1. What is the projected Compound Annual Growth Rate (CAGR) of the Diamond Jewelry?

The projected CAGR is approximately 1.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Diamond Jewelry

Diamond JewelryDiamond Jewelry by Application (Wedding, Festival, Fashion, Others), by Type (Rings, Necklaces, Earrings, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

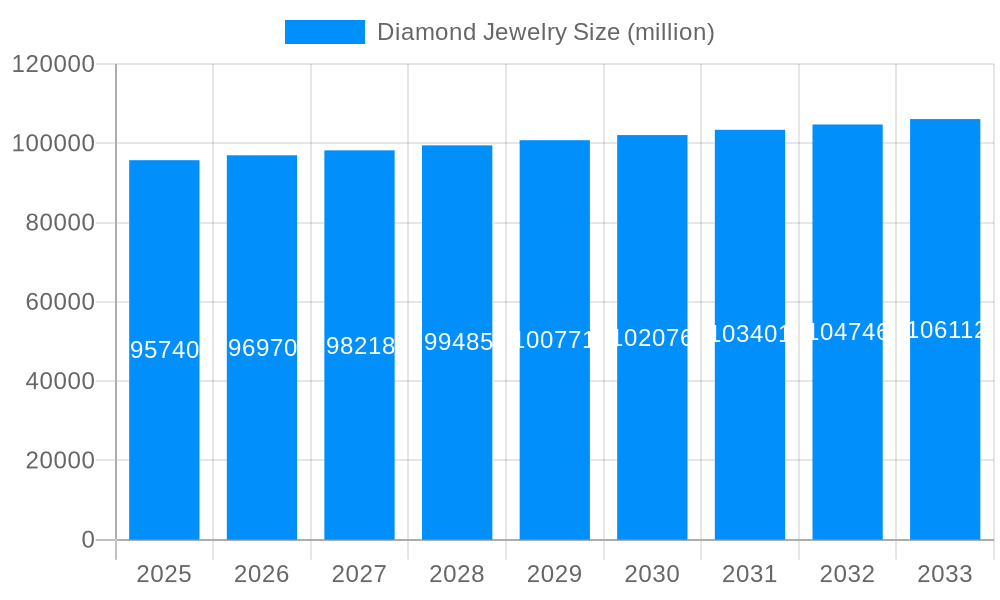

The global diamond jewelry market, valued at $95.74 billion in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 1.3% from 2025 to 2033. This relatively modest growth reflects a mature market, yet several factors contribute to ongoing demand. Increased disposable incomes in emerging economies, particularly in Asia, fuel continued expansion, driving demand for luxury goods, including diamond jewelry. Furthermore, evolving consumer preferences and the rise of personalized jewelry are reshaping the market. Consumers increasingly seek unique pieces that reflect individual style and values, creating opportunities for smaller, specialized brands to flourish alongside established players. However, economic downturns and fluctuations in precious metal prices pose significant challenges, potentially impacting consumer spending and profitability. The industry's sustainability practices and ethical sourcing are becoming increasingly crucial, with consumers demanding transparency and responsible production methods. This is likely to spur innovation in sustainable jewelry production and marketing strategies. Competition remains fierce, with established luxury brands like Chow Tai Fook, Richemont, and Tiffany & Co. facing competition from both emerging regional players and online retailers.

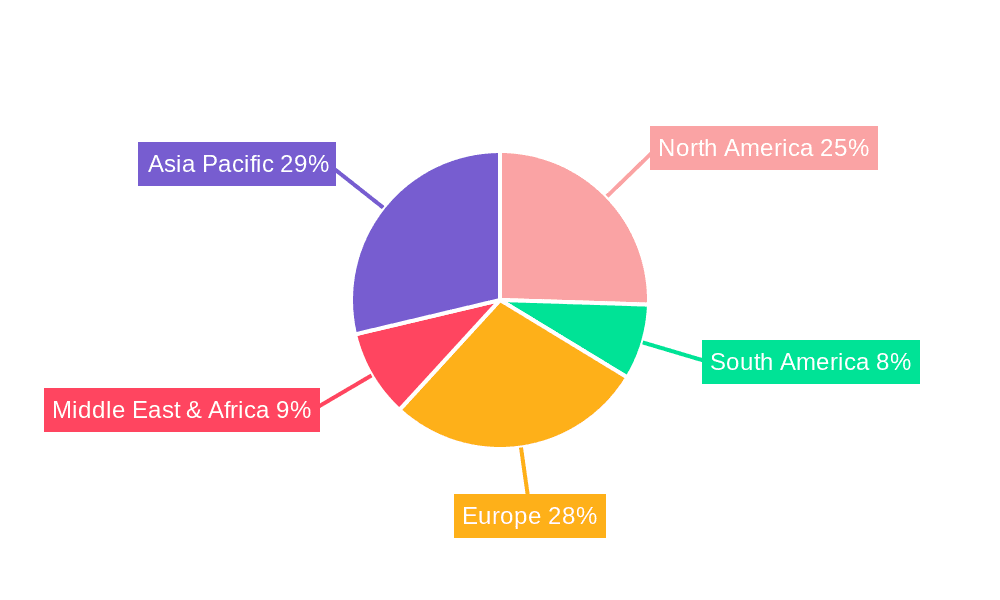

The market segmentation, while not explicitly provided, can be inferred to encompass various categories such as diamond type (e.g., natural, lab-grown), jewelry type (e.g., engagement rings, earrings, necklaces), price point (luxury, mid-range, budget), and distribution channels (online, brick-and-mortar). This segmentation is vital for understanding specific market dynamics. The geographical distribution is anticipated to show a significant concentration in established markets like North America and Europe, though emerging markets in Asia-Pacific are expected to show the most significant growth in the forecast period, fueled by increasing affluence and a growing middle class. The success of individual companies will hinge on their ability to adapt to evolving consumer preferences, embrace ethical sourcing and sustainability initiatives, and effectively leverage both online and offline channels to reach their target markets. Continuous innovation in design and marketing, alongside a strong emphasis on building customer loyalty, will be crucial for maintaining a competitive edge.

The global diamond jewelry market, valued at USD X billion in 2024, is projected to reach USD Y billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of Z% during the forecast period (2025-2033). This growth is fueled by a confluence of factors, including increasing disposable incomes in emerging economies, a rising preference for luxury goods, and innovative marketing strategies employed by key players. The historical period (2019-2024) witnessed significant fluctuations, influenced by global economic uncertainties and pandemic-related disruptions. However, the market demonstrated remarkable resilience, indicating a strong underlying demand for diamond jewelry. The estimated market size for 2025 is USD P billion, reflecting a steady recovery and growth trajectory. Consumer preferences are shifting towards ethically sourced diamonds, sustainable practices, and personalized designs, impacting the market's dynamics. The rise of e-commerce has significantly broadened the market's reach, providing access to a wider consumer base. Furthermore, the integration of technology, such as augmented reality and virtual try-on tools, has enhanced the customer experience and boosted online sales. Millennials and Gen Z consumers are increasingly driving demand, showcasing a preference for unique, expressive designs that reflect their individuality, which has influenced the creation of new styles and product lines. Key market insights reveal a growing focus on colored diamonds, lab-grown diamonds, and diamond jewelry incorporating alternative materials, reflecting a shift towards greater choice and affordability. The market is witnessing a trend towards smaller, more delicate pieces, as well as statement pieces suitable for diverse occasions.

Several powerful factors are driving the growth of the diamond jewelry market. Firstly, the rising affluence of the global middle class, particularly in Asia and other developing nations, is significantly increasing purchasing power, enabling a broader consumer base to afford luxury goods like diamond jewelry. Secondly, the enduring cultural significance of diamonds as symbols of love, commitment, and success continues to fuel demand, particularly for engagement rings and wedding jewelry. Thirdly, the constant innovation in diamond jewelry design, from classic styles to contemporary and trendy designs, ensures the market remains dynamic and appealing to various tastes and preferences. This includes the incorporation of other precious metals and gemstones, leading to unique and visually striking pieces. Furthermore, sophisticated marketing campaigns, effectively leveraging both traditional and digital media channels, contribute to shaping consumer desires and preferences for diamond jewelry. The expansion of the e-commerce sector provides increased accessibility and convenience to potential buyers worldwide, contributing further to market growth. The strategic partnerships and acquisitions made by major companies have played a crucial role in expanding market share and reaching new customer segments.

Despite the positive growth outlook, the diamond jewelry market faces several challenges. Fluctuations in global economic conditions, including recessions and geopolitical instability, can significantly impact consumer spending on luxury goods like diamond jewelry. Concerns regarding ethical sourcing and environmental sustainability are increasingly influencing consumer purchasing decisions, pushing manufacturers and retailers to adopt more responsible practices. The increasing availability and affordability of lab-grown diamonds pose a significant competitive threat to the natural diamond market. This necessitates the development of innovative marketing strategies that highlight the unique qualities and value proposition of natural diamonds. Furthermore, fluctuating prices of precious metals and gemstones, coupled with currency exchange rate volatility, can impact profitability and price stability in the industry. The potential for counterfeit products and the need for robust verification mechanisms pose a considerable challenge to maintaining consumer trust and brand integrity. Finally, evolving consumer preferences, influenced by fashion trends and lifestyle choices, necessitate continuous innovation and adaptation from market players to stay competitive.

The Asia-Pacific region, particularly China and India, is anticipated to dominate the diamond jewelry market during the forecast period due to several significant factors:

High Population Growth: These countries house a substantial population, providing a vast consumer base with increasing disposable incomes.

Rising Middle Class: A burgeoning middle class with a preference for luxury goods fuels demand for diamond jewelry.

Cultural Significance: Diamonds hold strong cultural significance in many Asian societies, driving gifting and self-purchase.

Strong Economic Growth: Positive economic growth in the region creates a favorable environment for luxury goods consumption.

Emerging Markets: Other regions, such as the Middle East and parts of Africa, also exhibit significant growth potential.

Dominant Segments:

In addition to the above, the following points highlight the dominance of these regions and segments:

The diamond jewelry industry is experiencing a resurgence propelled by several key catalysts. Firstly, the increasing adoption of e-commerce has broadened market reach, enhancing accessibility and convenience for consumers worldwide. The rising popularity of lab-grown diamonds offers an environmentally conscious alternative, appealing to a growing segment of ethically-minded consumers. Secondly, innovative marketing and branding strategies have elevated diamond jewelry to a symbol of self-expression and personal empowerment, appealing to a younger demographic. Finally, the industry's ongoing commitment to sustainable practices and responsible sourcing further enhances consumer trust and strengthens brand image.

This report provides a comprehensive overview of the diamond jewelry market, encompassing historical data (2019-2024), an estimated market size for 2025, and future projections (2025-2033). It analyzes key market trends, driving forces, challenges, and growth catalysts, offering detailed insights into regional and segmental performances. Leading players are profiled, and significant developments are highlighted, providing a robust understanding of the current and future state of the diamond jewelry industry. The report serves as a valuable resource for businesses, investors, and stakeholders seeking to understand and navigate the complexities of this dynamic market. The detailed analysis enables informed decision-making and strategic planning within the competitive landscape of the diamond jewelry sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 1.3%.

Key companies in the market include Chow Tai Fook, Richemont, Signet Jewellers, Swatch Group, Rajesh Exports, Lao Feng Xiang, Tiffany, Malabar Gold and Diamonds, LVMH Moet Hennessy, Zocai, Swarovski Corporation, Chow Sang Sang, Luk Fook, Pandora, Damiani, Stuller, Gitanjali Group, GUCCI, Graff Diamond, Damas International, Buccellati, De Beers, Blue Nile, CHANEL, .

The market segments include Application, Type.

The market size is estimated to be USD 95740 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Diamond Jewelry," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Diamond Jewelry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.