1. What is the projected Compound Annual Growth Rate (CAGR) of the Color Negative Films?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Color Negative Films

Color Negative FilmsColor Negative Films by Type (ISO 50, ISO 100, ISO 200, ISO 400, Others, World Color Negative Films Production ), by Application (Online Sales, Offline Sales, World Color Negative Films Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

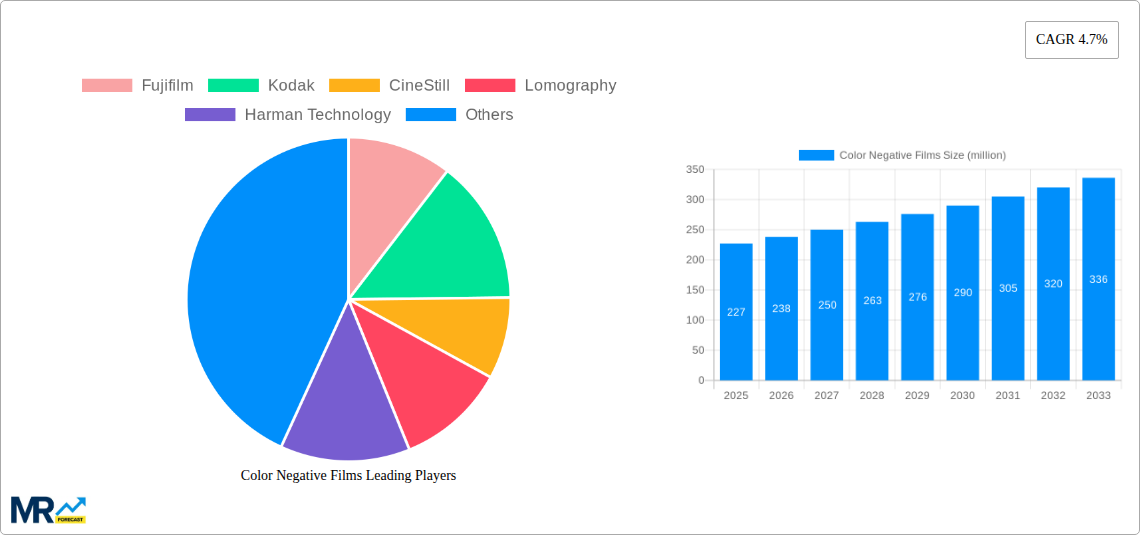

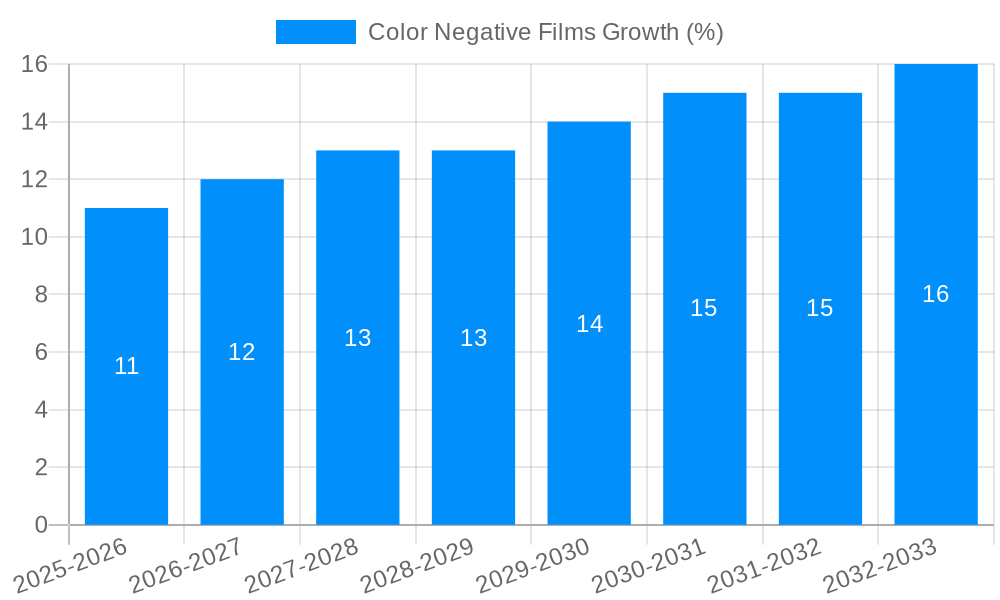

The global color negative film market, currently valued at approximately $227 million (2025), is experiencing a resurgence driven by several factors. A growing community of analog photography enthusiasts, seeking a unique aesthetic and tactile experience distinct from digital photography, is fueling demand. This niche market benefits from a strong online presence, with e-commerce platforms facilitating global sales and fostering a sense of community. Furthermore, the inherent limitations and unpredictable nature of film photography contribute to its allure, creating a unique artistic challenge and fostering creativity. While precise CAGR figures are unavailable, considering the market's niche nature and the consistent growth observed in analog photography, a conservative estimate of 3-5% annual growth is plausible over the forecast period (2025-2033). This growth is anticipated to be propelled by continued online sales expansion, coupled with innovative product offerings from key players like Fujifilm, Kodak, and Lomography, who are actively catering to this renewed interest. Specific ISO formats (ISO 50-400) will likely maintain a substantial share, reflecting varied photographic needs. However, factors like high production costs and the continued dominance of digital photography may act as restraints on overall market expansion.

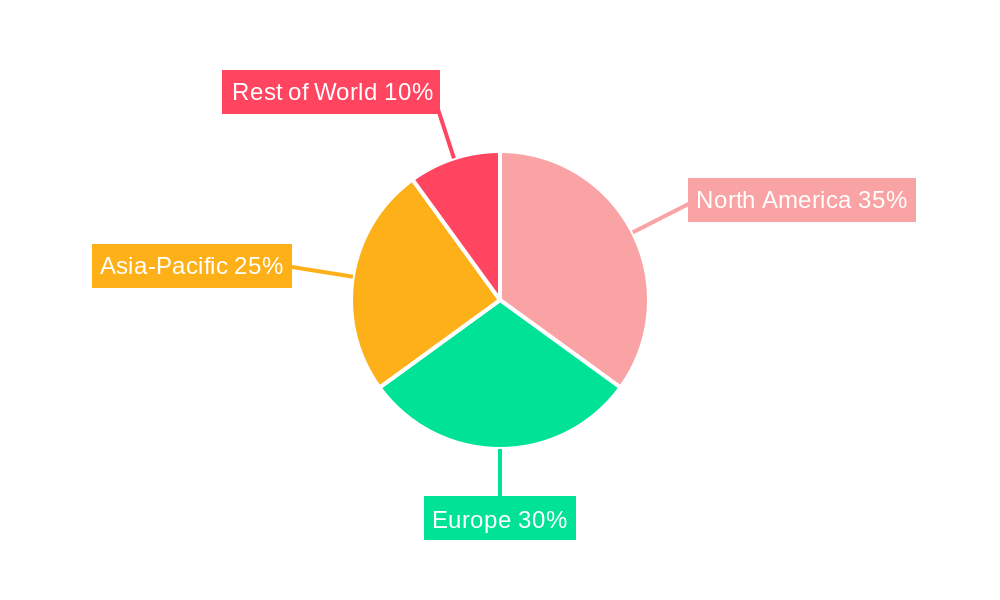

The regional distribution of the market likely reflects the global concentration of analog photography enthusiasts. North America and Europe, with their established photography cultures and significant online communities, are projected to hold significant market share. However, emerging markets in Asia-Pacific, especially in countries with growing middle classes and increasing disposable incomes, represent potentially untapped growth opportunities. The key players’ strategies for expanding distribution channels and introducing innovative film types will play a critical role in shaping regional performance. The competitive landscape is characterized by established players like Fujifilm and Kodak alongside smaller, specialized brands catering to niche segments. This dynamic competition ensures continued innovation and availability, supporting sustained market growth.

The global color negative film market, while facing the persistent challenge of digital photography's dominance, demonstrates surprising resilience and even growth in specific segments. The historical period (2019-2024) saw a decline in overall production, primarily driven by the continued shift towards digital imaging. However, the market exhibits signs of stabilization and even modest expansion, projected to reach several million units by 2033. This resurgence is fueled by a growing community of photographers and filmmakers who appreciate the unique aesthetic qualities of film – its grain, color rendition, and unpredictable nature. This trend is further supported by increasing online sales channels catering specifically to film enthusiasts, who are willing to embrace a more deliberate and hands-on approach to image capture. The estimated market value for 2025 reflects this stabilization, with significant growth potential driven by niche markets and increasing popularity amongst younger demographics discovering film photography. The forecast period (2025-2033) will likely witness continued expansion in specific ISO ranges and applications, particularly those linked to artistic expression and a counter-culture movement rejecting the immediacy and perfection of digital. The market's complexity arises from the interwoven forces of nostalgia, artistic preference, and technological limitations – each contributing to its nuanced growth trajectory. The base year of 2025 serves as a pivotal point, marking the potential shift from decline to sustainable growth in the color negative film market.

Several key factors are driving the resurgence of color negative film. Firstly, a growing appreciation for the unique aesthetic qualities of film photography is creating a dedicated niche market. The inherent grain, subtle color shifts, and unpredictable nature of film are now viewed as desirable artistic characteristics, setting it apart from the clinical precision of digital images. This is particularly true among younger generations who are actively seeking an alternative to the pervasive digital imagery they are constantly exposed to. Secondly, online sales channels have significantly expanded access to film products, bypassing traditional retail limitations. The ease of purchasing film online and connecting with a global community of film enthusiasts has fueled this market segment's growth. Finally, a resurgence of interest in analog filmmaking and the unique look achieved using film in cinematic productions is supporting demand. This demand transcends simple still photography, fueling a robust and growing niche market within the broader film industry. These combined factors contribute to a surprisingly resilient and evolving market for color negative film, defying the initial predictions of its complete obsolescence.

Despite the recent growth trends, the color negative film market faces significant challenges. The most prominent is the continuing dominance of digital photography and videography. Digital technologies offer unparalleled convenience, speed, immediate feedback, and cost-effectiveness in image capture and editing. This makes it difficult for film to compete on a mass-market level. Furthermore, the production and distribution of film are more complex and costly than digital counterparts. The need for specialized equipment for development and printing further increases the overall cost and accessibility barrier for consumers. Maintaining the production infrastructure for film manufacturing also presents significant logistical and financial obstacles for manufacturers. The high cost of film itself is also a limiting factor for many consumers. Finally, the lack of readily available processing facilities in many regions serves as a significant barrier to entry for new users. The market must address these challenges strategically to ensure long-term sustainability and growth.

The market is expected to witness significant growth across several segments. However, based on current trends and future projections, several regions and segments stand out as key drivers for growth in the color negative film industry.

ISO 400 Film: This segment is likely to dominate due to its versatility, allowing for shooting in various lighting conditions without requiring overly complex camera settings or accessories. Its higher sensitivity allows photographers to capture images even in lower light settings, expanding creative possibilities.

Online Sales Channels: The rise of e-commerce has opened new avenues for reaching film enthusiasts globally, overcoming geographical limitations associated with traditional retail models. Online platforms facilitate easy access, direct-to-consumer sales, and often offer curated selections of film stock from various manufacturers. This streamlined distribution model is a crucial component of the market's growth.

North America & Europe: These regions exhibit a strong and established community of analog photographers and filmmakers, fostering significant demand for color negative film. Furthermore, these areas boast a substantial infrastructure supporting film processing and development, making access easier for consumers. These regions show consistent growth projections throughout the forecast period, significantly contributing to the overall market expansion.

In summary, the ISO 400 segment's versatility, the expanding reach of online sales, and the established enthusiast communities in North America and Europe collectively position these areas as crucial drivers of growth within the global color negative film market. The overall market thrives on a combination of factors, including nostalgia, artistic preference, and technological limitations, all of which create a niche yet substantial market.

The color negative film industry's growth is catalyzed by a confluence of factors, including the increasing appeal of film's unique aesthetic qualities to both professional and amateur photographers and filmmakers, the expansion of online retail channels that cater specifically to this niche market, and the resurgence of interest in analog filmmaking within the broader cinematic community. These factors converge to create a sustainable and growing market segment, demonstrating the enduring relevance of film in an increasingly digital world.

This report provides a comprehensive overview of the color negative film market, detailing market trends, driving forces, challenges, key regions and segments, growth catalysts, leading players, and significant developments. It offers valuable insights into the current state of the market and provides projections for future growth, helping businesses navigate this dynamic and evolving landscape. The report utilizes detailed data and analysis to present a clear picture of the opportunities and challenges within the color negative film industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Fujifilm, Kodak, CineStill, Lomography, Harman Technology, KONO, Revolog, Dubblefilm, FPP, Candido, Rollei.

The market segments include Type, Application.

The market size is estimated to be USD 227 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Color Negative Films," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Color Negative Films, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.