1. What is the projected Compound Annual Growth Rate (CAGR) of the Approved COVID-19 Vaccines?

The projected CAGR is approximately 19.1%.

Approved COVID-19 Vaccines

Approved COVID-19 VaccinesApproved COVID-19 Vaccines by Type (Component Viral Vaccines, Whole Virus Vaccines), by Application (Adults, Children, Elderly), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

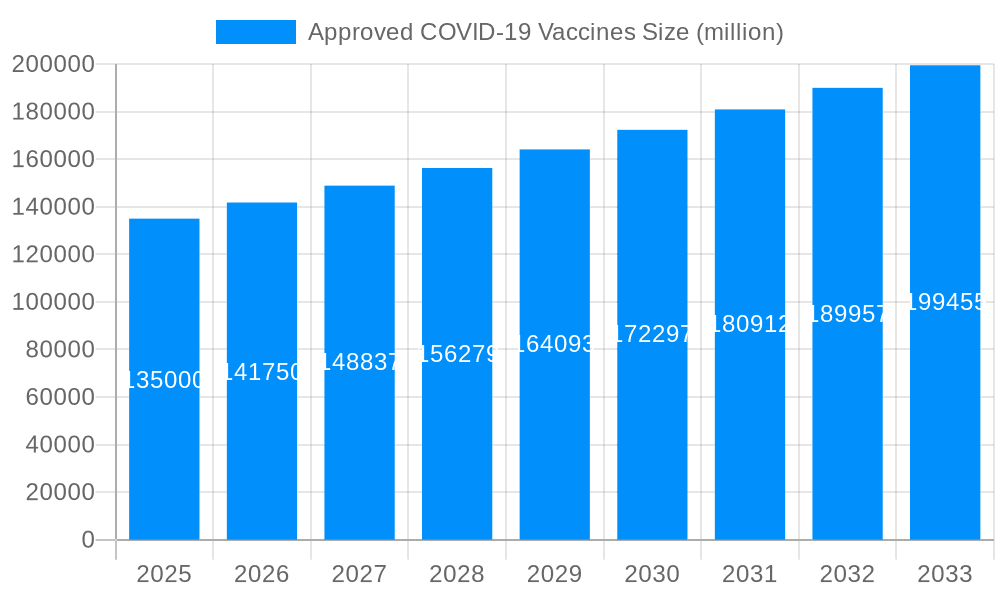

The global market for approved COVID-19 vaccines experienced explosive growth following the pandemic's onset. While precise figures for the market size in 2025 are unavailable, considering a CAGR of 5% from a reasonable estimated base year (2022) value of $50 billion (reflecting the substantial initial investment and vaccine rollout), we can project a 2025 market value of approximately $57.5 billion. This growth was fueled by massive global vaccination campaigns, driven by the urgent need to curb the spread of the virus and mitigate severe illness. Key players like Pfizer, Moderna, Johnson & Johnson, and AstraZeneca dominated the market, leveraging their existing infrastructure and expertise in vaccine development. The market witnessed a rapid shift from emergency use authorizations to full regulatory approvals, leading to increased confidence and wider adoption. However, the market is expected to undergo a significant correction post-pandemic, driven by waning demand as global immunity levels rise and the pandemic transitions to an endemic phase. Further growth will depend on factors like the emergence of new variants, booster shot campaigns, and the development of next-generation vaccines offering broader protection against existing and future viral strains. The market will likely see increased competition as companies adapt their strategies to a post-pandemic landscape, focusing on vaccine innovation and securing long-term supply agreements with governments.

Despite the initial surge, the long-term outlook for the approved COVID-19 vaccine market presents a more nuanced picture. The ongoing need for booster shots and potential future pandemic preparedness initiatives will sustain a degree of market activity. However, the high initial market penetration and evolving health priorities suggest a period of consolidation and slower growth compared to the pandemic peak. Regional variations in vaccination rates and access to healthcare will continue to influence market dynamics. Developing nations, where vaccine distribution faced significant challenges, may still present growth opportunities, though this is dependent on factors like healthcare infrastructure and financial resources. Meanwhile, developed nations will likely see a shift towards targeted vaccination strategies, focusing on vulnerable populations and emerging variants, leading to decreased overall market size over time, though a relatively stable market can be expected due to the constant requirement for booster shots.

The global market for approved COVID-19 vaccines witnessed an unprecedented surge during the 2019-2024 historical period, driven by the pandemic's devastating impact. Millions of doses were administered globally, leading to a market valued in the tens of billions of dollars. The initial years (2019-2021) were characterized by rapid vaccine development and emergency use authorizations, with significant investments pouring into research and manufacturing. The market experienced a period of intense competition amongst pharmaceutical giants like Pfizer, Moderna, and Johnson & Johnson, each striving to secure a dominant market share. However, as the initial urgency subsided in the later years (2022-2024), the market began to stabilize, transitioning from emergency demand to a more predictable, albeit still substantial, demand driven by booster shots, variant-specific vaccines, and ongoing vaccination efforts in lower-income countries. The estimated market value for 2025 is projected to be significantly higher than previous years, but at a slower growth rate compared to the initial pandemic years. The forecast period (2025-2033) anticipates continued, albeit more moderate, growth propelled by factors such as ongoing vaccination campaigns, the emergence of new variants requiring updated vaccines, and the potential for long-term COVID-19 management strategies incorporating vaccination. Market segmentation will play a crucial role in future growth, with the development of specialized vaccines tailored for specific populations likely to drive demand. The overall trend suggests a shift from crisis-driven growth to a more sustainable market based on long-term public health needs. This transition, however, presents new challenges for vaccine manufacturers, demanding strategic adaptations for sustained success in a more competitive and diversified market landscape. The market's size, measured in millions of vaccine units administered, showcases the immense scale of the global vaccination efforts.

Several key factors are driving the growth of the approved COVID-19 vaccine market. Firstly, the ongoing need for vaccination and booster shots against existing and emerging COVID-19 variants remains a significant driver. The continuous evolution of the virus necessitates updated vaccine formulations, ensuring continued demand for newer versions. Secondly, government initiatives and public health campaigns globally play a crucial role in promoting vaccination, thereby contributing to market expansion. These initiatives often include widespread vaccination drives, public awareness programs, and incentivized participation. Thirdly, the significant investment in research and development continues to fuel innovation in vaccine technology, leading to the development of more effective, safer, and convenient vaccines, including mRNA vaccines, viral vector vaccines, and protein subunit vaccines. This innovation also extends to delivery systems, striving for improved efficacy and accessibility. Fourthly, the increasing integration of digital technologies, such as vaccine passports and digital immunization records, enhance vaccine tracking and management, contributing to market growth. Finally, the continued demand for vaccines in developing countries, where access remains a challenge, presents a significant growth opportunity for vaccine manufacturers. Bridging the gap in vaccine equity will significantly impact market size.

Despite the significant market growth, the approved COVID-19 vaccine market faces several challenges and restraints. Firstly, vaccine hesitancy and misinformation remain significant obstacles to widespread vaccination, limiting market penetration in certain regions and demographics. Addressing these concerns through effective public health campaigns and transparent communication is crucial. Secondly, logistical challenges associated with vaccine distribution, particularly in remote and underserved areas, continue to hamper global access and hinder market growth. Efficient cold-chain management and effective distribution networks are vital to overcome this obstacle. Thirdly, the emergence of new variants and the need for updated vaccines present both an opportunity and a challenge. While new vaccines are needed, the development and approval process can be time-consuming and costly, potentially disrupting market stability. Fourthly, the fluctuating demand for vaccines as the pandemic evolves poses a challenge for manufacturers in terms of production planning and resource allocation. Finally, price competition and intellectual property rights issues can impact the market dynamics and limit the profitability of some manufacturers.

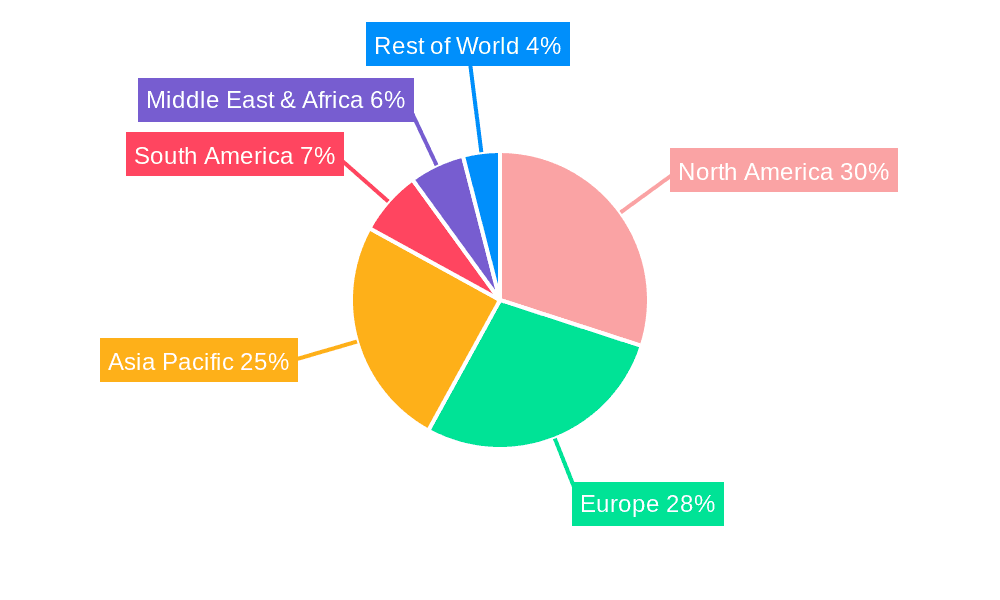

North America & Europe: These regions are expected to continue dominating the market due to high vaccination rates, robust healthcare infrastructure, and strong regulatory frameworks. These regions have historically invested heavily in vaccine research and development and possess strong vaccine distribution networks.

Asia-Pacific: This region shows significant growth potential, fueled by increasing population, rising disposable incomes, and expanding healthcare infrastructure in several countries. However, challenges related to vaccine access and distribution still exist in certain parts of the region.

mRNA Vaccines: This segment is expected to maintain a prominent market position due to their rapid development and high efficacy demonstrated during the pandemic. However, challenges regarding long-term stability and production scalability need continuous attention.

Viral Vector Vaccines: This segment holds a strong market share, particularly in certain regions. Its advantages include easier production and potentially broader distribution, though potential side effects need continued monitoring and improved manufacturing processes.

Protein Subunit Vaccines: This segment offers advantages such as increased safety profiles, but might lag behind mRNA and viral vector vaccines due to slower production rates and sometimes lower efficacy.

In the context of millions of units, the high-income nations in North America and Europe accounted for the largest share of vaccine doses administered during the early phases of the pandemic. However, the forecast period (2025-2033) anticipates increased uptake in middle- and lower-income countries, especially if equitable vaccine distribution programs are effectively implemented. The success of specific vaccine types within each segment will also depend on several factors, including pricing, distribution logistics, and sustained effectiveness against emerging variants. This complex interplay of geographic and segment-specific factors is shaping the dynamic landscape of the approved COVID-19 vaccine market.

Several factors will propel growth in the approved COVID-19 vaccine industry. Ongoing efforts to enhance vaccine efficacy against new variants, particularly through novel vaccine platforms and development of multivalent vaccines, are major catalysts. Government initiatives to expand vaccination coverage in underserved populations, both domestically and globally, coupled with improved vaccine storage and delivery infrastructure, significantly contribute to market expansion. Furthermore, the increasing development of next-generation vaccines with improved stability, delivery systems, and ease of administration will also accelerate market growth. The burgeoning research into long-term COVID-19 management further ensures sustained demand for improved vaccines in the coming years.

This report offers a comprehensive overview of the approved COVID-19 vaccine market, encompassing detailed historical data, current market estimations, and future projections for the period 2019-2033. By combining market analysis with in-depth reviews of key players, technological advancements, and regulatory landscapes, the report provides a valuable resource for stakeholders involved in the vaccine industry. It goes beyond simply presenting numbers to offer strategic insights and perspectives, providing a practical framework for businesses to plan for the future and respond to the ever-evolving market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 19.1%.

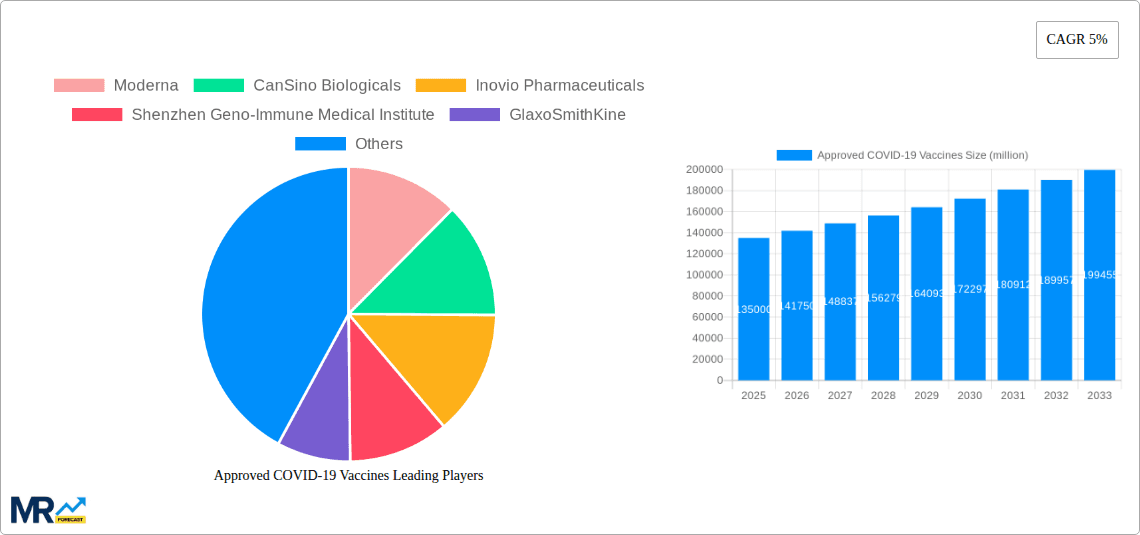

Key companies in the market include Moderna, CanSino Biologicals, Inovio Pharmaceuticals, Shenzhen Geno-Immune Medical Institute, GlaxoSmithKine, Pfizer, Johnson&Johnson, Heat Biologics, Sanofi, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Approved COVID-19 Vaccines," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Approved COVID-19 Vaccines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.