1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Vehicle Battery Swap Stations?

The projected CAGR is approximately 25%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Vehicle Battery Swap Stations

Commercial Vehicle Battery Swap StationsCommercial Vehicle Battery Swap Stations by Type (/> Subscription Model, Pay-Per-Use Model), by Application (/> Three-Wheeler Light Commercial Vehicle, Four-Wheeler Light Commercial Vehicle, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

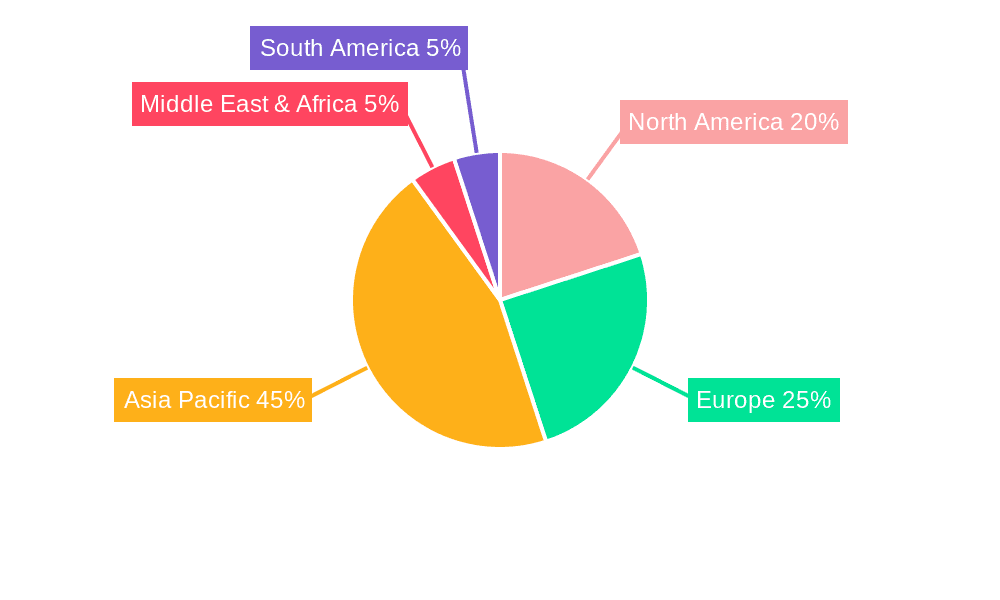

The commercial vehicle battery swap station market is poised for substantial expansion, driven by the escalating adoption of electric commercial vehicles (EVs) and the limitations of conventional charging. Key growth drivers include the imperative for efficient, rapid charging solutions for commercial fleets, supportive government incentives for EV uptake, and technological innovations enhancing battery swapping efficiency and cost-effectiveness. Analysis indicates a preference for subscription-based models over pay-per-use, especially in the light commercial vehicle segment, underscoring fleet operators' focus on predictable operational expenditures. Asia Pacific, notably China and India, leads market growth, attributed to their expansive commercial vehicle sectors and aggressive EV targets. North America and Europe represent significant markets, though growth may be tempered by higher infrastructure development costs and regulatory timelines. Market expansion is currently constrained by substantial initial investment for station deployment, challenges in standardizing battery types and vehicle compatibility, and a limited range of compatible vehicles. Addressing these hurdles will be pivotal to realizing the market's full potential.

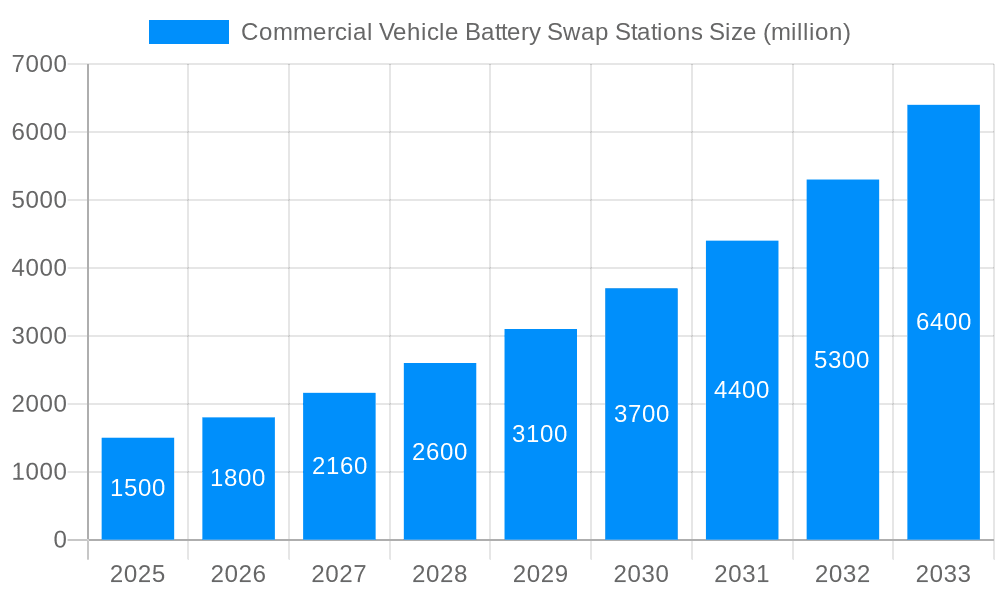

Despite these obstacles, the market is projected to achieve considerable growth between 2025 and 2033. The projected CAGR of 25% and a market size of $1.42 billion by 2025 present a compelling investment landscape. Continuous technological advancements in battery technology (improved lifespan, reduced swapping times), favorable government policies encouraging infrastructure development, and increasing fleet operator awareness of battery swapping benefits are expected to significantly accelerate market growth. Strategic collaborations among battery manufacturers, infrastructure providers, and commercial vehicle OEMs will be instrumental in market consolidation and widespread adoption. The competitive environment, characterized by both established leaders and innovative new entrants, signals a dynamic and rapidly maturing market, expected to foster innovation and cost reductions, thereby driving broader market penetration.

The global commercial vehicle battery swap stations market is experiencing robust growth, projected to reach multi-million unit installations by 2033. Driven by the increasing adoption of electric commercial vehicles (ECVs) and the inherent limitations of traditional charging infrastructure, battery swapping offers a compelling alternative for faster turnaround times and increased operational efficiency. The market's expansion is fueled by several key factors, including supportive government policies promoting electric mobility, technological advancements in battery technology leading to improved energy density and lifespan, and the growing awareness of environmental concerns associated with conventional fuel vehicles. The study period, spanning from 2019 to 2033, reveals a significant shift in market dynamics, with the historical period (2019-2024) showcasing initial market penetration and the forecast period (2025-2033) anticipating exponential growth. The estimated market size in 2025 signals a crucial inflection point, marking a transition from nascent adoption to widespread implementation. Different business models, such as subscription and pay-per-use, cater to diverse fleet operator needs, further enhancing market accessibility. The increasing range of ECVs compatible with swap stations, encompassing three-wheelers, four-wheelers, and other specialized vehicles, broadens the market's appeal across various sectors. Competition among key players is intensifying, pushing innovation in battery technology, station design, and overall operational efficiency. The market is expected to witness significant regional variations, with certain regions leading the charge in terms of adoption and infrastructure development. This report provides a detailed analysis of these trends, offering valuable insights for stakeholders involved in the market.

Several factors are significantly accelerating the adoption of commercial vehicle battery swap stations. Firstly, the rapid increase in the number of electric commercial vehicles (ECVs) on the roads is creating a substantial demand for efficient charging solutions. Traditional charging methods are often too time-consuming for commercial operations, leading to significant downtime and reduced productivity. Battery swapping overcomes this limitation by enabling quick battery replacements, minimizing operational disruptions. Secondly, government initiatives and policies promoting electric mobility, including substantial financial incentives and supportive regulations, are creating a favorable environment for the growth of battery swap station infrastructure. These policies aim to reduce carbon emissions and improve air quality, thereby making battery swapping a more attractive proposition. Thirdly, advancements in battery technology have resulted in increased energy density, extended lifespan, and improved safety features, addressing concerns about the durability and reliability of swappable batteries. Finally, the cost-effectiveness of battery swapping, particularly for large fleets, compared to the upfront investment and ongoing operational costs associated with individual vehicle charging, is a powerful driver of market expansion. The overall reduction in total cost of ownership (TCO) for ECV operations using battery swapping makes it a compelling option for businesses seeking to optimize their fleet management.

Despite the promising growth prospects, several challenges hinder the widespread adoption of commercial vehicle battery swap stations. Standardization of battery formats and interfaces remains a significant obstacle, limiting interoperability between different vehicle models and battery providers. This lack of standardization necessitates the development of numerous proprietary systems, increasing costs and potentially hindering the efficient scaling of the infrastructure. The high initial capital expenditure required to establish and operate swap stations presents another major barrier, particularly for smaller businesses and in regions with limited access to investment capital. Moreover, safety concerns related to handling high-voltage batteries and ensuring the proper functioning of swap systems need careful attention and the development of robust safety protocols. The reliable disposal and recycling of used batteries is also crucial for environmental sustainability and requires well-defined processes and infrastructure. Finally, the limited geographical reach of existing swap station networks can restrict the adoption of the technology, particularly in remote areas or regions with less developed transportation infrastructure. Addressing these challenges is critical to unlock the full potential of the battery swap station market.

The Asia-Pacific region is poised to dominate the commercial vehicle battery swap stations market due to several factors. China, in particular, is leading the charge with substantial government support for electric mobility, a large and rapidly growing ECV market, and significant investments in battery technology and infrastructure. Other Asian countries are also showing promising growth potential, driven by similar policy initiatives and the increasing demand for efficient transportation solutions.

Dominant Segment: Three-Wheeler Light Commercial Vehicle Application

The segment of three-wheeler light commercial vehicles (LCVs) is expected to dominate the market in the forecast period. This is due to the high density of these vehicles, particularly in urban and densely populated areas of Asia, combined with their short operational ranges and suitability for quick battery swaps. Three-wheelers are frequently used for last-mile delivery and other short-distance transportation, making rapid battery exchanges highly valuable to improve operational efficiency. The smaller size and relatively lower battery capacity compared to larger commercial vehicles also contribute to the lower cost of entry for battery swap solutions in this segment. This segment's strong growth will significantly influence the overall trajectory of the battery swap stations market. The pay-per-use model is likely to be favored in this segment given its flexibility and cost-effectiveness for individual operators.

The commercial vehicle battery swap stations industry is experiencing significant growth driven by several key factors. The rising adoption of electric commercial vehicles necessitates efficient charging solutions, while battery swapping offers a faster and more convenient alternative to traditional charging. Government support through subsidies and favorable regulations is creating an enabling environment for the deployment of swap stations. Technological advancements in battery technology are addressing earlier concerns related to safety, lifespan, and energy density. Finally, the cost-effectiveness of battery swapping, particularly for large fleets, compared to traditional charging, is a compelling incentive for businesses to adopt this technology. These factors are collectively propelling the industry towards substantial growth in the coming years.

This report provides a comprehensive analysis of the commercial vehicle battery swap stations market, covering market trends, driving forces, challenges, key regional and segmental dynamics, growth catalysts, leading players, and significant developments. The report offers valuable insights for stakeholders seeking to understand and participate in this rapidly evolving market. It provides detailed forecasts for the period 2025-2033, offering a clear roadmap for future market developments. The research methodology employed ensures the accuracy and reliability of the data presented. The report serves as a crucial resource for strategic planning and investment decisions within the commercial vehicle battery swap stations sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 25%.

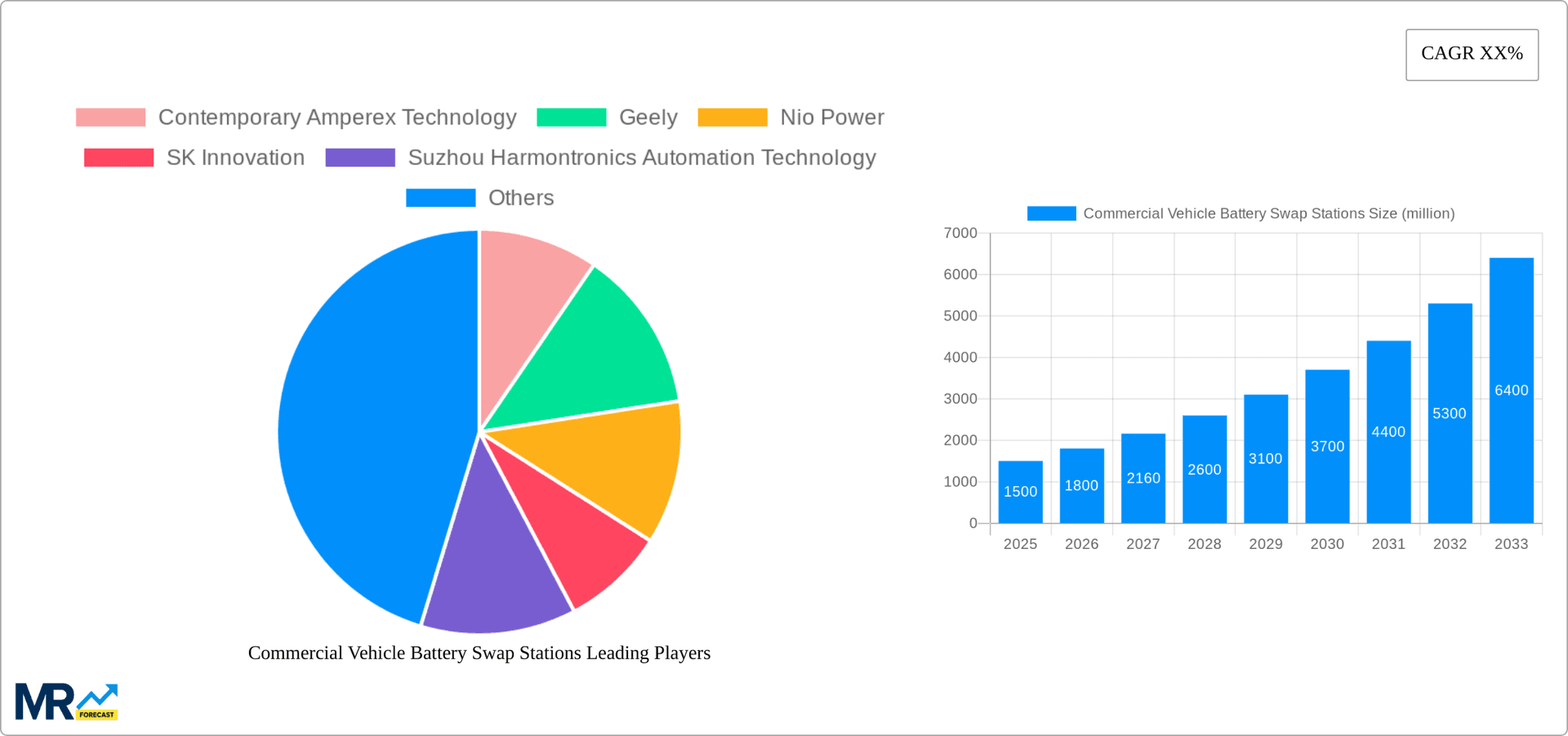

Key companies in the market include Contemporary Amperex Technology, Geely, Nio Power, SK Innovation, Suzhou Harmontronics Automation Technology, Aulton New Energy Automotive Technology, Gogoro, Lifan Technology, Esmito Solutions, GCL Energy Technology, BAIC BluePark New Energy Technology, Hangzhou Botan Technology Engineering, Shanghai Enneagon Energy Technology, Shandong Weida Machinery, Esmito Solutions, Amplify Cleantech Solutions, Chargeup, Lithion Power, Shenzhen Qingcheng, Ample.

The market segments include Type, Application.

The market size is estimated to be USD 1.42 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Commercial Vehicle Battery Swap Stations," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Vehicle Battery Swap Stations, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.