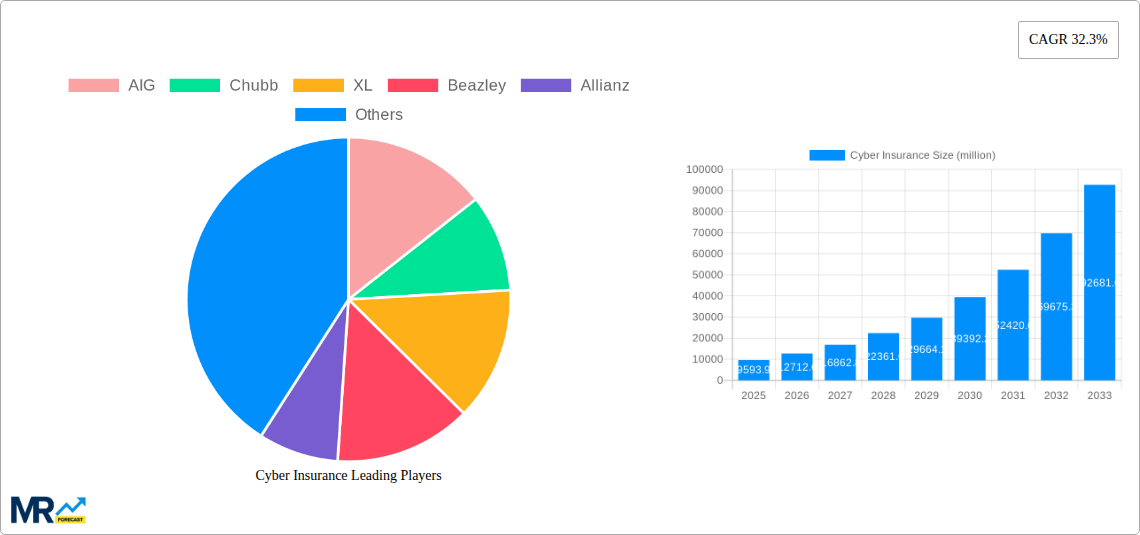

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Insurance?

The projected CAGR is approximately 32.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cyber Insurance

Cyber InsuranceCyber Insurance by Type (Stand-alone Cyber Insurance, Packaged Cyber Insurance), by Application (Financial Institutions, Retail and Wholesale, Healthcare, Business Services, Manufacturing, Technology, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

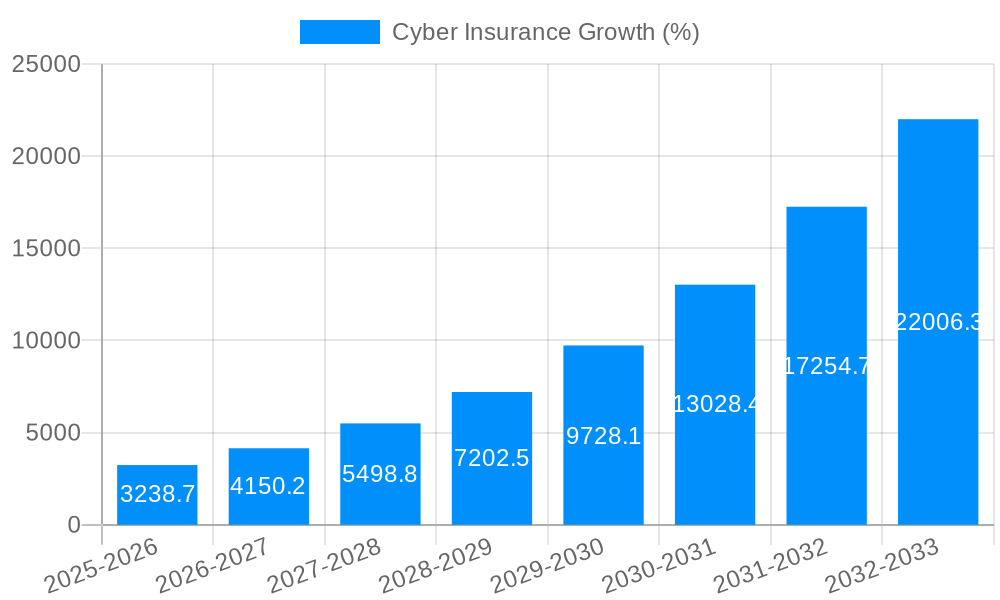

The global cyber insurance market is experiencing explosive growth, projected to reach $9593.9 million in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 32.3% from 2025 to 2033. This surge is driven by the escalating frequency and severity of cyberattacks targeting businesses across all sectors. Increased reliance on digital infrastructure, interconnected systems, and the proliferation of sensitive data make organizations increasingly vulnerable. Regulatory pressures, such as GDPR and CCPA, further incentivize businesses to procure cyber insurance to mitigate financial and reputational risks associated with data breaches and other cyber incidents. The market's segmentation reveals significant opportunities across various application areas. Financial institutions, with their vast amounts of sensitive customer data, consistently represent a substantial segment. However, growth is also being witnessed in sectors like healthcare, retail, and technology, reflecting the broad reach of cyber threats. The diverse range of insurance products, including stand-alone and packaged cyber insurance policies, cater to varied organizational needs and risk profiles. Leading insurers, such as AIG, Chubb, and Allianz, are actively expanding their cyber insurance offerings, fostering competition and driving innovation within the market. Geographic expansion, particularly in developing economies with rapidly increasing digital adoption, is also a key driver of market growth.

The competitive landscape is characterized by a mix of established multinational insurers and specialized cyber insurance providers. Strategic partnerships and acquisitions are reshaping the market, with insurers collaborating with cybersecurity firms to offer comprehensive risk management solutions. While the market shows immense promise, challenges remain. Accurate risk assessment and pricing continue to pose difficulties, particularly in the context of evolving threats and evolving attack vectors. Furthermore, the complexity of cyber insurance policies and the lack of awareness among smaller businesses represent potential obstacles to market penetration. Despite these hurdles, the long-term outlook for the cyber insurance market remains exceptionally positive, fueled by unrelenting technological advancements and persistent cyber threats. The market's robust growth trajectory is anticipated to continue throughout the forecast period, driven by the urgent need for robust cyber risk mitigation strategies in a digitally interconnected world.

The global cyber insurance market exhibited robust growth during the historical period (2019-2024), driven by the escalating frequency and severity of cyberattacks across various sectors. The market size, currently estimated at several billion dollars, is projected to experience exponential growth, reaching tens of billions of dollars by 2033. This growth trajectory is fueled by increasing digitalization, the expansion of interconnected systems, and a heightened awareness of cyber risks among businesses of all sizes. The estimated market value for 2025 is in the low tens of billions, showcasing the market's significant potential. While stand-alone cyber insurance policies remain popular, offering targeted coverage for specific cyber threats, packaged cyber insurance solutions are gaining traction due to their cost-effectiveness and comprehensive protection. The demand for cyber insurance is particularly high in sectors like financial institutions, healthcare, and technology, where the consequences of a cyber breach can be catastrophic, leading to significant financial losses, reputational damage, and regulatory penalties. However, the market also faces challenges, including the difficulty in accurately assessing and pricing cyber risks, the evolving nature of cyber threats, and the lack of standardized policies. This necessitates continuous innovation within the cyber insurance industry to stay ahead of emerging threats and adapt to the dynamic cyber landscape. The forecast period (2025-2033) anticipates further market expansion driven by technological advancements in cybersecurity and increasing government regulations aimed at bolstering cyber resilience. Market players are constantly striving to refine their underwriting models, leveraging advanced analytics and threat intelligence to better assess risk and develop more effective insurance products. This includes incorporating emerging technologies such as AI and machine learning to enhance risk assessment, fraud detection, and incident response capabilities. Ultimately, the future of cyber insurance is intricately linked to the evolving cyber threat landscape, and ongoing innovations will shape the market's trajectory in the coming years. The market is expected to surpass tens of billions of dollars by 2033, signifying a substantial increase from its current value.

Several key factors are propelling the growth of the cyber insurance market. The increasing sophistication and frequency of cyberattacks, ranging from ransomware attacks to data breaches, are forcing businesses to recognize the critical need for robust cyber risk mitigation strategies. Cyber insurance provides a crucial financial safety net in the event of a successful attack, covering costs associated with incident response, legal fees, regulatory fines, and business interruption. The expanding regulatory landscape, with governments worldwide implementing stricter data protection regulations like GDPR and CCPA, is another significant driver. Non-compliance with these regulations can result in hefty fines, making cyber insurance a vital tool for organizations to manage regulatory risk. Furthermore, the growing awareness of cyber risks among businesses, driven by high-profile data breaches and publicized incidents, is significantly influencing the adoption of cyber insurance policies. This increased awareness extends to small and medium-sized enterprises (SMEs), which were previously less likely to prioritize cyber insurance due to perceived costs. However, with the increasing ease and affordability of cyber insurance packages, even SMEs are recognizing its importance. The advancement of technology and the increasing interconnectedness of systems create new vulnerabilities and opportunities for cybercriminals, making cyber insurance an essential component of a comprehensive risk management plan. In addition, the development of more sophisticated and tailored cyber insurance products, catering to the unique needs of various industry sectors, has further boosted market growth. These factors collectively contribute to the dynamic expansion of the cyber insurance market.

Despite the significant growth potential, the cyber insurance market faces several challenges and restraints. Accurate risk assessment remains a major hurdle, as the constantly evolving nature of cyber threats makes it difficult to predict the likelihood and severity of future attacks. This difficulty in accurately assessing risk can lead to inadequate pricing of policies, potentially resulting in financial losses for insurers. The lack of standardized policies and definitions across the industry adds complexity to the market, making it difficult for businesses to compare different policies and understand their coverage. This lack of standardization also hinders the development of efficient and scalable underwriting models. Moreover, the high costs associated with cyber insurance, particularly for businesses with high-risk profiles, can serve as a barrier to entry for smaller companies. Another challenge lies in the difficulty of attributing losses to specific cyber events, as multiple factors can contribute to a breach. This complexity makes it challenging to determine liability and process claims effectively. Furthermore, the increasing frequency and severity of large-scale cyberattacks, such as ransomware attacks, raise concerns about the potential for insurers to face significant payouts, impacting their profitability. The development of new and sophisticated attack methods continuously challenges the insurers' ability to keep pace with the threat landscape. Addressing these challenges requires continuous innovation within the cyber insurance industry, focusing on developing advanced risk assessment models, enhancing data analytics capabilities, and promoting industry-wide standardization.

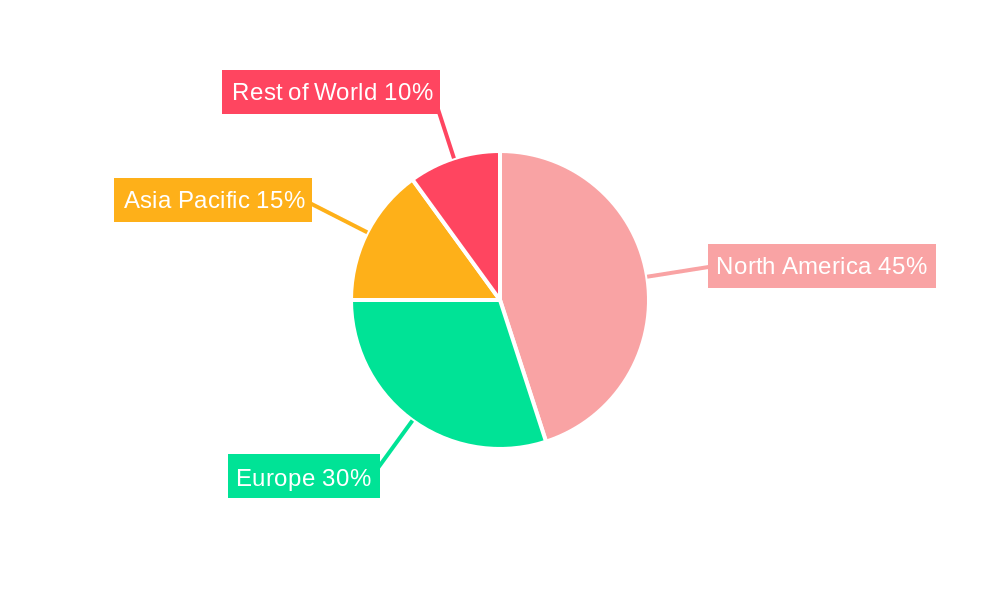

The Financial Institutions segment is projected to dominate the cyber insurance market during the forecast period (2025-2033). This dominance is driven by the high value of sensitive customer data held by financial institutions, making them prime targets for cybercriminals. A data breach within this sector can lead to significant financial losses, reputational damage, and legal repercussions. Consequently, financial institutions are highly incentivized to secure robust cyber insurance coverage, contributing significantly to the segment’s market share. Geographically, North America is anticipated to hold a substantial share of the global cyber insurance market. This is attributed to the region's high level of digitalization, strong regulatory framework concerning data protection, and a significant number of established cyber insurance providers. The sophisticated IT infrastructure, coupled with the higher awareness of cyber risks among businesses, further amplifies the demand for cyber insurance within this region. Furthermore, the presence of several major global players in the cyber insurance sector within North America further strengthens this region’s market position. The substantial increase in cyberattacks targeting financial institutions, particularly involving advanced persistent threats (APTs) and ransomware, underscores the urgency for comprehensive cyber insurance within this segment. The growing sophistication of cyberattacks also necessitates the development of specialized cyber insurance solutions tailored to the specific risks faced by financial institutions, such as those related to fraud and identity theft. The rising adoption of cloud-based services and the increasing use of Internet of Things (IoT) devices within financial institutions are also creating new vulnerabilities, emphasizing the importance of robust cyber insurance policies. The growth of FinTech and the expanding usage of mobile banking further contribute to the segment’s demand for enhanced cybersecurity measures and cyber insurance protection. As financial institutions continually strive to protect sensitive data and meet regulatory requirements, the demand for specialized cyber insurance coverage will remain high throughout the forecast period.

The cyber insurance industry is experiencing significant growth driven by the convergence of several key factors. Increasing cyber threats, stricter data protection regulations, and heightened awareness of cybersecurity risks are all contributing to a surge in demand for comprehensive cyber insurance solutions. Technological advancements, particularly in artificial intelligence (AI) and machine learning, are enabling insurers to better assess risk, detect fraud, and develop more effective underwriting models. These advancements are also leading to the development of innovative insurance products tailored to the specific needs of various industries. The growing adoption of cloud-based services and the expansion of interconnected systems, while increasing vulnerabilities, simultaneously amplify the demand for cyber insurance to mitigate these risks. Overall, this confluence of factors is significantly propelling the market's expansion, ensuring its continued growth in the years to come.

The cyber insurance market is poised for substantial growth over the next decade, driven by a confluence of factors including escalating cyber threats, expanding regulatory pressures, and heightened awareness of cyber risks. Technological innovations are leading to more accurate risk assessment, improved fraud detection, and the creation of specialized insurance products that cater to the distinct needs of individual sectors. This, coupled with the increasing digitalization of businesses, assures a considerable expansion of the market throughout the forecast period.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 32.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 32.3%.

Key companies in the market include AIG, Chubb, XL, Beazley, Allianz, Zurich Insurance, Munich Re, Berkshire Hathaway, AON, AXIS Insurance, Lockton, CNA, Travelers, BCS Insurance, Liberty Mutual, .

The market segments include Type, Application.

The market size is estimated to be USD 9593.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Cyber Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cyber Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.