1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Car Keys?

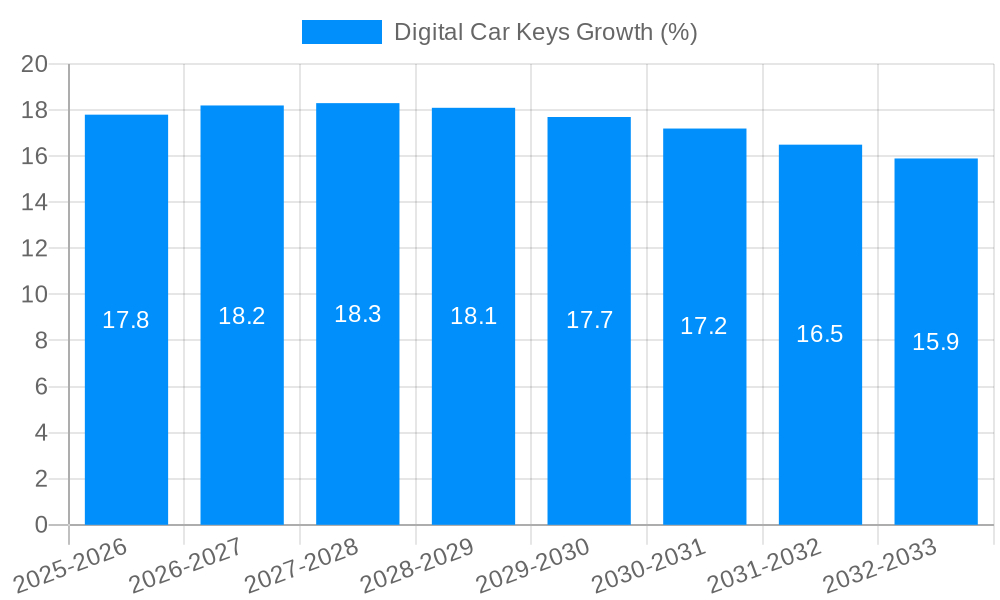

The projected CAGR is approximately 17.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Car Keys

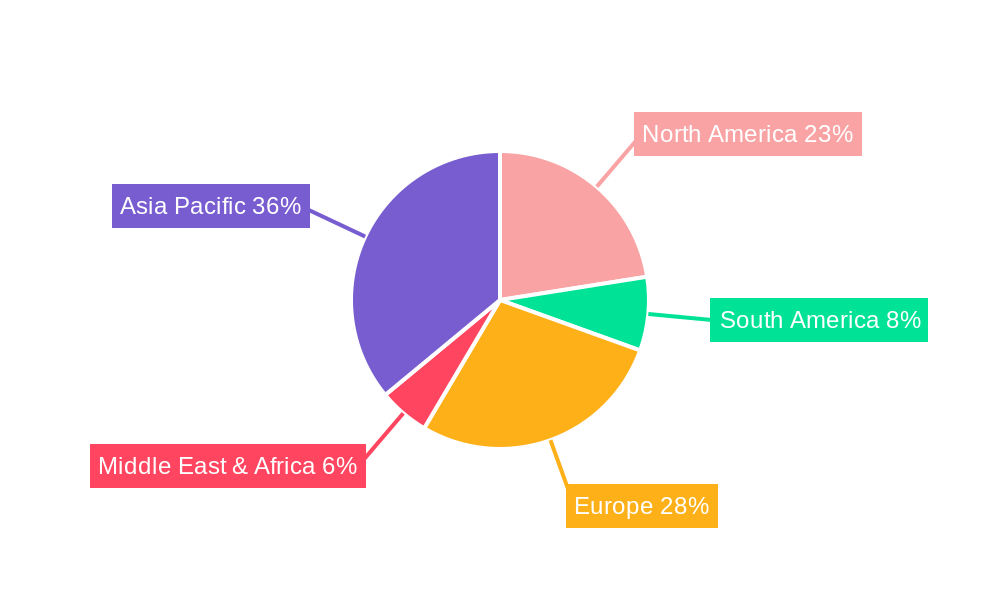

Digital Car KeysDigital Car Keys by Type (BLE Keys, NFC Keys, UWB Keys), by Application (Electric Vehicle, Hybrid Vehicle, Fuel Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

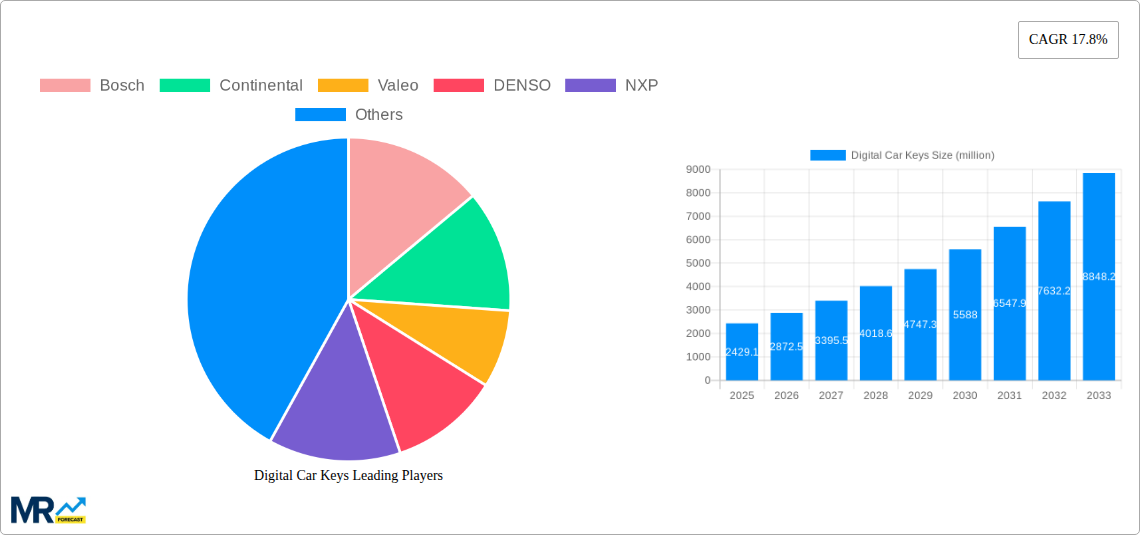

The digital car key market is experiencing robust growth, projected to reach \$2429.1 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 17.8% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of smartphones and their integration with vehicle systems offers a seamless and convenient user experience, eliminating the need for physical keys. Furthermore, the rising demand for enhanced security features, such as remote locking/unlocking and vehicle sharing capabilities, fuels market growth. Technological advancements, particularly in Bluetooth Low Energy (BLE), Near Field Communication (NFC), and Ultra-Wideband (UWB) technologies, are improving the reliability and security of digital key systems, further bolstering market adoption. The automotive industry's focus on connected car technologies and the integration of digital keys within broader infotainment systems also contribute to this upward trajectory. Electric vehicles (EVs) and hybrid vehicles are leading the adoption of digital keys due to their advanced technological integration.

Market segmentation reveals a strong preference for BLE keys due to their cost-effectiveness and wide compatibility. However, UWB keys are gaining traction due to their superior security and precision. Geographically, North America and Europe currently hold significant market shares, driven by early adoption and a robust automotive industry. However, the Asia-Pacific region, particularly China and India, is poised for substantial growth due to rising vehicle sales and increasing technological advancements. The competitive landscape is dynamic, with established automotive parts suppliers like Bosch, Continental, and Valeo competing with semiconductor companies such as NXP and STMicroelectronics, and specialized security firms like Giesecke+Devrient. This competition fosters innovation and drives the development of increasingly sophisticated digital car key solutions.

The digital car key market is experiencing explosive growth, projected to reach multi-million unit shipments by 2033. This surge is driven by a confluence of factors, including the increasing adoption of smartphones, the rise of connected cars, and the inherent convenience and security offered by digital key systems. The market's evolution is characterized by a rapid shift away from traditional mechanical keys toward more technologically advanced solutions. Over the historical period (2019-2024), we witnessed a steady increase in the adoption of BLE (Bluetooth Low Energy) keys, establishing a strong foundation for future growth. The estimated year 2025 showcases a significant leap in market size, driven by advancements in Ultra-Wideband (UWB) technology and its integration into premium vehicles. This technology offers enhanced security and precision compared to BLE and NFC, propelling its adoption within the luxury car segment. Looking ahead to the forecast period (2025-2033), we anticipate continued expansion, with UWB keys gaining significant market share, while BLE and NFC keys will retain their presence in the broader market due to their cost-effectiveness. The base year 2025 serves as a pivotal point, demonstrating the industry's transition towards a more technologically sophisticated and secure landscape. The market is witnessing a significant increase in collaborations between automotive manufacturers and technology providers, accelerating the pace of innovation and expanding the overall market potential into millions of units. This collaborative environment fosters the development of integrated digital key solutions that offer seamless integration with vehicle infotainment systems and other connected car services. Furthermore, the growing demand for enhanced security features, such as biometric authentication and tamper-proof encryption, is a key driver fueling the market's growth. The market is poised for significant expansion, with millions of units expected to be shipped annually throughout the forecast period.

Several key factors are accelerating the adoption of digital car keys. Firstly, the increasing integration of smartphones into daily life makes digital keys a natural extension of this trend. Consumers are accustomed to using their phones for a multitude of tasks, and the ability to unlock and start their car with the same device enhances convenience and streamlines their daily routines. Secondly, the rising popularity of electric vehicles (EVs) is playing a crucial role. EVs often incorporate advanced technology features, making the integration of digital key systems a seamless addition. Furthermore, the enhanced security offered by digital keys, including features like remote locking/unlocking and anti-theft measures, significantly reduces the risk of vehicle theft and unauthorized access. This is a compelling factor for consumers seeking enhanced security. The automotive industry's focus on improving the user experience is also a strong driver. Digital keys provide a superior user experience compared to traditional mechanical keys, offering features like key sharing, remote access, and the ability to manage access permissions for multiple users. Finally, evolving legislation and regulatory standards in various regions are encouraging the adoption of digital keys, making them a vital component of the future automotive landscape. This combination of factors creates a powerful synergy that is propelling the digital car key market towards rapid and sustained growth.

Despite the significant growth potential, several challenges hinder the widespread adoption of digital car keys. Security remains a paramount concern. While modern digital key systems employ advanced encryption and authentication methods, vulnerabilities still exist, and the potential for hacking or unauthorized access remains a significant deterrent. Furthermore, compatibility issues across different vehicle brands and smartphone operating systems pose a hurdle. A lack of standardization across the industry can lead to fragmentation and limit the seamless interoperability of digital keys. The cost of implementation is another major barrier, especially for entry-level vehicles. The technology required for digital key systems, including hardware and software components, can be relatively expensive compared to traditional mechanical keys. This cost barrier can limit adoption in price-sensitive segments of the market. Range limitations of certain technologies like Bluetooth Low Energy (BLE) also represent a challenge, especially in areas with weak signal coverage. Finally, the reliance on technology can create concerns among consumers who fear system failures, battery depletion, or smartphone malfunctions, which could leave them locked out of their vehicles. Addressing these challenges requires industry-wide collaboration and the development of robust and reliable solutions.

The Electric Vehicle (EV) segment is poised to dominate the digital car key market. The inherent technological advancements in EVs naturally lend themselves to the integration of digital key systems.

Key Regions: North America and Europe are projected to lead the market, driven by high EV adoption rates, robust technological infrastructure, and strong consumer demand for advanced features. Asia-Pacific is expected to show significant growth in the long term, driven by increasing EV production and market penetration in rapidly developing economies.

The UWB (Ultra-Wideband) segment is projected to show the fastest growth. The superior security and precision offered by UWB compared to BLE and NFC technologies make it increasingly attractive, especially for premium vehicles. The market for UWB digital keys is expected to surpass millions of units within the forecast period, outpacing other key technologies.

The convergence of smartphone technology, the expanding EV market, increasing consumer demand for convenience and security, and the automotive industry's focus on enhanced user experiences are collectively creating a strong impetus for the continued growth of the digital car key market. Government regulations pushing for advanced security and connectivity features are also significant catalysts for adoption.

This report provides a detailed analysis of the digital car key market, covering market trends, driving forces, challenges, key regional segments, growth catalysts, leading players, and significant developments. It provides valuable insights for stakeholders involved in the automotive, technology, and security industries, facilitating informed strategic decision-making regarding the adoption and development of digital car key technologies. The forecast period of 2025-2033 offers a comprehensive outlook on the market's future trajectory and potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 17.8%.

Key companies in the market include Bosch, Continental, Valeo, DENSO, NXP, Alpine, STMicroelectronics, Texas Instruments, Shanghai Yinji Information Security Consulting Associates, Giesecke+Devrient, Irdeto, TrustKernel, PATEO, .

The market segments include Type, Application.

The market size is estimated to be USD 2429.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Digital Car Keys," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Car Keys, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.