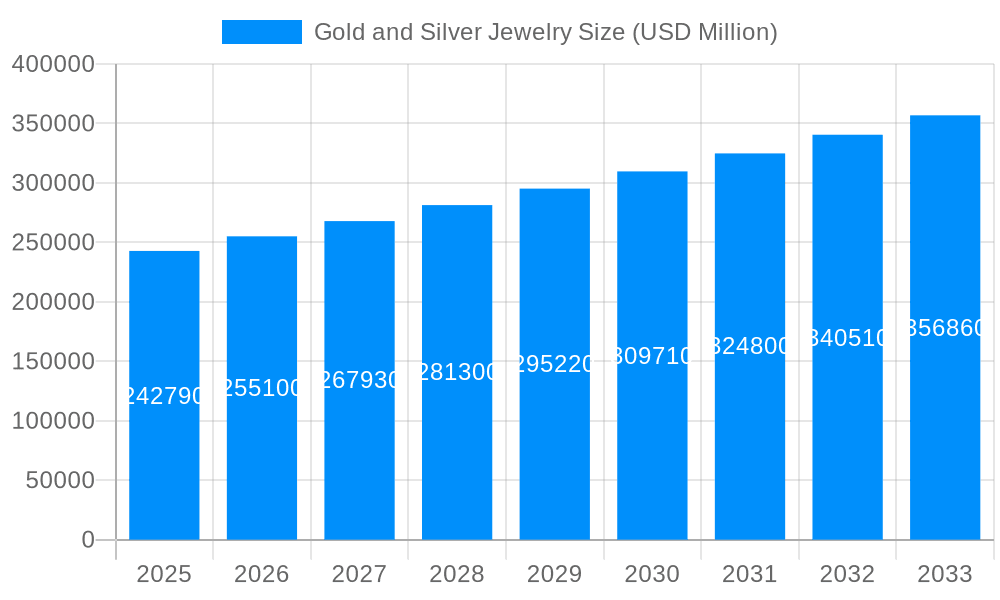

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gold and Silver Jewelry?

The projected CAGR is approximately 5.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Gold and Silver Jewelry

Gold and Silver JewelryGold and Silver Jewelry by Type (/> Gold Jewelry, Platinum Diamond), by Application (/> Man, Woman), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global gold and silver jewelry market exhibits robust growth, driven by increasing disposable incomes, particularly in developing economies, and a persistent preference for gold and silver as investment assets and heirloom pieces. The market's expansion is further fueled by evolving fashion trends, incorporating intricate designs and diverse styles to cater to a wider range of consumer preferences. Technological advancements in jewelry manufacturing, enabling greater precision and efficiency, also contribute to market growth. While economic downturns can temporarily restrain spending on luxury items like jewelry, the enduring cultural significance of gold and silver, coupled with their perceived value as a safe haven asset, ensures sustained market demand. The market is segmented by various factors, including metal type (gold, silver, and combinations thereof), jewelry type (necklaces, earrings, bracelets, rings), and price points (luxury, mid-range, budget-friendly). Key players in the market leverage strong brand recognition, extensive distribution networks, and innovative marketing strategies to maintain a competitive edge. Emerging trends include the integration of sustainable sourcing practices and ethical manufacturing processes, increasingly influencing consumer purchasing decisions.

The competitive landscape is characterized by a mix of established international brands and regional players. Large multinational companies often command a significant market share through their global presence and established brand recognition. However, regional businesses are thriving, capitalizing on local cultural preferences and crafting unique styles. Competition is intensifying due to the market's attractiveness, pushing players to enhance product offerings, improve distribution channels, and strengthen their brand identities. The forecast period (2025-2033) anticipates continued growth, although the pace may vary depending on macroeconomic conditions and shifts in consumer spending habits. The market's future will likely be shaped by the increasing adoption of e-commerce, the growing demand for personalized jewelry, and a greater emphasis on transparency and sustainability throughout the supply chain. To maintain their position, companies must adapt to changing consumer behaviors and invest in innovation and sustainable practices.

The global gold and silver jewelry market, valued at several million units in 2024, is projected to experience robust growth throughout the forecast period (2025-2033). The study period (2019-2024) revealed significant shifts in consumer preferences, driven by evolving fashion trends, economic fluctuations, and sociocultural changes. The base year, 2025, provides a critical benchmark for understanding current market dynamics, particularly concerning the increasing demand for personalized and ethically sourced jewelry. While traditional designs remain popular, there's a surge in demand for contemporary styles incorporating unique gemstones and unconventional metals. The rise of online retail channels has significantly impacted market accessibility, allowing smaller brands to compete with established players. This digital shift has also led to increased transparency regarding sourcing and manufacturing processes, influencing consumer buying decisions. Furthermore, the growing middle class in developing economies significantly contributes to market expansion, with a greater disposable income leading to increased spending on luxury and semi-luxury goods, including gold and silver jewelry. This trend is particularly prominent in Asia, a region currently dominating market share and expected to fuel future growth. The estimated year, 2025, reflects a market poised for sustained expansion, driven by several intertwined factors, including evolving consumer preferences, technological advancements, and changing economic landscapes. This report analyzes these factors comprehensively to project future market trends accurately. The interplay of these factors presents a dynamic landscape for stakeholders, demanding adaptable strategies to succeed in this rapidly changing market. Understanding the evolving preferences of the millennial and Gen Z demographics—who favor sustainable and ethically produced jewelry—is crucial for long-term success in this market.

Several key factors are driving the growth of the gold and silver jewelry market. The increasing disposable income, particularly in emerging economies, fuels higher discretionary spending on luxury items such as jewelry. The growing middle class in these regions represents a significant untapped market, eager to express their newfound affluence. Simultaneously, evolving fashion trends and the popularity of personalized and customized jewelry designs contribute to increased demand. Consumers are increasingly seeking unique pieces that reflect their individual style and personality, prompting manufacturers to innovate and offer diverse collections. The rise of e-commerce platforms has also broadened market accessibility, enabling both established brands and smaller, independent designers to reach wider customer bases. This online accessibility coupled with targeted advertising campaigns is driving sales growth, surpassing traditional retail channels in some segments. Moreover, the investment value associated with precious metals, particularly gold, contributes to consumer demand. Gold and silver are perceived as safe haven assets, providing a hedge against economic uncertainty, thus influencing purchases driven by investment strategies as well as aesthetic appeal. Finally, the growing preference for ethically sourced and sustainable jewelry is influencing consumer choices. Transparency and traceability in the supply chain are becoming increasingly important, pushing manufacturers to adopt responsible sourcing practices to cater to environmentally and socially conscious customers.

Despite the positive outlook, the gold and silver jewelry market faces several challenges and restraints. Fluctuations in the price of gold and silver significantly impact profitability and consumer demand. Sharp increases can discourage purchases, while drastic decreases may affect the perceived value of existing jewelry, influencing the secondary market. Economic downturns and recessions also pose considerable risks, as consumers tend to reduce discretionary spending on luxury goods during periods of economic uncertainty. This sensitivity to macroeconomic conditions creates significant volatility in the market. Furthermore, the rise of counterfeit and imitation jewelry poses a threat to the industry, particularly for consumers purchasing online. This necessitates strong brand protection measures and quality control to maintain consumer trust and prevent brand damage. The increasing competition from both established brands and emerging players also intensifies the pressure on profit margins and necessitates constant innovation to retain market share. Finally, environmental concerns related to mining and manufacturing processes are driving stricter regulations and increased scrutiny. Meeting these sustainability standards requires significant investments and shifts in production processes, posing a challenge to some manufacturers, particularly smaller ones.

Asia (particularly India and China): These regions exhibit exceptionally high demand due to strong cultural traditions associating gold and silver with prosperity and auspicious occasions. The burgeoning middle class and rising disposable incomes fuel this demand, leading to significant market share dominance. Furthermore, the strong preference for intricate craftsmanship and traditional designs drives innovation within these markets. The robust domestic manufacturing base in these countries also contributes to their market leadership.

High-Value Segment: Luxury jewelry, encompassing high-carat gold, precious gemstones, and intricate designs, commands premium prices and contributes disproportionately to overall market revenue. This segment benefits from the increasing affluence of high-net-worth individuals and their willingness to spend on exclusive and handcrafted pieces.

Online Retail Segment: The rapidly expanding e-commerce sector has opened new avenues for sales, enabling smaller brands to reach wider audiences and compete effectively with established players. The convenience and accessibility of online platforms, combined with targeted advertising, contribute to the growth of this segment. However, security and trust concerns necessitate stringent measures to prevent fraud and protect customer data.

Ethical and Sustainable Jewelry Segment: The growing awareness of environmental and social issues related to mining and manufacturing is driving increased demand for ethically sourced jewelry. Consumers are increasingly scrutinizing the origin of materials and the labor practices of manufacturers, leading to a substantial increase in this segment’s market share. This segment's growth is fueled by a socially and environmentally aware consumer base.

In summary: The combination of strong regional demand, particularly in Asia, combined with the growing popularity of high-value and ethically sourced jewelry, positions these segments as key drivers of market growth over the forecast period.

The gold and silver jewelry industry is experiencing accelerated growth due to several synergistic factors. The rising disposable income in emerging economies expands the consumer base significantly, particularly in Asia. Alongside this, evolving fashion trends, coupled with the increasing demand for personalized and customized designs, are driving innovation within the industry. E-commerce platforms offer enhanced accessibility and convenience, further fueling market growth. Finally, the growing awareness of ethical and sustainable sourcing practices is shaping consumer behavior, pushing the industry towards more responsible and transparent manufacturing methods. The convergence of these factors sets the stage for sustained growth in the years to come.

This report offers a comprehensive analysis of the gold and silver jewelry market, providing invaluable insights into current trends, growth drivers, and challenges. By combining historical data (2019-2024), current market estimations (2025), and future projections (2025-2033), this report offers a detailed roadmap for stakeholders navigating the complexities of this dynamic market. The inclusion of key players and significant developments provides a granular perspective on the competitive landscape and future trajectory of the industry. This in-depth analysis is essential for informed decision-making within the gold and silver jewelry sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.1%.

Key companies in the market include Shanghai Lao Fengxiang, Beijing Caibai Department Store, Shanghai Yuyuan Tourist Mart, Hubei Dongfang Jinyu, Chow Tai Fook Jewelry, Hang Fung Gold Technology Group, Cartier, ENZO, Chow Tai Seng Jewelry, Rain Ring, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Gold and Silver Jewelry," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Gold and Silver Jewelry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.