1. What is the projected Compound Annual Growth Rate (CAGR) of the COVID-19 Nasal Swab Test?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

COVID-19 Nasal Swab Test

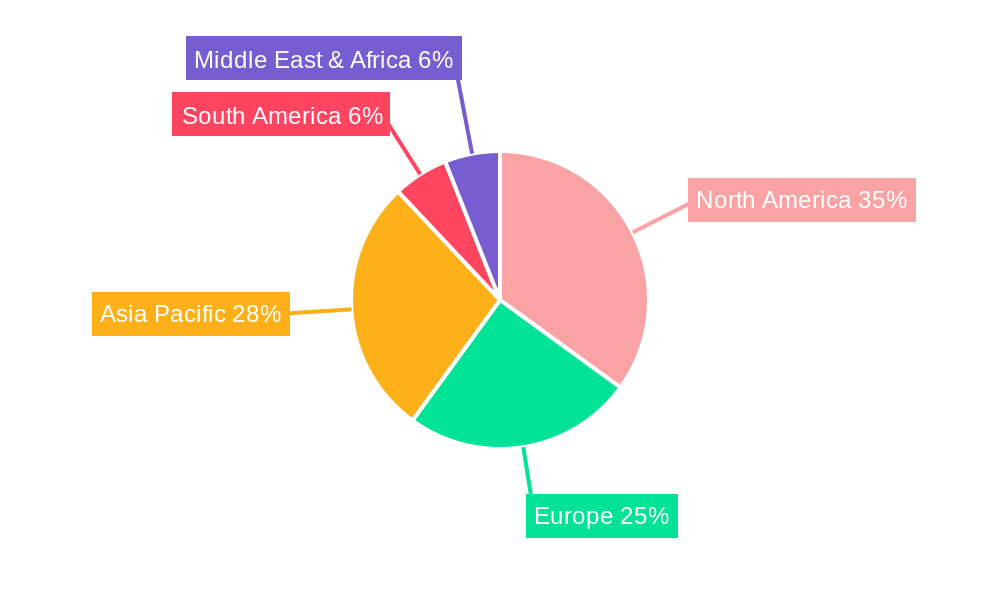

COVID-19 Nasal Swab TestCOVID-19 Nasal Swab Test by Type (Foam Tipped Swabs, Non-Woven, Others, World COVID-19 Nasal Swab Test Production ), by Application (Hospital & Clinic, Laboratories & Diagnostics Centers, World COVID-19 Nasal Swab Test Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

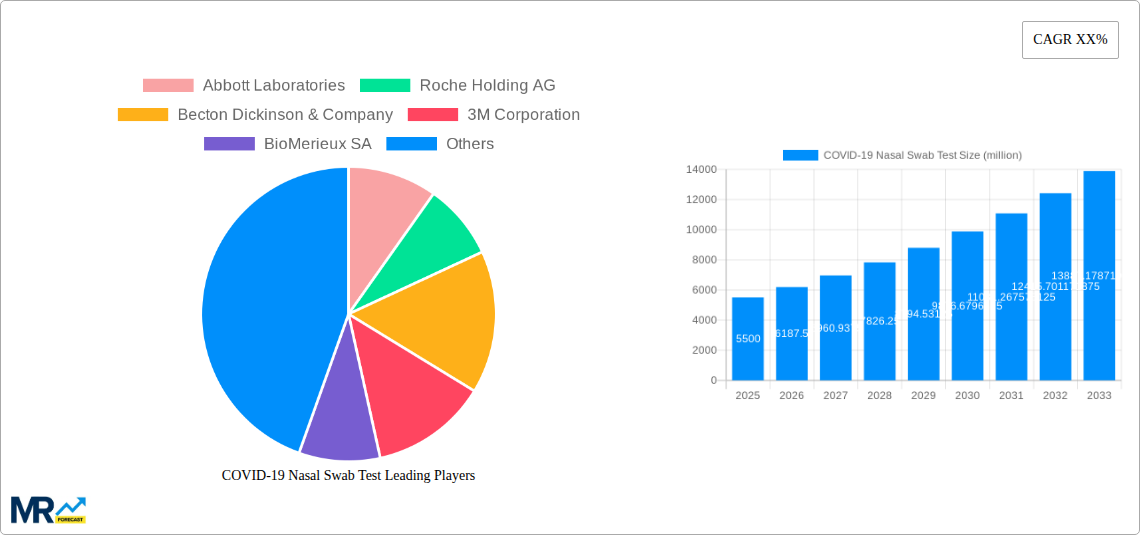

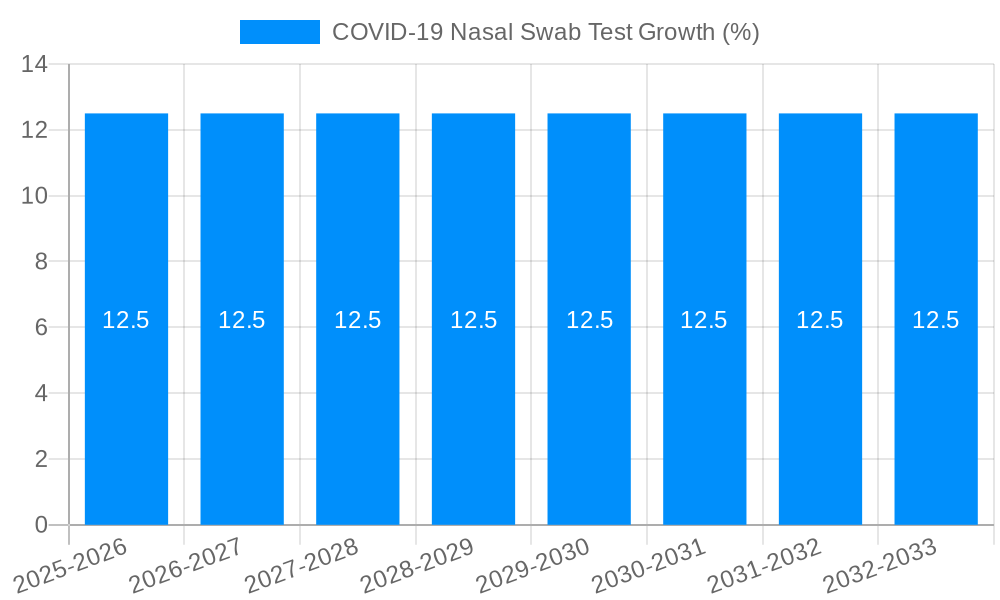

The global COVID-19 nasal swab test market is projected to reach a significant valuation by 2025, driven by the ongoing need for accessible and rapid diagnostic solutions for SARS-CoV-2. While the initial surge in demand during the pandemic has evolved, the market continues to be shaped by the persistent presence of the virus, the development of new variants, and the integration of testing into routine healthcare and public health strategies. The market size is estimated to be around USD 5,500 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033. This growth is fueled by advancements in testing technologies, leading to improved accuracy, speed, and ease of use, particularly for nasal swab-based tests. The increasing adoption of these tests in hospitals, clinics, laboratories, and diagnostic centers worldwide underpins this sustained expansion.

Key drivers for the COVID-19 nasal swab test market include the continuous efforts to manage outbreaks, the demand for pre-travel and pre-employment screening, and the growing awareness among individuals about the importance of timely diagnosis. Trends such as the development of multiplex tests capable of detecting multiple respiratory pathogens simultaneously, and the increasing integration of point-of-care testing solutions, are further propelling the market forward. While the market faces some restraints, including the declining volume of mass testing campaigns and potential price pressures, the overall outlook remains robust. The market is segmented by type into Foam Tipped Swabs, Non-Woven, and Others, with Foam Tipped Swabs likely dominating due to their widespread use and efficacy. Geographically, North America and Asia Pacific are expected to be significant contributors to the market growth.

The landscape of COVID-19 nasal swab testing has undergone a dramatic transformation since its inception during the historical period of 2019-2024. Initially characterized by a desperate scramble to meet unprecedented demand, the market has since evolved towards greater sophistication, efficiency, and accessibility. During the base year of 2025, the global production of COVID-19 nasal swab tests is projected to have reached approximately 150 million units, a figure that underscores the sustained importance of this diagnostic tool. Looking ahead, the forecast period of 2025-2033 anticipates a dynamic evolution. While the immediate post-pandemic surge has subsided, the test's role in ongoing surveillance, outbreak management, and for individuals experiencing symptoms is expected to maintain a significant market presence.

Key market insights reveal a growing emphasis on speed and accuracy. The development of rapid antigen tests, often administered at point-of-care locations and providing results within minutes, has become a cornerstone of public health strategies. PCR testing, while more sensitive and considered the gold standard, continues to be crucial for confirmatory diagnostics and in specific clinical settings. The market is also witnessing a trend towards multiplex testing, where nasal swabs are analyzed for a panel of respiratory pathogens, including influenza and RSV, in addition to SARS-CoV-2. This integrated approach enhances diagnostic efficiency and resource utilization. Furthermore, innovation in swab materials and collection techniques is aimed at improving patient comfort and sample integrity. For instance, the development of flocked swabs, designed to enhance sample elution, has seen increased adoption. The integration of artificial intelligence and machine learning in analyzing test results, particularly for high-throughput laboratory settings, is also an emerging trend that promises to optimize workflow and diagnostic precision. The global market is also observing a diversification of distribution channels, with a move beyond traditional healthcare settings to pharmacies, workplaces, and even direct-to-consumer models, reflecting the evolving needs and preferences of individuals and organizations. This diversification has been instrumental in maintaining accessibility, especially in regions with limited healthcare infrastructure. The nuanced understanding of viral shedding patterns and their correlation with infectivity is also influencing testing strategies, leading to more targeted and effective use of nasal swab tests in different scenarios.

Several potent forces are continuously driving the market for COVID-19 nasal swab tests, ensuring its continued relevance and growth. The most significant propellant remains the ongoing need for accurate and timely diagnosis of COVID-19, particularly in the face of emerging variants and the potential for future outbreaks. Public health agencies worldwide continue to recommend testing for individuals exhibiting symptoms, close contacts of confirmed cases, and in high-risk settings, thereby sustaining a baseline demand. Furthermore, the evolving global health landscape, characterized by increased awareness of infectious diseases and preparedness for future pandemics, is a major driver. Governments and healthcare organizations are investing in robust diagnostic infrastructure and maintaining stockpiles of essential testing supplies, including nasal swabs, to ensure rapid response capabilities. The increasing integration of COVID-19 testing into routine healthcare practices, such as pre-operative screening or admission protocols for vulnerable populations, further contributes to market expansion.

The development and widespread adoption of various testing technologies, including rapid antigen tests and more sensitive molecular tests like RT-PCR, have made testing more accessible and versatile, catering to different clinical needs and preferences. This technological advancement itself acts as a growth catalyst, encouraging greater utilization. Additionally, the economic implications of uncontrolled outbreaks, including workforce disruption and healthcare system strain, provide a strong incentive for continued investment in diagnostic solutions. The growing recognition of the economic benefits of early detection and containment, through effective testing strategies, underpins sustained market activity. Finally, the global commitment to disease surveillance and genomic sequencing efforts, which often rely on nasal swab samples, ensures a consistent demand for these essential collection devices. The continuous research into improved diagnostic accuracy and faster turnaround times further fuels innovation and market growth.

Despite the robust growth drivers, the COVID-19 nasal swab test market is not without its significant challenges and restraints. One of the primary hurdles is the waning demand as the acute phase of the pandemic recedes. With reduced public health mandates and a shift towards endemic management of the virus, the unprecedented demand experienced during the historical period of 2019-2024 has naturally decreased. This necessitates a recalibration of production capacities and supply chain strategies for manufacturers. Another significant restraint is the price sensitivity of the market, especially in resource-limited regions. While technological advancements aim to improve accessibility, the cost of high-quality nasal swabs and associated testing kits can still be a barrier to widespread adoption, particularly in lower and middle-income countries.

The evolving regulatory landscape also presents a challenge. Continuous updates and changes in testing guidelines and approvals by health authorities can create uncertainty for manufacturers and impact market dynamics. Ensuring compliance with diverse and evolving regulatory frameworks across different jurisdictions requires significant investment in research, development, and quality control. Furthermore, the potential for test inaccuracies and false results, although improving with technology, can lead to public mistrust and reduced reliance on these tests. This necessitates ongoing efforts to enhance sensitivity and specificity. The development of alternative testing modalities, such as saliva-based tests or breathalyzers, while offering convenience, could also pose a competitive threat to nasal swab-based testing in certain applications. Finally, supply chain disruptions, though less severe than during the peak of the pandemic, can still impact the availability and cost of raw materials required for swab production, posing a logistical challenge for manufacturers.

Several regions and specific segments are poised to exert significant influence and dominate the global COVID-19 nasal swab test market.

Dominant Regions:

Dominant Segments:

The COVID-19 nasal swab test industry is propelled by several key growth catalysts. The persistent threat of new variants and the potential for resurgent outbreaks necessitate ongoing surveillance and testing, ensuring a baseline demand. Public health initiatives focused on early detection and containment remain crucial. Furthermore, the increasing integration of COVID-19 testing into routine healthcare, such as pre-operative screenings and testing for immunocompromised individuals, expands the market’s reach. Technological advancements leading to more accurate, rapid, and user-friendly tests further fuel adoption. The global commitment to pandemic preparedness and the establishment of robust diagnostic infrastructure in many countries also act as significant growth catalysts.

This comprehensive report delves into the intricate dynamics of the COVID-19 nasal swab test market, offering a holistic view of its evolution and future trajectory. It meticulously analyzes the market size and projected growth, with an estimated production of 150 million units in 2025. The report scrutinizes key market trends, including the shift towards rapid diagnostics, the rise of multiplex testing, and innovations in swab materials. It identifies the primary driving forces, such as ongoing diagnostic needs, public health preparedness, and technological advancements, as well as the significant challenges including waning demand and price sensitivity. Furthermore, the report highlights dominant regions and segments, with a deep dive into North America, Europe, and Asia-Pacific, and the crucial roles of laboratories, hospitals, and clinics, alongside the preference for foam-tipped swabs. The report also details growth catalysts and provides an exhaustive list of leading players and their significant market developments.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Abbott Laboratories, Roche Holding AG, Becton Dickinson & Company, 3M Corporation, BioMerieux SA, Lucira Health, Mesa Biotech, Inc., Siemens Healthineers AG, QIAGEN N.V., Cepheid, LumiraDx Ltd., Fluidigm Corporation, Quidel Corporation, GenMark Diagnostics, Inc., Sherlock Biosciences, PrivaPath Diagnostics Limited, OraSure Technologies, Inc..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "COVID-19 Nasal Swab Test," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the COVID-19 Nasal Swab Test, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.