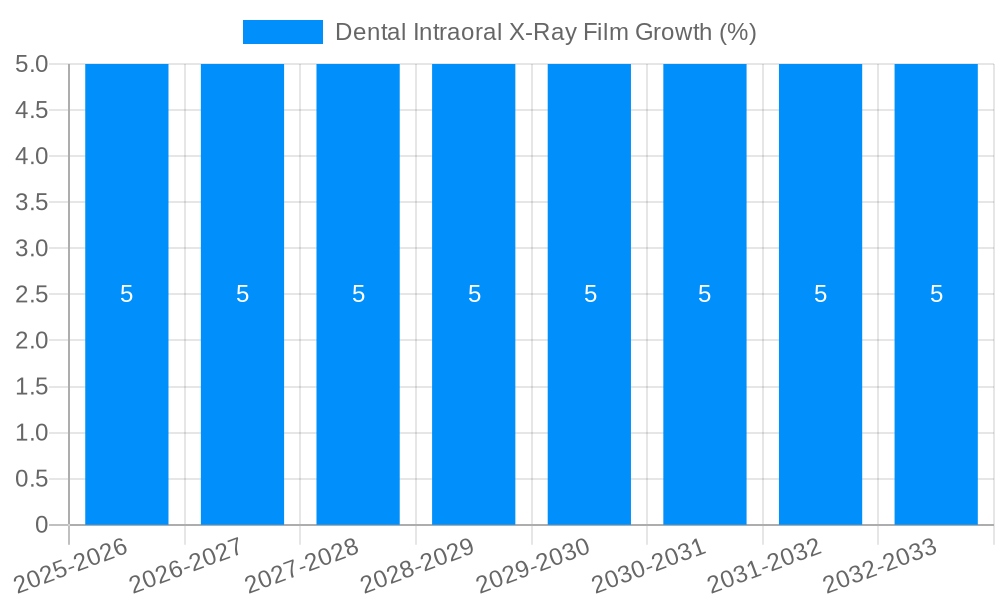

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Intraoral X-Ray Film?

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Dental Intraoral X-Ray Film

Dental Intraoral X-Ray FilmDental Intraoral X-Ray Film by Type (D-Speed X-Ray Film, Ultra-speed X-Ray Film), by Application (Hospital, Dental Clinic), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

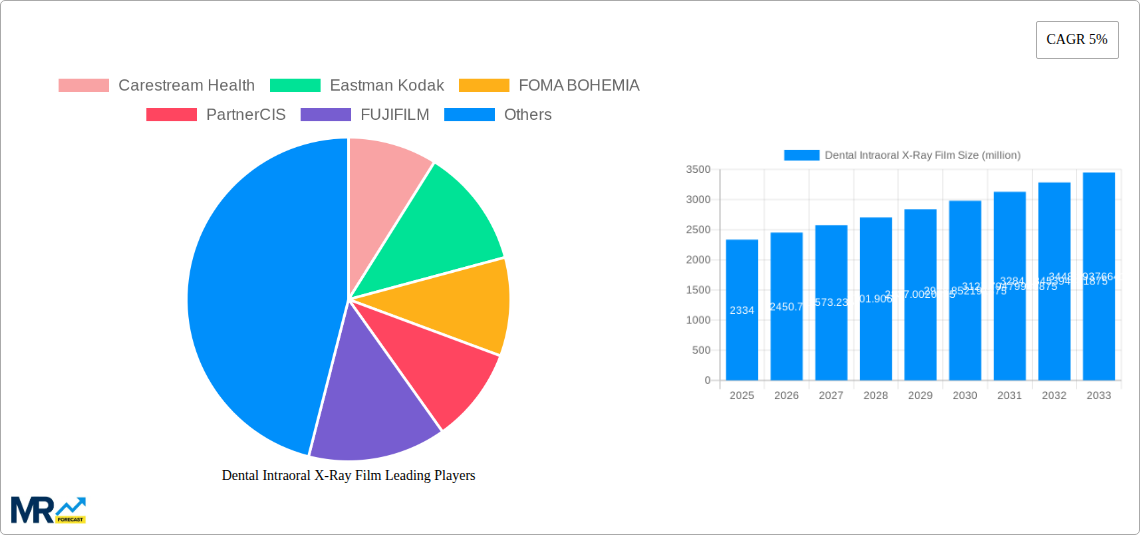

The global dental intraoral X-ray film market, valued at $1,599.1 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033. This expansion is fueled by several key factors. The increasing prevalence of dental diseases globally necessitates frequent X-ray examinations, bolstering demand. Technological advancements in film types, such as the development of faster D-speed and ultra-speed films, contribute to improved image quality and reduced radiation exposure, further driving market adoption. Furthermore, the rising number of dental clinics and hospitals, coupled with a growing awareness of preventative dental care, particularly in developing economies, fuels market expansion. The segment breakdown shows significant contributions from both D-speed and ultra-speed X-ray films, catering to varying clinical needs and budgetary considerations. Hospitals constitute a larger market segment compared to dental clinics due to higher patient volumes and the need for comprehensive diagnostic imaging.

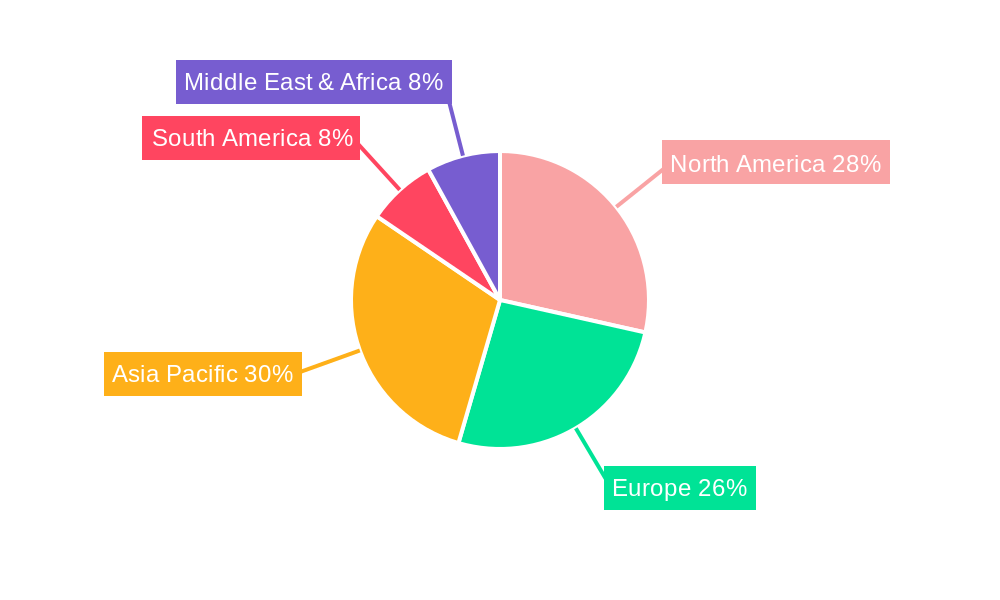

However, the market faces certain challenges. The emergence of digital radiography systems presents a significant restraint, offering advantages such as instant image viewing, reduced storage space, and enhanced image manipulation capabilities. The higher initial investment cost associated with digital systems, however, continues to support the market for traditional X-ray films, particularly in cost-conscious settings. Regional variations exist, with North America and Europe currently holding larger market shares, driven by higher healthcare expenditure and technological advancements. However, the Asia-Pacific region is expected to witness substantial growth, fueled by rising disposable incomes, improved healthcare infrastructure, and an expanding middle class. This continued growth will be influenced by the balance between the cost-effectiveness of film and the benefits of digital technology within specific market segments and geographic regions.

The global dental intraoral X-ray film market is a multi-million-unit industry exhibiting a dynamic interplay of traditional methods and technological advancements. While digital radiography is rapidly gaining traction, the demand for intraoral X-ray films remains substantial, particularly in regions with limited access to advanced digital imaging technologies or where cost-effectiveness is a primary concern. The market's evolution is characterized by a gradual shift from D-speed films towards the faster, more efficient ultra-speed films, driven by the need for reduced radiation exposure to both patients and dental professionals. This trend is further supported by ongoing improvements in film sensitivity and processing techniques. The historical period (2019-2024) saw moderate growth, largely influenced by the established presence of film-based systems in numerous dental clinics globally. However, the forecast period (2025-2033) anticipates a more nuanced trajectory, with growth likely to be tempered by the persistent rise of digital alternatives. This transition isn't expected to be a complete displacement of film but rather a gradual market share adjustment, with film continuing to hold a significant position, especially in budget-conscious settings and specific applications where its simplicity and reliability remain advantageous. The estimated market value for 2025, while substantial in the millions of units, is projected to exhibit a more moderate growth rate compared to previous years, reflecting this evolving market landscape. Geographic variations also influence market trends, with developing economies potentially showing stronger growth in film usage due to cost-effectiveness considerations, in contrast to developed nations where digital adoption is more prevalent.

Several factors contribute to the continued relevance of dental intraoral X-ray film. Firstly, the lower initial investment cost compared to digital systems makes film a more accessible option for smaller dental clinics and practices in developing nations or those with limited budgets. This affordability factor outweighs the potential higher long-term operational costs associated with film processing and disposal. Secondly, the simplicity and ease of use of film-based systems contribute to its sustained popularity. The process is straightforward and requires minimal specialized training, which is a considerable advantage in areas with limited access to skilled technicians. Thirdly, the reliability of film technology continues to be a strong selling point. Unlike digital systems, film does not rely on sophisticated electronic components and software, making it less susceptible to technical malfunctions. This inherent robustness is a crucial factor for dental practices that value consistency and dependability. Furthermore, some dental professionals still prefer the visual clarity and detail offered by traditional film, particularly in certain diagnostic applications. The perception of greater familiarity and established workflow with film-based systems also contributes to its continued adoption within the dental community.

Despite its continued relevance, the dental intraoral X-ray film market faces significant headwinds. The most significant challenge is the growing adoption of digital radiography. Digital systems offer numerous advantages, including immediate image availability, reduced radiation exposure, enhanced image manipulation capabilities, and easier storage and retrieval of patient records. This technological advancement presents a compelling alternative for many dental practices, pushing film towards a niche market. Secondly, the increasing awareness of the environmental impact of film processing and disposal poses a concern. The chemical waste generated necessitates proper disposal methods, which can be costly and environmentally demanding. This increasing scrutiny on sustainability further reduces film’s attractiveness. Thirdly, the fluctuating prices of silver halide, a key component in film production, can impact the overall cost and profitability of film-based systems. Finally, the lack of sophisticated image enhancement capabilities compared to digital counterparts limits the diagnostic value, a factor that influences preferences among dental professionals seeking optimal image clarity.

The dental intraoral X-ray film market exhibits regional variations in dominance. While developed nations witness a decline in film usage due to digital adoption, developing economies show a different picture.

Developing Economies (e.g., parts of Asia, Africa, and South America): These regions are projected to experience continued, albeit potentially slower, growth in dental intraoral X-ray film demand throughout the forecast period. This is primarily attributed to the lower cost and greater accessibility of film compared to digital systems. The established infrastructure and familiarity with traditional film-based practices further fuel its usage. The large and growing populations in these regions also contribute to the potential market size.

Dental Clinic Application: The segment encompassing dental clinics remains the largest consumer of intraoral X-ray film. The vast number of independent dental clinics globally, especially in developing economies, sustains a substantial demand for this traditional method. Smaller clinics often find the lower initial investment and operational simplicity of film more appealing than the upfront costs and technological complexities associated with digital alternatives.

D-Speed X-Ray Film: Although ultra-speed films are gaining market share, D-speed films still hold a significant portion, particularly in regions with less advanced infrastructure. The lower cost of D-speed films makes them attractive to budget-conscious dental practices.

In summary, while the overall market shows a trend towards digitalization, developing economies and the continued use of D-speed films within dental clinics represent significant market segments in the millions of units, sustaining the demand for intraoral X-ray film.

Continued growth, though at a slower rate than previously, is propelled by the cost-effectiveness of film in certain markets and its simple operation, maintaining its relevance in areas with limited resources or preference for established workflows. Furthermore, advancements in film technology, such as improvements in sensitivity and processing speed, enhance its efficiency and appeal.

This report provides a comprehensive analysis of the dental intraoral X-ray film market, encompassing historical data, current market trends, and future projections. It offers deep insights into various market segments, including film type, application, and geographic regions, highlighting both growth opportunities and challenges faced by industry stakeholders. The report’s analysis helps understand the shifting market dynamics, allowing companies to strategically adapt to the ongoing changes in the industry landscape while continuing to capitalize on the remaining demand for film-based intraoral X-ray imaging.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include Carestream Health, Eastman Kodak, FOMA BOHEMIA, PartnerCIS, FUJIFILM, 3D Dental, iCRco, Hitachi Medical Corporation, Dentamerica, .

The market segments include Type, Application.

The market size is estimated to be USD 1599.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Dental Intraoral X-Ray Film," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Dental Intraoral X-Ray Film, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.