1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cyber Insurance

Cyber InsuranceCyber Insurance by Type (Stand-alone Cyber Insurance, Packaged Cyber Insurance), by Application (Financial Institutions, Retail and Wholesale, Healthcare, Business Services, Manufacturing, Technology, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

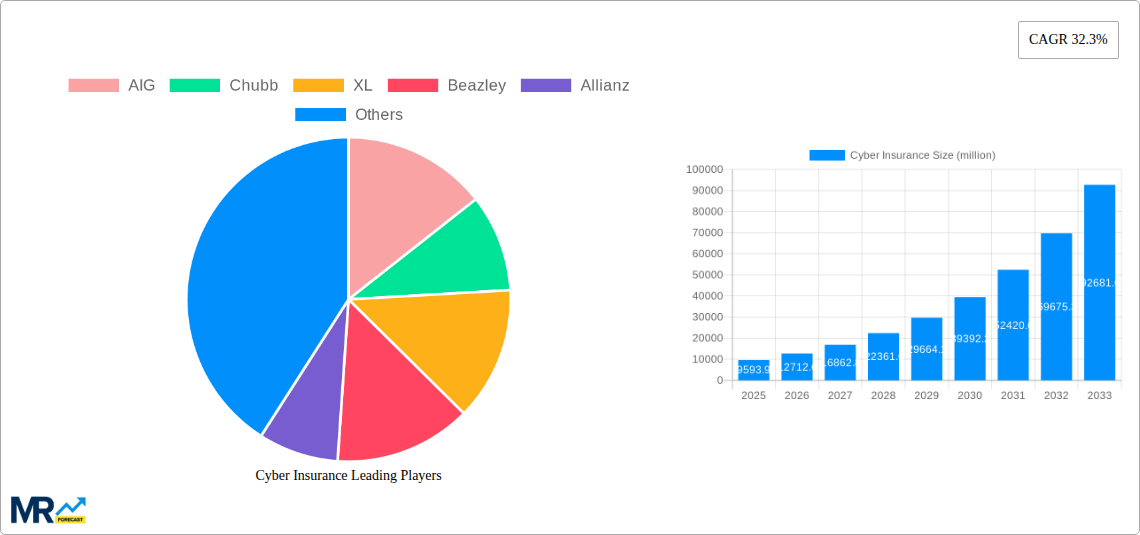

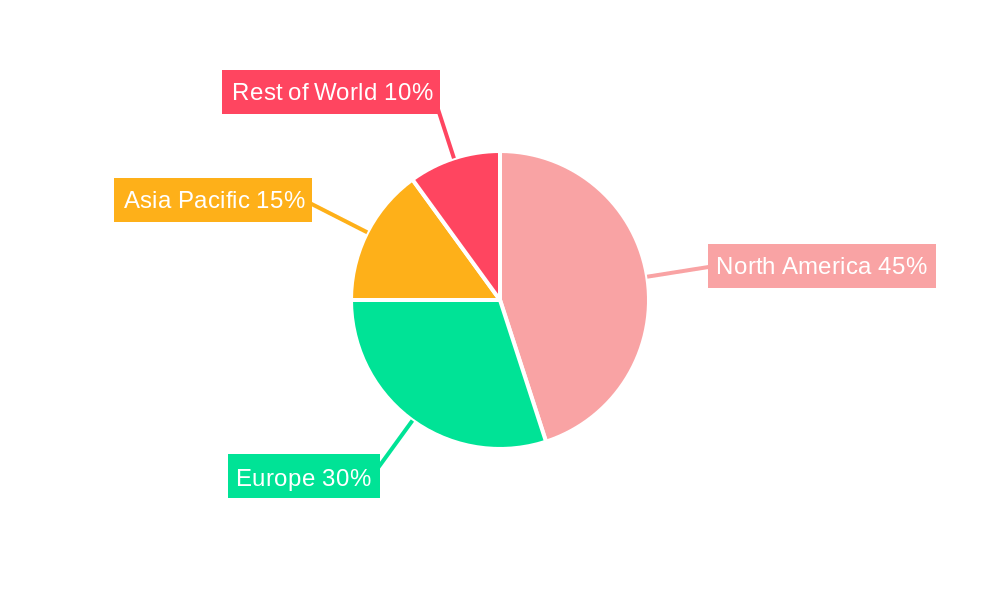

The global cyber insurance market, currently valued at approximately $68.23 billion in 2025, is experiencing robust growth fueled by the escalating frequency and severity of cyberattacks targeting businesses of all sizes across diverse sectors. The increasing reliance on digital technologies, coupled with evolving cyber threats like ransomware and data breaches, is driving strong demand for comprehensive cyber risk mitigation solutions. The market is segmented by insurance type (stand-alone and packaged) and application (financial institutions, retail, healthcare, etc.), with financial institutions and technology companies representing significant market segments due to their inherent vulnerability and high-value data assets. Geographic distribution shows North America and Europe currently holding substantial market shares, reflecting higher levels of digitalization and stringent data privacy regulations in these regions. However, rapid digital adoption in Asia-Pacific and other developing economies presents significant growth opportunities in the coming years. The market's growth is also influenced by factors such as governmental regulations promoting cybersecurity and insurers' increasing sophistication in underwriting and risk assessment capabilities.

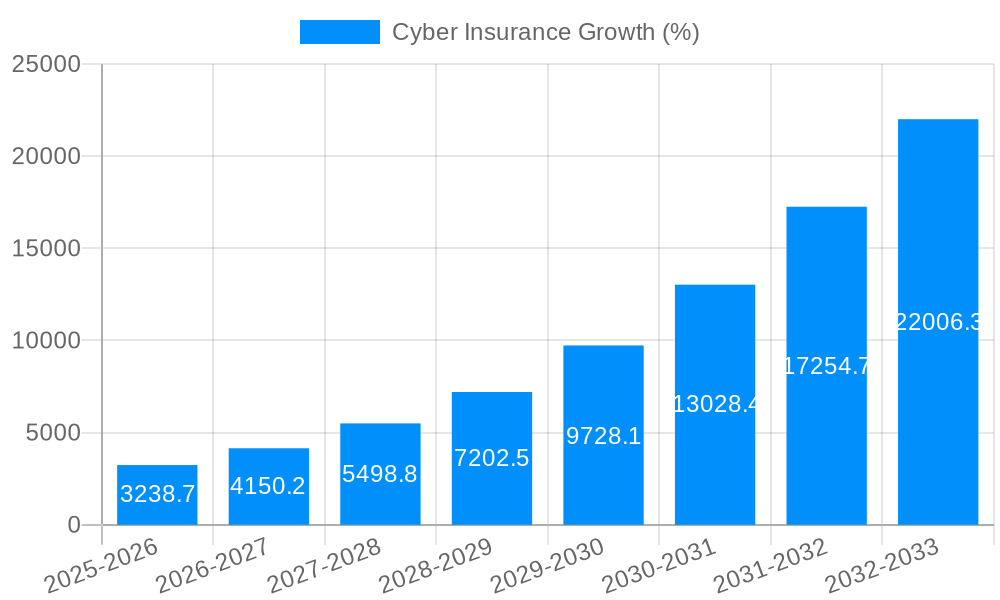

Looking ahead to 2033, the market is projected to experience considerable expansion. While a precise CAGR is unavailable, considering the drivers and the market's current trajectory, a conservative estimate of 15% annual growth is reasonable, suggesting significant market expansion. This growth will likely be driven by increasing awareness of cyber risks, advancements in cybersecurity insurance product offerings, and a broader adoption of insurance solutions by small and medium-sized enterprises (SMEs). Nevertheless, challenges remain, including the evolving nature of cyber threats, difficulties in accurately assessing cyber risk, and the potential for large payouts associated with significant data breaches. The industry will need to adapt and innovate to address these challenges and sustain its impressive growth trajectory.

The global cyber insurance market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. The study period from 2019 to 2033 reveals a significant upward trajectory, driven by escalating cyber threats and increasing regulatory pressures. The estimated market value in 2025 surpasses several billion dollars, a figure expected to expand exponentially during the forecast period (2025-2033). This expansion is fueled by heightened awareness among businesses of the devastating financial and reputational consequences of cyberattacks. The historical period (2019-2024) already demonstrated substantial growth, laying a strong foundation for the market's future trajectory. The increasing sophistication of cyberattacks, coupled with the expanding digital landscape, means that businesses across all sectors are seeking robust cyber insurance coverage. This demand is pushing insurers to innovate, offering a wider range of products and services to meet specific industry needs. We observe a clear shift towards more comprehensive policies that cover not only data breaches but also business interruption, extortion, and regulatory fines. The market is also witnessing a rise in demand for standalone cyber insurance policies, offering dedicated and tailored protection, as opposed to packaged solutions where cyber coverage is a smaller component. Furthermore, the adoption of proactive security measures by businesses, often encouraged by insurers, is contributing to a reduction in the frequency of severe incidents, but also driving an overall increase in market value as companies invest more in security measures. This proactive approach focuses on risk mitigation rather than just reactive responses. The base year of 2025 represents a pivotal point, marking the beginning of a period of sustained and accelerated growth that will continue to shape the global cyber insurance landscape for years to come, with estimations placing the market value well into the billions.

The cyber insurance market's rapid expansion is driven by several interconnected forces. Firstly, the ever-increasing frequency and severity of cyberattacks are a primary catalyst. Ransomware attacks, data breaches, and other malicious activities inflict substantial financial losses, operational disruptions, and reputational damage on businesses worldwide. This directly translates into a heightened demand for protection. Secondly, stringent data privacy regulations, such as GDPR and CCPA, impose significant penalties for data breaches, compelling organizations to secure comprehensive cyber insurance coverage to mitigate potential fines and legal costs. Thirdly, the growing interconnectedness of businesses and the increasing reliance on digital technologies expand the attack surface, making organizations more vulnerable to cyber threats. Furthermore, the evolving nature of cyberattacks, characterized by increasingly sophisticated techniques and the emergence of new threat actors, necessitates more robust and comprehensive insurance solutions. Finally, insurers themselves are playing a crucial role, actively promoting cyber insurance and developing innovative products and services, including risk assessment tools and cybersecurity consulting, which further drives market adoption. This is fueled by the considerable profit opportunities this growing market presents, leading to heightened competition and further innovation within the industry.

Despite the rapid growth, the cyber insurance market faces several challenges. One significant hurdle is the difficulty in accurately assessing and pricing cyber risk. The dynamic nature of cyber threats and the complexities involved in quantifying potential losses make it challenging for insurers to develop precise risk models. This uncertainty can lead to high premiums and reluctance from some businesses to invest in cyber insurance. Another key challenge is the issue of insufficient data on cyber incidents. The lack of comprehensive and standardized data on cyberattacks makes it difficult to analyze trends, identify high-risk sectors, and develop effective risk mitigation strategies. This data scarcity also contributes to the difficulty in accurate pricing and risk assessment. Additionally, the increasing sophistication of cyberattacks and the emergence of new threats require insurers to constantly adapt their products and services, necessitating significant investments in research and development to stay ahead of the curve. Furthermore, the potential for large-scale, catastrophic cyber events, such as widespread ransomware attacks impacting critical infrastructure, presents a significant challenge to the industry's capacity to absorb potential losses. The need for collaborative efforts between insurers, businesses, and governments to improve data sharing and enhance cybersecurity awareness is crucial to address these challenges effectively.

The Technology sector is poised to dominate the cyber insurance market during the forecast period. The intense reliance on digital infrastructure, sensitive data, and intellectual property within technology companies makes them prime targets for cyberattacks. This results in significantly higher demand for sophisticated and comprehensive cyber insurance solutions.

This concentration on the technology segment highlights the sector's increasing dependence on digital systems and the significant financial implications of cyber-attacks. This, in turn, has created a profitable and growing market segment within the cyber insurance industry.

The cyber insurance industry's growth is fueled by several key factors. Increased awareness of cyber threats and their potential impact on businesses has prompted organizations of all sizes to seek protection. Stricter data privacy regulations globally are also driving demand for insurance policies that cover potential fines and legal costs. The development of innovative insurance products and services, tailored to specific industry needs, is further expanding the market. Finally, increased collaboration between insurers, businesses, and governments to improve cybersecurity awareness and risk mitigation strategies is contributing to overall market growth.

This report offers a thorough analysis of the cyber insurance market, providing valuable insights into market trends, drivers, challenges, and key players. It offers detailed segment analysis and forecasts to facilitate informed business decisions in this rapidly evolving landscape, covering both the historical period and offering predictions that stretch into the coming decade. The report includes a comprehensive overview of leading companies and their strategies, offering a valuable resource for stakeholders in the industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include AIG, Chubb, XL, Beazley, Allianz, Zurich Insurance, Munich Re, Berkshire Hathaway, AON, AXIS Insurance, Lockton, CNA, Travelers, BCS Insurance, Liberty Mutual, .

The market segments include Type, Application.

The market size is estimated to be USD 68230 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Cyber Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cyber Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.