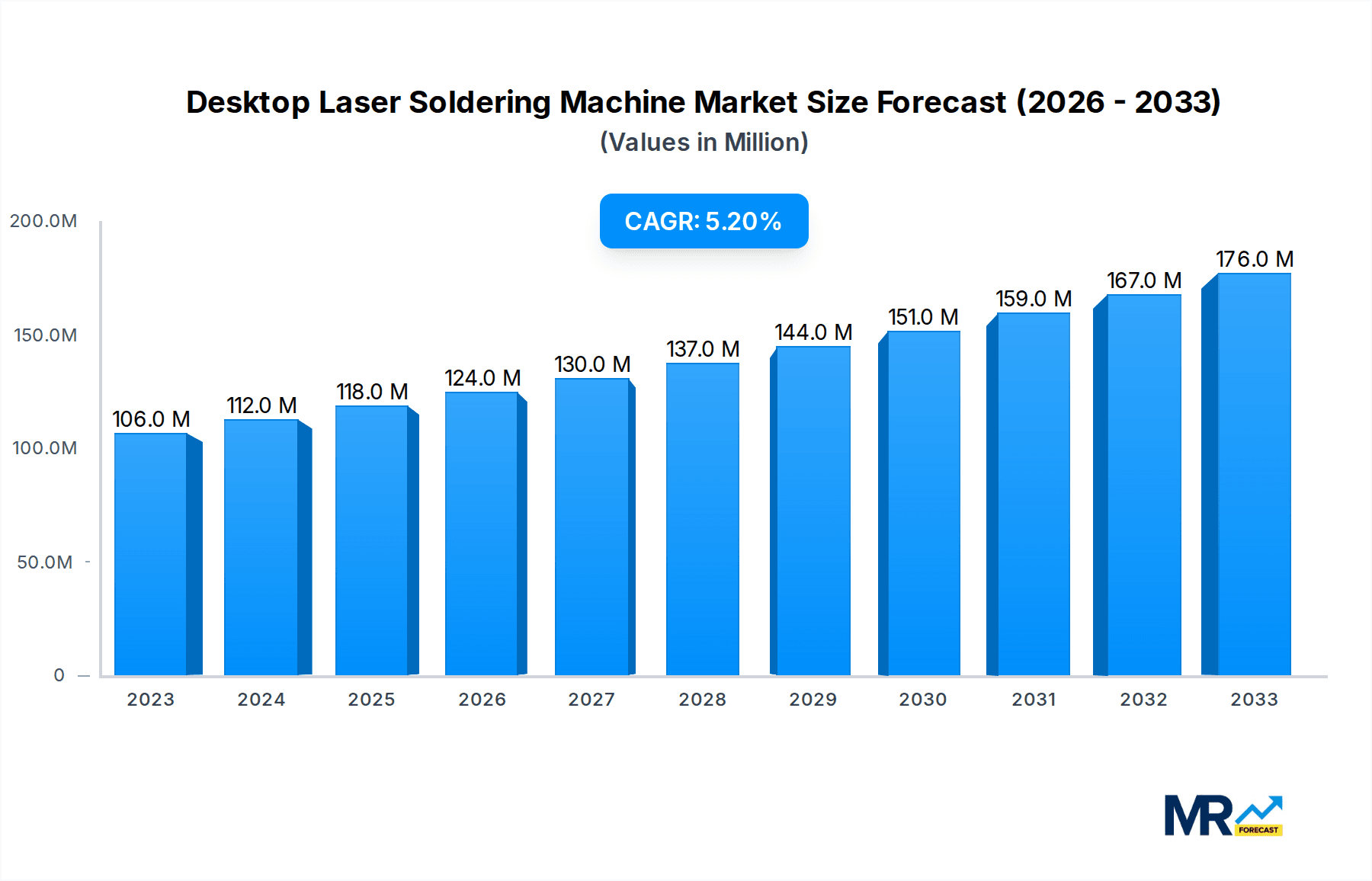

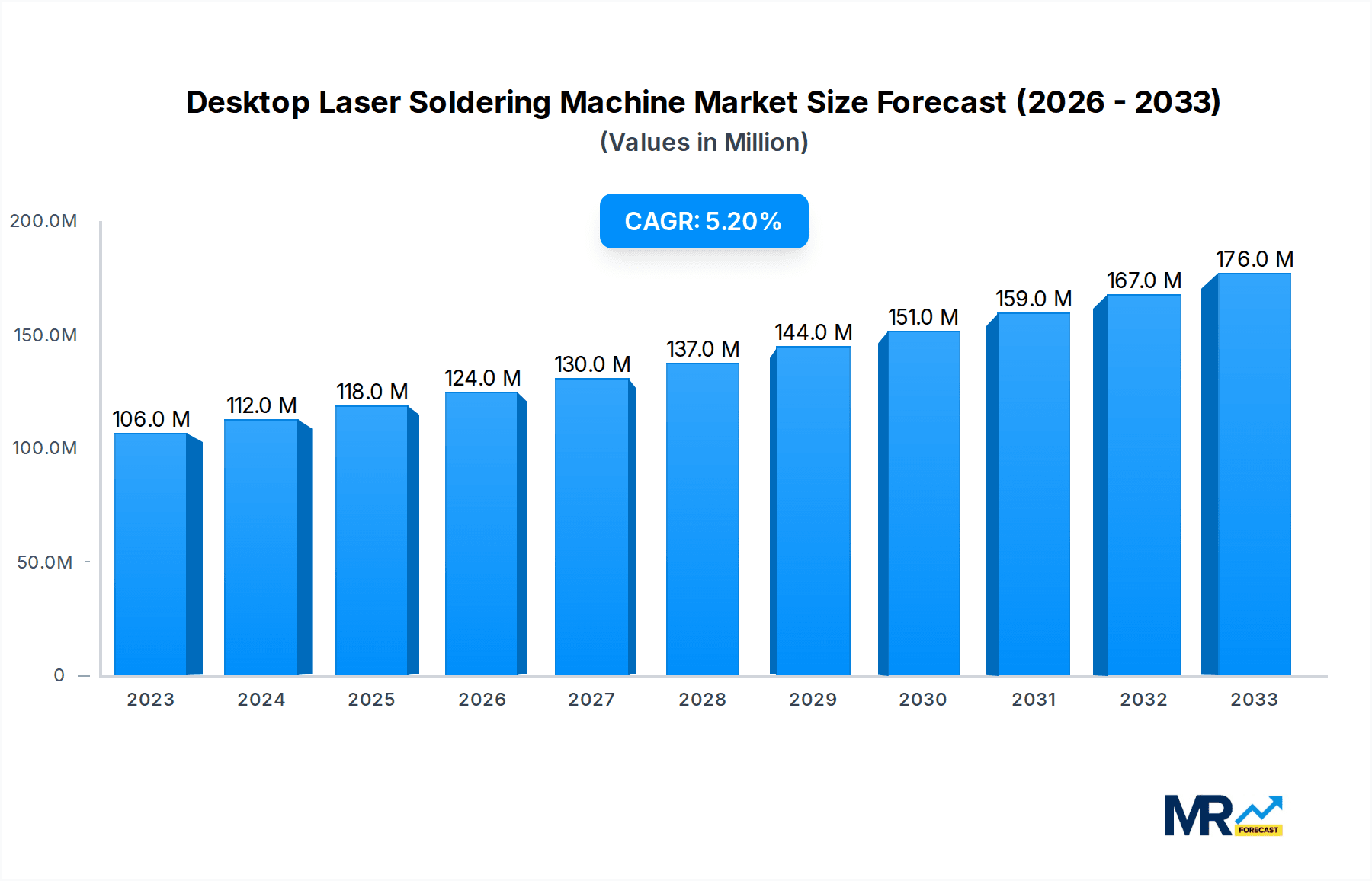

1. What is the projected Compound Annual Growth Rate (CAGR) of the Desktop Laser Soldering Machine?

The projected CAGR is approximately 5.1%.

Desktop Laser Soldering Machine

Desktop Laser Soldering MachineDesktop Laser Soldering Machine by Type (Integration, Modularization, World Desktop Laser Soldering Machine Production ), by Application (Consumer Electronics, Automotive Electronics, Electrical and Electronic, Others, World Desktop Laser Soldering Machine Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global Desktop Laser Soldering Machine market is poised for robust growth, projected to reach an estimated market size of $118 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.1% expected to propel it through 2033. This expansion is largely driven by the escalating demand for precision and efficiency in electronics manufacturing, particularly within the consumer electronics and automotive sectors. The increasing complexity and miniaturization of electronic components necessitate advanced soldering solutions that laser technology excels at providing. Integration and modularization are key trends shaping the market, offering manufacturers greater flexibility and customization in their production lines. The growing adoption of advanced manufacturing techniques and the continuous innovation in laser soldering systems are further fueling market expansion. The market's trajectory indicates a strong future, driven by technological advancements and the evolving needs of the electronics industry for high-quality, automated soldering processes.

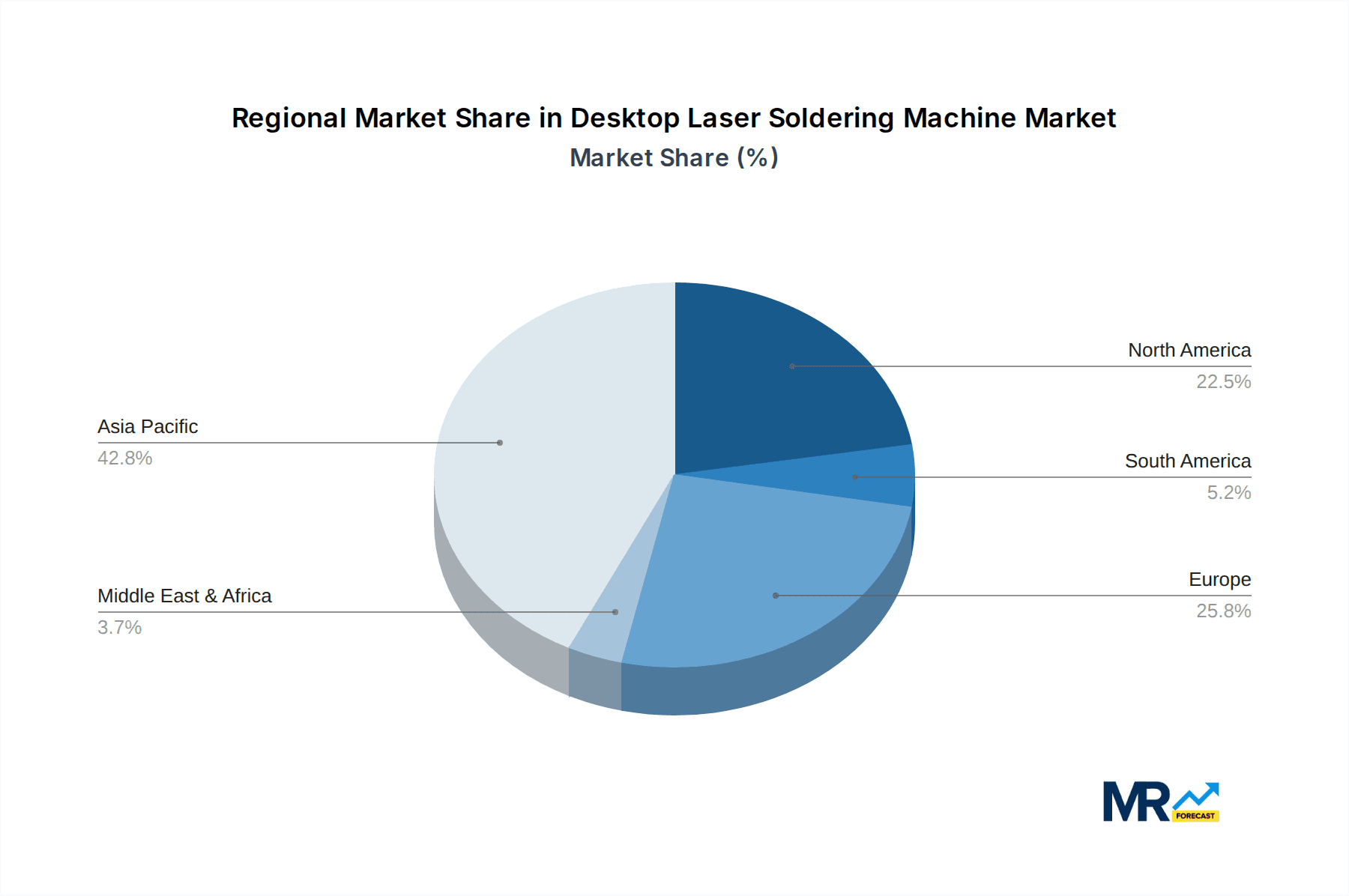

The competitive landscape features prominent players such as Japan Unix, Apollo Seiko, and Unitechnologies, alongside emerging companies from China and other regions, all contributing to innovation and market dynamism. Geographically, Asia Pacific, led by China, is expected to maintain its dominance due to its vast manufacturing base and the presence of numerous key players. North America and Europe also represent significant markets, driven by their advanced technological infrastructure and the demand for high-reliability electronic products. Restraints such as the initial high cost of advanced laser soldering equipment and the need for skilled personnel to operate and maintain them, are being gradually overcome by technological advancements and increased automation, making the technology more accessible and cost-effective for a wider range of manufacturers. The market is anticipated to see continued development in laser power, beam quality, and software integration, enhancing its capabilities for various applications beyond traditional soldering.

This comprehensive report delves into the dynamic landscape of the global desktop laser soldering machine market, offering an in-depth analysis from the historical period of 2019-2024 to a robust forecast extending to 2033. With a base year established at 2025, the report meticulously dissects market trends, driving forces, challenges, and burgeoning growth opportunities, positioning itself as an indispensable resource for stakeholders aiming to navigate this rapidly evolving sector. The estimated market value is projected to reach into the millions of dollars, reflecting the significant economic impact of this technology.

The global desktop laser soldering machine market is currently experiencing a transformative phase, characterized by rapid technological advancements and an escalating demand across diverse industrial applications. The historical period from 2019 to 2024 has witnessed a steady upward trajectory, fueled by the inherent advantages of laser soldering, including its non-contact nature, superior precision, and reduced thermal impact on sensitive components. This has propelled its adoption beyond traditional electronics manufacturing into more specialized areas like automotive electronics and advanced electrical and electronic assemblies. Looking ahead to the forecast period of 2025-2033, the market is poised for substantial expansion, with the Integration type segment expected to witness particularly strong growth. This surge is driven by the increasing need for streamlined manufacturing processes and the development of more sophisticated, all-in-one laser soldering solutions that can seamlessly integrate into existing production lines. The ability of integrated systems to offer enhanced automation, improved throughput, and consistent solder joint quality makes them highly attractive to manufacturers seeking to optimize their operations and maintain a competitive edge. Furthermore, the continuous miniaturization of electronic components across all application sectors, from consumer electronics to complex automotive systems, necessitates soldering technologies capable of handling increasingly fine pitch connections and delicate circuitry. Laser soldering, with its unparalleled precision and focused energy delivery, is perfectly positioned to meet these evolving requirements. The market is also seeing a growing emphasis on intelligent features, such as advanced vision systems for precise targeting, real-time process monitoring, and adaptive soldering parameters. These innovations are not only improving the efficiency and reliability of the soldering process but are also contributing to a higher yield and reduced rework rates, further solidifying the position of desktop laser soldering machines as a critical technology for modern manufacturing. The integration of Industry 4.0 principles, including IoT connectivity and data analytics, is also beginning to influence the development of these machines, promising more connected and intelligent manufacturing environments. The overall trend points towards a market that is becoming more sophisticated, automated, and indispensable for high-precision soldering applications.

The desktop laser soldering machine market is propelled by a confluence of powerful forces, chief among them being the relentless drive for enhanced precision and miniaturization in electronic component manufacturing. As devices shrink and become more complex, traditional soldering methods struggle to keep pace with the demands of fine-pitch connections and sensitive components. Laser soldering, with its non-contact, highly focused energy delivery, offers unparalleled accuracy and minimal thermal distortion, making it an ideal solution for these intricate applications. This is particularly evident in the burgeoning automotive electronics sector, where the increasing integration of advanced driver-assistance systems (ADAS) and infotainment technologies requires highly reliable and precise solder joints. Furthermore, the growing emphasis on automation and Industry 4.0 initiatives across manufacturing sectors is a significant driver. Desktop laser soldering machines are inherently well-suited for integration into automated production lines, offering benefits such as consistent performance, reduced human error, and improved throughput. The demand for higher quality and more reliable electronic products across consumer electronics and general electrical and electronic applications also plays a crucial role. Manufacturers are increasingly recognizing that the superior solder joint integrity and reduced defect rates offered by laser soldering translate into improved product lifespan and customer satisfaction, ultimately driving its adoption as a key enabler of quality. The increasing adoption of advanced materials and emerging technologies, such as flexible electronics and advanced packaging techniques, further expands the application scope for laser soldering. The ability of laser systems to precisely control heat and weld dissimilar materials makes them a valuable tool in these innovative areas.

Despite its compelling advantages, the desktop laser soldering machine market faces several challenges and restraints that could temper its growth trajectory. A primary hurdle is the initial capital investment. Laser soldering machines, due to their advanced technology and precision engineering, often come with a higher upfront cost compared to conventional soldering equipment. This can be a significant barrier for small and medium-sized enterprises (SMEs) or manufacturers in price-sensitive markets, limiting their ability to adopt this cutting-edge technology. Another significant restraint is the requirement for specialized expertise. Operating and maintaining laser soldering machines effectively often necessitates a skilled workforce with a deep understanding of laser physics, optical systems, and process parameters. The availability of such skilled labor can be a bottleneck in certain regions, hindering widespread adoption. Furthermore, while laser soldering offers precision, the complexity of certain applications and materials can still pose challenges. For instance, soldering highly reflective materials or working with extremely large or irregularly shaped components might require specialized laser systems or intricate process optimization, increasing complexity and cost. The perception and awareness gap among some potential users also plays a role. Not all manufacturers are fully aware of the full capabilities and benefits of desktop laser soldering, and there might be a reliance on familiar, albeit less efficient, traditional methods. Finally, integration challenges within existing, older manufacturing infrastructures can sometimes be a hurdle. Retrofitting older production lines to accommodate advanced laser soldering equipment may require significant modifications and investments, slowing down the adoption process.

The global desktop laser soldering machine market is characterized by regional dominance and the significant impact of specific segments. Asia-Pacific, particularly countries like China, South Korea, and Japan, is poised to be a dominant region in both production and consumption. This dominance is driven by the region's status as a global manufacturing hub for electronics, with a vast ecosystem of companies involved in consumer electronics, automotive electronics, and electrical and electronic components. The presence of major Original Equipment Manufacturers (OEMs) and a strong emphasis on technological innovation and cost-competitiveness further solidify Asia-Pacific's leading position.

Within this dominant region, the Integration segment of the Type classification is projected to witness substantial growth and potentially lead the market. The increasing demand for streamlined, automated production processes in high-volume manufacturing environments across Asia-Pacific is a key factor. Integrated desktop laser soldering machines offer a holistic solution, combining the laser source, optics, control systems, and often vision inspection in a single, user-friendly unit. This simplifies installation, reduces footprint, and ensures seamless integration into existing assembly lines, which is a significant advantage for manufacturers looking to boost efficiency and reduce lead times. The ability of integrated systems to offer pre-programmed soldering profiles and intuitive interfaces also lowers the barrier to entry for adopting advanced laser technology, making them particularly attractive to the diverse manufacturing base in Asia-Pacific.

Furthermore, the Consumer Electronics application segment is expected to remain a powerhouse, driving significant demand for desktop laser soldering machines. The insatiable global appetite for smartphones, laptops, wearables, and other personal electronic devices necessitates high-precision, high-throughput soldering solutions. As these devices become more compact and feature increasingly sophisticated circuitry, laser soldering's ability to handle fine-pitch components and prevent thermal damage is critical. The rapid product cycles and the need for agile manufacturing in the consumer electronics sector also favor the efficiency and reliability that laser soldering offers.

The Automotive Electronics application segment is another crucial area of dominance. The automotive industry's rapid evolution towards electrification, autonomous driving, and advanced connectivity is leading to an exponential increase in the complexity and number of electronic components within vehicles. These components, often operating in harsh environments, require exceptionally robust and reliable solder joints. Laser soldering provides the precision and control necessary to meet these stringent quality and reliability standards, making it indispensable for the production of critical automotive electronic modules.

In summary, the Asia-Pacific region, driven by its manufacturing prowess, will be the dominant force. Within this, the Integration type, coupled with the Consumer Electronics and Automotive Electronics application segments, will spearhead market growth and influence.

The desktop laser soldering machine industry is experiencing a surge fueled by key growth catalysts. The relentless pursuit of miniaturization in electronics across all application sectors, from smartphones to medical devices, is a primary driver, demanding soldering solutions with unparalleled precision. Furthermore, the global push towards automation and Industry 4.0 is accelerating the adoption of laser soldering due to its inherent compatibility with automated production lines and its ability to deliver consistent, high-quality results. The increasing sophistication of automotive electronics, driven by electrification and autonomous driving technologies, necessitates highly reliable solder joints, making laser soldering a critical component.

This report offers a thorough examination of the global desktop laser soldering machine market. It provides a detailed analysis of market size and forecasts, meticulously tracking the evolution from the historical period of 2019-2024 through to a projected outlook extending to 2033, with 2025 serving as the base year. The report delves into the intricate dynamics of market trends, the underlying forces driving its expansion, and the prevalent challenges and restraints that shape its trajectory. Furthermore, it identifies key regions and segments poised for market dominance, offering a strategic perspective on where growth will be most pronounced. The report also highlights the critical growth catalysts that are propelling the industry forward and provides an overview of the leading players and their significant contributions through recent developments. This comprehensive coverage aims to equip stakeholders with the knowledge needed to make informed decisions in this rapidly advancing technological landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.1%.

Key companies in the market include Japan Unix, Apollo Seiko, Unitechnologies, Dr. Mergenthaler, Shenzhen Anewbest Electronic Technology, Shanghai 3S-laser Industry, Wuhan Pusili Laser Technology, Shenzhen Huahan Laser Technology, Shenzhen Vi Laser Equipment, Demark (Wuhan) Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Desktop Laser Soldering Machine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Desktop Laser Soldering Machine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.