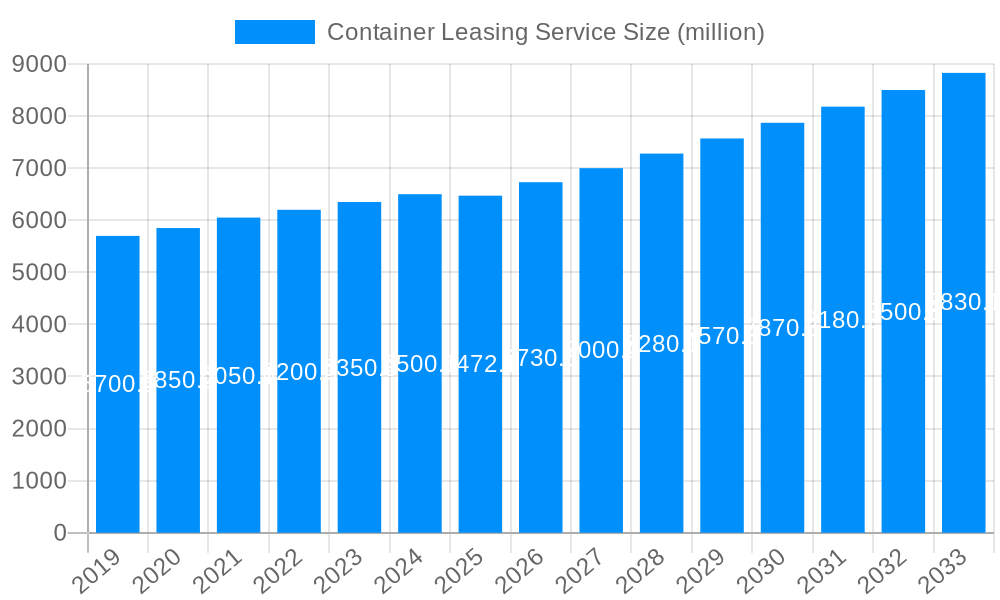

1. What is the projected Compound Annual Growth Rate (CAGR) of the Container Leasing Service?

The projected CAGR is approximately 4.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Container Leasing Service

Container Leasing ServiceContainer Leasing Service by Type (Tank Container, Square Container, Others), by Application (Equipment, Food, Drug, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global container leasing service market is projected to experience robust growth, reaching an estimated market size of USD 6,472.1 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 4.1% through 2033. This expansion is fueled by the increasing demand for efficient and flexible logistics solutions across various industries. The market is characterized by a diverse range of container types, including tank containers, square containers, and others, catering to specialized needs such as the transportation of equipment, food, and pharmaceuticals. The growth trajectory indicates a sustained demand for these services, driven by the ever-increasing volume of global trade and the need for adaptable supply chain management.

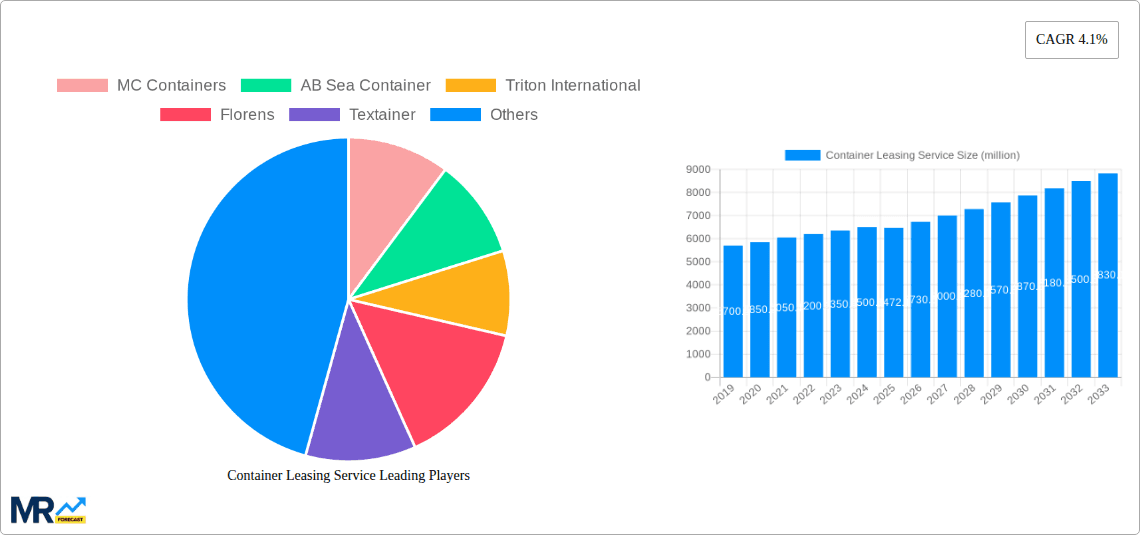

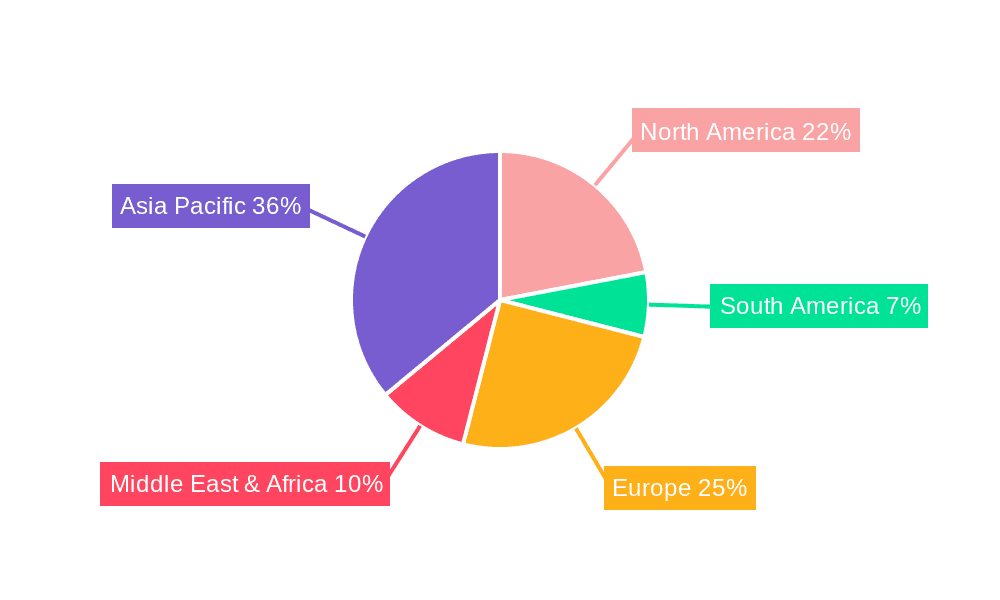

Key trends shaping the container leasing market include the growing emphasis on intermodal transportation, the development of smart containers with enhanced tracking and monitoring capabilities, and the increasing adoption of leasing models over outright ownership for greater financial flexibility. While the market benefits from these positive drivers, it also faces certain restraints. Fluctuations in global trade volumes, geopolitical instabilities, and potential disruptions in the supply chain can impact demand. Furthermore, the operational costs associated with container maintenance and repositioning, along with the evolving regulatory landscape, present challenges that market players must navigate effectively. The competitive landscape features a multitude of key players, including MC Containers, AB Sea Container, Triton International, and Florens, all vying for market share through strategic expansions and service innovations. The Asia Pacific region is expected to dominate the market, driven by its significant manufacturing output and burgeoning trade activities.

The global container leasing service market is poised for significant expansion, with a projected market size reaching $XX million by 2033. The XXX million valuation in the base year of 2025 underscores the sector's current robustness and its future potential. A key trend observed during the historical period of 2019-2024 has been the increasing demand for specialized container types, particularly tank containers, driven by the evolving needs of industries such as chemicals, petrochemicals, and food and beverage. This surge in specialized leasing is a direct response to the growing complexity of global supply chains and the imperative for safe and efficient transportation of diverse cargo. The study period of 2019-2033 reveals a dynamic shift from standard dry containers to more niche solutions, reflecting an industry that is not only expanding but also maturing in its offerings.

The forecast period of 2025-2033 is expected to witness sustained growth fueled by several macro-economic factors. Globalization continues to be a fundamental driver, necessitating the movement of goods across continents and thereby increasing the demand for leasing services to manage fleet sizes effectively. Furthermore, the ongoing emphasis on sustainability and the circular economy is subtly influencing the leasing landscape. Companies are increasingly looking for flexible leasing arrangements that allow for easier upgrades to more energy-efficient or environmentally friendly container options. The report also highlights the growing importance of digital solutions in container management, including tracking, maintenance, and billing, which are becoming integral to the leasing value proposition. The integration of IoT devices and advanced analytics is set to revolutionize operational efficiency and provide greater visibility across the supply chain, further enhancing the attractiveness of container leasing services. The dynamic nature of trade routes and the volatility in new container manufacturing costs also contribute to the attractiveness of leasing, offering a more predictable and manageable cost structure for businesses. This multifaceted growth narrative paints a picture of a sector ripe for innovation and strategic investment.

Several potent forces are actively propelling the container leasing service market forward, ensuring its continued expansion and relevance in the global logistics ecosystem. Foremost among these is the relentless expansion of international trade and e-commerce. As businesses increasingly operate on a global scale, the need for efficient and cost-effective methods to transport goods becomes paramount. Container leasing offers a flexible and scalable solution, allowing companies to manage their fleet requirements without the substantial capital investment associated with outright ownership. This is particularly crucial for small to medium-sized enterprises (SMEs) and businesses with fluctuating shipping volumes, who can leverage leasing to adapt quickly to market demands.

Another significant driver is the inherent volatility and cyclical nature of the shipping industry. Fluctuations in new container manufacturing costs, coupled with unpredictable demand cycles, can make outright fleet acquisition a risky proposition. Leasing provides a buffer against these market uncertainties, offering greater financial predictability and operational agility. Moreover, the increasing specialization of cargo types, such as hazardous materials, temperature-sensitive goods, and oversized equipment, has created a growing demand for specialized container leasing, including tank containers and reefer containers. This niche demand allows leasing companies to offer tailored solutions, thereby expanding their market reach and revenue streams. The ongoing focus on optimizing supply chain costs and operational efficiency further bolsters the demand for leasing as a strategic tool for managing assets and mitigating financial risks.

Despite the robust growth trajectory, the container leasing service sector is not without its inherent challenges and restraints that can impede its progress. A primary concern is the potential for oversupply of containers, which can lead to price wars and compressed profit margins for leasing companies. This situation can be exacerbated by rapid expansion in container manufacturing during periods of high demand, followed by a downturn that leaves leasing fleets underutilized. Economic downturns and geopolitical instability can also significantly impact global trade volumes, directly affecting the demand for container leasing and potentially leading to higher idle fleet percentages.

Furthermore, the fluctuating costs of container manufacturing and maintenance can create an unpredictable operating environment for leasing firms. Rising steel prices and labor costs can directly translate to higher leasing rates, potentially deterring some customers. Regulatory changes related to shipping, environmental standards, and international trade can also impose additional compliance costs and operational complexities on leasing companies. For instance, stricter regulations on the transportation of certain chemicals or hazardous materials might necessitate investment in specialized, compliant container types, which can be a significant capital outlay. Finally, the management of container repositioning, especially across vast geographical distances, remains a persistent logistical challenge, incurring substantial costs and requiring sophisticated planning to minimize empty legs and optimize utilization.

The container leasing service market exhibits strong regional dominance and segment-specific growth. Asia Pacific, particularly China, is consistently emerging as a dominant region. This is attributed to its position as the world's manufacturing hub and a major player in global trade, leading to an insatiable demand for containerized shipping and, consequently, container leasing services. The region’s extensive coastline, numerous ports, and established logistics infrastructure further solidify its leadership.

In terms of market segments, the Tank Container segment is poised for significant dominance. This is driven by the escalating global demand for the transportation of bulk liquids and gases across various industries. The Food and Beverage industry, in particular, relies heavily on tank containers for the safe and efficient transport of liquids like edible oils, milk, and juices. The Drug industry also presents a burgeoning application, with tank containers being crucial for transporting bulk pharmaceutical ingredients and sterile liquids, where temperature control and containment are paramount. The "Others" application category, encompassing chemicals, petrochemicals, and industrial gases, further amplifies the demand for tank containers due to the inherent need for specialized, secure, and often hazardous material transportation.

The growth of the tank container segment is further bolstered by advancements in container technology, including the development of specialized coatings, insulation, and pressure-rated designs. These innovations enable the transportation of a wider range of products with enhanced safety and efficiency. The increasing stringency of regulations governing the transportation of hazardous materials across different countries also compels businesses to opt for reliable and compliant tank container leasing solutions. Leasing provides a cost-effective way for companies to access these specialized assets without the burden of ownership and maintenance.

Beyond tank containers, the Equipment application segment also plays a crucial role. This encompasses the leasing of containers for the transportation of construction equipment, agricultural machinery, and other heavy-duty assets. The flexibility offered by leasing is particularly beneficial for projects with variable timelines and equipment needs. The "Others" segment in terms of container type, which includes specialized containers beyond standard dry vans or tank containers, is also witnessing growth due to niche industry requirements.

The dominance of Asia Pacific, coupled with the ascendance of the Tank Container segment across critical applications like Food, Drug, and Others (chemicals/petrochemicals), paints a clear picture of where the most significant market activity and growth will be concentrated in the coming years.

The container leasing service industry is experiencing robust growth driven by several key catalysts. The accelerating pace of globalization and the expansion of international trade are fundamental drivers, increasing the need for efficient and scalable logistics solutions. Furthermore, the growing trend towards outsourcing non-core assets and operations encourages companies to lease rather than own their container fleets, thereby optimizing capital allocation and operational flexibility. The increasing demand for specialized containers, particularly tank containers for diverse liquid and gaseous cargo, also opens up new avenues for growth.

This comprehensive report delves into the multifaceted landscape of the container leasing service market, providing in-depth analysis and actionable insights. It meticulously examines market trends, drivers, and restraints, offering a holistic view of the sector's dynamics. The report also identifies key regions and segments poised for dominant growth, with a particular focus on the burgeoning demand for specialized container types like tank containers, driven by critical applications in food, drug, and other industrial sectors. Leading players, significant developments, and future growth catalysts are thoroughly explored to equip stakeholders with a strategic advantage.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.1%.

Key companies in the market include MC Containers, AB Sea Container, Triton International, Florens, Textainer, Seaco Global, Beacon Intermodal, Seacube Containers, CAI, Touax, Blue Sky Intermodal, CARU Containers, Raffles Lease, Trident, Unitas, Conical, Container Rental Company, Alconet, RAVA Group, K-tainer, arkcontainer, Container Services, Brooks, MK Containers, OV Lahtinen, SeaCube, CS Leasing, Railion, Trifleet Leasing, Bofort, VTG Tanktainer, LOTUS Containers, NWCS, Trans Asia, Xines, McLarens Logistics Group, One Way Lease, Eagle Leasing, Maxon, Peacock Container, GGR Enterprises, V S & B Containers, Fan-C, Conway, .

The market segments include Type, Application.

The market size is estimated to be USD 6472.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Container Leasing Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Container Leasing Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.