1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Healthcare Drug?

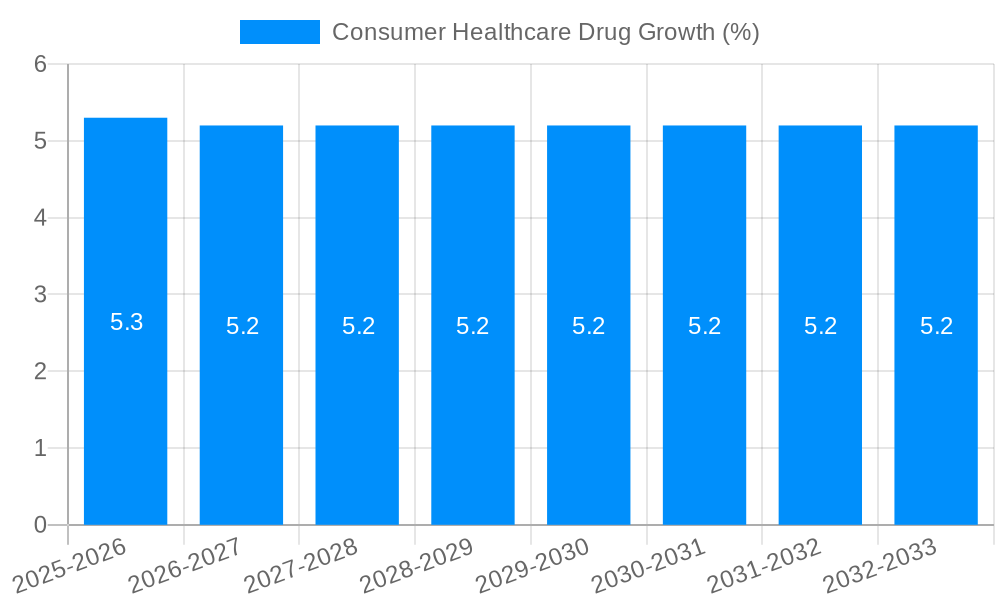

The projected CAGR is approximately 5.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Consumer Healthcare Drug

Consumer Healthcare DrugConsumer Healthcare Drug by Type (Solid Preparations, Oral Liquid, Patch, Other), by Application (Hospital, Retail Pharmacy, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

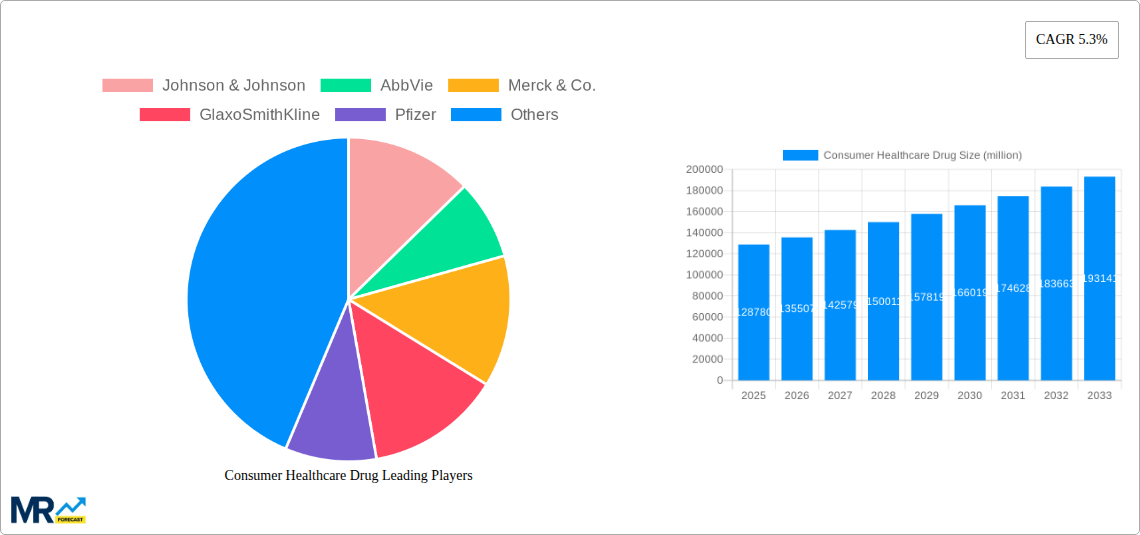

The global Consumer Healthcare Drug market is poised for significant expansion, projected to reach an estimated market size of $128,780 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.3% anticipated throughout the forecast period of 2025-2033. This impressive growth trajectory is fueled by a confluence of escalating consumer awareness regarding proactive health management, an aging global population susceptible to chronic conditions, and continuous innovation in drug formulations and delivery systems. The increasing prevalence of lifestyle-related ailments and a greater emphasis on self-care are driving demand for accessible and effective over-the-counter (OTC) and behind-the-counter (BTC) medications. Furthermore, the expanding reach of e-pharmacies and direct-to-consumer (DTC) marketing strategies are making these products more readily available, further stimulating market penetration.

The market is characterized by a dynamic landscape of product segmentation and application diversity. Solid preparations, encompassing tablets and capsules, are expected to maintain their dominance due to ease of use and long shelf life. However, oral liquids are gaining traction, particularly for pediatric and geriatric populations, while patches offer convenient and sustained drug delivery for specific therapeutic areas. In terms of application, hospitals and retail pharmacies represent the primary distribution channels, catering to a broad spectrum of consumer needs. Emerging trends include the rise of personalized medicine in consumer healthcare, the integration of digital health solutions, and a growing preference for natural and herbal-based remedies. While the market presents substantial opportunities, challenges such as stringent regulatory frameworks, intense competition, and the potential for counterfeit products necessitate strategic navigation by industry players.

This report offers an in-depth analysis of the global Consumer Healthcare Drug market, providing critical insights into its historical performance, current landscape, and future trajectory. Spanning the Study Period of 2019-2033, with a Base Year and Estimated Year of 2025, and a Forecast Period of 2025-2033, the report meticulously examines trends, drivers, challenges, and key players. Utilizing unit sales in the millions, this analysis is designed to equip stakeholders with actionable intelligence for strategic decision-making.

XXX The global consumer healthcare drug market is exhibiting robust growth, driven by an increasing awareness of preventive healthcare and a growing demand for over-the-counter (OTC) medications. During the Historical Period of 2019-2024, the market demonstrated consistent expansion, fueled by factors such as an aging global population prone to chronic ailments and a rising prevalence of self-medication for minor health concerns. The Estimated Year of 2025 projects a market poised for further acceleration, with significant unit sales expected across various therapeutic areas. A key trend is the burgeoning demand for Solid Preparations (e.g., tablets, capsules), which are projected to continue their dominance due to convenience and established efficacy. The report anticipates a notable shift towards more specialized and targeted OTC formulations, addressing specific consumer needs like pain management, digestive health, and immune support. Furthermore, the integration of digital platforms for information dissemination and even prescription refills (where applicable) is subtly influencing consumer purchasing decisions, pushing for more accessible and informed choices. The Forecast Period of 2025-2033 is expected to witness sustained growth, albeit with evolving consumer preferences and increasing regulatory scrutiny. Innovation in drug delivery systems, such as improved Patch technologies offering sustained release and enhanced patient compliance, will also play a pivotal role. While Oral Liquid formulations remain crucial, especially for pediatric and geriatric populations, their market share might see a relative decline compared to the growing dominance of solid dosage forms and novel delivery methods. The broader impact of industry developments, including advancements in pharmaceutical research and development and shifts in global healthcare policies, will continue to shape the market's dynamics. The increasing focus on wellness and proactive health management is a significant underlying trend, translating into higher consumption of non-prescription remedies. This proactive consumer mindset, coupled with an expanding global middle class with greater disposable income, underpins the positive outlook for the consumer healthcare drug market.

Several powerful forces are acting as accelerators for the global consumer healthcare drug market. Foremost among these is the growing consumer self-awareness and proactive health management. Individuals are increasingly taking ownership of their well-being, actively seeking solutions for minor ailments and preventive health measures before they escalate into more serious conditions requiring professional medical intervention. This shift from a reactive to a proactive approach directly translates into higher demand for accessible OTC medications. Secondly, the aging global population is a significant demographic driver. As populations age, the prevalence of chronic conditions like arthritis, digestive issues, and cardiovascular concerns rises, leading to a sustained demand for pain relief, digestive aids, and other supportive OTC therapies. This demographic trend is expected to intensify throughout the Forecast Period. Furthermore, the increasing accessibility and affordability of OTC drugs, particularly in emerging economies, is unlocking new consumer segments. As disposable incomes rise in developing nations, more individuals can afford to purchase these medications, contributing significantly to market volume. The convenience and reduced cost associated with self-medication compared to doctor visits for minor ailments also play a crucial role. Consumers value the ability to address their health needs quickly and efficiently without the need for appointments or extensive waiting times, thereby fueling the demand for readily available consumer healthcare drugs.

Despite the robust growth, the consumer healthcare drug market faces several formidable challenges and restraints that could temper its expansion. A primary concern is the increasing regulatory scrutiny and evolving compliance requirements. Governments worldwide are placing greater emphasis on the safety, efficacy, and labeling of OTC drugs, leading to more stringent approval processes and post-market surveillance. This can increase the cost and time associated with bringing new products to market and maintaining existing ones. Another significant restraint is the growing competition and market saturation. The consumer healthcare drug landscape is highly competitive, with numerous players vying for market share. This can lead to price erosion, reduced profit margins, and difficulties for smaller companies to establish a strong foothold. The risk of inappropriate self-medication and potential for misuse or abuse of OTC drugs also presents a considerable challenge. Misunderstanding of drug indications, dosages, or potential interactions can lead to adverse health outcomes, necessitating ongoing consumer education campaigns and responsible marketing practices. Furthermore, the impact of generic competition and the threat of biosimil alternatives in certain segments, though less prevalent in OTC than prescription drugs, can exert downward pressure on pricing and market share for established brands. The increasing demand for natural and herbal remedies as alternatives to conventional pharmaceuticals also represents a growing segment that could divert some consumer spending away from traditional OTC drugs.

The Solid Preparations segment, particularly in the Retail Pharmacy application channel, is poised to dominate the global consumer healthcare drug market. This dominance is anticipated across key regions and countries, driven by a confluence of consumer preferences, product efficacy, and market dynamics observed throughout the Historical Period and projected to continue through the Forecast Period.

Dominance of Solid Preparations:

Dominance of Retail Pharmacy Application:

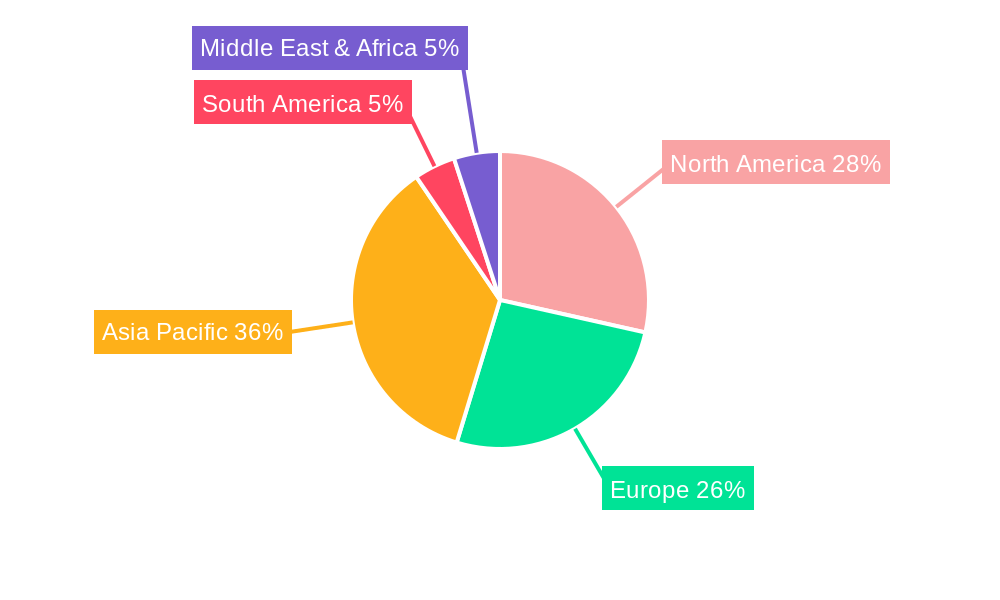

Key Regions and Countries: While North America and Europe are historically strong markets for consumer healthcare drugs due to high disposable incomes and established healthcare awareness, the Asia-Pacific region, particularly countries like China, is emerging as a significant growth engine. The vast population, increasing urbanization, rising disposable incomes, and a growing middle class with a greater propensity for self-care are driving substantial demand. China, with its large and rapidly developing pharmaceutical industry and a growing emphasis on domestic drug production, is projected to be a key player. The combination of Solid Preparations and the Retail Pharmacy channel in these rapidly growing markets, along with established markets, will continue to define the dominant landscape of the consumer healthcare drug sector.

Several factors are acting as potent growth catalysts for the consumer healthcare drug industry. The increasing health consciousness and a greater emphasis on preventive healthcare are encouraging individuals to proactively manage their well-being, leading to higher demand for OTC solutions. The burgeoning middle class, especially in emerging economies, is unlocking significant market potential due to increased disposable income and a greater willingness to spend on health-related products. Furthermore, advancements in pharmaceutical research and development, leading to novel formulations, improved drug delivery systems, and the reclassification of certain prescription drugs to OTC status, are continuously expanding the product portfolio and consumer options.

This report provides a holistic view of the consumer healthcare drug market, encompassing detailed analyses of market size, segmentation, competitive landscapes, and future projections. It delves into the intricate dynamics of key segments such as Solid Preparations, which are anticipated to maintain their stronghold due to convenience and established efficacy, and the Retail Pharmacy channel, recognized for its extensive reach and accessibility. The report also scrutinizes critical industry developments, including technological advancements in drug delivery and evolving regulatory frameworks. By offering a comprehensive understanding of the market's trajectory from 2019-2033, this analysis equips stakeholders with the necessary insights to navigate the complexities and capitalize on the opportunities within this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.3%.

Key companies in the market include Johnson & Johnson, AbbVie, Merck & Co., GlaxoSmithKline, Pfizer, Sanofi, Takeda, Bayer, Teva, Sinopharm Group, CR Pharmaceutical, Shanghai Pharmaceuticals, Hualan Bio, North China Pharmaceutical, Hengrui Medicine, Fosun Pharma, East China Medicine, Livzon Group, .

The market segments include Type, Application.

The market size is estimated to be USD 128780 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Consumer Healthcare Drug," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Consumer Healthcare Drug, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.