1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Adhesive System?

The projected CAGR is approximately XX%.

Dental Adhesive System

Dental Adhesive SystemDental Adhesive System by Application (Hospitals, Dental Clinics, Others, World Dental Adhesive System Production ), by Type (Self-etch, Total-etch, World Dental Adhesive System Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

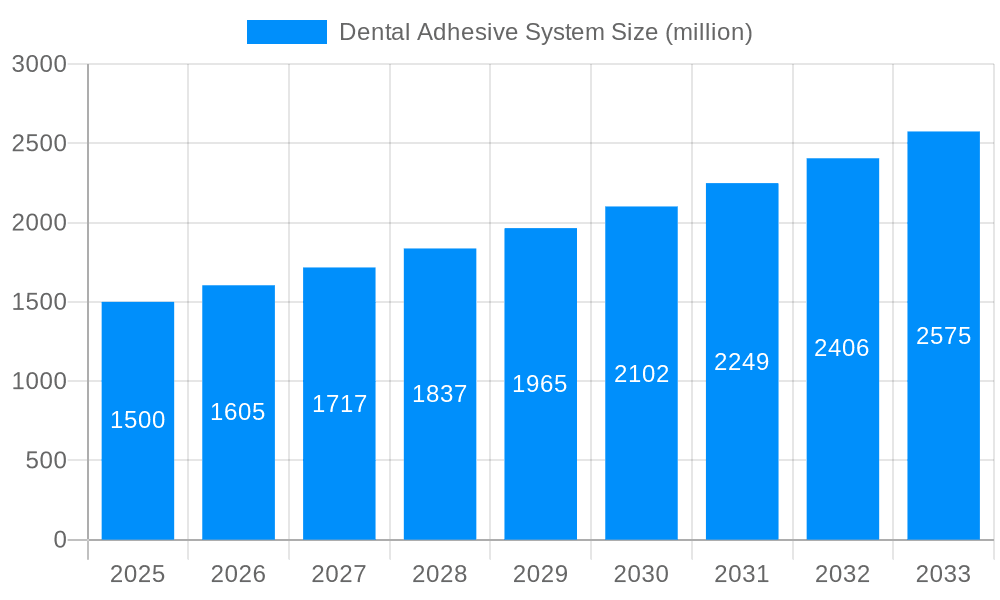

The global dental adhesive systems market, valued at $1415.7 million in 2025, is poised for significant growth. While a precise CAGR isn't provided, considering the consistent advancements in dental technology and the rising prevalence of dental procedures, a conservative estimate of 5-7% annual growth over the forecast period (2025-2033) seems reasonable. Key drivers include the increasing demand for minimally invasive dental treatments, the growing elderly population requiring more restorative procedures, and technological advancements leading to improved adhesive properties, such as enhanced bond strength and reduced sensitivity. Furthermore, the market is witnessing a shift towards self-adhesive resin cements, offering simplified application and improved efficiency, while the integration of digital dentistry technologies is streamlining workflows and boosting demand. Market restraints include the potential for sensitivity following application and the relatively high cost of certain advanced systems, limiting accessibility in some markets. Segmentation likely exists across product type (e.g., resin cements, self-adhesive systems), application (e.g., crowns, bridges, inlays/onlays), and end-user (e.g., dental clinics, hospitals). The competitive landscape is populated by major players such as 3M, Kerr Dental, and others, constantly vying for market share through innovation and strategic partnerships.

The projected growth trajectory suggests a substantial market expansion by 2033. This growth will likely be influenced by factors such as increasing disposable incomes in developing economies, expanding dental insurance coverage, and rising awareness of oral health. Companies are likely focusing on product differentiation, expanding their product portfolio, and strengthening their distribution networks to capture a larger market share. Regional variations in market growth will likely be influenced by healthcare infrastructure, economic conditions, and the prevalence of dental diseases in each region. North America and Europe currently hold a significant portion of the market; however, emerging markets in Asia-Pacific and Latin America present considerable growth potential, driven by increasing awareness and adoption of advanced dental technologies.

The global dental adhesive system market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by an aging global population, rising dental caries prevalence, and increasing demand for minimally invasive restorative procedures, the market is witnessing a significant shift towards advanced adhesive technologies. The historical period (2019-2024) showed consistent growth, exceeding expectations in several key regions. The estimated year (2025) indicates a further acceleration, setting the stage for robust expansion during the forecast period (2025-2033). Key market insights reveal a growing preference for self-etching adhesives due to their simplified application and reduced treatment times, leading to increased efficiency for dental professionals. Simultaneously, there is a rising demand for light-cure adhesives offering enhanced polymerization control and improved bond strength. This trend is particularly noticeable in developed markets, where aesthetic dentistry and the preservation of natural tooth structure are highly prioritized. Furthermore, the market is witnessing the emergence of innovative adhesive systems incorporating nanotechnology and biomimetic materials, promising superior performance and enhanced biocompatibility. This technological advancement is driving premium pricing but is also being fueled by an increasing patient willingness to pay for superior results and long-term dental health. The shift towards digital dentistry is also indirectly impacting the market by increasing the demand for compatible adhesive systems for CAD/CAM restorations. Overall, the market is characterized by increasing product innovation, a focus on improved clinical outcomes, and a growing awareness among both dentists and patients about the critical role of effective bonding in dental procedures. The market is poised for significant growth in the coming years, driven by these ongoing trends.

Several factors are propelling the growth of the dental adhesive system market. Firstly, the global rise in dental caries, particularly in developing nations with limited access to preventive dental care, fuels the demand for restorative procedures necessitating strong adhesive bonding. Secondly, the increasing prevalence of geriatric populations worldwide significantly contributes to the market’s expansion as this demographic often requires more extensive dental work including restorations and implants which rely heavily on adhesive systems. The simultaneous shift toward minimally invasive dentistry, aiming to preserve tooth structure as much as possible, highlights the importance of reliable and durable adhesive systems capable of strong bonding to minimal tooth structure preparations. Moreover, advancements in adhesive technology, including the development of self-etching and light-cure adhesives, are simplifying application procedures and improving bond strength and longevity, thereby enhancing both clinician efficiency and patient outcomes. Furthermore, the ongoing evolution of dental materials, such as the development of new composite resins, demands compatible adhesive systems, driving further market growth through complementary product development. The increasing awareness among both dental professionals and patients regarding the importance of proper bonding for long-term restoration success fuels demand for high-quality dental adhesive systems. This rising awareness is driven by educational initiatives, professional conferences, and increased public access to dental health information through various media channels. Finally, regulatory approvals of innovative dental adhesives, reflecting their safety and efficacy profiles, create greater confidence among dental practitioners, facilitating market penetration.

Despite the strong growth potential, the dental adhesive system market faces certain challenges. Firstly, the market is characterized by intense competition, with numerous established and emerging players vying for market share. This competition leads to price pressures and necessitates ongoing innovation to differentiate products and maintain competitiveness. Secondly, the high cost of some advanced adhesive systems, particularly those incorporating novel technologies, can limit their accessibility to practitioners and patients in certain regions, particularly developing nations with limited healthcare infrastructure and budgets. This cost constraint necessitates the development of more affordable and efficient solutions without compromising quality and performance. Regulatory hurdles and stringent approval processes for new adhesive systems in different regions also present a challenge for market expansion and entry by new players, requiring significant investment in regulatory compliance. Additionally, the need for ongoing research and development to address potential issues, such as hypersensitivity reactions to certain components of the adhesive systems and ensuring long-term bond integrity in diverse oral environments, poses ongoing challenges for manufacturers. Finally, maintaining the quality and consistency of dental adhesives across various production batches and formulations is critical, demanding sophisticated quality control measures to guarantee reliable performance and avoid potential complications.

North America: The region is expected to dominate the market owing to high dental awareness, advanced healthcare infrastructure, and high adoption rates of advanced dental technologies. The region demonstrates consistent growth driven by factors like a high prevalence of dental procedures, substantial expenditure on dental care, and a strong presence of key market players with extensive distribution networks. Within this region, the United States stands as a key driver.

Europe: Following North America, Europe represents a substantial market for dental adhesive systems, driven by a strong healthcare infrastructure and the presence of several major dental material manufacturers within the region. This is further augmented by the increasing adoption of minimally invasive techniques and a growing focus on aesthetic dentistry. Germany and France are particularly significant within this region.

Asia-Pacific: This region exhibits significant growth potential, driven by rapidly expanding middle classes in various countries, increased dental awareness, and growing investments in healthcare infrastructure. Rapid economic growth in nations like China and India is expected to fuel significant demand. However, factors like varied regulatory landscapes and disparities in dental infrastructure across different countries within the region may pose challenges.

Self-Etching Adhesives: This segment is projected to dominate due to its simplified application protocol, which leads to reduced treatment time, increased efficiency for dentists, and lower potential for procedural errors. The ease of use coupled with satisfactory performance is attractive to practitioners of various experience levels.

Light-Cure Adhesives: While self-etching adhesives are gaining prominence, light-cure adhesives continue to maintain a substantial market share, particularly in cases where enhanced control over polymerization and improved bond strength are desired for specific applications.

Resin-Based Adhesives: This is the most widely used type due to its versatility and effectiveness in a wide variety of restorative procedures. The segment’s dominance is driven by proven clinical performance and broad availability.

The paragraph above summarizes the key regions and segments, providing insights into the driving forces and associated nuances within each category. The key regions’ dominance is further accentuated by higher disposable incomes, leading to greater access to high-quality dental care, including the utilization of advanced adhesive systems.

Several factors are accelerating the growth of the dental adhesive system industry. These include the rising prevalence of dental caries and other dental conditions globally, leading to increased demand for restorative dentistry and thus for effective adhesive systems. Technological advancements are also playing a vital role, producing improved adhesives with enhanced bonding strength, ease of use, and biocompatibility. The increasing focus on minimally invasive dentistry further bolsters the market, as adhesive systems are crucial for the success of these procedures. Finally, heightened awareness among both dental professionals and the general public regarding the significance of effective bonding in maintaining long-term dental health contributes significantly to the expansion of this industry.

(Further significant developments can be added here, as specific information requires further research)

This report provides a comprehensive overview of the dental adhesive system market, covering historical data, current market trends, and future projections. It analyzes key growth drivers and challenges, examining market segmentation by type and region. The report profiles leading industry players, including their market share, product offerings, and strategic initiatives. It offers insights for manufacturers, investors, and other stakeholders interested in navigating the opportunities and challenges presented by this dynamic market. Further details of product specific innovations and regional market penetrations are incorporated, ensuring the most accurate and up-to-date market picture.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include 3M, Kerr Dental, DMG America, Envista, GC America, DenMat, Kuraray Dental, DiaDent, FGM Dental, BISCO Dental, Ormco, Ivoclar, VOCO America, DMP Dental, Pentron, Parkell, ACTEON GROUP, .

The market segments include Application, Type.

The market size is estimated to be USD 1415.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Dental Adhesive System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Dental Adhesive System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.