1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Aircraft Flight Recorders?

The projected CAGR is approximately 5.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Aircraft Flight Recorders

Commercial Aircraft Flight RecordersCommercial Aircraft Flight Recorders by Type (Flight Data Recorder(FDR), Cockpit Voice Recorder(CVR)), by Application (Narrow-body Aircraft, Wide-body Aircraft, Regional Aircraft), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

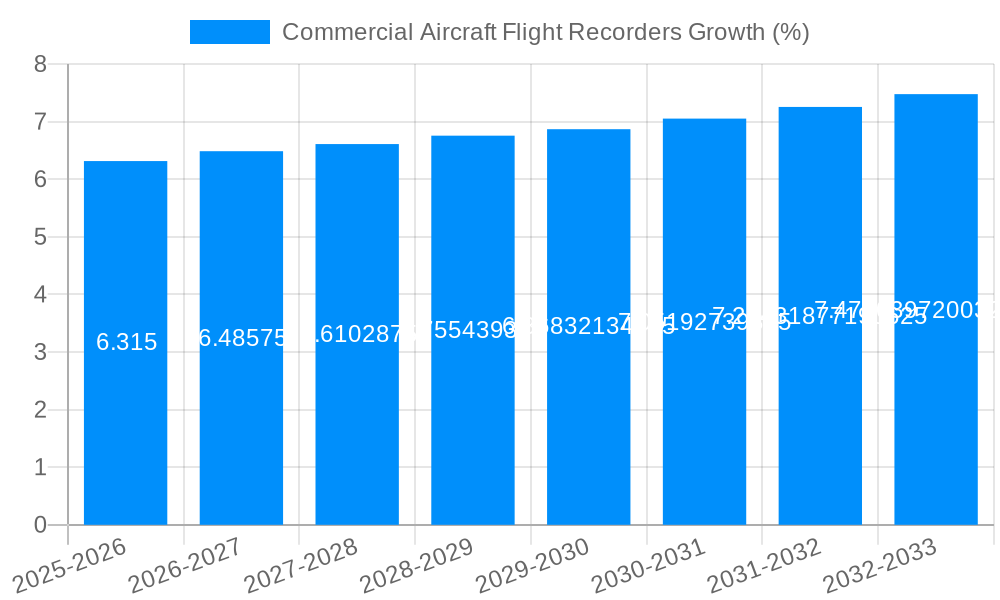

The global Commercial Aircraft Flight Recorders market is poised for robust growth, with an estimated market size of $85 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 5.8% through 2033. This expansion is primarily fueled by the increasing global air traffic and the subsequent rise in aircraft fleet size, necessitating advanced safety and data recording solutions. Stringent aviation regulations and the continuous drive for enhanced flight safety by regulatory bodies worldwide are significant market drivers, pushing airlines to adopt state-of-the-art Flight Data Recorders (FDRs) and Cockpit Voice Recorders (CVRs). The market segments are clearly defined by the type of recorder (FDR and CVR) and the aircraft application, including narrow-body, wide-body, and regional aircraft. The demand for both FDRs and CVRs is expected to remain strong, driven by the need for comprehensive data for accident investigation and performance monitoring.

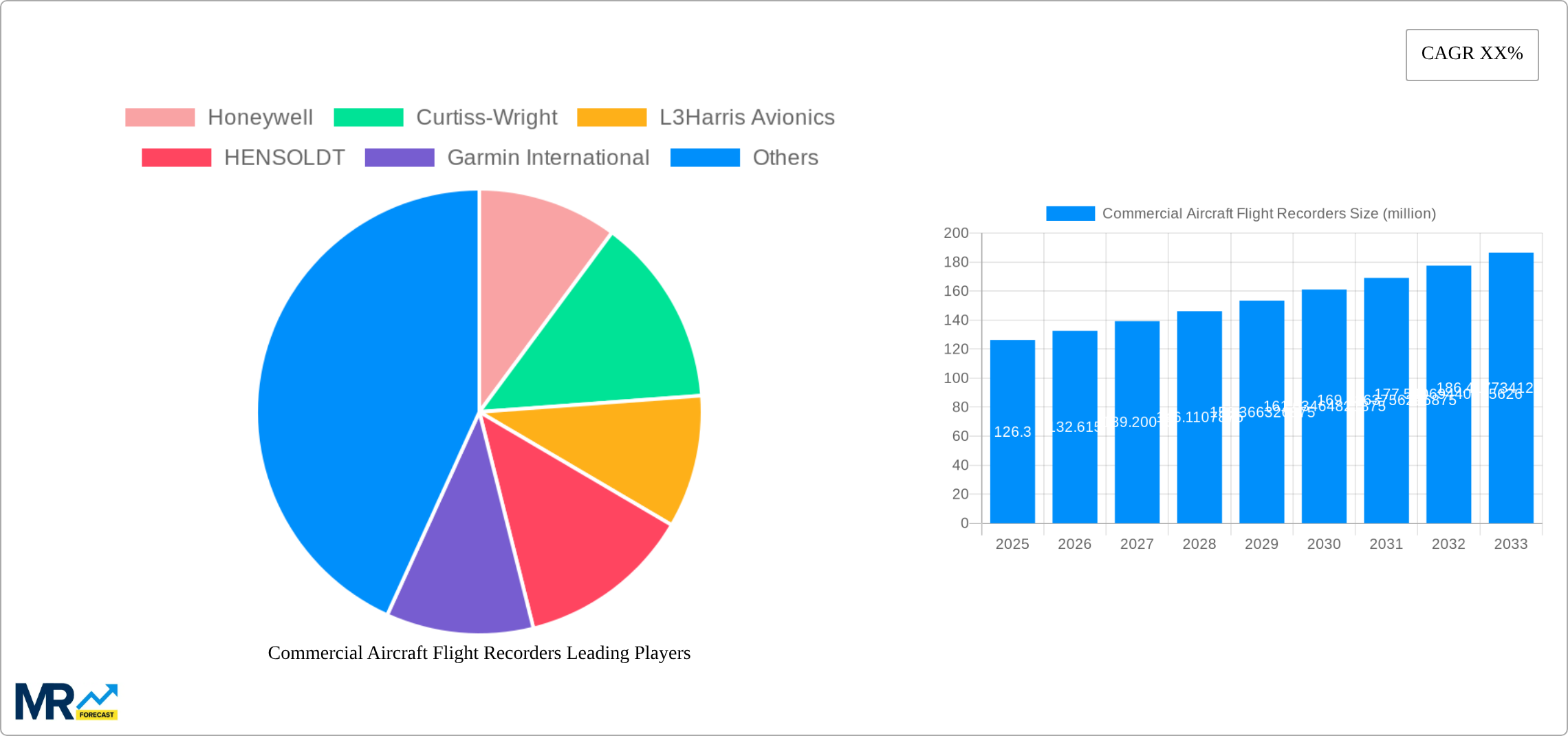

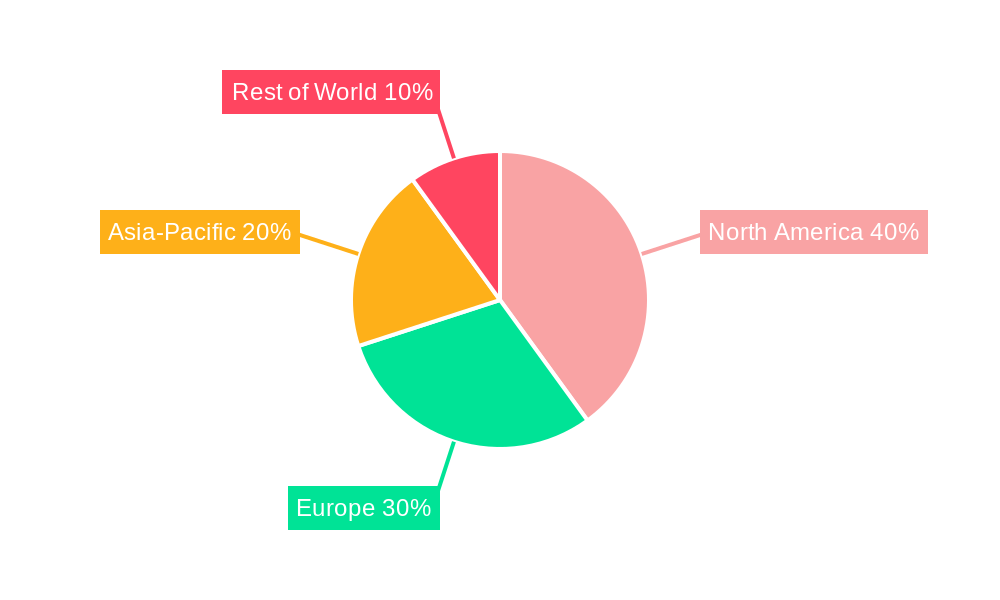

Key trends shaping the Commercial Aircraft Flight Recorders market include the integration of advanced sensor technologies for more detailed data capture, miniaturization of recorder components for space and weight optimization, and the increasing adoption of solid-state memory technology for enhanced durability and data integrity. The growing emphasis on predictive maintenance, leveraging flight data for early detection of potential issues, also contributes to market growth. While the market is generally robust, potential restraints could arise from the high initial cost of advanced recorder systems and the long lifecycle of existing aircraft fleets, which may delay upgrades. Geographically, North America and Europe are expected to lead the market due to their established aviation infrastructure and stringent safety standards. However, the Asia Pacific region, with its rapidly expanding aviation sector, presents significant growth opportunities. Leading companies such as Honeywell, Curtiss-Wright, and L3Harris Avionics are at the forefront of innovation, offering a wide array of flight recorder solutions to meet the evolving demands of the commercial aviation industry.

The global commercial aircraft flight recorders market is poised for robust expansion, with a projected trajectory indicating significant growth over the study period of 2019-2033. Driven by escalating air traffic, stringent aviation safety regulations, and the continuous advancement of avionics technology, the market is expected to witness a compound annual growth rate (CAGR) that will see its valuation reach multi-million dollar figures. The base year, 2025, sets a crucial benchmark for understanding current market dynamics, while the forecast period of 2025-2033 anticipates sustained momentum. Historical data from 2019-2024 provides valuable insights into past performance and lays the groundwork for future projections. A key trend observed is the increasing demand for more sophisticated flight data recorders (FDRs) and cockpit voice recorders (CVRs) that can capture a wider array of parameters with higher fidelity. This is directly linked to evolving regulatory requirements aimed at improving accident investigation capabilities and proactively enhancing flight safety. Furthermore, the integration of advanced data analytics and AI capabilities into flight recorder systems is emerging as a significant trend, promising predictive maintenance and enhanced operational efficiency. The growing fleet of both narrow-body and wide-body aircraft, coupled with the continued operation of regional aircraft, forms the bedrock of demand. The shift towards lighter, more compact, and more resilient flight recorders, capable of withstanding extreme environmental conditions, is also a defining characteristic of current market trends. The anticipated growth is not merely incremental but represents a substantial surge in the adoption of these critical safety devices across the global aviation landscape. This upward trend is underpinned by a global commitment to aviation safety, making flight recorders an indispensable component of every commercial aircraft. The market is responding to these demands by developing next-generation recorders that offer enhanced data storage, improved transmission capabilities, and greater survivability.

Several potent forces are collectively propelling the commercial aircraft flight recorders market forward. Foremost among these is the unwavering global emphasis on aviation safety. As air travel continues to expand its reach, governmental aviation authorities worldwide are implementing and strengthening regulations that mandate the installation and regular maintenance of flight recorders. These regulations are not static; they are constantly evolving to incorporate lessons learned from past incidents and to leverage technological advancements. The increasing complexity of modern aircraft, with their intricate systems and vast amounts of data generated during flight, necessitates more comprehensive and precise data capture capabilities, which advanced flight recorders provide. Furthermore, the rising global air traffic, particularly in emerging economies, directly translates into a larger installed base of aircraft requiring these critical safety systems. The continuous modernization of existing fleets, with airlines upgrading older aircraft to newer models equipped with state-of-the-art avionics, also contributes significantly to the demand for updated flight recorder technology. The proactive approach to aviation safety, where flight recorders are not just for post-incident analysis but also for operational monitoring and performance optimization, is another significant driver. This proactive stance encourages airlines and manufacturers to invest in advanced recording solutions that can offer real-time or near-real-time data insights, thereby preventing potential issues before they escalate.

Despite the optimistic growth outlook, the commercial aircraft flight recorders market faces several challenges and restraints that could temper its expansion. The initial cost of sophisticated flight recorder systems, particularly for newer models incorporating advanced features, can be a significant barrier, especially for smaller airlines or those operating in cost-sensitive regions. Retrofitting older aircraft with the latest generation of recorders can also involve substantial capital expenditure, leading to delayed adoption. The complex regulatory landscape, while a driver, can also be a restraint. Navigating the diverse and ever-changing international aviation regulations and certification processes for flight recorders requires significant investment in research, development, and testing, which can slow down product deployment. Furthermore, the market is susceptible to the cyclical nature of the aerospace industry. Economic downturns or global events that negatively impact air travel demand can lead to reduced aircraft manufacturing and fleet expansion, thereby affecting the demand for new flight recorders. The emergence of new technologies, while ultimately beneficial, can also create a period of uncertainty, as the industry adapts to and certifies these innovations. Maintenance and calibration of existing recorders also represent an ongoing cost for operators, and any disruptions to the supply chain for spare parts or specialized maintenance services could pose a challenge. Finally, data security and privacy concerns, especially with the increasing amount of data being recorded, may also present challenges that need to be addressed through robust protocols and industry standards.

The Flight Data Recorder (FDR) segment, within the broader commercial aircraft flight recorders market, is anticipated to dominate in terms of value and volume. This dominance stems from the fundamental and increasingly comprehensive data logging requirements for accident investigation and operational monitoring.

Dominant Segment: Flight Data Recorder (FDR)

Key Region: North America

The dominance of the FDR segment, coupled with the strong market influence of North America, underscores the critical role of detailed flight data in ensuring aviation safety and operational efficiency. The continuous evolution of FDR technology and its integration with broader aviation systems will further cement its leading position in the coming years.

The commercial aircraft flight recorders industry is propelled by several key growth catalysts. The escalating global air traffic, driven by economic growth and increasing demand for air travel, directly translates into a larger fleet size and consequently, a greater demand for flight recorders. Stringent and evolving aviation safety regulations worldwide are a primary catalyst, compelling airlines to adopt advanced and compliant recording systems. Continuous technological advancements, leading to lighter, more robust, and higher-capacity recorders, encourage fleet modernization and upgrades. The growing emphasis on proactive safety management and data analytics for operational optimization also drives the adoption of sophisticated flight recorder solutions.

This report offers a comprehensive analysis of the commercial aircraft flight recorders market, covering the study period of 2019-2033, with 2025 as the base year. It delves into key market insights, including current trends and future projections, with estimated market values reaching into the millions of units. The report meticulously examines the driving forces behind market growth, such as increasing air traffic and stringent safety regulations, as well as the challenges and restraints that may impact expansion. Furthermore, it identifies the dominant regions and segments, providing an in-depth understanding of market dynamics and future opportunities. The analysis also highlights significant growth catalysts and provides a detailed overview of the leading players in the industry, alongside a timeline of significant technological developments. This all-encompassing report serves as an indispensable resource for stakeholders seeking to understand the current landscape and future trajectory of the commercial aircraft flight recorders sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.8%.

Key companies in the market include Honeywell, Curtiss-Wright, L3Harris Avionics, HENSOLDT, Garmin International, Appareo Systems, NSE INDUSTRIES, LX Navigation, Universal Avionics Systems, UAV Navigation, Universal Avionics (Elbit Systems Ltd.), .

The market segments include Type, Application.

The market size is estimated to be USD 85 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Commercial Aircraft Flight Recorders," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Aircraft Flight Recorders, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.