1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Helicopter?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Helicopter

Commercial HelicopterCommercial Helicopter by Application (Tourism Industry, Oil & Gas Transport, Others), by Type (Light Helicopter, Heavy Helicopter), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

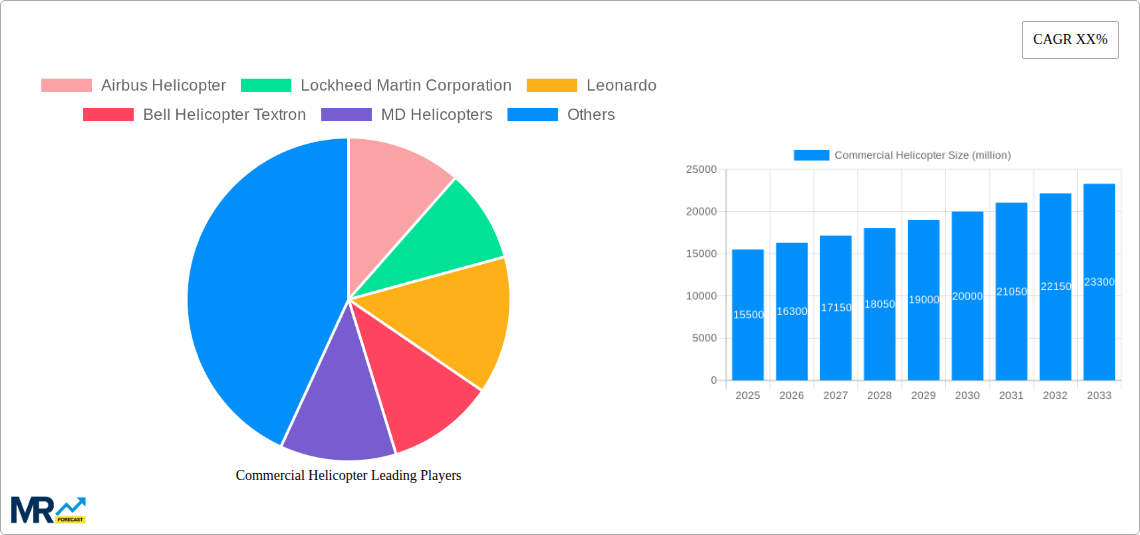

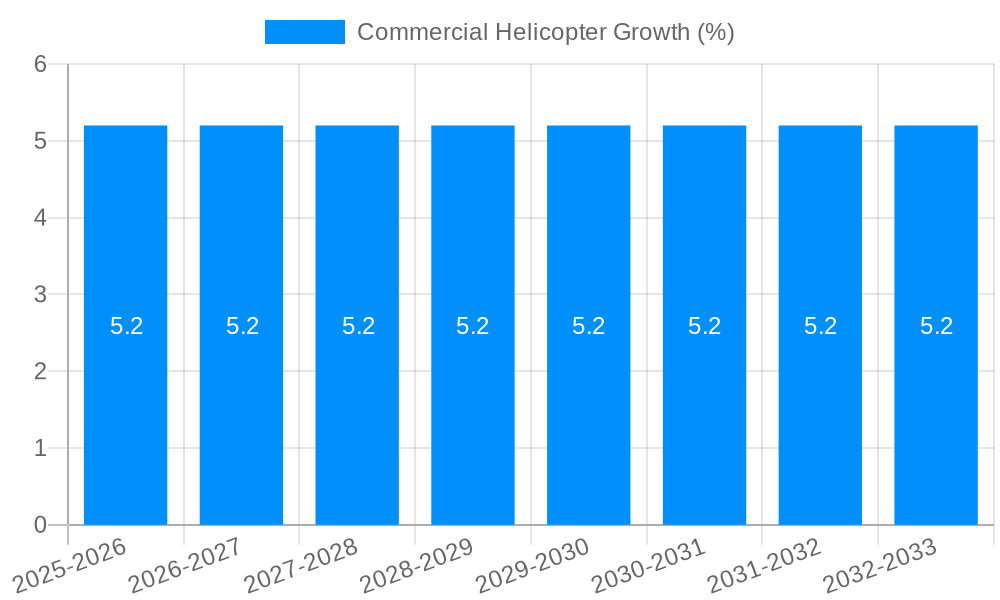

The global Commercial Helicopter market is poised for significant expansion, projected to reach an estimated USD 15.5 billion by 2025, driven by robust growth and an anticipated CAGR of approximately 5.2% through 2033. This upward trajectory is largely fueled by increasing demand from the tourism industry, where helicopters offer unique aerial sightseeing and transport solutions, and the critical role they play in the Oil & Gas sector for offshore transport and logistics. The burgeoning economies in Asia Pacific, particularly China and India, are emerging as key growth engines, alongside established markets in North America and Europe, which continue to invest in fleet modernization and expansion for various commercial applications. The market is segmented by application into the Tourism Industry, Oil & Gas Transport, and Others, with type categories including Light Helicopters and Heavy Helicopters. Each segment benefits from distinct market dynamics, with light helicopters finding broad use in corporate transport and emergency medical services, while heavy helicopters are crucial for complex industrial operations and cargo lifting.

The market's expansion is further supported by advancements in helicopter technology, including enhanced safety features, improved fuel efficiency, and the integration of digital systems for operational optimization. This technological evolution is not only enhancing performance but also broadening the applicability of commercial helicopters across diverse sectors. However, the market faces certain restraints, including high initial acquisition costs and stringent regulatory frameworks governing helicopter operations and maintenance. Despite these challenges, the overall outlook remains highly positive, with sustained investment from major players like Airbus Helicopters, Lockheed Martin Corporation, and Leonardo expected to innovate and expand their offerings. Emerging markets, coupled with the increasing adoption of helicopters for specialized commercial services, underscore a dynamic and growing future for the commercial helicopter industry.

This comprehensive report delves into the dynamic global Commercial Helicopter market, providing an in-depth analysis from the Historical Period of 2019-2024, through the Base Year and Estimated Year of 2025, and extending to the Forecast Period of 2025-2033. The study leverages extensive market research and data, presenting key insights into market trends, driving forces, challenges, and growth catalysts that will shape the industry's trajectory. The report quantifies market size and growth projections, with values presented in millions of units, offering a clear understanding of the commercial helicopter landscape.

XXX The global commercial helicopter market is poised for significant evolution, driven by a confluence of technological advancements, shifting industry demands, and emerging economic opportunities. The market is characterized by an increasing emphasis on advanced avionics, enhanced safety features, and greater fuel efficiency across all helicopter types, from agile Light Helicopters to robust Heavy Helicopters. The Tourism Industry, a consistent driver, is expected to witness sustained growth, particularly in scenic and remote destinations, necessitating a fleet capable of offering comfort, safety, and unparalleled aerial perspectives. The Oil & Gas Transport segment, while traditionally a strong pillar, is undergoing a transformation. While exploration and production activities in offshore and remote onshore locations continue to demand specialized helicopter capabilities, the sector is also exploring more sustainable and efficient transport solutions, potentially impacting the types and numbers of helicopters deployed. The "Others" segment, encompassing a wide array of applications such as emergency medical services (EMS), law enforcement, corporate transport, and utility operations, is exhibiting remarkable diversification and growth. The increasing reliance on helicopters for rapid response, critical medical evacuations, and efficient infrastructure management is creating new avenues for market expansion. Across these applications, the report highlights a growing preference for helicopters with greater payload capacity and longer range, a trend that will influence the demand for both Light and Heavy Helicopter configurations. Furthermore, the market is witnessing a gradual integration of semi-autonomous and potentially fully autonomous flight capabilities, albeit with stringent regulatory frameworks still under development, which promises to redefine operational efficiency and safety paradigms. The overarching trend indicates a maturing market, yet one brimming with innovation and strategic opportunities for stakeholders.

The commercial helicopter market's ascent is being fueled by several powerful drivers that are reshaping its landscape. A primary catalyst is the burgeoning global tourism industry, where the demand for unique aerial experiences, from city tours to remote adventure excursions, continues to soar. This translates into a consistent need for reliable and comfortable passenger transport helicopters. Simultaneously, the persistent global energy demand, particularly in offshore exploration and remote onshore operations, underpins the critical role of helicopters in the Oil & Gas Transport sector for crew changes, supply delivery, and emergency response. Beyond these established segments, the "Others" category presents a dynamic growth engine. The increasing need for swift emergency medical services, efficient law enforcement operations, expedited VIP transport, and essential utility work like power line inspection and agricultural spraying are all contributing to a broader market expansion. Technological advancements also play a pivotal role. Innovations in engine efficiency, composite materials, and advanced avionics are leading to helicopters that are more fuel-efficient, safer, quieter, and capable of performing a wider range of missions. This continuous improvement in helicopter technology makes them more attractive and viable for an expanding array of applications.

Despite the positive growth trajectory, the commercial helicopter market faces several significant challenges and restraints that could temper its expansion. The high initial purchase cost and ongoing operational expenses, including maintenance, fuel, and pilot salaries, remain a substantial barrier to entry, particularly for smaller operators or in emerging markets. Stringent and evolving regulatory frameworks, encompassing airworthiness standards, pilot licensing, and operational procedures, can also create complexities and increase compliance costs. The public perception of helicopter noise pollution and safety concerns, although diminishing with advancements in technology and operational practices, can still influence public acceptance and dictate operational limitations in urban and sensitive areas. Furthermore, the availability of skilled pilots and maintenance personnel is a growing concern, as the industry struggles to attract and retain talent to meet future demands. Geopolitical instability and economic downturns in key regions can also lead to unpredictable fluctuations in demand, particularly for sectors like oil and gas exploration which are sensitive to global commodity prices. The development and integration of new technologies, while a growth catalyst, can also present challenges in terms of initial investment, training requirements, and the need for robust infrastructure to support them.

Dominant Segments:

Regional Dominance:

The commercial helicopter market is projected to witness significant dominance from specific segments and regions due to a confluence of economic, demographic, and operational factors. The Tourism Industry application is expected to be a primary driver of growth, particularly in scenic and adventure tourism destinations. This segment thrives on the unique ability of helicopters to offer unparalleled aerial views, access remote locations, and provide swift and comfortable transport for high-value tourist experiences. Countries with well-developed tourism infrastructures and a high influx of international and domestic tourists are expected to lead this demand. This includes destinations known for their natural beauty, like the Grand Canyon in the US, the Swiss Alps in Europe, or the tropical islands in Asia Pacific. The convenience and exclusivity offered by helicopter tours are increasingly sought after by affluent travelers, making this a consistently expanding market.

In terms of helicopter Type, Light Helicopters are anticipated to dominate the market share. Their versatility, lower acquisition cost compared to heavy counterparts, and suitability for a wide range of applications, including tourism, personal transport, light cargo, and emergency services, make them highly attractive. Light helicopters are often the preferred choice for operators in the Tourism Industry due to their maneuverability in varied terrains and their ability to cater to smaller groups, optimizing operational efficiency and cost-effectiveness. Their adaptability also makes them crucial for urban air mobility concepts and other emerging applications that require agility and accessibility.

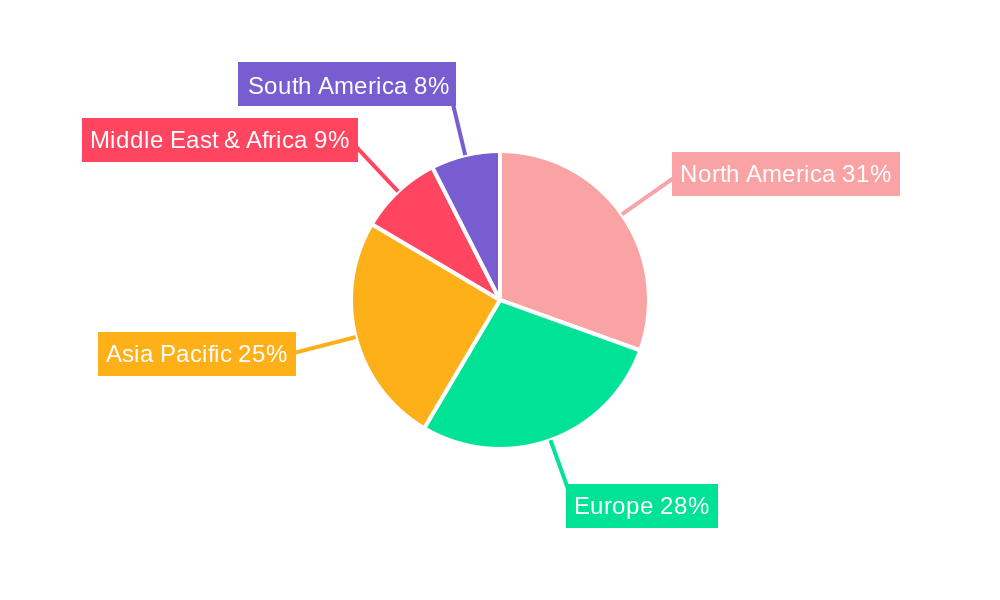

Geographically, North America is poised to remain a dominant region in the commercial helicopter market. This is attributed to its mature aviation industry, strong economic base, significant investments in defense and emergency services, and a robust tourism sector. The presence of leading helicopter manufacturers like Bell Helicopter Textron and MD Helicopters further solidifies its position. Europe also represents a substantial market, driven by its well-established tourism industry, increasing demand for air ambulance services, and a growing interest in corporate aviation. Stringent safety regulations and a focus on advanced technology adoption contribute to the high-value segment of the European market. The Asia Pacific region is emerging as a key growth frontier, propelled by rapid economic development, expanding tourism infrastructure, and increasing adoption of helicopters for various applications, including disaster relief and offshore oil and gas operations. Countries like China and India, with their vast populations and growing disposable incomes, represent significant long-term potential for commercial helicopter market expansion, especially in the Light Helicopter and Tourism segments.

The commercial helicopter industry's growth is being significantly spurred by advancements in technology, leading to more efficient, safer, and versatile aircraft. The expanding global tourism sector, with its increasing demand for aerial sightseeing and luxury transport, acts as a major catalyst. Furthermore, the critical need for rapid response in emergency medical services and disaster relief operations, particularly in remote or congested areas, consistently drives demand. The ongoing exploration and production activities in the Oil & Gas sector, especially in offshore environments, continue to necessitate helicopter transportation for crew and supplies. Finally, the development of urban air mobility concepts and the increasing use of helicopters in utility and infrastructure management are opening up new avenues for market expansion.

This report offers a holistic view of the commercial helicopter market, providing granular insights into market size, segmentation, and future projections. It analyzes the intricate interplay of driving forces, challenges, and growth catalysts, presenting a nuanced understanding of the industry's dynamics. The report details the competitive landscape, highlighting the strategies and market positions of leading players like Airbus Helicopter and Bell Helicopter Textron. Furthermore, it examines significant industry developments and technological advancements expected to shape the market. With a focus on quantitative data, including market values in the millions of units and detailed historical and forecast periods, this report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on the opportunities within the global commercial helicopter sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Airbus Helicopter, Lockheed Martin Corporation, Leonardo, Bell Helicopter Textron, MD Helicopters, Russian Helicopters, Robinson Helicopter Company, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Commercial Helicopter," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Helicopter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.