1. What is the projected Compound Annual Growth Rate (CAGR) of the Compostable Tableware?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Compostable Tableware

Compostable TablewareCompostable Tableware by Type (Paper Pulp Material, Wood Material, Eco-Friendly Plastic Material, Others), by Application (Household, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

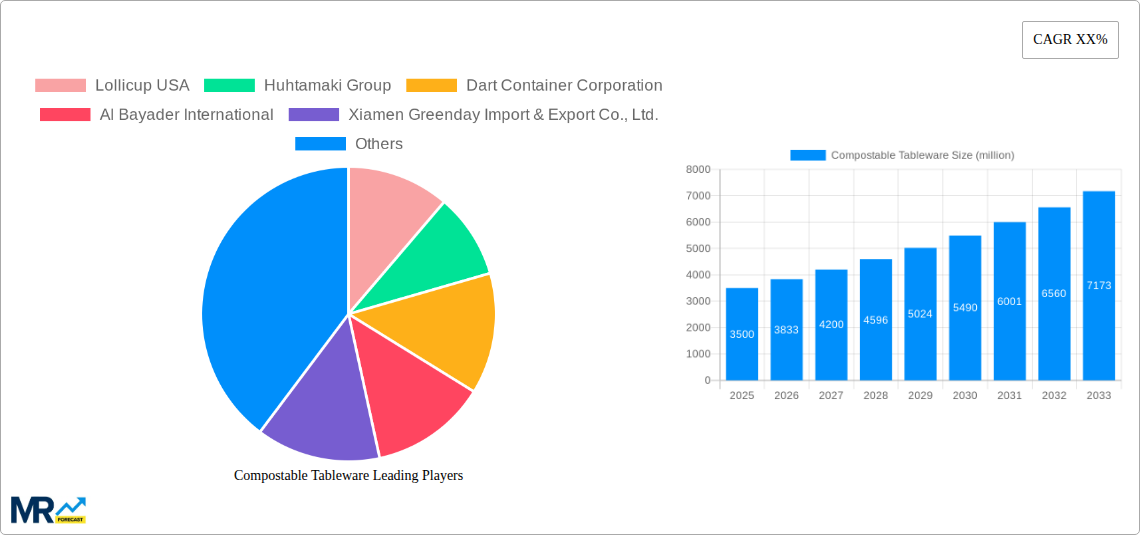

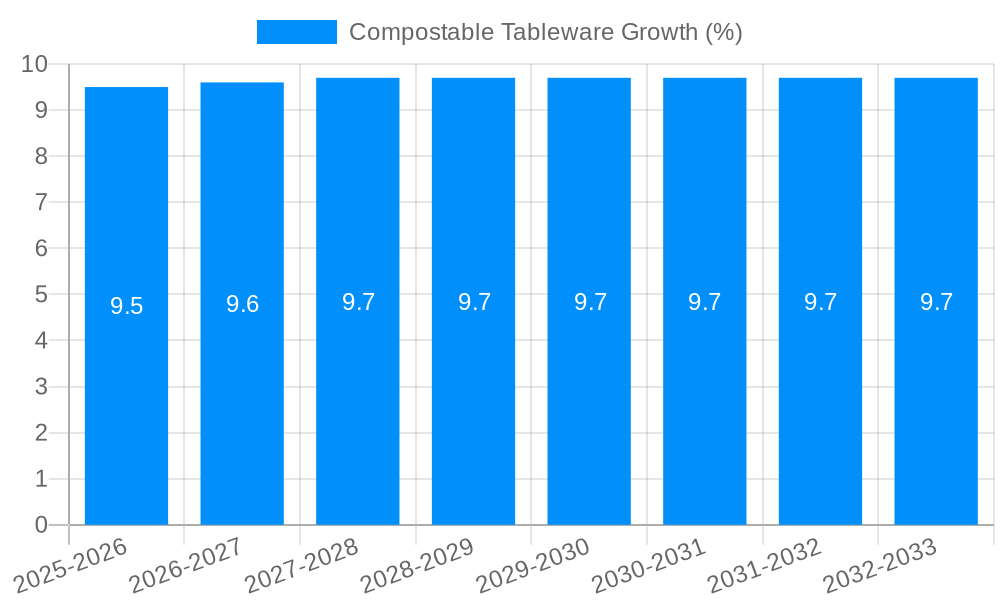

The global compostable tableware market is experiencing robust growth, projected to reach an estimated USD 3500 million by 2025, with a compound annual growth rate (CAGR) of 9.5% anticipated through 2033. This upward trajectory is primarily fueled by a growing consumer preference for sustainable and eco-friendly alternatives to conventional plastic and styrofoam dinnerware. Increasing environmental awareness, coupled with stringent government regulations aimed at curbing plastic waste, is compelling both households and commercial establishments to adopt biodegradable and compostable solutions. The shift towards responsible consumption and production is a significant driver, pushing the demand for products made from materials like paper pulp, wood, and innovative eco-friendly plastics. This transition is not merely a trend but a fundamental change in consumer and industry behavior, positioning compostable tableware as a vital component of a circular economy.

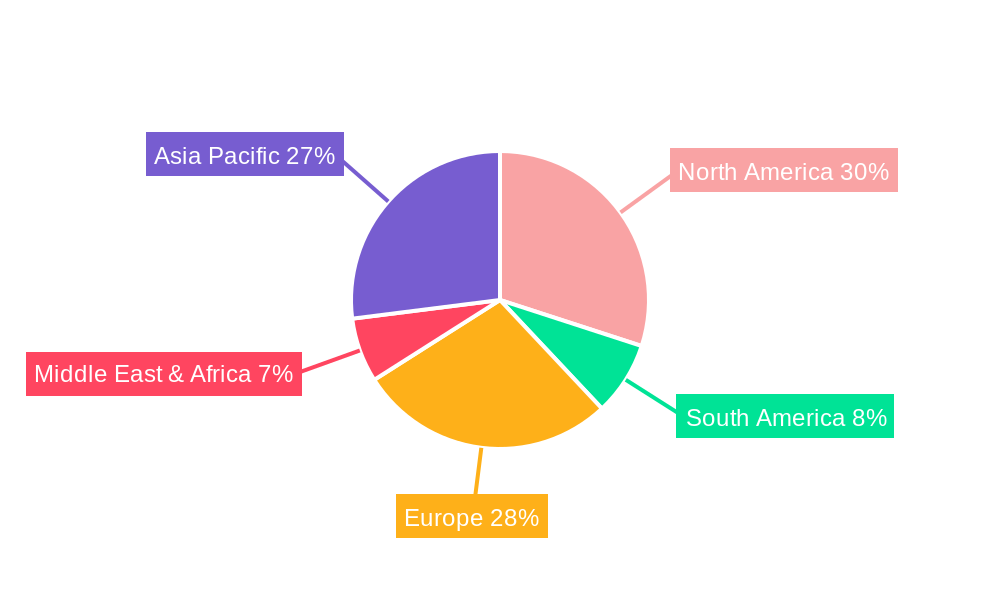

The market is segmented into various types, with paper pulp and wood materials currently dominating due to their widespread availability and established manufacturing processes. However, eco-friendly plastic materials are rapidly gaining traction, offering enhanced durability and functionality. Applications span both household and commercial sectors, with food service businesses, catering companies, and event organizers leading the adoption for their sustainability commitments and to appeal to eco-conscious clientele. Key players like Lollicup USA, Huhtamaki Group, and Dart Container Corporation are actively investing in R&D and expanding their product portfolios to cater to this burgeoning demand. Regions like North America and Europe are at the forefront of this market expansion, driven by progressive environmental policies and a high level of consumer engagement with sustainable practices, while the Asia Pacific region is poised for significant growth due to its large population and increasing focus on waste management.

Here's a unique report description for "Compostable Tableware Market" incorporating your specified elements:

This comprehensive report offers an in-depth analysis of the global compostable tableware market, meticulously forecasting its trajectory from the historical period of 2019-2024 through to the estimated year of 2025 and projecting its growth through the forecast period of 2025-2033, with a base year of 2025. The study delves into the intricate dynamics shaping this burgeoning sector, from evolving consumer preferences and stringent environmental regulations to technological innovations and emerging market opportunities. With an estimated market size projected to reach XXX million units by the end of the forecast period, this report provides critical insights for stakeholders seeking to capitalize on the accelerating demand for eco-conscious disposable food service ware.

The compostable tableware market is experiencing a significant paradigm shift, driven by an increasing global awareness of environmental sustainability and a growing aversion to single-use plastics. Throughout the historical period (2019-2024), a discernible trend has been the rapid adoption of compostable alternatives across various food service channels, from bustling cafes and restaurants to large-scale industrial catering operations. This adoption is fueled by a combination of proactive consumer choices and evolving legislative landscapes, particularly in developed economies, where bans and restrictions on traditional plastic disposables are becoming more commonplace. The demand for aesthetically pleasing yet environmentally responsible products is on the rise, pushing manufacturers to innovate in terms of material design, durability, and functionality. Furthermore, the perceived health benefits of natural materials are also contributing to consumer preference for compostable options. The market is witnessing a diversification of product offerings, extending beyond basic plates and cutlery to include a wider array of containers, cups, and even specialized items for different culinary applications. This evolution reflects a maturing market that is moving beyond basic compliance to offer sophisticated and practical solutions. As we move into the estimated year of 2025 and beyond, the integration of circular economy principles will become increasingly central, with a focus on the entire lifecycle of compostable tableware, from sourcing and manufacturing to end-of-life disposal and composting infrastructure development. The growth in e-commerce and food delivery services has also presented a unique opportunity for compostable tableware, as consumers increasingly expect sustainable packaging for their delivered meals. This trend is expected to accelerate, further solidifying the market's growth trajectory and creating new avenues for product innovation and market penetration. The push towards bio-based and renewable resources as raw materials for tableware production is another prominent trend, indicating a long-term commitment to reducing reliance on fossil fuels and minimizing the environmental footprint of the industry.

The accelerated growth of the compostable tableware market is underpinned by a confluence of potent driving forces. Foremost among these is the escalating global concern over plastic pollution and its detrimental impact on ecosystems and human health. Governments worldwide are responding with increasingly stringent regulations, including outright bans on certain single-use plastic items and mandates for the adoption of sustainable alternatives. This regulatory push creates a compelling business case for manufacturers and consumers alike to transition to compostable tableware. Simultaneously, a significant shift in consumer consciousness is underway. Consumers, particularly younger demographics, are actively seeking out brands and products that align with their environmental values. This demand translates into a preference for compostable tableware, influencing purchasing decisions in both household and commercial settings. The convenience and perceived eco-friendliness of compostable options make them an attractive choice for events, picnics, and everyday use. Moreover, technological advancements in material science have enabled the development of compostable tableware that rivals traditional plastic in terms of durability, heat resistance, and functionality. Innovations in paper pulp molding, bioplastics derived from corn starch or sugarcane, and even wood-based materials are expanding the range and improving the performance of available products. This continuous innovation ensures that compostable tableware can meet the diverse needs of the food service industry. The expansion of composting infrastructure, albeit still a developing area in many regions, is also a crucial enabler, providing a viable end-of-life solution for these products and closing the loop on their sustainable lifecycle.

Despite its robust growth trajectory, the compostable tableware market faces several significant challenges and restraints that could temper its expansion. A primary hurdle is the often higher cost of production for compostable materials compared to conventional plastics. This cost differential can make compostable options less attractive to price-sensitive businesses, particularly small and medium-sized enterprises. Furthermore, consumer education and awareness remain critical. A significant portion of the population is still unclear about the proper disposal methods for compostable items, leading to confusion and potential contamination of recycling streams. Without adequate composting infrastructure readily available, many compostable items end up in landfills, where they may not decompose as intended, negating their environmental benefits. This lack of widespread industrial composting facilities poses a significant barrier to the widespread adoption and true environmental efficacy of compostable tableware. The performance limitations of certain compostable materials, particularly in terms of heat resistance and liquid retention, can also be a concern for some food service applications, necessitating careful selection and product development. Additionally, supply chain complexities and the availability of raw materials can fluctuate, impacting production volumes and pricing. The "greenwashing" phenomenon, where products are marketed as environmentally friendly without sufficient substantiation, can also erode consumer trust and create skepticism towards genuinely compostable products. Finally, the initial investment required for manufacturers to retool production lines for compostable materials can be substantial, slowing down the pace of market entry for new players.

The compostable tableware market is poised for significant growth, with several regions and segments set to lead the charge. North America, particularly the United States and Canada, is emerging as a dominant force, driven by a combination of progressive environmental legislation, strong consumer demand for sustainable products, and a well-established food service industry. The increasing number of states and municipalities implementing single-use plastic bans or restrictions has created a substantial market opportunity for compostable alternatives. Furthermore, major food service corporations in the region are increasingly adopting sustainable packaging initiatives to meet consumer expectations and corporate social responsibility goals.

Within this dominant region, the Commercial application segment is expected to exhibit the most substantial growth. This encompasses a wide range of businesses, including restaurants, cafes, fast-food chains, catering services, and event venues. The sheer volume of disposable tableware consumed in the commercial sector, coupled with the growing pressure to adopt eco-friendly practices, makes it a prime area for compostable tableware penetration. Businesses are recognizing that offering compostable options can enhance their brand image and attract environmentally conscious customers. The industrial sector, including large-scale food processing and packaging operations, also presents a considerable market, driven by regulatory compliance and efficiency demands.

Analyzing the Type of compostable tableware, Paper Pulp Material is anticipated to be a significant market leader. This is due to its widespread availability, relatively lower cost compared to some bioplastics, and established recycling and composting pathways in many areas. The versatility of paper pulp allows for the creation of a diverse range of products, from sturdy plates and bowls to intricate containers. Its inherent biodegradability and compostability make it a preferred choice for many environmentally aware consumers and businesses. Innovations in coatings and treatments for paper pulp are further enhancing its durability and functionality, making it suitable for a wider array of food service applications. While Eco-Friendly Plastic Material (such as PLA derived from corn starch) is also a strong contender, challenges related to specialized composting requirements and end-of-life disposal infrastructure can sometimes limit its widespread adoption compared to paper pulp in certain regions. The Wood Material segment, while offering a premium feel and good performance, often comes at a higher price point, positioning it more towards niche or premium applications. Therefore, the combination of strong demand from the commercial sector in North America, fueled by regulatory support and consumer preference, and the dominance of paper pulp as a primary material type, paints a clear picture of the market's leading dynamics. The market is projected to witness the consumption of XXX million units within these leading segments by the end of the forecast period.

Several key factors are acting as significant growth catalysts for the compostable tableware industry. The increasing stringency of environmental regulations and bans on traditional plastics globally is a primary driver, forcing businesses to seek viable alternatives. Furthermore, a rising tide of consumer awareness and a growing preference for sustainable products are creating substantial market pull. Innovations in material science are leading to the development of more durable, functional, and cost-effective compostable tableware, expanding its applicability. The growing emphasis on corporate social responsibility by businesses, coupled with the expanding food delivery and takeout market, also presents significant opportunities for compostable packaging solutions.

This report offers an all-encompassing exploration of the compostable tableware market, providing a detailed quantitative and qualitative analysis from the historical period of 2019-2024 through to the forecast period of 2025-2033, with 2025 serving as both the base and estimated year. It dissects the market into key segments based on material type (Paper Pulp Material, Wood Material, Eco-Friendly Plastic Material, Others) and application (Household, Commercial, Industry). The report meticulously examines the driving forces, challenges, key regional market dynamics, and critical growth catalysts that are shaping the industry's landscape. With a deep dive into the strategic initiatives and developments of leading players such as Lollicup USA, Huhtamaki Group, and Dart Container Corporation, and an estimated market size projected to reach XXX million units by 2033, this research is an indispensable resource for manufacturers, suppliers, investors, and policymakers seeking to navigate and capitalize on the transformative potential of the global compostable tableware market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Lollicup USA, Huhtamaki Group, Dart Container Corporation, Al Bayader International, Xiamen Greenday Import & Export Co., Ltd., Reynolds Consumer Products, Yash Pakka Limited, Cosmos Eco Friends, CHUK (Yash Papers Limited), DOpla SpA, Natural Tableware, Pactiv LLC, PAPSTAR GmbH, Eco-Products, Inc, Al Bayader International, Xiamen Greenday Import & Export Co., Ltd., Pappco Greenware, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Compostable Tableware," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Compostable Tableware, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.