1. What is the projected Compound Annual Growth Rate (CAGR) of the Covid-19 Vaccine Logistics?

The projected CAGR is approximately XX%.

Covid-19 Vaccine Logistics

Covid-19 Vaccine LogisticsCovid-19 Vaccine Logistics by Type (/> Refrigerated Storage, Cold Chain Logistics), by Application (/> Pfizer Covid-19 Vaccine, Moderna Covid-19 Vaccine, AstraZeneca Covid-19 Vaccine, SinopharmCovid-19 Vaccine, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The COVID-19 vaccine logistics market experienced explosive growth between 2019 and 2024, driven by the urgent need for global vaccine distribution. While precise figures aren't provided, a reasonable estimation, considering the global scale of vaccination efforts and the involvement of major logistics players, suggests a market size exceeding $10 billion in 2024. The market's Compound Annual Growth Rate (CAGR) likely exceeded 20% during this period, reflecting the unprecedented demand and logistical complexities associated with ultra-cold chain transportation and storage of mRNA vaccines. Key drivers included the massive scale of vaccination programs, stringent cold chain requirements for vaccine efficacy, and the involvement of governments and international organizations in ensuring equitable distribution. Market segmentation reveals a significant share held by refrigerated storage and cold chain logistics services, with Pfizer, Moderna, AstraZeneca, and Sinopharm vaccines representing major applications. Leading companies like DHL, FedEx, UPS, and others established crucial global networks. Regional distribution likely saw a concentration in North America and Europe initially, followed by increasing demand in Asia Pacific and other regions.

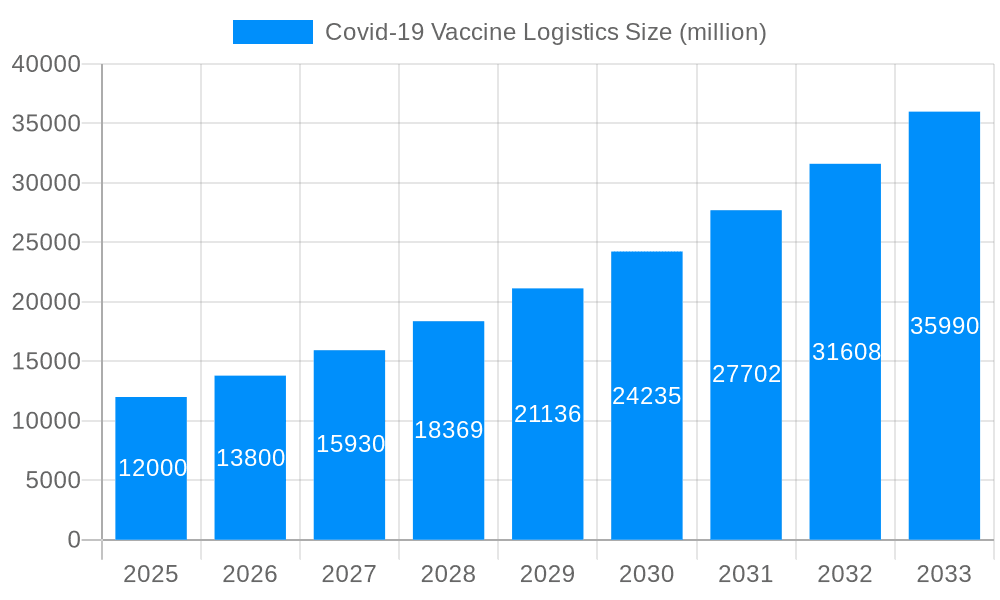

Looking forward, while the immediate surge related to initial vaccination campaigns may subside, the COVID-19 vaccine logistics market will continue to evolve. Demand for logistical solutions will remain high, driven by booster programs, the ongoing need for vaccine distribution in underserved regions, and the potential for future pandemics. The market will likely see a continued focus on innovation in temperature-controlled transportation and storage technologies, as well as an increased emphasis on data-driven optimization and real-time tracking of vaccine shipments. Furthermore, the market will likely consolidate as leading logistics providers continue to enhance their capabilities and expand their global reach. A moderate CAGR of around 10-15% is anticipated from 2025 to 2033, reflecting a mature but still significant market driven by evolving global health needs.

The COVID-19 pandemic dramatically reshaped the logistics landscape, highlighting the critical role of efficient vaccine distribution. The market witnessed unprecedented demand, forcing a rapid evolution in cold chain infrastructure and transportation methods. Between 2019 and 2024 (historical period), the industry grappled with the initial challenges of procuring and delivering millions of vaccine doses under stringent temperature requirements. This period saw significant investments in specialized equipment, such as temperature-controlled containers and monitoring devices, alongside the expansion of existing cold chain networks. The estimated year 2025 shows a consolidation of this infrastructure, with major players like DHL, FedEx, and UPS solidifying their positions. The forecast period (2025-2033) suggests continued growth, driven by the ongoing need for booster shots, the development of new vaccines for variants, and the potential for future pandemics. This growth will likely be accompanied by technological advancements in vaccine storage and transportation, further optimizing efficiency and reducing costs. The market is projected to reach multi-billion dollar valuations by 2033, reflecting the sustained importance of reliable and scalable vaccine logistics. The base year of 2025 provides a crucial benchmark for understanding the trajectory of this dynamic market. Overall, the industry is transitioning from emergency response to a more sustainable, strategically planned approach to global vaccine distribution, emphasizing preparedness for future health crises. This transition also includes improved data management and supply chain visibility to better anticipate and manage vaccine demand fluctuations.

Several factors are driving the growth of the COVID-19 vaccine logistics market. The immediate impetus was the global urgency to distribute vaccines swiftly and efficiently to curb the pandemic's spread. This necessitated massive investments in cold chain infrastructure, specialized transportation, and sophisticated tracking systems. Beyond the immediate pandemic response, ongoing demand for booster shots and the emergence of new vaccine formulations for COVID-19 variants are sustaining market growth. Furthermore, the lessons learned during the pandemic are leading to increased preparedness for future outbreaks, creating a long-term demand for robust and scalable vaccine logistics solutions. Government initiatives and funding play a crucial role, supporting investments in infrastructure and technology. Increased collaboration between pharmaceutical companies, logistics providers, and governments is further streamlining operations and improving efficiency. Technological innovations, such as real-time temperature monitoring and AI-powered optimization, are also enhancing the capabilities of the vaccine supply chain, leading to significant improvements in the speed, safety, and efficiency of vaccine distribution globally. The overall global health security concerns are pushing nations to invest heavily in bolstering their pandemic response capabilities. This includes improving their cold-chain capacity for vaccine storage and transportation.

Despite the significant growth, the COVID-19 vaccine logistics sector faces numerous challenges. Maintaining the ultra-low temperatures required for some vaccines, particularly mRNA vaccines like Pfizer's, presents a significant hurdle, necessitating specialized equipment and meticulous handling. The sheer volume of vaccines needing distribution globally during the initial phases posed logistical bottlenecks and capacity constraints, leading to delays in several regions. Variations in regulatory requirements across different countries create complexity in compliance and cross-border transportation. Security concerns related to vaccine theft or damage during transit add another layer of complexity and require sophisticated security measures. Furthermore, ensuring equitable vaccine distribution, especially to remote and underserved areas with limited infrastructure, remains a substantial challenge. Finally, fluctuating demand influenced by evolving public health guidelines and vaccine efficacy data makes accurate forecasting and resource allocation challenging, necessitating robust and adaptable logistics solutions capable of handling unexpected shifts in requirements.

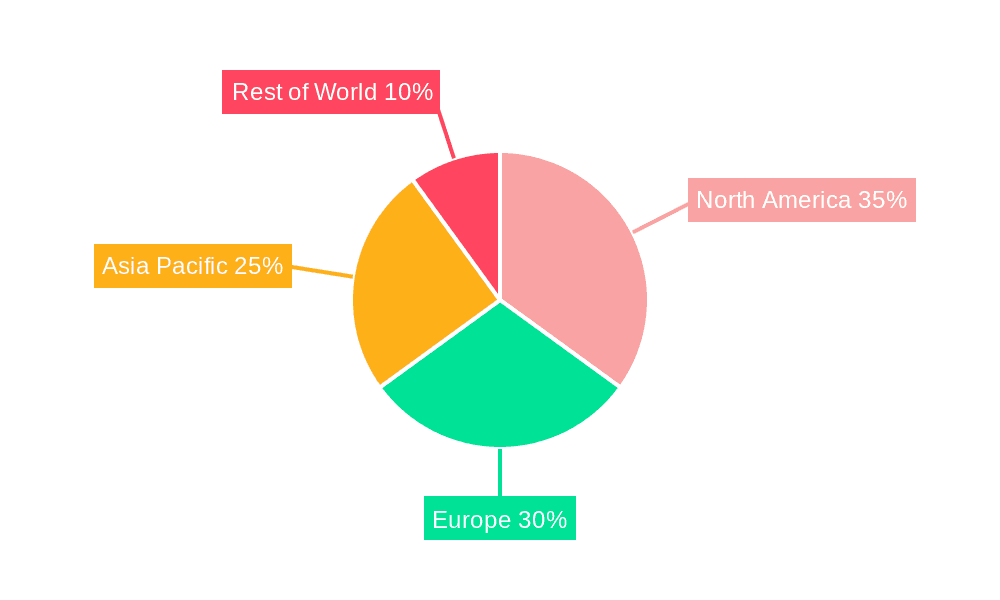

The COVID-19 vaccine logistics market is experiencing diverse growth patterns across various regions and segments.

North America and Europe: These regions initially dominated the market due to higher vaccine production and consumption rates. However, increasing vaccination rates worldwide will lead to more balanced growth across regions. The strong regulatory frameworks and robust cold chain infrastructure in these regions provide a favorable environment for market expansion.

Asia-Pacific: This region is witnessing rapid growth, driven by the increasing population size and rising demand for vaccines. Investments in cold chain infrastructure and increasing collaboration between logistics providers and governments are propelling market expansion in the region. China, India and other emerging markets have seen significant increase in vaccination programs, boosting the need for effective logistics solutions.

Refrigerated Storage: This segment dominates due to the stringent temperature requirements of many vaccines. Investment in specialized storage facilities and technologies like ultra-low temperature freezers remains a crucial aspect of the industry's growth. The ability to maintain the required temperature is paramount to the effectiveness of the vaccines and the storage segment addresses this directly. The market also sees an increase in demand for improved monitoring technologies to maintain a constant and unbroken chain of low temperatures, ensuring vaccine integrity.

Cold Chain Logistics: This is the backbone of vaccine distribution and is crucial for the safe and efficient movement of vaccines from manufacturing sites to vaccination centers. This segment involves specialized transportation, handling, and tracking systems, highlighting the demand for reliable, temperature-controlled transportation modes and advanced monitoring systems that ensure efficacy and safety during transit.

Pfizer and Moderna Vaccines: These mRNA vaccines, requiring ultra-low temperature storage and transport, initially had a significant impact on the market. However, the increased use of other vaccines, including AstraZeneca and Sinopharm, is leading to a diversification within the application segment. The segment continues to be vital due to the stringent needs of these vaccines. The continued use of mRNA vaccines for boosters and new strains will keep this segment strong and relevant in future developments.

In summary, while North America and Europe initially led in market share due to early vaccine production and deployment, the Asia-Pacific region is quickly catching up. Refrigerated storage and cold chain logistics remain crucial segments, but market growth will also be driven by the needs of diverse vaccine types, including the ongoing use of mRNA technologies. The overall market is characterized by its diverse needs, and the continued development of different vaccines, requiring various storage temperatures and transportation logistics.

The COVID-19 vaccine logistics industry is experiencing significant growth spurred by ongoing needs for booster shots, the development of vaccines for new variants, and the increasing focus on global health security. Technological advancements, such as improved temperature-controlled containers and real-time tracking systems, are enhancing efficiency and safety. Government investments in infrastructure and supportive regulations are playing a key role. Moreover, collaborations between pharmaceutical companies, logistics providers, and governments are leading to better coordination and optimized vaccine distribution strategies.

The COVID-19 vaccine logistics market is experiencing a period of significant growth driven by the ongoing need for vaccination programs globally, including booster shots and addressing new variants. Technological advances and increased public-private partnerships are leading to improved efficiency and effectiveness in vaccine distribution. The report will provide a comprehensive overview of market dynamics, trends, and future projections.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DHL, FedEx, UPS, TNT Post Group, Nippon Express, S.F. Express, Hiron, Zhejiang Int'l Group, China National Accord, Square Technology Group, Aucma.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Covid-19 Vaccine Logistics," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Covid-19 Vaccine Logistics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.