1. What is the projected Compound Annual Growth Rate (CAGR) of the COVID-19 Nucleic Acid Detection Mobile Laboratory?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

COVID-19 Nucleic Acid Detection Mobile Laboratory

COVID-19 Nucleic Acid Detection Mobile LaboratoryCOVID-19 Nucleic Acid Detection Mobile Laboratory by Type (Vehicular, Shelter), by Application (Hospital, Clinic, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

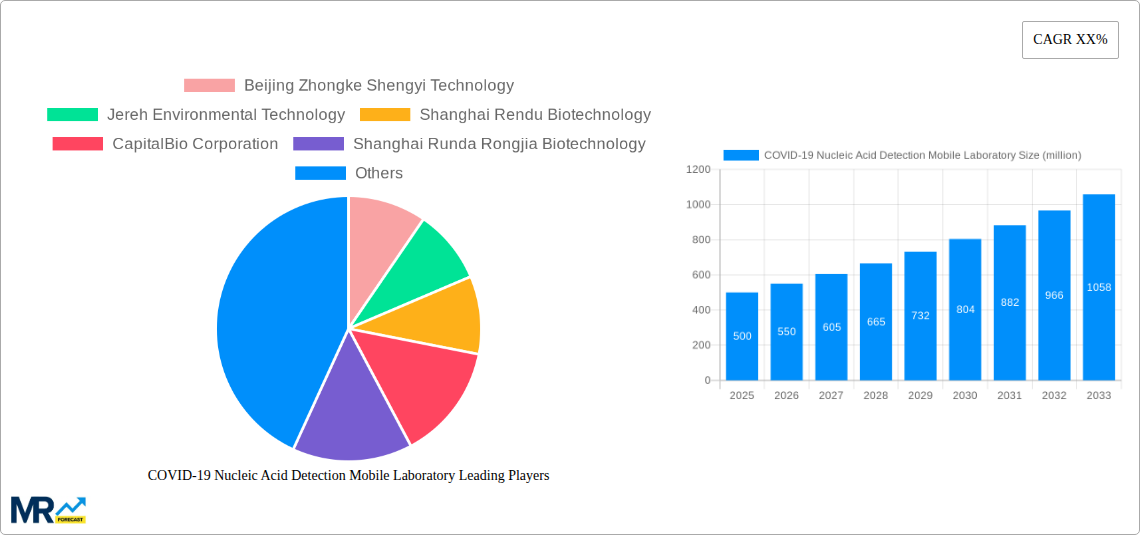

The global market for COVID-19 Nucleic Acid Detection Mobile Laboratories experienced significant growth during the pandemic (2019-2024) driven by the urgent need for rapid, on-site testing capabilities. While precise figures for the market size during this period are unavailable, we can infer substantial expansion based on the widespread adoption of mobile testing units across various regions. The market's Compound Annual Growth Rate (CAGR) from 2019 to 2024 was likely high, perhaps exceeding 30%, reflecting the escalating demand. Key drivers included the need for efficient mass testing, particularly in areas with limited laboratory infrastructure, and the advantages of mobile labs in containing outbreaks and facilitating quicker public health responses. The market segmented by vehicle type (e.g., vans, buses) and application (hospitals, clinics, remote areas) witnessed varying growth rates, with applications catering to underserved populations showing potentially higher growth. Major players such as Beijing Zhongke Shengyi Technology and Jereh Environmental Technology capitalized on this surge in demand, establishing themselves as key players within the sector.

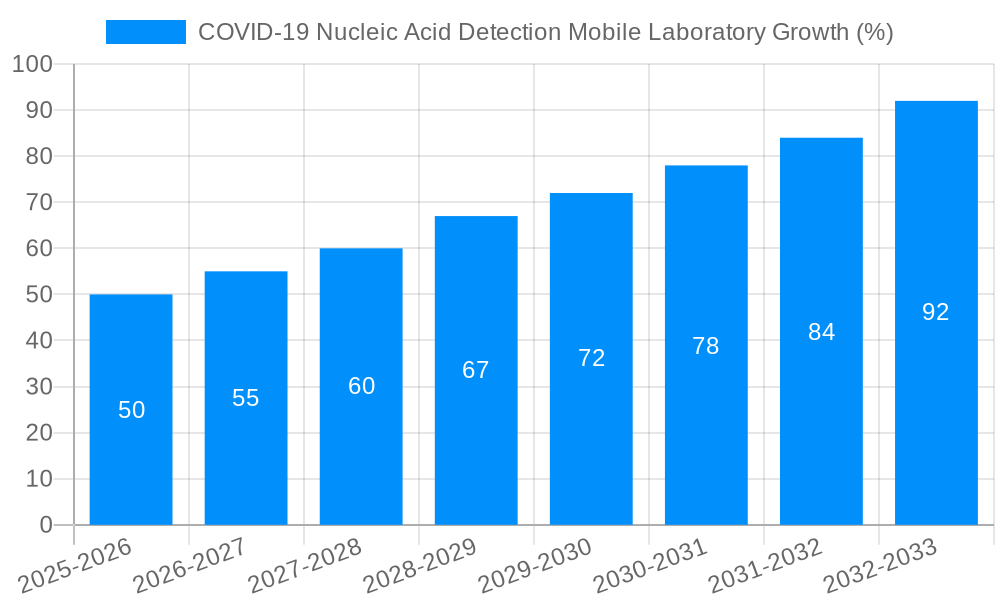

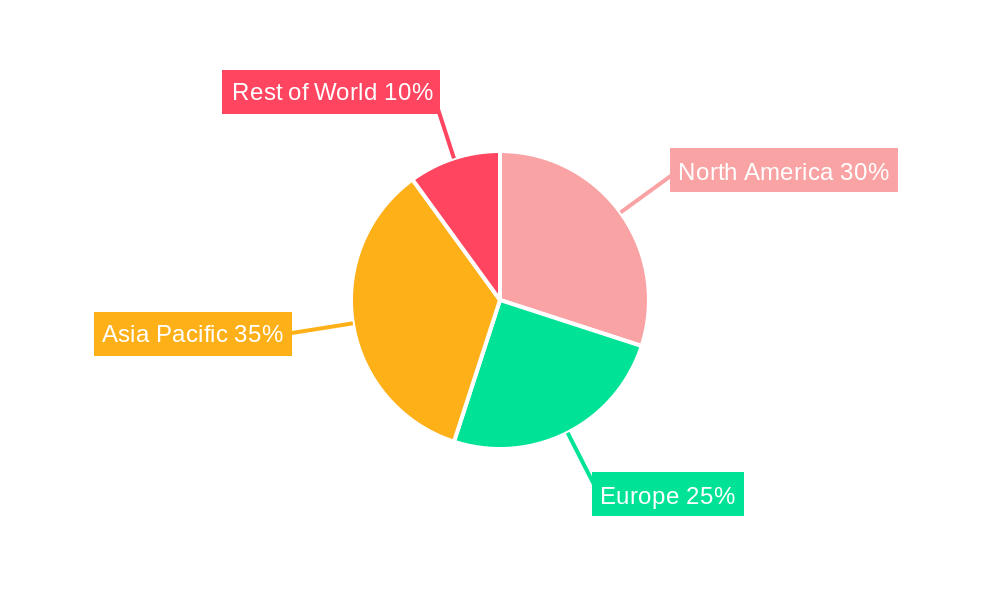

Post-pandemic (2025-2033), the market is projected to maintain growth, albeit at a moderated CAGR (estimated at 15-20%). While the initial urgency has subsided, the ongoing need for infectious disease surveillance, pandemic preparedness, and rapid diagnostic testing in remote or underserved areas sustains demand. Emerging trends point towards increasing integration of advanced technologies such as automated sample processing and AI-powered diagnostics, enhancing efficiency and accuracy. Restraints include the high initial investment costs associated with establishing mobile laboratories and the need for skilled personnel for operation and maintenance. However, government initiatives focused on improving public health infrastructure and ongoing research into new diagnostic technologies will continue to support market expansion, albeit at a more sustainable pace than during the peak of the pandemic. The market is expected to be dominated by North America and Asia-Pacific regions, reflecting both higher healthcare expenditure and the substantial population base.

The global COVID-19 Nucleic Acid Detection Mobile Laboratory market experienced explosive growth during the pandemic's peak (2019-2024), driven by the urgent need for rapid and widespread testing capabilities. The market, valued at approximately $X billion in 2024, is projected to reach $XX billion by 2033, representing a Compound Annual Growth Rate (CAGR) of XX%. This growth is fueled by continuous technological advancements, expanding applications beyond initial pandemic response, and increasing government investments in public health infrastructure. The historical period saw a surge in demand, particularly for vehicular-based mobile labs deployed in hotspots and remote areas lacking adequate testing facilities. However, the market is now entering a more stabilized phase, transitioning from emergency response to a more integrated role within routine healthcare systems. This shift will see a greater focus on cost-effectiveness, efficiency, and the development of more sophisticated, multi-functional mobile labs capable of performing a broader range of diagnostic tests. The market is also seeing increased diversification in terms of applications, expanding beyond hospitals and clinics to include applications in airports, schools, and large-scale events, anticipating future outbreaks or managing other infectious diseases. Competition is intensifying, with established players expanding their product portfolios and newer entrants leveraging innovative technologies to gain market share. The overall trend points towards sustained growth, albeit at a more moderate pace than observed during the height of the pandemic, underpinned by a shift towards long-term public health strategies. This includes integrating mobile labs into broader disease surveillance and management programs, leading to a more robust and resilient healthcare system.

Several key factors propel the growth of the COVID-19 Nucleic Acid Detection Mobile Laboratory market. The increasing prevalence of infectious diseases, beyond COVID-19, creates a persistent need for rapid and accessible diagnostic testing in various settings. Governments worldwide are prioritizing investments in public health infrastructure, recognizing the crucial role of mobile laboratories in strengthening healthcare systems, particularly in underserved regions. Technological advancements in nucleic acid detection technologies, such as PCR and CRISPR-based methods, continuously improve the speed, accuracy, and portability of testing. The miniaturization of laboratory equipment enables the development of smaller, more efficient mobile labs, reducing operational costs and logistical complexities. Furthermore, the rising demand for point-of-care diagnostics reduces the turnaround time for test results, facilitating timely interventions and better patient management. The increasing adoption of telehealth and remote healthcare services complements the use of mobile labs, enabling faster diagnosis and treatment in remote or underserved communities. Finally, the growing awareness of the importance of early disease detection and prevention among individuals and healthcare providers drives increased investment in mobile diagnostic solutions, ensuring widespread access to testing and contributing to healthier populations.

Despite the significant growth potential, several challenges hinder the expansion of the COVID-19 Nucleic Acid Detection Mobile Laboratory market. High initial investment costs associated with purchasing and maintaining mobile laboratories pose a significant barrier, especially for smaller healthcare providers or resource-constrained settings. The need for skilled personnel to operate and maintain sophisticated equipment presents a challenge, requiring specialized training and ongoing professional development. Regulatory hurdles and approval processes for new diagnostic technologies and mobile laboratory deployments can delay market entry and limit innovation. Maintaining stringent quality control and ensuring the accuracy and reliability of test results in mobile laboratory settings is paramount, requiring robust quality management systems and continuous monitoring. Furthermore, ensuring the security and privacy of patient data generated by mobile laboratories presents a critical challenge, requiring the implementation of robust data protection measures. The reliance on a stable power supply and reliable communication networks can be problematic in remote or underserved areas, hindering the deployment and effective operation of mobile laboratories. Finally, the sustainability and long-term maintenance of these laboratories are crucial aspects that need careful consideration for the market’s continued growth.

The Vehicular segment is projected to dominate the COVID-19 Nucleic Acid Detection Mobile Laboratory market during the forecast period (2025-2033). This is driven by its flexibility and ability to reach remote and underserved areas, particularly critical in emergency situations.

The market will see increased competition among major players in all regions, pushing for efficiency, affordability, and enhanced diagnostic capabilities. The global reach of this technology, tailored to specific regional needs, is poised for continued growth throughout the forecast period.

The market's growth is catalyzed by several factors: a rising demand for rapid, point-of-care diagnostics, technological advancements reducing the size and cost of mobile laboratories, and increasing government investments in public health infrastructure. The versatility of mobile labs to address various infectious diseases beyond COVID-19 ensures continued relevance, while growing adoption in diverse settings like airports and schools solidifies its long-term market presence. The integration of advanced technologies, such as AI-powered diagnostic tools and improved data management systems, will further enhance the efficiency and capabilities of these mobile units.

This report provides a comprehensive overview of the COVID-19 Nucleic Acid Detection Mobile Laboratory market, offering in-depth analysis of market trends, drivers, restraints, and growth opportunities. It includes detailed profiles of key market players, analysis of major segments, and regional market forecasts up to 2033. This report serves as an invaluable resource for companies seeking to enter or expand their presence in this dynamic and rapidly growing market, offering strategic insights and actionable intelligence for informed decision-making. The comprehensive market segmentation allows for a granular understanding of the varied applications and future growth potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Beijing Zhongke Shengyi Technology, Jereh Environmental Technology, Shanghai Rendu Biotechnology, CapitalBio Corporation, Shanghai Runda Rongjia Biotechnology, Beijing Kayudi Biotechnology, Shanghai Lubang Electromechanical Equipment, Dyna Intelligent Manufacturing Hebei Industrial Equipment, ESCO, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "COVID-19 Nucleic Acid Detection Mobile Laboratory," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the COVID-19 Nucleic Acid Detection Mobile Laboratory, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.