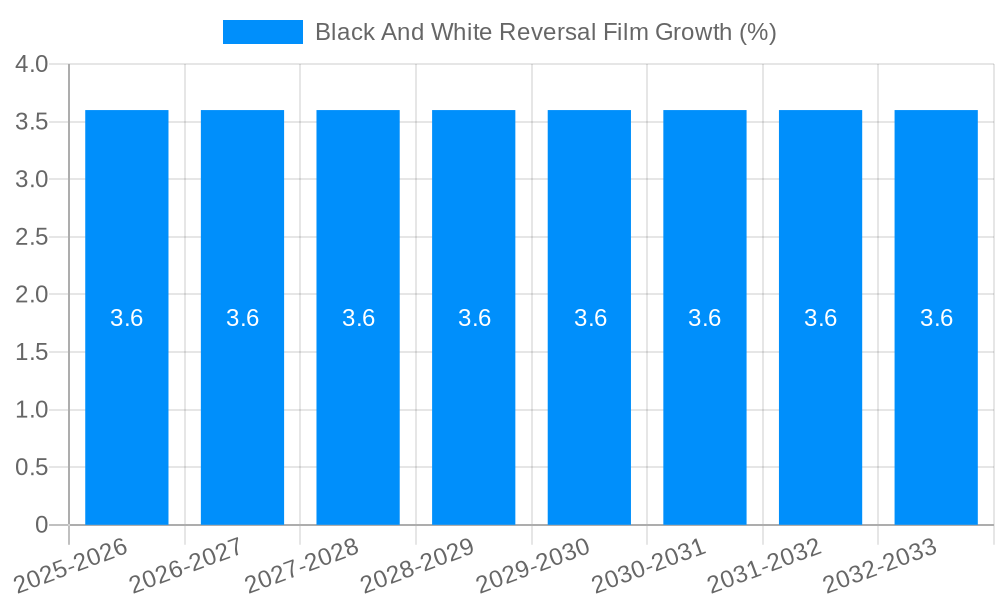

1. What is the projected Compound Annual Growth Rate (CAGR) of the Black And White Reversal Film?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Black And White Reversal Film

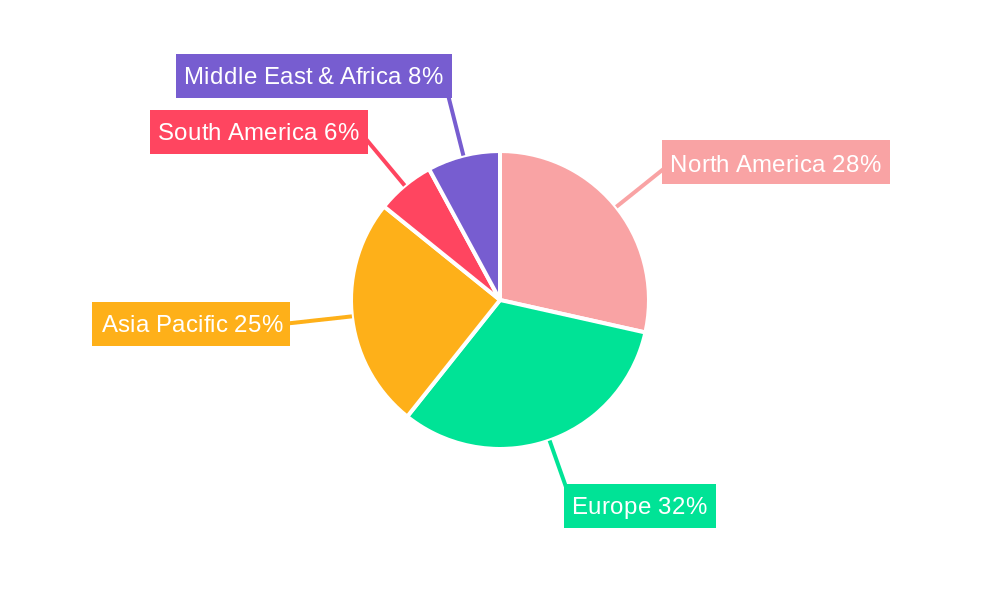

Black And White Reversal FilmBlack And White Reversal Film by Type (ISO 50, ISO 100, ISO 200, ISO 400, Others, World Black And White Reversal Film Production ), by Application (Online Sales, Offline Sales, World Black And White Reversal Film Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

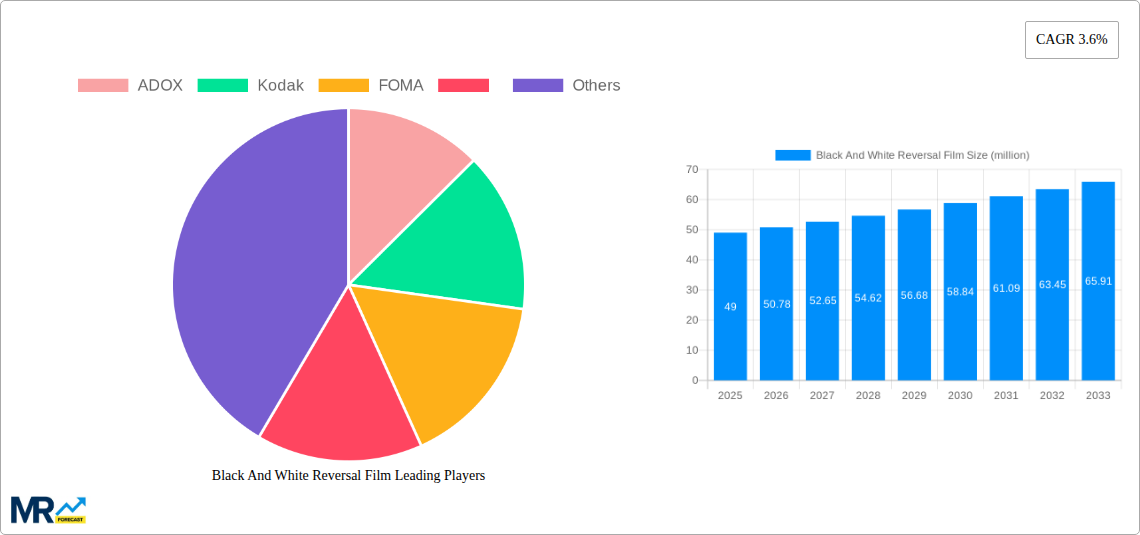

The black and white reversal film market, currently valued at approximately $63 million (2025), exhibits a niche yet persistent demand driven by a dedicated community of photographers and filmmakers who appreciate its unique aesthetic qualities and the creative control it offers. The market's growth, while not explosive, demonstrates steady expansion, propelled by factors such as rising interest in analog photography, the growing popularity of alternative photographic processes, and a counter-cultural movement against digital dominance. While precise CAGR data is unavailable, a conservative estimate, considering the niche nature and limited production, would place it between 3-5% annually for the forecast period (2025-2033). This growth is tempered by constraints including the high cost of production, limited accessibility compared to digital options, and the specialized equipment required for processing. Key segments include professional-grade films targeting experienced photographers and hobbyist-grade options catering to a wider audience. Major players like ADOX, Kodak, and Foma are strategically positioned to capitalize on the market’s growth, focusing on enhancing product quality and promoting the art form through workshops and community engagement.

This specialized market demonstrates a resilience not found in many other photographic mediums. The desire for unique aesthetics and tangible results continues to attract new users, while experienced photographers are likely to maintain long-term loyalty. The relatively small market size allows for focused marketing efforts targeted towards specific demographics and interest groups. Companies are likely focusing on premium-priced product lines, emphasizing image quality and archival properties. The regional distribution likely sees a higher concentration in developed countries with established photography scenes, although emerging markets in Asia and South America may represent untapped potential for growth. Future market projections will be largely influenced by evolving consumer preferences, technological advancements in analog processing, and effective marketing strategies that successfully target specific user groups.

The black and white reversal film market, while niche, exhibits fascinating trends reflecting a vibrant subculture within photography. The study period from 2019-2033 reveals a complex picture, moving beyond simple supply and demand. While the overall market size remains in the low millions of units annually, a significant portion of growth is fueled not by mass adoption, but by dedicated enthusiasts and professionals seeking a unique aesthetic. The historical period (2019-2024) showed a period of relative stability, with slight fluctuations influenced by economic factors and the rise of digital alternatives. However, the estimated year (2025) points to a potential uptick, driven by several factors detailed later. The forecast period (2025-2033) anticipates continued slow but steady growth, propelled by the enduring appeal of film photography and the emergence of new applications within artistic and specialized fields. This growth is not uniform across all segments. While the professional segment remains a stable driver, the amateur and enthusiast sectors show more volatility, responding to shifts in trends and access to equipment and development services. The market’s resilience hinges upon the unique characteristics of reversal film – its inherent contrast, tonal qualities, and the intangible charm associated with the analog process. These characteristics provide a distinct creative advantage unavailable in digital mediums, thereby sustaining demand for this specialized product, even in a digital age. This creates an opportunity for manufacturers to cater to this niche but passionate user base, fostering innovation and further cementing the place of black and white reversal film within the broader photography landscape.

Several factors contribute to the continued, albeit modest, growth of the black and white reversal film market. Firstly, the enduring appeal of film photography plays a crucial role. Many photographers appreciate the unique aesthetic qualities of film, specifically the unpredictable nature and grain structure of black and white reversal film, which often leads to unexpected and visually striking results. This distinct aesthetic provides a creative edge not easily replicated digitally. Secondly, the resurgence of analog photography as a hobby and art form is a significant driver. A growing community of young photographers and artists are actively seeking out film for its tactile nature and the slower, more deliberate process it encourages. This contributes to a sustained demand for film stocks and development services. Thirdly, specialized applications within areas like fine art photography, motion picture production, and even specific industrial applications (where high-contrast imagery is crucial) maintain a consistent need for this type of film. Finally, the rise of limited-edition film releases and collaborations between film manufacturers and artists have created further excitement and increased demand amongst collectors and enthusiasts. Collectively, these factors point towards a specialized market with consistent, albeit not explosive, growth potential in the coming years.

The black and white reversal film market faces several challenges. Firstly, the high cost of production, processing, and specialized equipment acts as a significant barrier to entry for many aspiring photographers. This limits market reach, especially amongst casual hobbyists. Secondly, the digital photography revolution has undeniably impacted the overall film market. The ease, speed, and cost-effectiveness of digital cameras and processing remain powerful competitors. The near-instant feedback loop of digital photography is difficult for film to match. Thirdly, the availability of processing and development services is a crucial factor. The dwindling number of professional labs equipped to handle reversal film limits accessibility, especially in certain regions. This creates logistical bottlenecks and increased costs for those seeking to use this type of film. Fourthly, environmental concerns regarding chemical processing and the disposal of film and chemicals also represent a growing concern. Manufacturers are compelled to address these issues through sustainable practices and potentially explore new processing methods. Finally, the relatively low volume production of reversal film compared to its color counterparts restricts economies of scale, impacting profitability and potentially hindering investment in innovation.

Segments:

Professional Photography: This segment remains the most stable and consistent, with professional photographers valuing the unique qualities of reversal film for their work. The demand for high-quality, consistent results drives a steady market within this segment.

Amateur/Enthusiast Photography: This segment is more volatile, responding to trends and accessibility of equipment and processing services. The increased accessibility of information and the growth of online communities dedicated to film photography support this market.

The paragraph above demonstrates the key geographical regions and segments currently showing the strongest demand. The interplay between a dedicated professional segment and a burgeoning enthusiast segment maintains a balance within the market, contributing to its long-term survival. The geographic focus on North America and Europe largely reflects established photography cultures and infrastructure conducive to film photography. However, the emergence of Asian markets suggests potential for future expansion. The professional segment ensures a stable baseline, while the enthusiastic segment contributes to its vibrancy and continued evolution.

The black and white reversal film industry's growth is catalyzed by several key factors. The enduring appeal of film's unique aesthetic and the resurgence of analog photography among younger generations represent major driving forces. Furthermore, specialized applications within fine art, motion pictures, and industrial sectors create a sustained demand. Finally, targeted marketing and collaborations focusing on the artistic and creative aspects of film photography help foster a passionate and growing community of users.

The black and white reversal film market, while niche, shows consistent growth driven by dedicated enthusiasts, professionals, and a unique aesthetic unavailable in digital alternatives. The report provides a comprehensive analysis of market trends, driving forces, challenges, key players, and future growth prospects across key regions and segments. It's a valuable resource for companies involved in the production, distribution, and processing of this specialized film stock.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ADOX, Kodak, FOMA, .

The market segments include Type, Application.

The market size is estimated to be USD 63 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Black And White Reversal Film," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Black And White Reversal Film, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.