1. What is the projected Compound Annual Growth Rate (CAGR) of the Diamond and Gold Jewelry?

The projected CAGR is approximately 5.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Diamond and Gold Jewelry

Diamond and Gold JewelryDiamond and Gold Jewelry by Type (/> Diamond Jewelry, Gold Jewelry), by Application (/> Men Use, Ladies Use), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global diamond and gold jewelry market is poised for significant expansion, propelled by rising disposable incomes in emerging economies and an increasing consumer inclination towards luxury items. This growth is further stimulated by a growing demand for personalized and ethically sourced jewelry, facilitated by the availability of lab-grown diamonds and sustainably sourced gold. Leading companies, including Chow Tai Fook, Richemont, and Tiffany & Co., are actively employing technological innovations in design and marketing to enhance their market presence. Concurrently, specialized brands are capitalizing on niche markets such as sustainable jewelry and artisanal creations. The market is categorized by product type (diamond, gold, etc.), price segments, and distribution channels (online and retail). Despite potential temporary impacts from economic fluctuations, the intrinsic emotional value and timeless appeal of diamond and gold jewelry contribute to its market resilience. Strategic alliances, mergers, and product portfolio expansion are crucial growth avenues for industry frontrunners.

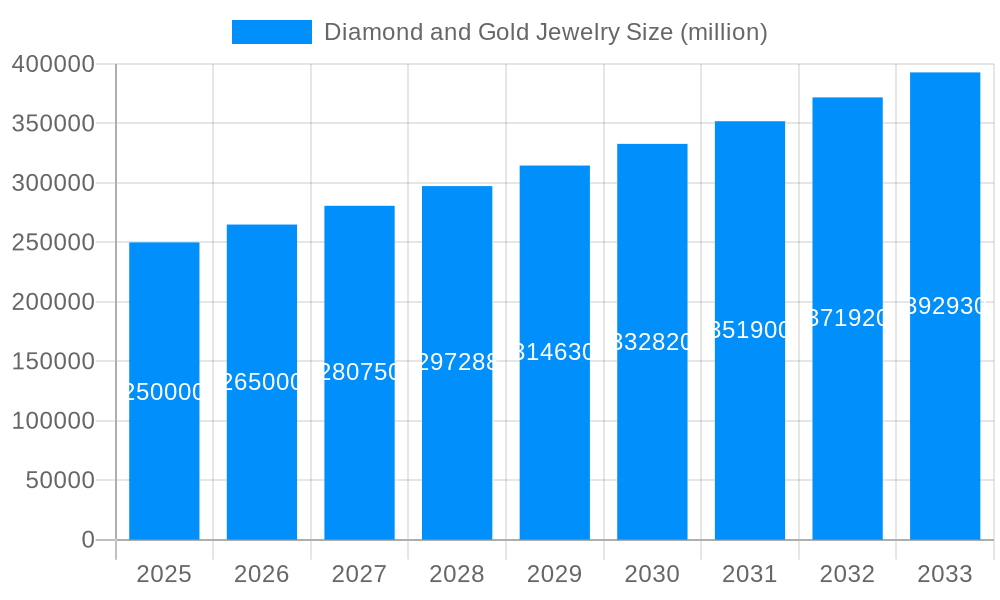

For the forecast period of 2025-2033, sustained market expansion is projected, with an estimated Compound Annual Growth Rate (CAGR) of 5.5%. The market size is expected to reach 381.54 billion by the base year 2025. While macroeconomic influences and potential market saturation in specific segments may moderate growth rates, continuous innovation in design, targeted marketing campaigns for younger demographics, and geographical market expansion will sustain momentum. The Asia-Pacific region and other developing economies are anticipated to witness a surge in demand, complementing the established markets of North America and Europe. Intense competition persists, with established brands facing challenges from new entrants and the proliferation of online direct-to-consumer models. Future success will be contingent upon adaptability to evolving market dynamics through technological integration, a strong emphasis on sustainability, and a keen understanding of contemporary consumer preferences.

The diamond and gold jewelry market, valued at several hundred million dollars in 2024, exhibits a dynamic interplay of evolving consumer preferences and industry innovations. Over the historical period (2019-2024), we witnessed a surge in demand for ethically sourced diamonds and recycled gold, driven by increasing consumer awareness of environmental and social responsibility. This trend is projected to continue and intensify throughout the forecast period (2025-2033). The market is also witnessing a shift towards personalized and customizable jewelry, with consumers increasingly seeking unique pieces that reflect their individual style and values. This is fueling the growth of bespoke jewelry services and the rise of online platforms offering personalized design options. Furthermore, technological advancements, such as 3D printing and advanced manufacturing techniques, are revolutionizing jewelry production, leading to greater efficiency and the creation of intricate and innovative designs. The rise of e-commerce has also significantly impacted the market, offering consumers a wider selection and greater convenience. This online presence, however, also necessitates strong branding and marketing strategies for businesses to compete effectively. In the coming years, we anticipate further diversification in product offerings, with a growing emphasis on sustainable materials and unique design aesthetics. The market will likely see a consolidation of players, with larger companies acquiring smaller, niche brands to expand their market share and product portfolio. The estimated market value for 2025 reflects this ongoing evolution and anticipates substantial growth driven by a confluence of factors. Millennials and Gen Z are increasingly driving luxury purchases, showcasing a distinct shift in consumer demographics impacting the overall market trajectory. Furthermore, the fluctuating prices of gold and diamonds continue to influence buying patterns and investment decisions in this sector.

Several key factors are propelling the growth of the diamond and gold jewelry market. Firstly, the enduring appeal of gold and diamonds as symbols of luxury, status, and investment remains a significant driver. Gold's inherent value and its role as a safe haven asset contribute to consistent demand, particularly in times of economic uncertainty. The increasing disposable income in emerging economies, coupled with a growing middle class, is significantly boosting demand for luxury goods, including diamond and gold jewelry. This demographic shift fuels consumption in regions previously underserved by this market. Furthermore, innovative marketing and branding strategies by major players, emphasizing the emotional value and storytelling aspects of jewelry, are effectively connecting with younger consumers. The rise of social media and influencer marketing further amplifies brand awareness and fuels consumer desire for these coveted items. The increasing popularity of diamond and gold jewelry as heirloom pieces, passed down through generations, also adds to the market's longevity and cyclical growth pattern. Finally, ongoing advancements in jewelry design, incorporating innovative materials and techniques, help maintain market dynamism and attract a wider range of consumers.

Despite strong growth prospects, the diamond and gold jewelry market faces several challenges. Fluctuations in the prices of gold and diamonds, influenced by global economic conditions and currency exchange rates, represent a major constraint. These price swings directly impact consumer purchasing power and profitability for businesses. Ethical sourcing and sustainability concerns are increasingly critical for consumers and regulators, putting pressure on companies to demonstrate transparent and responsible sourcing practices. Failure to meet these expectations can lead to reputational damage and reduced sales. Competition within the market is fierce, with both established players and emerging brands vying for market share. This necessitates continuous innovation, effective marketing strategies, and efficient operational management to stay competitive. Counterfeit products also pose a significant challenge, eroding consumer trust and impacting the profitability of legitimate businesses. The need for rigorous authentication processes and effective anti-counterfeiting measures is therefore paramount. Finally, economic downturns and geopolitical instability can significantly dampen consumer spending on luxury goods, leading to temporary slowdowns in market growth.

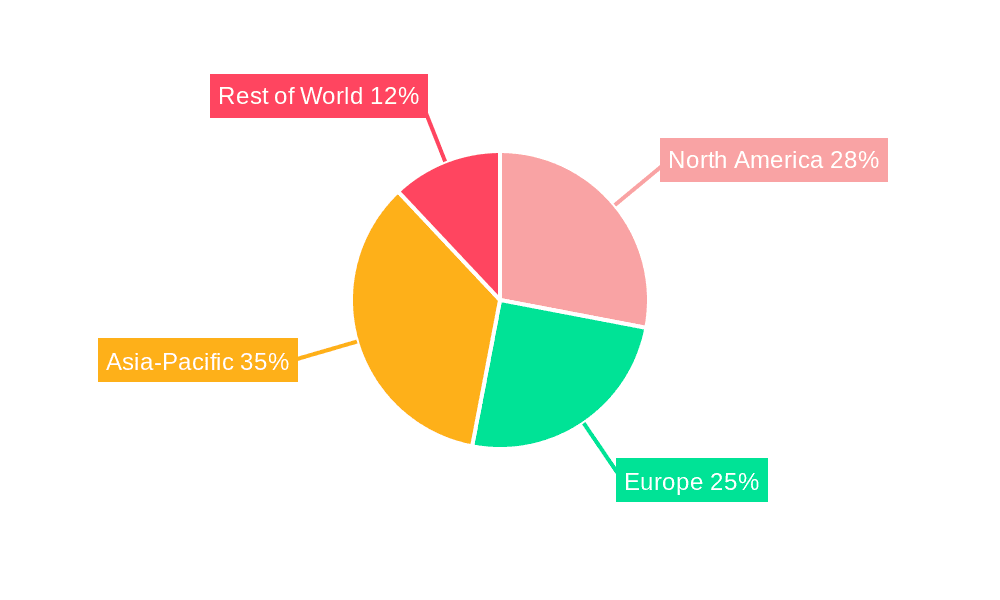

The diamond and gold jewelry market shows a diverse regional landscape, with several key areas and segments exhibiting significant growth potential.

Asia-Pacific: This region, particularly India and China, is projected to dominate the market due to a burgeoning middle class, increasing disposable incomes, and strong cultural significance attached to gold jewelry. The demand for intricate designs and traditional pieces remains high, fueling considerable market expansion.

North America: This region continues to be a significant market, characterized by a preference for more contemporary designs and a growing awareness of ethical sourcing. The presence of well-established brands and a strong luxury goods market contributes to the region's substantial market size.

Europe: While exhibiting relatively mature market dynamics compared to Asia-Pacific, Europe retains a strong presence, especially for high-end luxury jewelry. The segment focuses on sophisticated designs and craftsmanship, attracting discerning consumers willing to pay a premium.

Dominant Segments:

Gold Jewelry: Gold remains the most dominant segment, driven by its inherent value, versatility, and cultural significance across various regions.

Diamond Jewelry: The diamond segment experiences strong growth, fueled by demand for engagement rings, luxury pieces, and investments. The increasing focus on ethical sourcing also shapes consumer preferences in this segment.

High-End Jewelry: A significant growth area, particularly in established luxury markets, as consumers increasingly seek unique and high-value pieces reflecting their status and individuality.

In summary, the Asia-Pacific region's rapid economic growth and cultural significance of gold jewelry are key drivers for market dominance, while the high-end segment caters to discerning consumers' desire for unique and valuable pieces globally.

The diamond and gold jewelry industry is experiencing robust growth fueled by several key factors. Increasing disposable incomes in emerging markets, coupled with a growing middle class, are driving demand for luxury goods. Furthermore, innovative designs and marketing strategies, particularly those connecting with younger generations through social media, are significantly boosting sales. The evolving consumer preference for ethically sourced and sustainable jewelry is also creating new market opportunities, incentivizing responsible practices across the supply chain.

This report provides a comprehensive analysis of the diamond and gold jewelry market, encompassing historical data, current market dynamics, and future projections. It covers key market trends, drivers, challenges, and leading players, offering valuable insights for businesses and investors within the industry. The detailed regional and segmental breakdown helps understand market opportunities and potential growth areas. With a forecast extending to 2033, this report offers a valuable long-term perspective for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.5%.

Key companies in the market include Chow Tai Fook Jewelry Group, Richemont, Signet Jewellers, Swatch Group, Rajesh Exports, Lao Feng Xiang, Tiffany, Malabar Gold and Diamonds, LVMH Moet Hennessy, Daniel Swarovski Corporation, Chow Sang Sang, Luk Fook, Pandora, Stuller, .

The market segments include Type, Application.

The market size is estimated to be USD 381.54 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Diamond and Gold Jewelry," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Diamond and Gold Jewelry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.