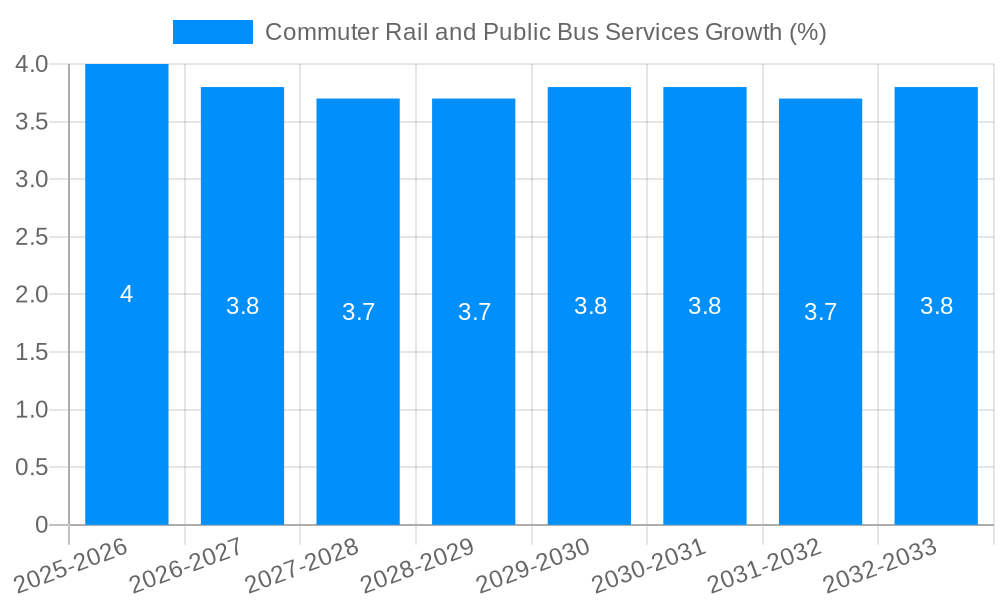

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commuter Rail and Public Bus Services?

The projected CAGR is approximately 4.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commuter Rail and Public Bus Services

Commuter Rail and Public Bus ServicesCommuter Rail and Public Bus Services by Type (Commuter Rail Services (Metro and MMTS), Public Bus Services, Adults, Children), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

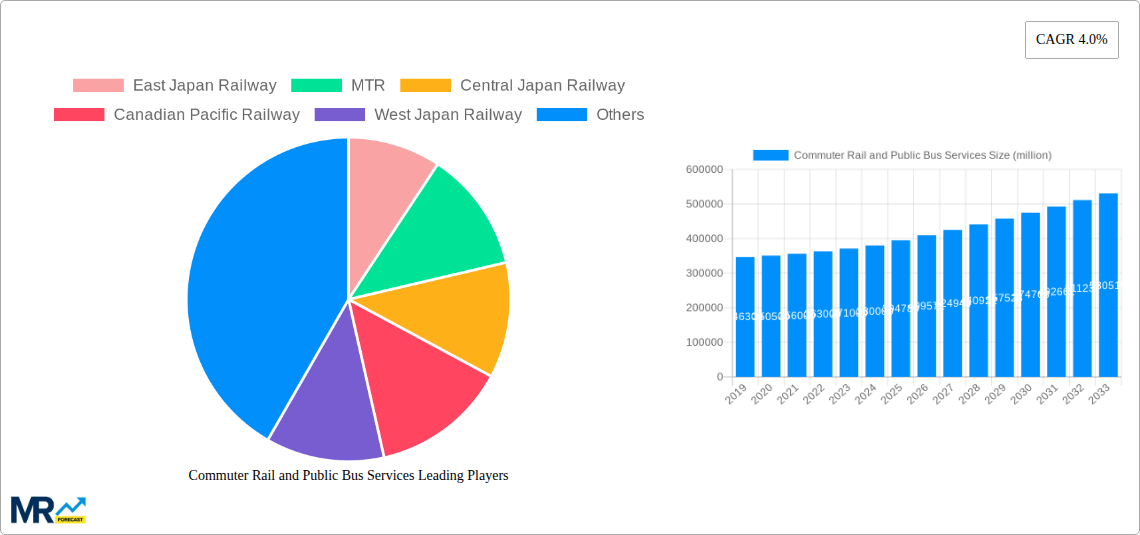

The global commuter rail and public bus services market is poised for significant expansion, projected to reach a valuation of approximately $394.78 billion by 2025. This robust growth is underpinned by a compound annual growth rate (CAGR) of 4.0% expected to persist through 2033. The primary drivers fueling this upward trajectory are the increasing urbanization worldwide, leading to a surge in demand for efficient and sustainable transportation solutions. Governments are actively investing in public transport infrastructure to alleviate traffic congestion, reduce carbon emissions, and enhance urban mobility. Furthermore, a growing environmental consciousness among consumers, coupled with rising fuel costs, is steering individuals towards public transit options. The market is segmented into Commuter Rail Services (including Metro and MMTS) and Public Bus Services, both witnessing steady adoption. Key players like East Japan Railway, MTR, Central Japan Railway, Canadian Pacific Railway, and West Japan Railway are at the forefront, innovating and expanding their networks to cater to the evolving needs of commuters.

The forecast period from 2025 to 2033 anticipates continued momentum, driven by technological advancements and policy support. Smart city initiatives, the integration of real-time tracking and mobile ticketing, and the development of more comfortable and accessible public transport options are expected to further boost ridership. While the market demonstrates strong growth potential, certain restraints may influence its pace. These include the substantial capital investment required for infrastructure development and modernization, potential regulatory hurdles, and the challenge of competing with the convenience offered by private vehicles in some regions. However, the persistent need for cost-effective and eco-friendly transportation solutions, especially in densely populated urban centers, suggests that these challenges will likely be overcome. The Asia Pacific region, with its rapidly developing economies and massive urban populations, is expected to be a major contributor to market growth, closely followed by North America and Europe, which are continuously upgrading their public transit systems.

This report provides an in-depth examination of the global commuter rail and public bus services market, analyzing trends, drivers, challenges, and growth opportunities from the historical period of 2019-2024 through to the forecast period of 2025-2033, with a base year of 2025. We delve into the intricate dynamics shaping this vital sector, utilizing millions as our unit of measurement for passenger volumes, revenue, and investments. The study encompasses key segments including Commuter Rail Services (Metro and MMTS), Public Bus Services, and demographic groups such as Adults and Children, alongside crucial Industry Developments. Through meticulous research and robust data analysis, this report aims to equip stakeholders with the actionable insights needed to navigate and capitalize on the evolving mobility landscape.

The global commuter rail and public bus services market is experiencing a dynamic shift, driven by an increasing urbanization rate and a growing awareness of sustainable transportation alternatives. From 2019 to 2024, passenger volumes in major metropolitan areas have shown a steady upward trajectory, with commuter rail systems in densely populated regions like East Asia and Europe handling over 500 million passenger journeys annually. The Metro segment, a cornerstone of urban mobility, continues to be the most dominant form of commuter rail, accounting for an estimated 70% of all commuter rail trips. MMTS (Metropolitan Mass Transit System) services, while perhaps less ubiquitous than metros, are gaining traction in developing urban centers, demonstrating a growth rate of approximately 7% year-on-year. Public bus services, often serving as crucial feeder networks and providing last-mile connectivity, have also witnessed consistent demand, with global passenger numbers hovering around 1,200 million annually during the historical period. The adult demographic constitutes the largest user base, representing an estimated 80% of all commuter rail and public bus users, a figure projected to remain stable through 2033. Children, while a smaller but significant segment, are increasingly benefiting from integrated ticketing and affordable fare structures, contributing to a growth of around 3% in their ridership. The industry has observed a significant surge in technological integration, with smart ticketing solutions and real-time information systems becoming standard offerings, enhancing passenger experience and operational efficiency. Furthermore, a growing emphasis on electric and low-emission vehicle adoption within public bus fleets is reshaping the market, signaling a commitment to environmental sustainability. The study period ending in 2033 anticipates further consolidation of these trends, with a projected increase in overall ridership by an average of 5% per annum, particularly in emerging economies seeking to alleviate traffic congestion and improve air quality. The market's resilience, even through periods of global disruption, underscores its fundamental importance to the functioning of modern cities.

The surge in demand for commuter rail and public bus services is fueled by a confluence of powerful factors. Foremost among these is the unrelenting trend of global urbanization. As more people flock to cities in search of economic opportunities and better living standards, the strain on existing transportation infrastructure intensifies. This necessitates robust and efficient public transit systems to ferry millions of commuters daily. The average daily passenger volume for commuter rail services in large metropolises is estimated to reach over 300 million in 2025, a figure expected to climb steadily. Concurrently, a growing global consciousness regarding environmental sustainability and the imperative to reduce carbon footprints is a significant propellant. The decreasing reliance on private vehicles, coupled with government initiatives promoting public transport, is directly translating into increased ridership. For instance, investments in electric bus fleets alone are projected to exceed 10 billion USD by 2030, indicating a clear industry direction. Furthermore, rising fuel costs and the economic advantages of using public transport for daily commutes, especially for the adult demographic, make it a more attractive and cost-effective option. The cost savings can be substantial, with some estimates suggesting individual savings of up to 1,500 USD per year by opting for public transport over private car ownership in major cities. The development of integrated ticketing systems and the enhancement of passenger experience through real-time information, Wi-Fi availability, and improved comfort are also playing a crucial role in attracting and retaining users, particularly for the younger demographic. These combined forces are creating a fertile ground for the continued growth and evolution of the commuter rail and public bus services sector, making it an indispensable component of modern urban life.

Despite the robust growth, the commuter rail and public bus services sector faces a distinct set of challenges that can impede its progress. One of the most significant is the substantial capital investment required for infrastructure development and fleet upgrades. Building new metro lines or modernizing existing rail networks can easily run into billions of dollars, often requiring long-term public funding commitments that can be politically volatile. For example, the expansion of a single metro line in a major city can exceed 5 billion USD. Similarly, transitioning to electric bus fleets necessitates significant upfront investment in charging infrastructure and vehicle procurement, potentially costing upwards of 500 million USD for a medium-sized city's bus fleet. Operational costs, including labor, maintenance, and energy, also pose a continuous challenge. Maintaining a balance between affordable fares for passengers and profitability for service providers is a delicate act. Overcrowding during peak hours remains a persistent issue in many urban areas, leading to a decline in passenger comfort and potentially deterring new users, even with high demand. For instance, some metro lines experience peak hour loads exceeding 20,000 passengers per hour. Furthermore, the inherent inflexibility of fixed rail routes can be a limitation in rapidly expanding urban areas or in serving less dense suburban regions, where the demand might not justify the high infrastructure costs. Disruptions caused by maintenance, unforeseen technical issues, or extreme weather events can have a cascading effect on the entire network, leading to significant delays and passenger dissatisfaction. The competition from ride-sharing services, though a different segment, also presents a subtle challenge, particularly for non-peak hour travel or in areas not well-served by public transport. Regulatory hurdles and complex approval processes for new projects can also prolong development timelines and increase costs. These factors collectively create a complex operating environment that demands strategic planning and robust financial management.

The Commuter Rail Services (Metro and MMTS) segment, particularly within the East Asia region, is poised to dominate the global commuter rail and public bus services market in the coming years. East Asia, led by countries such as China, Japan, and South Korea, has consistently demonstrated a commitment to investing heavily in its public transportation infrastructure. This region accounts for a significant portion of global metro ridership, with projections indicating passenger volumes exceeding 300 million daily in its major urban centers by 2025. The sheer scale of urbanization and population density in cities like Shanghai, Tokyo, and Seoul necessitates and supports extensive and efficient metro networks.

The Metro sub-segment within Commuter Rail Services is the primary driver of this dominance. Metros are the backbone of daily commutes in megacities, handling the vast majority of passengers. For example, the Beijing Subway alone transports over 10 million passengers daily. MMTS (Metropolitan Mass Transit System) services are also crucial, especially in developing urban areas within the region, acting as essential links to the broader transit network.

Beyond East Asia, Europe also presents a significant market, with established and well-maintained commuter rail networks serving densely populated areas. Countries like Germany, the United Kingdom, and France have robust systems that are continuously being upgraded to meet evolving passenger demands. However, the sheer scale of investment and expansion in East Asia, particularly China, places it in a leading position.

While Public Bus Services remain vital and are experiencing growth, their dominance is primarily in providing supplementary and last-mile connectivity. They are crucial for reaching areas not served by rail and for providing flexible routes, especially in less dense urban or suburban environments. The growth in electric buses is a key trend, with significant investments being made globally. However, in terms of sheer passenger volume and the ability to move massive numbers of people across long distances within urban cores, the metro segment continues to be the undisputed leader.

The Adult demographic, as previously mentioned, will continue to be the largest user base across all segments, representing approximately 80% of all passengers. Their reliance on public transport for work and daily activities ensures consistent demand. However, the growth in the Children segment, driven by integrated family fare policies and improved safety features, is also noteworthy and contributes to the overall ridership figures. The forecast period indicates that the synergy between robust commuter rail infrastructure, particularly metros, and the sustained demand from the adult population in rapidly developing East Asian megacities will cement this region and segment's dominance in the global market.

Several key factors are acting as significant growth catalysts for the commuter rail and public bus services industry. The persistent global trend of urbanization, with people increasingly migrating to cities, directly fuels the demand for efficient and high-capacity public transportation. Governments worldwide are recognizing public transport as a critical solution for traffic congestion and air pollution, leading to increased investment in infrastructure development and fleet modernization. Furthermore, the growing environmental consciousness and the push towards sustainability are driving the adoption of electric and low-emission vehicles, making public transport a more attractive and eco-friendly option. Technological advancements, such as the implementation of smart ticketing, real-time passenger information systems, and integrated mobility platforms, are enhancing the overall passenger experience and operational efficiency.

This report offers unparalleled depth and breadth in its analysis of the commuter rail and public bus services market. It provides a granular view of market dynamics, dissecting trends, drivers, and challenges across various segments and regions. With a focus on key players and their strategic initiatives, the report aims to illuminate the competitive landscape and potential partnership opportunities. The inclusion of future projections, based on a comprehensive study period from 2019 to 2033, equips stakeholders with foresight into market evolution. Detailed segmentation by service type, passenger demographic, and geographic location ensures that the report caters to the specific needs of diverse stakeholders, from transit authorities and private operators to investors and policymakers. The report's commitment to presenting data in the millions unit offers a clear and impactful understanding of the market's scale and financial implications.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.0%.

Key companies in the market include East Japan Railway, MTR, Central Japan Railway, Canadian Pacific Railway, West Japan Railway, .

The market segments include Type.

The market size is estimated to be USD 394780 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Commuter Rail and Public Bus Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commuter Rail and Public Bus Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.