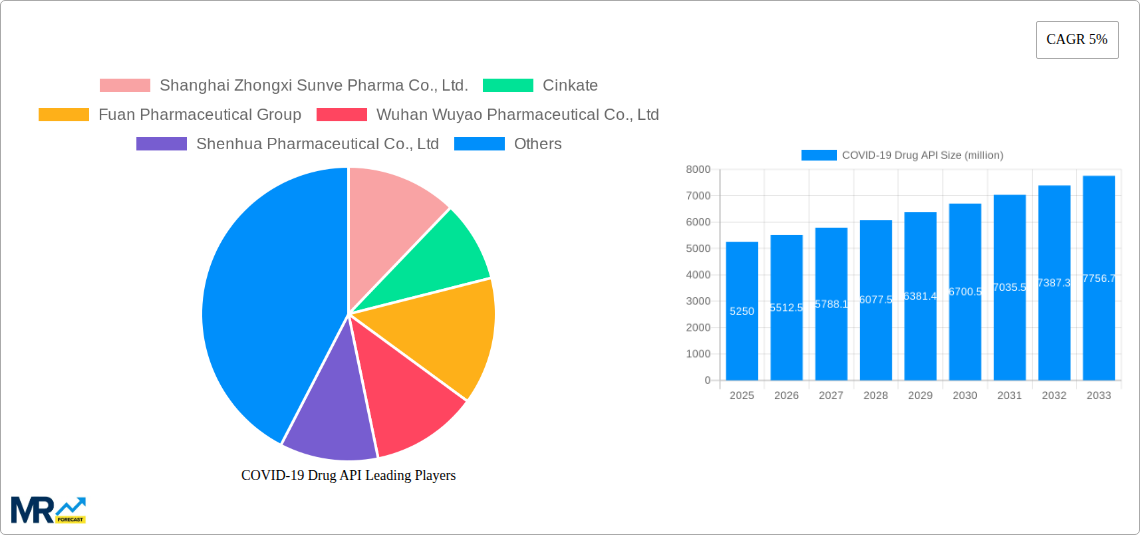

1. What is the projected Compound Annual Growth Rate (CAGR) of the COVID-19 Drug API?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

COVID-19 Drug API

COVID-19 Drug APICOVID-19 Drug API by Type (/> Hydroxychloroquine, Chloroquine Phosphate, Others), by Application (/> Tablet, Injection), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

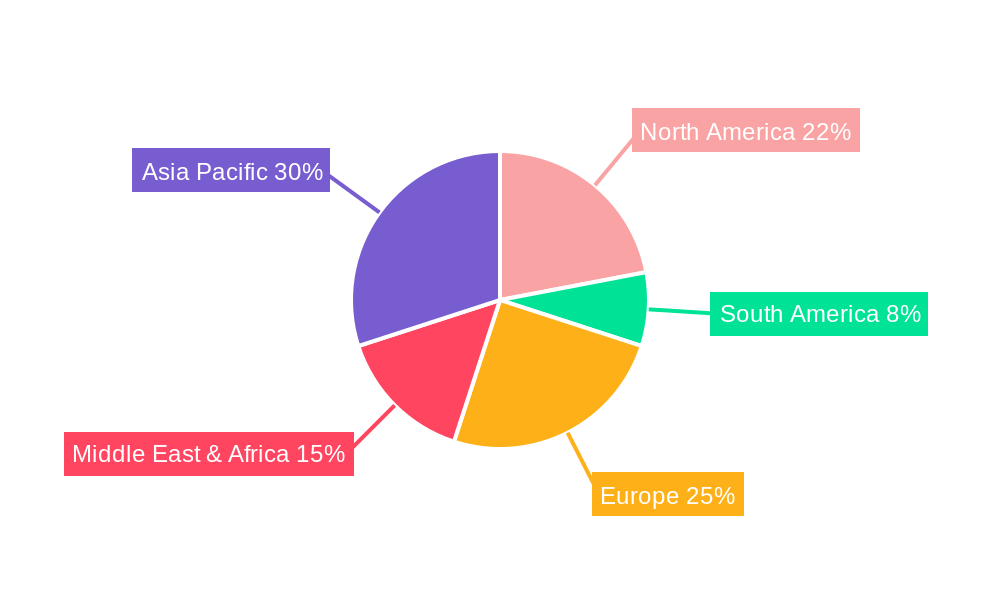

The global COVID-19 drug API market, encompassing key components like Hydroxychloroquine and Chloroquine Phosphate, experienced significant growth during the pandemic's initial phases. While the initial surge subsided as treatments evolved, the market retains a steady presence driven by ongoing research into antiviral therapies and the potential for future pandemics. The market's 5% CAGR suggests a consistent, albeit moderate, expansion. This growth is fueled by the continued need for readily available, affordable treatment options, particularly in developing nations. Tablet formulations currently dominate the market due to ease of administration and cost-effectiveness, though injectables represent a significant segment for specialized applications. Major players, including Shanghai Zhongxi Sunve Pharma Co., Ltd., Cinkate, and Fuan Pharmaceutical Group, are key contributors to the market's supply chain. Competition is expected to remain robust, with companies focusing on cost optimization, enhanced production capabilities, and potential expansion into novel antiviral APIs. Geographical distribution reveals a concentration in North America and Europe due to higher healthcare expenditure and established pharmaceutical infrastructure; however, the Asia-Pacific region presents a significant growth opportunity driven by increasing healthcare awareness and rising prevalence of infectious diseases.

The market's future trajectory is intricately linked to global health policies, pandemic preparedness strategies, and the emergence of novel viral threats. Ongoing research into COVID-19 and other viral infections will shape future demand. While the initial pandemic-driven surge has stabilized, the market’s sustained growth reflects the inherent need for readily available antiviral APIs. Regulatory changes and the introduction of innovative drug delivery systems may also impact market segmentation and growth in the coming years. The focus remains on ensuring consistent supply chain resilience and affordability to ensure equitable access to essential antiviral medications globally.

The COVID-19 pandemic spurred unprecedented demand for active pharmaceutical ingredients (APIs) used in treating the disease. The market for COVID-19 drug APIs experienced a dramatic surge during the initial outbreak (2019-2020), driven by the urgent need for effective treatments. While the initial frenzy subsided as the pandemic transitioned to an endemic phase, the market continues to evolve. The initial focus on repurposed drugs like Hydroxychloroquine and Chloroquine Phosphate gave way to a more nuanced landscape encompassing a wider array of APIs as new antiviral treatments emerged and vaccines became widely available. The market size, initially exceeding several hundred million units annually during the peak of the pandemic, has stabilized, although the long-term demand depends heavily on the emergence of new variants and the ongoing need for effective therapeutics. The shift in demand reflects the changing priorities of healthcare systems globally, focusing on long-term management of COVID-19, prevention, and addressing the lingering health consequences of the pandemic. The market, while not at the feverish pace of 2020, remains significant, driven by both existing demand and the potential for future outbreaks or the development of new treatment modalities. The production capacity of many manufacturers adjusted to meet this fluctuating need, leading to a degree of market consolidation and increased focus on cost efficiency and supply chain resilience. Looking ahead to 2033, the market is projected to maintain a steady, though more moderate growth trajectory compared to the explosive growth observed during the acute phase of the pandemic.

Several factors have propelled the COVID-19 Drug API market. Initially, the sheer scale of the pandemic created an immediate and urgent need for drug APIs to manufacture treatments. The rapid spread of the virus and the high infection rates worldwide created an unprecedented demand for antiviral medications, directly impacting the market. Further fueling growth was the extensive research and development into new antiviral drugs and therapies, creating a continuous pipeline of potential candidates needing their respective APIs. This includes not just repurposed drugs but novel molecules targeted at specific aspects of the virus's life cycle. The increasing prevalence of long COVID, with its diverse range of lingering symptoms, also contributes to ongoing demand for certain drug APIs used in treating these complications. Government initiatives, funding programs, and emergency procurement measures undertaken globally to combat the pandemic had a massive influence on the market, providing substantial support for API manufacturers. The drive to establish robust and secure pharmaceutical supply chains, learning from early supply chain vulnerabilities revealed during the pandemic, also created further market momentum.

The COVID-19 Drug API market faces several challenges. The fluctuating nature of demand, influenced by the unpredictable progression of the pandemic and the emergence of new variants, poses a significant risk for manufacturers. Balancing production capacity with varying demand levels is crucial to avoid overstocking or shortages, impacting profitability and market stability. Stringent regulatory requirements and quality control standards for pharmaceutical APIs can increase manufacturing costs and lead to lengthy approval processes. Competition within the market remains intense, with many established and emerging players vying for market share. Maintaining competitive pricing while ensuring profitability is crucial for sustainable growth. Furthermore, the inherent volatility of the global health landscape introduces uncertainty into long-term market forecasts. The emergence of new infectious diseases or unforeseen changes in the trajectory of COVID-19 itself can drastically affect the demand for specific drug APIs. Finally, securing raw materials for API synthesis can prove challenging, further impacting manufacturing efficiency and pricing.

The COVID-19 Drug API market displays regional disparities in both production and consumption. Initially, regions heavily affected by the pandemic, such as North America and Europe, witnessed substantial increases in demand. However, Asia, particularly India and China, emerged as key manufacturing hubs for many drug APIs due to established pharmaceutical infrastructure and cost-effective production capabilities.

Paragraph on Regional Dominance: While initial demand surges were widespread, the long-term market will likely be shaped by a combination of factors. Established manufacturing hubs in Asia will continue to play a crucial role due to production costs and existing infrastructure. However, regions with greater disposable income and advanced healthcare systems (North America, Europe) will maintain a significant demand for high-quality, efficacious APIs, creating a complex global landscape of both production and consumption.

The continued evolution of COVID-19 treatments, including the development of new antiviral drugs and improved formulations, will significantly impact the market. Government support for pharmaceutical research and development, along with initiatives to strengthen pharmaceutical supply chains, will further fuel growth.

(Note: Website links were not provided for these companies, preventing hyperlinking.)

This report offers a comprehensive analysis of the COVID-19 Drug API market, covering historical data, current market dynamics, and future projections. The report provides detailed insights into key market drivers, challenges, and growth opportunities, enabling stakeholders to make informed decisions regarding investments, production strategies, and market positioning. It includes granular segment-level analysis, regional breakdowns, and profiles of key market players. The forecast period extends to 2033, providing a long-term perspective on market evolution.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Shanghai Zhongxi Sunve Pharma Co., Ltd., Cinkate, Fuan Pharmaceutical Group, Wuhan Wuyao Pharmaceutical Co., Ltd, Shenhua Pharmaceutical Co., Ltd, Chongqing Kangle Pharmaceutical Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "COVID-19 Drug API," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the COVID-19 Drug API, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.