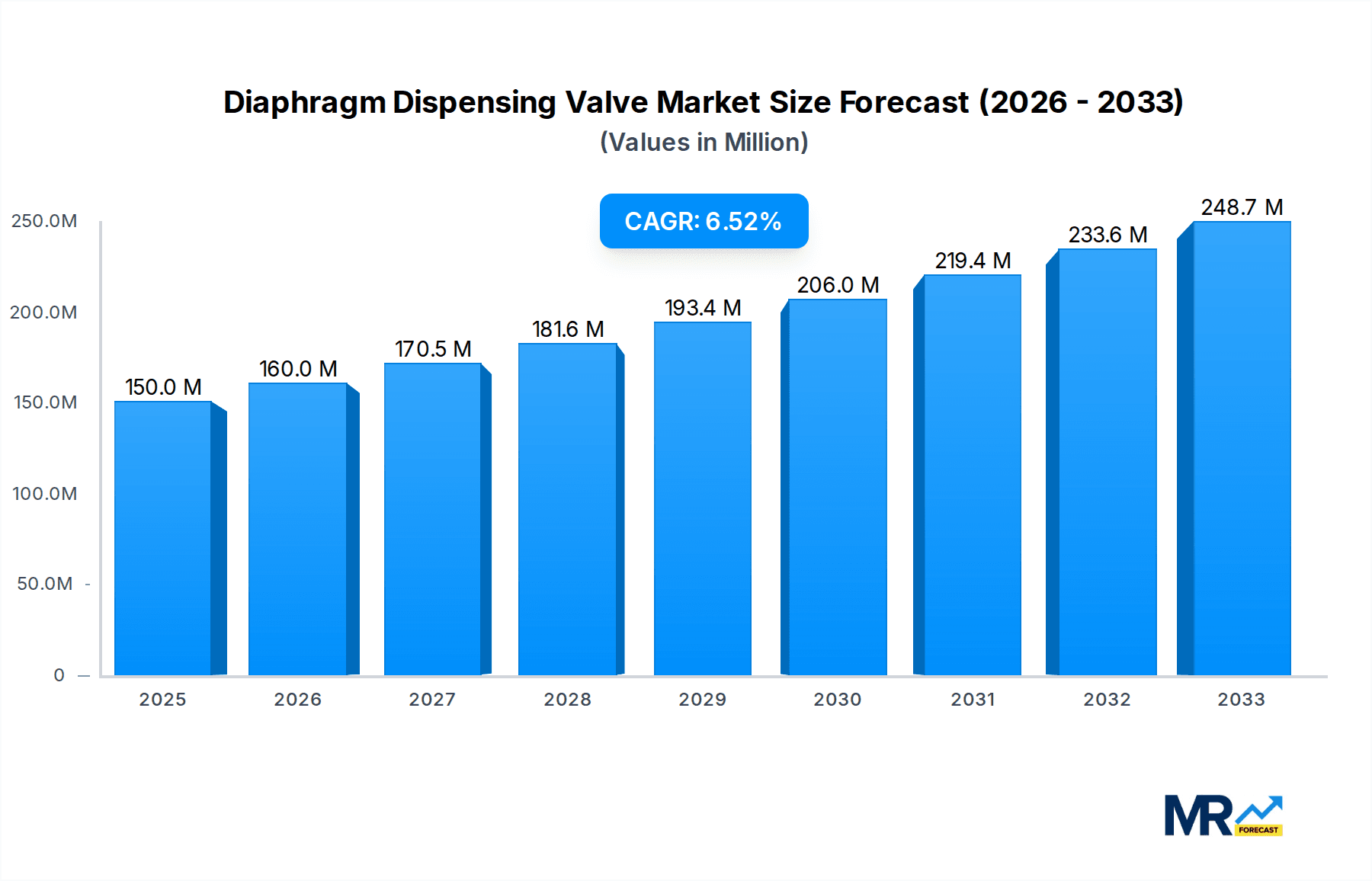

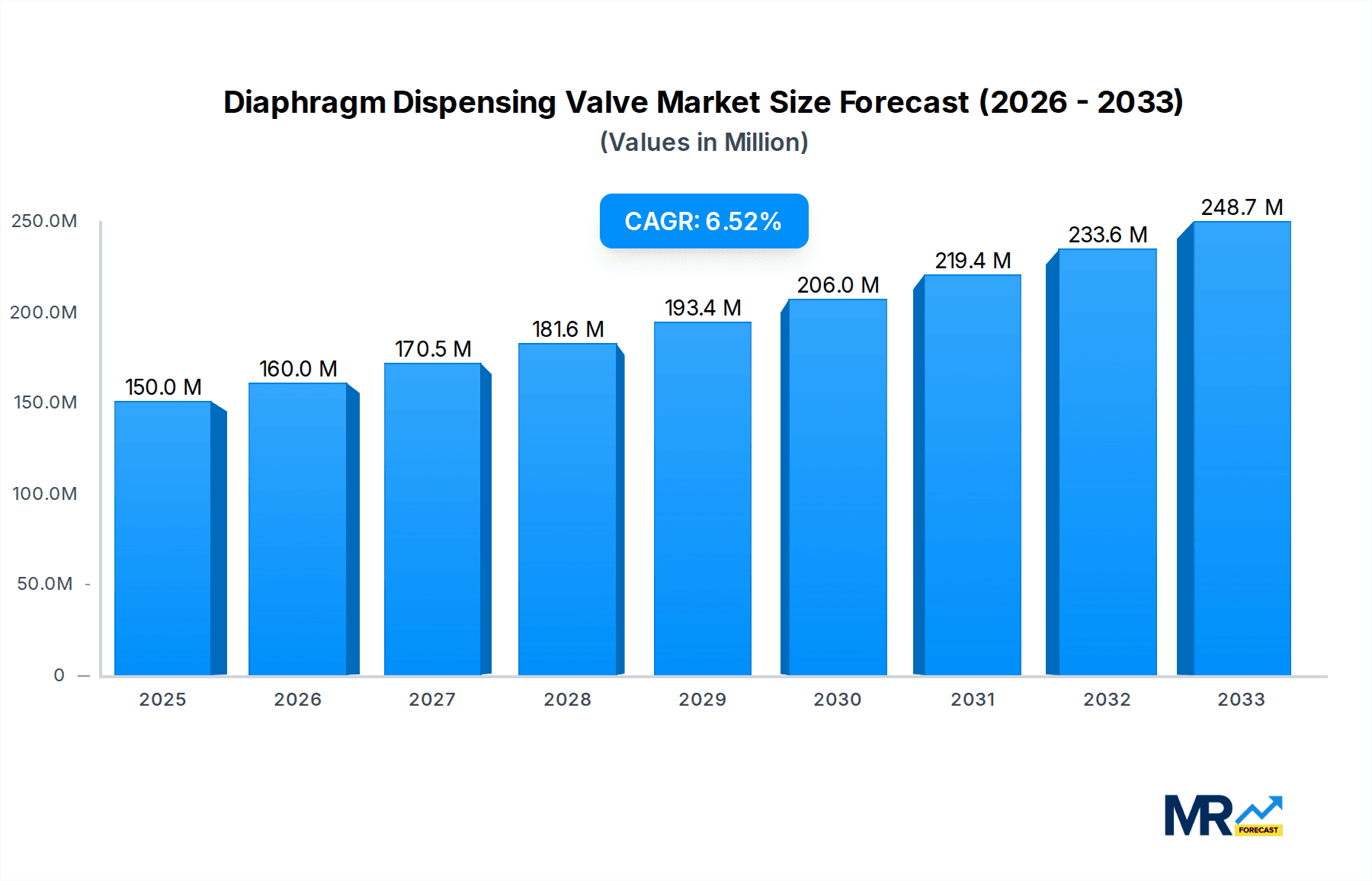

1. What is the projected Compound Annual Growth Rate (CAGR) of the Diaphragm Dispensing Valve?

The projected CAGR is approximately 6.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Diaphragm Dispensing Valve

Diaphragm Dispensing ValveDiaphragm Dispensing Valve by Type (Pneumatic, Electric), by Application (Electronic, Automobile, Medical, Aerospace, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Diaphragm Dispensing Valve market is poised for robust expansion, projected to reach a substantial market size by 2033. Driven by the increasing demand for precision fluid handling across various industries, including electronics, automotive, and medical devices, the market is expected to witness a Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. This sustained growth is fueled by advancements in automation and the growing need for accurate and repeatable dispensing of adhesives, sealants, and other fluids. The electronics sector, with its miniature components and intricate assembly processes, represents a significant application area, demanding high levels of control and minimal waste. Similarly, the automotive industry's focus on lightweighting and enhanced performance requires precise application of specialized materials. The medical sector also contributes significantly, with stringent requirements for sterility and accuracy in drug delivery and device manufacturing.

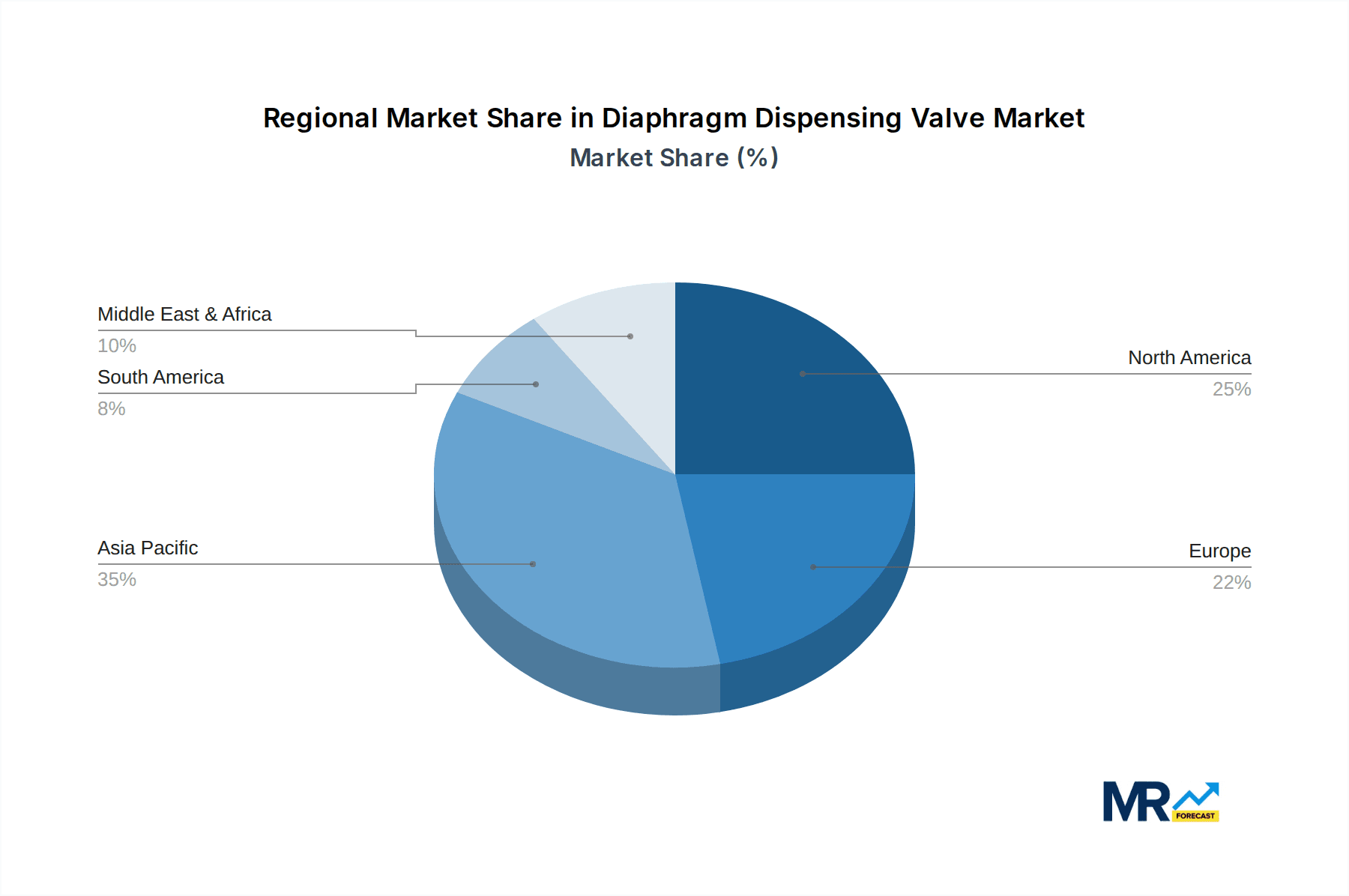

The market is characterized by evolving trends such as the development of intelligent dispensing systems with enhanced connectivity and real-time monitoring capabilities, alongside a growing preference for electric dispensing valves due to their superior control and energy efficiency. These technological advancements are crucial for optimizing manufacturing processes and ensuring product quality. However, the market also faces certain restraints, including the initial high cost of sophisticated dispensing equipment and the need for skilled labor to operate and maintain them. Geographically, Asia Pacific is anticipated to emerge as a dominant region, driven by its expansive manufacturing base, particularly in China and India, and a rapid adoption of advanced dispensing technologies. North America and Europe also represent significant markets, supported by established industrial infrastructure and a strong emphasis on innovation and quality control. The competitive landscape is marked by key players like Nordson, Fisnar, and Henkel Adhesives, who are actively engaged in research and development to introduce novel solutions that cater to the evolving needs of diverse end-user industries.

The diaphragm dispensing valve market is poised for significant evolution, driven by an insatiable demand for precision, miniaturization, and automation across a multitude of industries. During the study period of 2019-2033, with a base year of 2025 and a forecast period extending from 2025-2033, the market is projected to witness robust growth. The estimated market value in 2025 is expected to be in the hundreds of millions, with a substantial CAGR anticipated. This growth is fundamentally rooted in the increasing adoption of advanced manufacturing techniques and the stringent quality control requirements inherent in sectors like electronics and medical devices. The shift towards Industry 4.0 principles, emphasizing connectivity, data analytics, and intelligent automation, is directly fueling the need for highly reliable and accurate dispensing systems. Furthermore, the miniaturization trend, particularly prevalent in consumer electronics and implantable medical devices, necessitates dispensing valves capable of handling minuscule fluid volumes with exceptional accuracy. The report will delve into the nuanced trends, including the rising popularity of electric diaphragm valves due to their superior control and repeatability, the increasing integration of smart features like IoT connectivity for real-time monitoring and diagnostics, and the growing emphasis on specialized valve designs for handling high-viscosity or abrasive materials. The market's trajectory will be closely examined through the lens of historical performance (2019-2024) and future projections, highlighting key inflection points and emerging opportunities. The increasing complexity of adhesives, sealants, and lubricants used in modern manufacturing also demands valves that can precisely meter and dispense these materials without degradation or clogging, further propelling innovation in diaphragm valve technology. The overarching trend is towards greater control, efficiency, and adaptability in fluid dispensing, making diaphragm valves indispensable components in next-generation manufacturing processes. The growing emphasis on sustainability and waste reduction within manufacturing will also contribute to the demand for precise dispensing solutions, as it minimizes material wastage. The market's expansion will also be influenced by the development of new materials that enhance valve durability and chemical resistance, enabling their use in more demanding applications. The increasing global focus on healthcare and the associated demand for precision in medical device manufacturing will act as another significant driver.

The diaphragm dispensing valve market is experiencing a powerful surge driven by several interconnected forces, fundamentally reshaping fluid handling capabilities across industries. The relentless pursuit of enhanced product quality and reduced manufacturing costs stands as a primary catalyst. Industries across the board are recognizing that precise and repeatable fluid dispensing is not merely a production step but a critical determinant of final product performance, reliability, and aesthetics. This translates directly into a demand for diaphragm dispensing valves that can deliver consistent micro-liter volumes of adhesives, sealants, lubricants, and other fluids with utmost accuracy, minimizing waste and rework. The escalating complexity of modern products, especially in the realms of consumer electronics, automotive, and medical devices, further amplifies this need. These products often feature intricate designs and require the application of specialized materials in very specific locations, a task that diaphragm valves are ideally suited to perform. The overarching trend towards automation and the implementation of Industry 4.0 principles are also significant drivers. As factories become smarter and more connected, the need for automated, data-driven dispensing processes grows. Diaphragm valves, with their potential for precise control, integration with robotic systems, and compatibility with advanced sensors, are becoming integral components of these automated workflows. Moreover, the growing emphasis on miniaturization across various sectors, from advanced medical implants to compact electronic components, demands dispensing solutions that can accurately handle ever-decreasing fluid volumes, a niche where diaphragm technology excels. The development of novel materials with unique flow characteristics also necessitates sophisticated dispensing solutions, pushing the boundaries of diaphragm valve design and performance.

Despite the promising growth trajectory, the diaphragm dispensing valve market is not without its inherent challenges and restraints, which could temper its expansion. One of the significant hurdles is the inherent complexity in handling highly abrasive or particulate-laden fluids. While diaphragm valves offer excellent control, prolonged exposure to such materials can lead to diaphragm wear and premature failure, necessitating frequent maintenance or replacement, which can increase operational costs and downtime. Achieving absolute and consistent zero-drip performance, especially with low-viscosity fluids, can also be a technical challenge for certain diaphragm valve designs, leading to potential contamination or wastage. The initial capital investment for high-precision diaphragm dispensing systems, particularly those with advanced automation and control features, can be substantial, posing a barrier for smaller enterprises or those with limited budgets. Furthermore, the market is characterized by a diverse range of applications, each with unique fluid compatibility and process requirements. Developing and offering a comprehensive portfolio of diaphragm valves that can effectively cater to every specific need requires significant research and development investment and expertise. Stringent regulatory compliance, especially in industries like medical and aerospace, adds another layer of complexity. Ensuring that the materials used in valve construction are compliant with relevant standards and that the dispensing process meets exact specifications can be a time-consuming and resource-intensive undertaking. Finally, the availability of alternative dispensing technologies, such as syringe pumps or pinch valves, in certain less demanding applications, can present competitive pressure, forcing diaphragm valve manufacturers to continuously innovate and highlight their unique advantages.

The Electronic segment, encompassing the manufacturing of semiconductors, printed circuit boards (PCBs), and various electronic components, is poised to be a dominant force in the diaphragm dispensing valve market, primarily driven by its strong presence in Asia Pacific, particularly China, South Korea, and Taiwan. This dominance is rooted in several critical factors. Firstly, Asia Pacific is the undisputed global manufacturing hub for electronics. The sheer volume of electronic devices produced in this region, from smartphones and laptops to complex industrial automation systems, necessitates a vast and consistent supply of precision dispensing equipment. Diaphragm dispensing valves play a pivotal role in critical electronic manufacturing processes such as underfill dispensing for microchips, conformal coating applications on PCBs, precise application of thermal interface materials, and the bonding of various components. The ongoing miniaturization trend in electronics, where components are becoming increasingly smaller and more densely packed, directly translates into a demand for highly accurate and repeatable dispensing of adhesives and sealants at micron-level precision. Diaphragm valves, particularly those with electric actuation, offer the fine control required for these intricate applications.

Secondly, the rapid advancement and innovation within the electronics industry constantly drive the adoption of new manufacturing techniques and materials. This includes the development of advanced adhesives, conductive inks, and specialized encapsulants that require precise dispensing for optimal performance. Diaphragm valves are adaptable to a wide range of fluid viscosities and chemistries, making them versatile for these evolving material needs. The increasing automation within electronics manufacturing plants, driven by the need to improve efficiency, reduce labor costs, and ensure consistent quality, further propels the demand for automated dispensing solutions like diaphragm valves. These valves can be seamlessly integrated with robotic arms and automated assembly lines.

Moreover, the stringent quality control requirements in the electronics sector, where even minor dispensing errors can lead to product failure, directly favor the reliability and precision offered by diaphragm dispensing valves. The increasing emphasis on reliability and longevity in electronic devices further underscores the importance of precise material application.

Beyond the electronics segment, the Automobile application is also a significant contributor, with Germany, Japan, and the United States leading the charge due to their robust automotive manufacturing industries. Diaphragm valves are critical for applications such as sealing windshields, applying adhesives for structural bonding, dispensing lubricants in engine components, and the precise application of sealants in battery manufacturing for electric vehicles. The growing adoption of electric vehicles (EVs) is creating new opportunities, particularly in battery pack assembly where precise dispensing of thermal management materials and adhesives is paramount.

The Medical segment, while smaller in overall volume compared to electronics, represents a high-value market, with strong demand emanating from North America and Europe. The stringent requirements for biocompatibility, sterility, and ultra-precision in medical device manufacturing, such as the assembly of diagnostic equipment, drug delivery systems, and implantable devices, make diaphragm valves indispensable.

In summary, the Electronic segment, predominantly in the Asia Pacific region, is anticipated to dominate the diaphragm dispensing valve market due to the massive scale of production, the relentless drive for miniaturization and precision, and the continuous innovation in materials and processes. This is closely followed by the automotive sector, with significant contributions from key manufacturing nations, and the high-value medical segment.

The diaphragm dispensing valve industry is experiencing significant growth fueled by several key catalysts. The relentless pursuit of precision and accuracy in manufacturing across sectors like electronics, automotive, and medical devices is paramount. As products become more complex and miniaturized, the need for precise application of fluids such as adhesives, sealants, and lubricants becomes critical for product performance and reliability. The accelerating trend of automation and Industry 4.0 implementation across manufacturing facilities worldwide is a major driver, as diaphragm valves integrate seamlessly into automated assembly lines and robotic systems, enabling efficient and repeatable dispensing. Furthermore, the increasing adoption of advanced materials with unique flow properties necessitates dispensing solutions that can handle them effectively, pushing innovation in valve design and functionality.

This comprehensive report provides an in-depth analysis of the global diaphragm dispensing valve market, meticulously covering the period from 2019 to 2033, with a detailed focus on the estimated market landscape in 2025. The study meticulously details market segmentation by Type (Pneumatic, Electric), Application (Electronic, Automobile, Medical, Aerospace, Other), and key Industry Developments. It delves into the driving forces propelling the market, such as the increasing demand for precision dispensing in advanced manufacturing and the adoption of automation. Simultaneously, it addresses the challenges and restraints, including material compatibility issues and the initial investment costs. The report highlights the dominant regions and segments, with a particular emphasis on the significant role of the electronics industry in Asia Pacific and the growing influence of the automotive sector globally. Detailed information on leading market players and their innovative strategies, along with a timeline of significant technological advancements, offers a holistic view of the market's evolution and future potential, providing actionable insights for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.5%.

Key companies in the market include Nordson, Fisnar, DELO adhesives, Techcon, Iwashita Engineering, Inc, DOPAG, Henkel Adhesives, PVA, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Diaphragm Dispensing Valve," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Diaphragm Dispensing Valve, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.