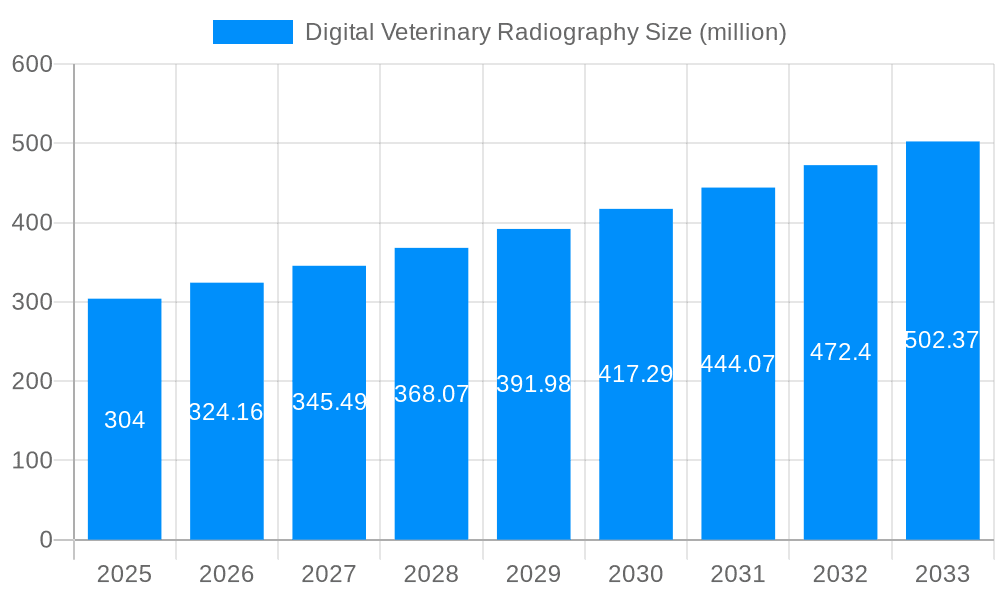

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Veterinary Radiography?

The projected CAGR is approximately 6.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Veterinary Radiography

Digital Veterinary RadiographyDigital Veterinary Radiography by Type (Veterinary X-ray System, Veterinary Dental Radiography System, Veterinary Fluoroscopy System), by Application (Pet Clinic, Zoo, Laboratory, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Digital Veterinary Radiography market is poised for robust expansion, projected to reach $304 million by 2025, demonstrating a healthy Compound Annual Growth Rate (CAGR) of 6.5% throughout the forecast period of 2025-2033. This substantial growth is primarily fueled by the escalating adoption of advanced diagnostic imaging solutions in veterinary care, driven by an increasing pet ownership globally and a growing willingness among pet owners to invest in their animal companions' health and well-being. The enhanced accuracy and speed offered by digital radiography systems compared to traditional film-based methods contribute significantly to their widespread acceptance, enabling faster diagnoses and more effective treatment planning for a diverse range of animal conditions. The expanding scope of veterinary services, encompassing routine check-ups, specialized diagnostics, and advanced surgical procedures, further propels the demand for sophisticated imaging equipment.

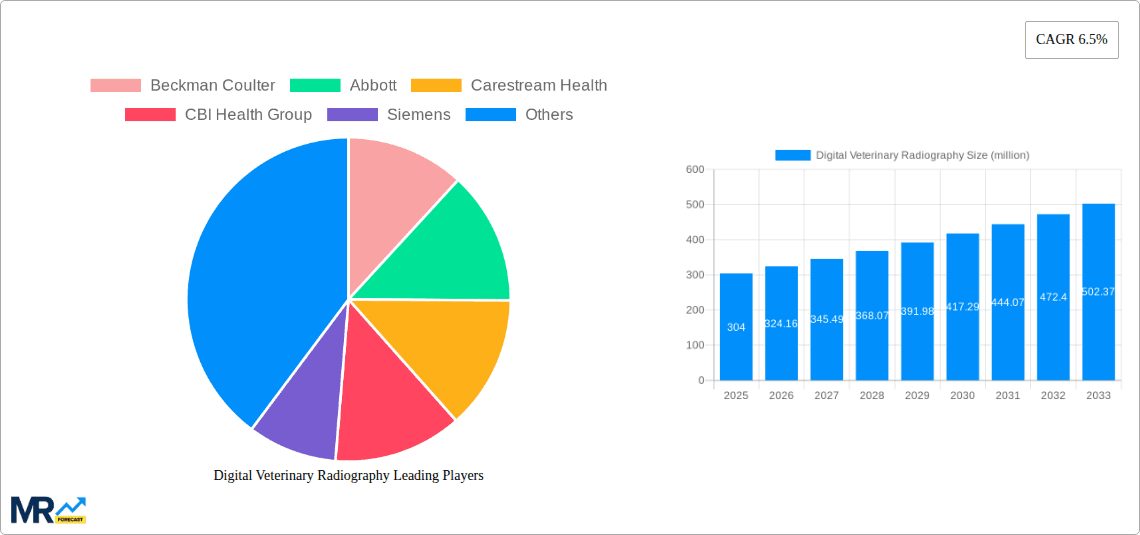

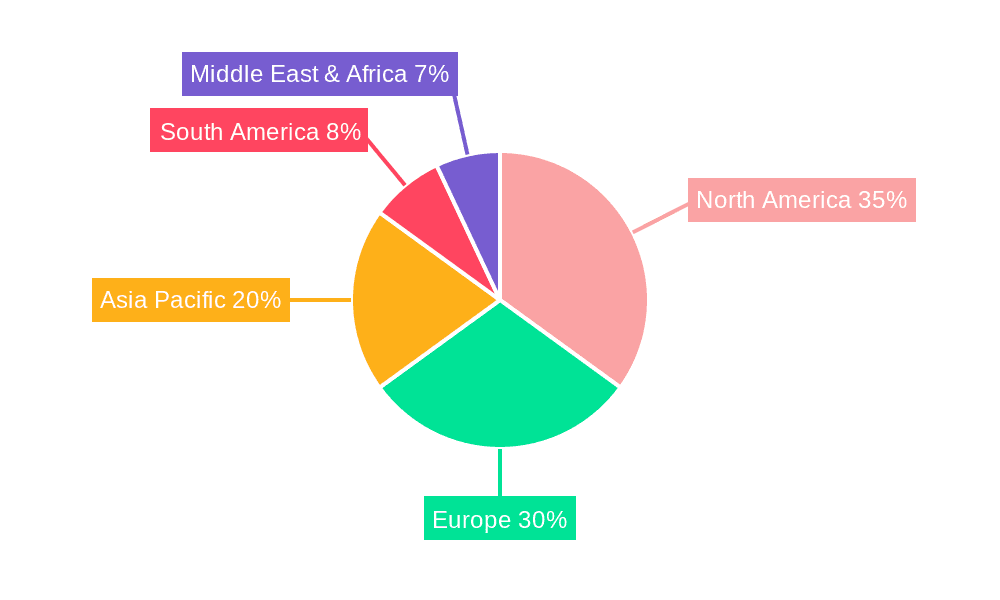

Key market drivers include technological advancements leading to more portable, user-friendly, and cost-effective digital radiography systems, coupled with an increasing awareness among veterinarians about the benefits of digital imaging in improving diagnostic capabilities and patient outcomes. The market is segmented into Veterinary X-ray Systems, Veterinary Dental Radiography Systems, and Veterinary Fluoroscopy Systems, each catering to specific diagnostic needs. Applications span across pet clinics, zoos, and laboratories, highlighting the versatility of these technologies. Leading companies such as Siemens, Carestream Health, and Hitachi are actively innovating and expanding their product portfolios, contributing to market competition and technological evolution. Geographically, North America and Europe are expected to dominate the market due to high disposable incomes, advanced healthcare infrastructure for animals, and a strong pet care culture. However, the Asia Pacific region is anticipated to exhibit the fastest growth, driven by increasing pet adoption rates and the burgeoning veterinary sector.

Here is a comprehensive report description on Digital Veterinary Radiography, incorporating your specified elements:

The global Digital Veterinary Radiography market is poised for significant expansion, projected to reach an impressive $2,700 million by 2033. This robust growth trajectory is underpinned by a confluence of technological advancements, increasing pet ownership, and a growing emphasis on advanced diagnostic capabilities within veterinary medicine. During the historical period of 2019-2024, the market has witnessed a steady adoption of digital radiography systems, primarily driven by the superior image quality, reduced radiation exposure for both animals and practitioners, and enhanced workflow efficiencies they offer compared to traditional film-based radiography. The base year of 2025 is estimated to see the market value hover around $1,250 million, setting the stage for substantial compound annual growth rates (CAGR) in the subsequent forecast period. Key market insights reveal a strong inclination towards integrated systems that combine imaging acquisition, processing, and archiving capabilities, streamlining the diagnostic process and improving patient management. The study period of 2019-2033 encompasses a comprehensive analysis of market dynamics, including shifts in technology, regulatory landscapes, and evolving end-user demands. Furthermore, the market is witnessing an increased demand for portable radiography units, particularly catering to emergency veterinary services and large animal practices. The development of advanced software solutions for image enhancement, analysis, and artificial intelligence (AI)-driven diagnostics is also a pivotal trend, promising to revolutionize how veterinary professionals interpret radiographic images and make treatment decisions. The rising awareness among pet owners regarding the importance of early and accurate diagnosis is further fueling the demand for sophisticated imaging modalities, positioning digital veterinary radiography as an indispensable tool in modern veterinary care. The overall market sentiment is one of optimistic growth, driven by innovation and an unwavering commitment to animal well-being.

The surge in the Digital Veterinary Radiography market is being powerfully propelled by a multifaceted array of factors that are reshaping veterinary diagnostics. Foremost among these is the escalating trend of pet humanization, where pets are increasingly viewed as integral family members, leading to a commensurate increase in the demand for high-quality healthcare services. This translates directly into a greater willingness among pet owners to invest in advanced diagnostic procedures, including digital radiography, to ensure the optimal health and well-being of their companions. Concurrently, significant advancements in digital imaging technology, such as the development of more sensitive detectors and sophisticated image processing software, have made these systems more accessible, affordable, and user-friendly for veterinary clinics. The inherent advantages of digital radiography, including faster image acquisition times, reduced radiation dosage for patients and staff, and the ability to digitally manipulate and enhance images for clearer visualization, further solidify its position as the preferred diagnostic modality. Moreover, the growing awareness among veterinary professionals about the benefits of digital systems in improving diagnostic accuracy, enhancing workflow efficiency, and facilitating remote consultation and case sharing is a critical driver. The continuous innovation within the industry, spearheaded by leading companies, is introducing even more advanced features and applications, further stimulating market growth and adoption. The integration of artificial intelligence (AI) into veterinary imaging is another emerging force, promising to automate certain diagnostic tasks and provide deeper insights from radiographic data.

Despite the optimistic outlook, the Digital Veterinary Radiography market is not without its hurdles. A significant challenge remains the initial capital investment required for acquiring high-quality digital radiography systems. While prices have become more competitive, the upfront cost can still be a substantial barrier for smaller veterinary practices or those in less affluent regions, particularly when compared to the long-established and lower-cost traditional radiography equipment. Another restraining factor is the learning curve associated with adopting new technology. While digital systems are designed for user-friendliness, veterinary staff may require training and time to fully optimize their use, including image acquisition techniques, software operation, and data management. Furthermore, reimbursement policies and economic downturns can indirectly impact the adoption rate. In some regions, the extent to which pet insurance covers advanced diagnostic procedures can influence purchasing decisions. During periods of economic uncertainty, veterinary clinics might postpone capital expenditures. Ensuring interoperability and data integration with existing veterinary practice management software can also present challenges, requiring careful consideration of IT infrastructure and compatibility. Finally, the availability of skilled technicians and ongoing maintenance support across diverse geographical locations can be a concern, especially in remote areas. Addressing these challenges through robust customer support, flexible financing options, and continuous product development that emphasizes ease of use will be crucial for sustained market growth.

The North America region, particularly the United States and Canada, is projected to dominate the Digital Veterinary Radiography market throughout the study period of 2019-2033. This regional dominance is attributed to several interwoven factors, including the exceptionally high pet ownership rates, a robust veterinary healthcare infrastructure, and a strong economic capacity for investment in advanced medical technologies. Pet owners in North America demonstrate a significant willingness to spend on their animal companions' health, readily embracing diagnostic tools that promise superior care and outcomes. The presence of a substantial number of veterinary colleges and research institutions further bolsters the demand for cutting-edge diagnostic equipment, fostering early adoption and innovation.

Among the segments, the Veterinary X-ray System segment is expected to hold the largest market share and exhibit significant growth. This broad category encompasses a wide range of systems used for general diagnostic radiography of various animal species. The increasing prevalence of chronic diseases and orthopedic conditions in pets, coupled with routine health check-ups and diagnostic imaging for a multitude of ailments, drives the demand for these versatile X-ray systems.

Within the Application segment, Pet Clinics are anticipated to be the primary revenue generators and growth drivers. The sheer volume of animals treated in general practice pet clinics, ranging from cats and dogs to small mammals, necessitates efficient and reliable diagnostic imaging solutions. These clinics are at the forefront of adopting digital radiography to provide comprehensive care, from diagnosing fractures and detecting foreign bodies to identifying internal abnormalities and monitoring treatment progress. The ease of use, rapid image acquisition, and immediate availability of diagnostic information in digital radiography systems make them exceptionally well-suited for the fast-paced environment of a pet clinic. The ability to archive and share images easily also facilitates consultations with specialists and improved record-keeping, further solidifying the dominance of this application.

Furthermore, the market is witnessing a growing adoption of Veterinary Dental Radiography Systems as dental health becomes a more recognized and critical component of overall animal well-being. As awareness of periodontal disease and other dental issues increases, veterinarians are investing in specialized dental radiography units to provide accurate diagnoses and treatment plans, thereby contributing to the segment's significant growth.

The Digital Veterinary Radiography industry is experiencing accelerated growth fueled by several key catalysts. The escalating trend of pet humanization, leading to increased spending on companion animal healthcare, is a primary driver. Advancements in imaging technology, such as higher resolution detectors and sophisticated image processing software, are making digital radiography more precise and accessible. Furthermore, the growing emphasis on early and accurate diagnosis for improved treatment outcomes is compelling veterinary professionals to adopt these advanced modalities. The development of portable and integrated radiography units also expands accessibility and efficiency, particularly in diverse veterinary settings.

This report offers a comprehensive analysis of the Digital Veterinary Radiography market, providing in-depth insights into its current status and future trajectory from 2019 to 2033. The study delves into key market trends, including the increasing adoption of advanced imaging technologies and the growing demand for specialized veterinary diagnostic solutions. It meticulously examines the driving forces behind market expansion, such as rising pet expenditure and technological innovations, alongside the challenges and restraints that influence market dynamics, including the initial investment costs and the need for user training. The report also identifies and elaborates on the key regions and segments poised for significant growth, with a particular focus on North America and the Veterinary X-ray System segment, and the dominant application in Pet Clinics. Furthermore, it highlights the critical growth catalysts and profiles the leading companies actively shaping the industry landscape, along with a timeline of significant historical and recent developments. This comprehensive coverage equips stakeholders with the essential data and strategic intelligence needed to navigate and capitalize on the evolving Digital Veterinary Radiography market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.5%.

Key companies in the market include Beckman Coulter, Abbott, Carestream Health, CBI Health Group, Siemens, Control-X Medical, Eiken Chemical, IpsXray, IBIS X RAY SYSTEM, IDeVet, Sysmex Corporation, JPI Healthcare Solutions, Hitachi, MinXray, Podoblock, Qiagen, Vet Ray Technology, .

The market segments include Type, Application.

The market size is estimated to be USD 304 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Digital Veterinary Radiography," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Veterinary Radiography, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.