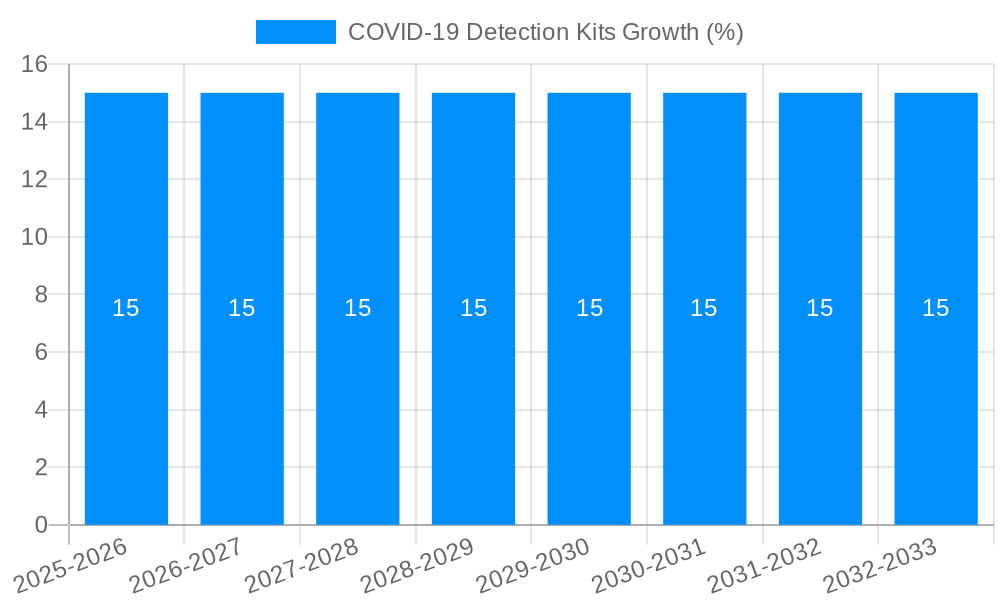

1. What is the projected Compound Annual Growth Rate (CAGR) of the COVID-19 Detection Kits?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

COVID-19 Detection Kits

COVID-19 Detection KitsCOVID-19 Detection Kits by Type (Nucleic Acid Detection Kit, Antibody Detection Kit, World COVID-19 Detection Kits Production ), by Application (Hospital, Scientific Research, Diagnostic Center, World COVID-19 Detection Kits Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

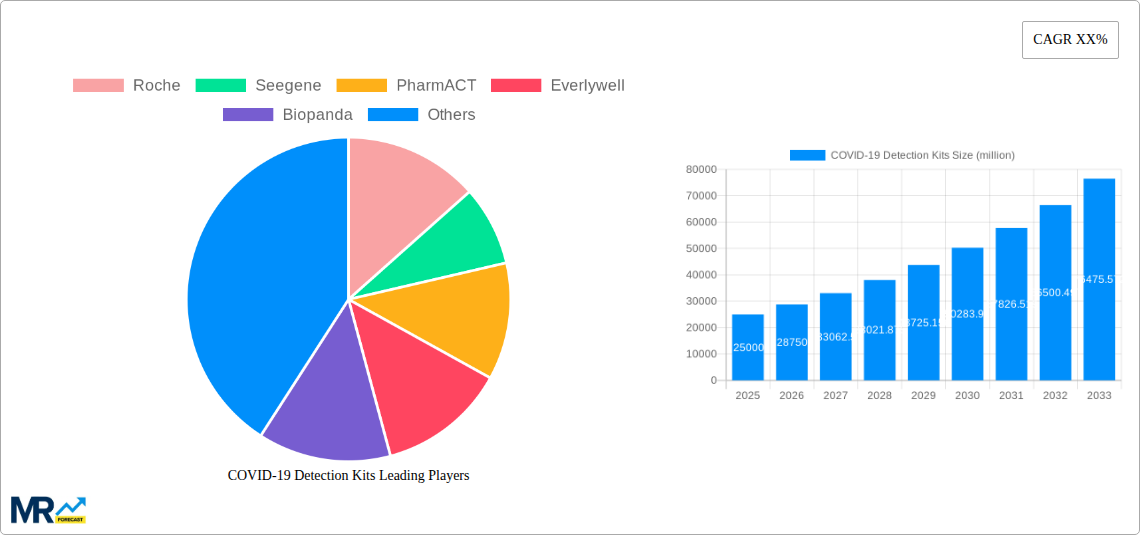

The global COVID-19 Detection Kits market is poised for substantial growth, projected to reach approximately $25,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 15% during the forecast period (2025-2033). This robust expansion is driven by persistent demand for accurate and rapid diagnostic solutions to manage the ongoing COVID-19 pandemic and its variants. The market's trajectory is significantly influenced by the continuous need for mass testing, surveillance, and early detection in various settings, including hospitals, diagnostic centers, and scientific research institutions. Advancements in nucleic acid detection technologies, such as RT-PCR and isothermal amplification, alongside the development of highly sensitive antibody detection kits, are key market drivers. These innovations offer improved specificity and sensitivity, contributing to more reliable diagnoses and effective public health strategies. The increasing accessibility of testing, both in clinical environments and through at-home testing solutions, further fuels market expansion, making diagnostic tools more readily available to a wider population.

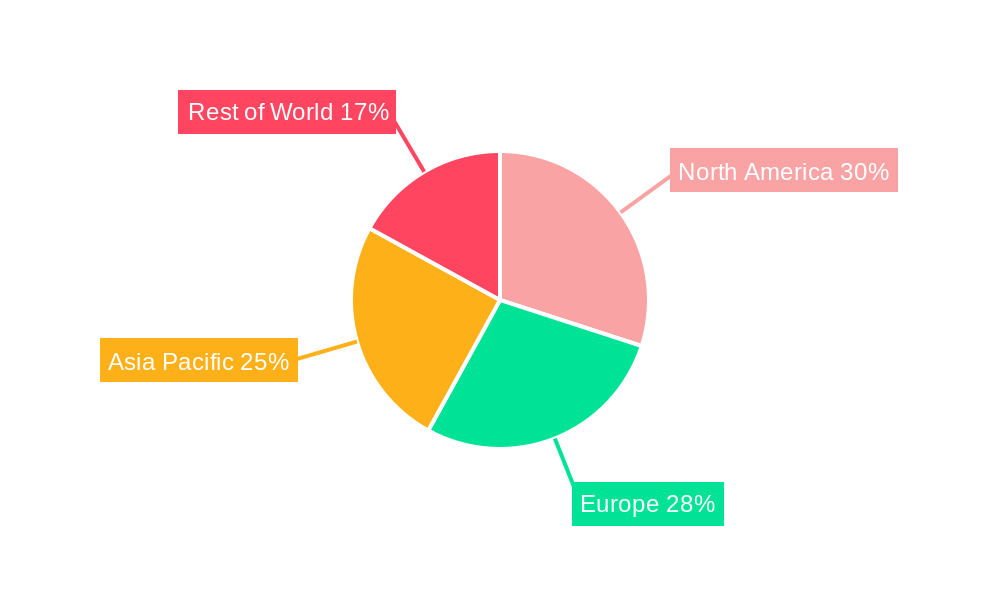

Despite significant progress, the market faces certain restraints, including the evolving nature of the virus, leading to the emergence of new variants that may impact test efficacy, and a gradual decline in the sheer volume of testing as the pandemic transitions into an endemic phase in some regions. However, the long-term outlook remains positive, supported by the integration of COVID-19 testing into routine healthcare screenings and the potential for these detection platforms to be adapted for other infectious diseases. The market's segmentation highlights the dominance of Nucleic Acid Detection Kits, which are considered the gold standard for early and accurate diagnosis, followed by Antibody Detection Kits that play a crucial role in assessing past infections and immune responses. North America and Europe currently hold significant market shares due to well-established healthcare infrastructures and early adoption of advanced diagnostic technologies. The Asia Pacific region is anticipated to witness the fastest growth, driven by increasing healthcare expenditure, rising awareness, and government initiatives to bolster diagnostic capabilities.

This comprehensive report delves into the dynamic global market for COVID-19 Detection Kits, offering an in-depth analysis of its trajectory from its nascent stages during the pandemic's onset to its projected evolution over the coming decade. Spanning a study period from 2019 to 2033, with a base year of 2025 and an estimated year also set at 2025, this report meticulously examines historical trends from 2019-2024 and forecasts future developments through the forecast period of 2025-2033. We dissect the market by kit type, application, and global production, identifying key players and industry-shaping developments.

The global COVID-19 detection kits market has undergone a remarkable transformation, evolving from an emergency response necessity to an integral component of ongoing public health surveillance and management. During the initial phases of the pandemic (2019-2021), the market was characterized by an unprecedented surge in demand, driven by the urgent need for diagnostic tools to identify infected individuals and curb the virus's spread. This period saw the rapid proliferation of various detection technologies, with Nucleic Acid Detection Kits, primarily RT-PCR based, emerging as the gold standard due to their high sensitivity and specificity. Production volumes for these kits, which were virtually non-existent pre-pandemic, skyrocketed into the hundreds of millions, with key players like Roche, Seegene, and Mylab Discovery rapidly scaling up their manufacturing capabilities to meet global shortages. Antibody Detection Kits also gained significant traction, offering valuable insights into past infections and population immunity, with an estimated production reaching tens of millions during this period.

As the pandemic evolved (2022-2024), the market began to mature. While the demand for Nucleic Acid Detection Kits remained robust, particularly for clinical diagnosis and outbreak investigations, Antibody Detection Kits found new applications in seroprevalence studies and vaccine efficacy monitoring. Innovations in rapid antigen tests, offering faster turnaround times and point-of-care accessibility, also captured a substantial market share, with production reaching hundreds of millions of units annually. Diagnostic Centers and Hospitals continued to be the primary end-users, but the increasing accessibility and affordability of home testing kits, championed by companies like Everlywell and Curative, opened up new avenues for consumer-driven testing and self-monitoring. The estimated global production of all COVID-19 detection kits in 2024 reached a staggering figure, with Nucleic Acid Detection Kits accounting for an estimated 700 million units and Antibody Detection Kits around 300 million units, underscoring the immense scale of the market. Looking ahead, the market is expected to stabilize but not diminish. While the acute emergency phase has passed, the persistent presence of SARS-CoV-2, the emergence of new variants, and the growing emphasis on integrated respiratory disease surveillance will ensure sustained demand for reliable and accessible detection solutions.

The persistent and evolving threat posed by the SARS-CoV-2 virus remains the primary driver for the global COVID-19 detection kits market. The emergence of new variants, each with potentially altered transmissibility or immune escape characteristics, necessitates continuous and widespread testing to track their spread and inform public health responses. This ongoing need for surveillance, coupled with the increasing integration of COVID-19 testing into routine respiratory illness diagnostics, fuels a sustained demand for a variety of detection kits. Furthermore, the development of more accurate, faster, and user-friendly testing technologies continues to expand market accessibility. Innovations in nucleic acid amplification techniques, such as isothermal amplification, and the refinement of antibody detection assays contribute to improved performance and broader application. The growing recognition of the importance of early detection for effective containment of infectious diseases, not just for COVID-19 but for future public health crises, also serves as a significant propellant for the market. Countries and healthcare systems are investing in robust diagnostic infrastructure, recognizing the critical role detection kits play in safeguarding public health and economic stability. The increasing focus on personalized medicine and the ability to differentiate between various respiratory pathogens with multiplex assays further contribute to the sustained relevance and growth of this market.

Despite the robust demand, the COVID-19 detection kits market faces several significant challenges and restraints. One of the primary hurdles is the increasing price sensitivity among end-users, particularly in resource-limited settings, as governments and healthcare systems grapple with evolving public health priorities and budget constraints. The market saturation and intense competition among numerous manufacturers have also led to price erosion, impacting profitability for some players. Another critical challenge is the rapid pace of technological advancement. While innovation is a driver, it also necessitates continuous investment in research and development to remain competitive, posing a significant barrier for smaller companies. The need for continuous validation and regulatory approval for new kits, especially those targeting emerging variants, can be a time-consuming and costly process. Furthermore, concerns regarding the accuracy and reliability of certain rapid diagnostic tests, particularly those with lower sensitivity, can lead to misdiagnosis and undermine public trust, thereby acting as a restraint on market growth. The shift from widespread public testing to more targeted screening for symptomatic individuals or high-risk groups also influences demand patterns. Supply chain disruptions, though less severe than in the early pandemic, can still pose challenges in ensuring the consistent availability of raw materials and finished products. Finally, the increasing adoption of vaccination strategies, while beneficial for public health, can also lead to a perceived decrease in the immediate need for widespread testing, potentially impacting market volume growth in the long term.

The global COVID-19 Detection Kits market is projected to witness significant dominance from specific regions and market segments, driven by a confluence of factors including public health infrastructure, testing policies, disease prevalence, and technological adoption.

Dominant Segments:

Dominant Region/Country:

Interplay between Segments and Regions:

The dominance of Nucleic Acid Detection Kits and Hospitals within North America is intrinsically linked. The advanced healthcare systems in the US rely heavily on laboratory-based diagnostics, making hospitals and their affiliated diagnostic centers prime consumers of high-throughput and sensitive Nucleic Acid Detection Kits. While rapid antigen tests have a role, the demand for definitive diagnosis in a clinical setting will continue to favor nucleic acid-based methods. The scale of testing required in a population of over 330 million, coupled with a proactive public health approach, ensures that the overall production volume for COVID-19 detection kits originating from or consumed within North America remains exceptionally high. The competitive landscape, featuring both multinational giants and innovative domestic players, further fuels market activity and technological advancement within this key region.

The sustained growth of the COVID-19 Detection Kits industry is propelled by several key catalysts. The ongoing evolution of the virus, including the emergence of new variants and the potential for reinfection, necessitates continuous monitoring and diagnostic capabilities. Furthermore, the growing integration of COVID-19 testing into routine respiratory disease surveillance programs, allowing for differentiation from other pathogens, provides a foundational demand. Advancements in diagnostic technologies, leading to more accurate, rapid, and accessible kits, including point-of-care and at-home testing solutions, are expanding the market reach. Government initiatives supporting public health preparedness and the establishment of robust diagnostic infrastructure also act as significant growth enablers.

This report provides unparalleled and exhaustive coverage of the global COVID-19 Detection Kits market, offering a holistic view of its past, present, and future. Beyond market sizing and segmentation, it delves into the intricate interplay of technological innovations, regulatory landscapes, and evolving public health strategies that shape the industry. We analyze the competitive dynamics, profiling leading players and emerging contenders, and scrutinize their strategic moves, from R&D investments to market expansion initiatives. The report further explores the economic implications, including pricing trends, cost-effectiveness analyses, and the impact on healthcare expenditure. With a robust forecast methodology based on extensive data analysis and expert insights, this report equips stakeholders with the critical intelligence needed to navigate this complex and vital sector of the global health industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Roche, Seegene, PharmACT, Everlywell, Biopanda, Mylab Discovery, Integrated DNA Technologies, Cosara Diagnostics, Solgent, Kogene Biotech, SD Biosensor, Biosewoom, Curative, Biolidics, Shanghai ZJ Bio-Tech, Shanghai Geneodx Biotech, INNOVITA, Genomics Biotech (Wuhan), Zhongshan Daan Gene, Sanaure, Shanghai Bio-Germ, Guangzhou Wonfo Bio-Tech, Chengdu Boaojing Bio-Tech, Beijing XABT, Bioscience(Chongqing) Bio-Tech, Maccura Bio-Tech, Xiamen InnoDx, Guangdong Hecin-Scientific, Wuhan Easydiagnosis Biomedicine.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "COVID-19 Detection Kits," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the COVID-19 Detection Kits, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.