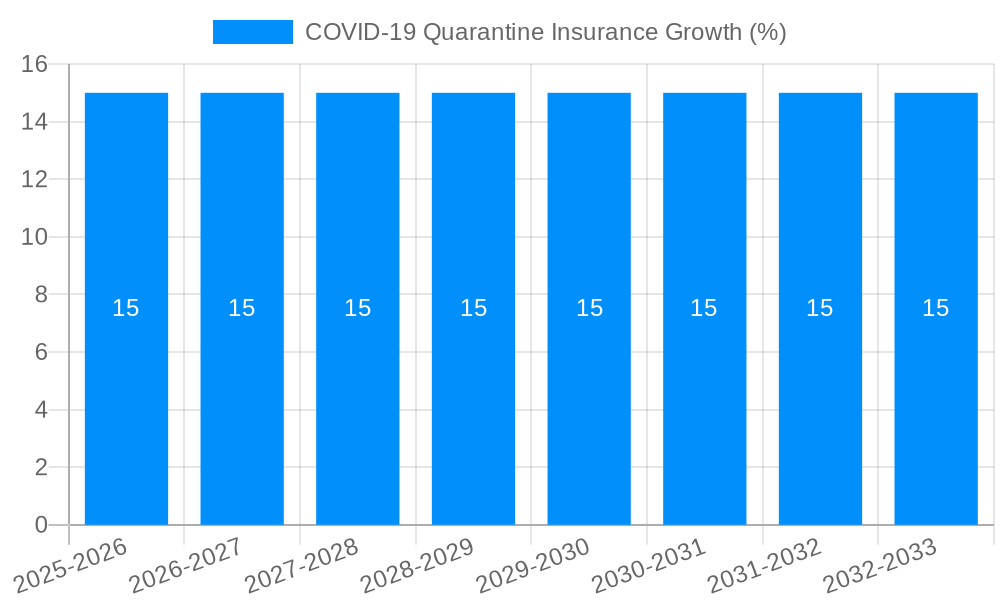

1. What is the projected Compound Annual Growth Rate (CAGR) of the COVID-19 Quarantine Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

COVID-19 Quarantine Insurance

COVID-19 Quarantine InsuranceCOVID-19 Quarantine Insurance by Type (Active Isolation, Passive Isolation), by Application (Teenager, Aldult), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

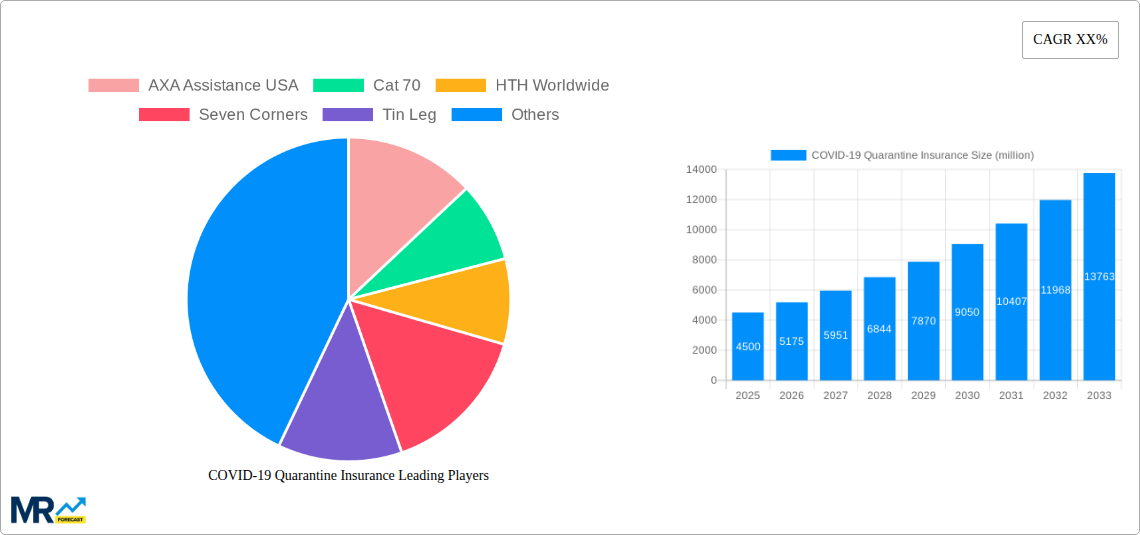

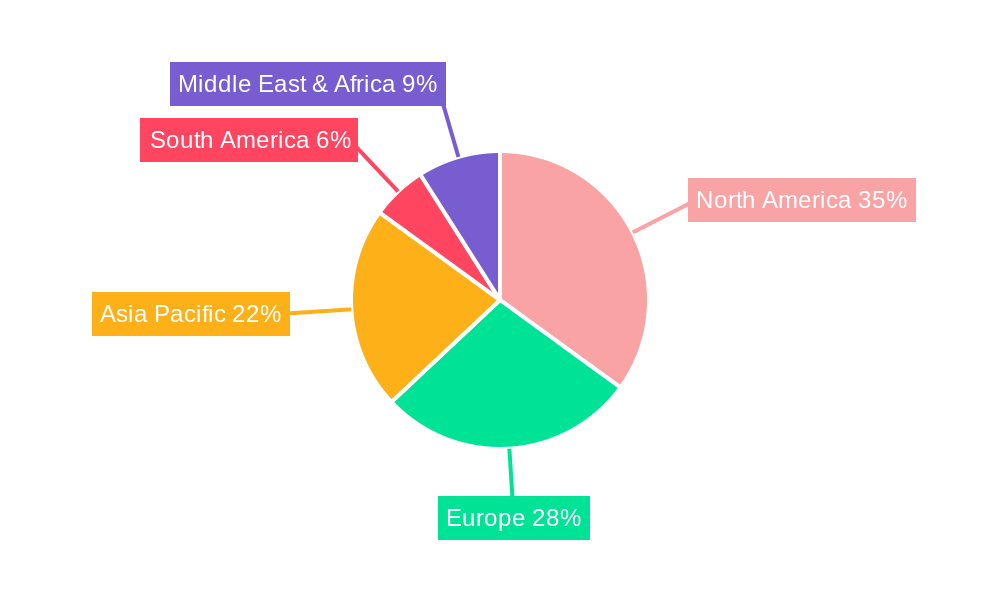

The COVID-19 pandemic dramatically altered the travel insurance landscape, creating a surge in demand for quarantine insurance. While precise market sizing data for this niche is unavailable, we can infer significant growth based on broader travel insurance trends and the pandemic's impact. The global travel insurance market, encompassing various coverages, experienced substantial growth in the years following the pandemic's initial wave as travel resumed. This uptick suggests a parallel expansion in the demand for COVID-19 quarantine insurance, particularly during periods of renewed outbreaks or stricter travel regulations. Several factors drove this demand, including government-mandated quarantines, concerns about unexpected medical expenses related to COVID-19, and the need for financial protection against trip disruptions. The market segmentation reveals a focus on two primary areas: active isolation coverage (covering costs associated with actively contracting COVID-19) and passive isolation (covering costs related to quarantine due to exposure or travel restrictions). Furthermore, distinct segments target teenagers and adults, reflecting varying needs and risk profiles. Major players in the travel insurance sector, including AXA Assistance USA, Allianz Assistance, and others listed, adapted their offerings to include COVID-19-related coverages, fueling competition and further market development. The geographical spread mirrors global travel patterns, with North America and Europe initially representing significant markets, followed by growth in Asia-Pacific and other regions as travel restrictions eased.

The market's future growth depends on several factors. Ongoing concerns about new variants and potential future pandemics could sustain demand for quarantine insurance. However, the gradual return to normalcy and increased vaccination rates could lessen the perceived risk, potentially moderating growth. Government policies, travel advisories, and the overall economic climate also play crucial roles. While the initial surge might have peaked, a stable level of demand is expected to remain as travelers seek protection against unforeseen travel disruptions, regardless of the specific threat. The insurance industry's ability to adapt its products and pricing strategies to meet evolving consumer needs and governmental regulations will also be critical in shaping this market segment's trajectory. Continued monitoring of global health situations and travel trends will remain paramount for predicting future market performance in this evolving niche.

The COVID-19 pandemic dramatically reshaped the travel insurance landscape, catapulting quarantine insurance from a niche product to a significant market segment. The study period (2019-2033), encompassing the pre-pandemic era and its aftermath, reveals a market trajectory marked by explosive growth initially, followed by a period of stabilization and adaptation. The base year, 2025, reflects a market valued in the hundreds of millions of dollars, representing a considerable increase from pre-pandemic levels. While the initial surge was driven by widespread travel restrictions and the fear of unexpected quarantine costs, the market's evolution post-2025 is characterized by a shift towards more nuanced coverage, addressing both active and passive isolation scenarios. The estimated year (2025) data suggests a strong demand for policies covering medical expenses, repatriation, and accommodation during mandatory quarantine periods. The forecast period (2025-2033) projects continued, albeit more moderate, growth, driven by factors such as the persistence of new virus variants, increasing international travel, and the growing awareness of the financial burden associated with unforeseen quarantines. This trend necessitates a shift in policy offerings from insurers toward more comprehensive and flexible plans tailored to diverse traveler demographics and risk profiles. The historical period (2019-2024) provides a crucial benchmark for understanding the unprecedented growth spurred by the pandemic. The market's future trajectory depends on the interplay of global health dynamics and evolving consumer behavior regarding travel and risk mitigation. The continued need for pandemic preparedness and the evolving insurance industry practices will be crucial factors in shaping future market projections.

Several factors have propelled the growth of the COVID-19 quarantine insurance market. The initial surge was undeniably linked to the pandemic's unprecedented travel disruptions. Government-mandated quarantines, coupled with the potential for significant out-of-pocket medical and accommodation expenses, created a substantial demand for insurance products offering protection against these unforeseen costs. Beyond the immediate crisis, the lingering uncertainty surrounding new variants and the ongoing evolution of pandemic-related regulations continue to drive demand. The increased awareness among travelers of the financial risks associated with unexpected quarantine, coupled with the relatively affordable nature of many quarantine insurance plans, further contributes to market expansion. Furthermore, the insurance industry's rapid adaptation to the changing needs of travelers is crucial, with many providers quickly developing and refining products to meet the specific challenges posed by the pandemic. This proactive response has helped build trust and confidence in quarantine insurance, thereby driving market growth. The emergence of more comprehensive and flexible plans catering to diverse traveler segments, from individual leisure travelers to large corporate groups, has also expanded the overall market potential.

Despite the strong growth, several challenges and restraints hinder the COVID-19 quarantine insurance market. One major factor is the inherent uncertainty associated with future pandemic-related developments. The emergence of new variants or unforeseen changes in global travel restrictions could significantly impact demand. Additionally, the complexity of designing comprehensive and yet cost-effective insurance plans covering varying quarantine scenarios remains a significant obstacle. Accurate risk assessment and the development of robust pricing models that account for diverse situations are vital but challenging tasks. Furthermore, the market faces the ongoing risk of adverse selection. As individuals with a higher perceived risk are more inclined to purchase insurance, it could lead to increased costs or even market instability if not properly managed. Finally, regulatory uncertainty and varying national policies regarding quarantine and travel insurance could pose significant barriers for insurers operating across multiple jurisdictions, requiring careful navigation of diverse legal frameworks. This complexity increases the operational costs and reduces market efficiency.

The adult segment is projected to dominate the COVID-19 quarantine insurance market due to higher international travel rates compared to teenagers. Adults represent a broader and more established segment of travelers who are more likely to have disposable income to purchase travel insurance.

The market will continue to observe a high demand for Active Isolation insurance, covering those who test positive and are required to isolate themselves, because of the direct medical and accommodation costs. However, the Passive Isolation segment also represents a significant and growing market as individuals facing quarantine due to close contact with infected persons will be increasingly likely to seek financial protection against lost wages or other expenses. This signifies the substantial potential for both active and passive isolation insurance segments in the overall COVID-19 quarantine insurance landscape.

The COVID-19 quarantine insurance industry’s growth is propelled by several factors. Firstly, increased awareness of the financial repercussions of unexpected quarantines is driving demand for protective insurance policies. Secondly, advancements in technology are streamlining policy acquisition and claim processing. Finally, the industry's innovation in designing versatile and cost-effective insurance products caters to a wider range of travelers and their unique risk profiles. These three factors collectively boost market expansion.

This report provides a comprehensive overview of the COVID-19 quarantine insurance market, analyzing its trends, drivers, challenges, and key players. It offers valuable insights into the market's evolution from its inception during the pandemic to its projected growth trajectory in the coming years. The report's data-driven analysis and market segmentation provide crucial information for stakeholders looking to navigate this evolving landscape and make informed decisions. Specific forecasts for the next decade are based on thorough market research and expert analysis, factoring in the influence of macroeconomic conditions and global health developments.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include AXA Assistance USA, Cat 70, HTH Worldwide, Seven Corners, Tin Leg, USI Affinity Travel Insurance Services, John Hancock Insurance Agency, Nationwide, Trawick International, Squaremouth, Allianz Assistance, International Medical Group, WorldTrips, Global Underwriters, Travel Insure, GeoBlue, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "COVID-19 Quarantine Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the COVID-19 Quarantine Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.