting the technology. While other regions are catching up, the established position of North America in this market appears secure for the foreseeable future. The popularity of sibling DNA tests, driven by their straightforwardness and cost-effectiveness, underlines the need for accessible and affordable options. This segment's dominance, therefore, underscores the market’s sensitivity to cost and the ease of access. Finally, the emerging market for genetic reconstruction tests represents an area of significant future growth. As technological advancements continue to increase the accuracy and reduce the cost of these tests, their adoption rate is poised to significantly increase, leading to substantial market expansion.

Several factors are catalyzing growth within the DTC relationship testing industry. These include decreasing test costs due to technological advancements in genetic sequencing, the increasing accessibility of online platforms, and rising consumer awareness of the benefits and applications of these tests. Further growth is fueled by strategic partnerships between DTC companies and healthcare providers, extending the reach and integration of these services. The expanding legal applications of these tests, broadening consumer base, also contribute to the market's overall dynamism and growth trajectory.

This report provides a comprehensive overview of the DTC relationship testing market, covering historical data (2019-2024), the base year (2025), and a forecast to 2033. It analyzes market trends, driving factors, challenges, key players, and significant developments, offering valuable insights into this rapidly evolving sector. The report segments the market by test type, application (online vs. offline), and geographical region, providing a granular understanding of market dynamics and growth opportunities. Detailed company profiles and competitive landscapes are included, offering valuable information for businesses and investors involved in or interested in this growing market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.3%.

Key companies in the market include 23andMe, MyHeritage, LabCorp, Myriad Genetics, Ancestry.com, Quest Diagnostics, Gene By Gene, DNA Diagnostics Center, Invitae, IntelliGenetics, Ambry Genetics, Living DNA, EasyDNA, Pathway Genomics, Centrillion Technology, Xcode, Color Genomics, Anglia DNA Services, African Ancestry, Canadian DNA Services, DNA Family Check, Alpha Biolaboratories, Test Me DNA, 23 Mofang, Genetic Health, DNA Services of America, Shuwen Health Sciences, Mapmygenome, Full Genomes, .

The market segments include Type, Application.

The market size is estimated to be USD 904.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Direct-to-consumer Relationship Tests," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Direct-to-consumer Relationship Tests, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.