1. What is the projected Compound Annual Growth Rate (CAGR) of the Black and White Negative Film?

The projected CAGR is approximately 4.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Black and White Negative Film

Black and White Negative FilmBlack and White Negative Film by Type (35mm Film, Medium Format Film, Large Format Film, Others), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

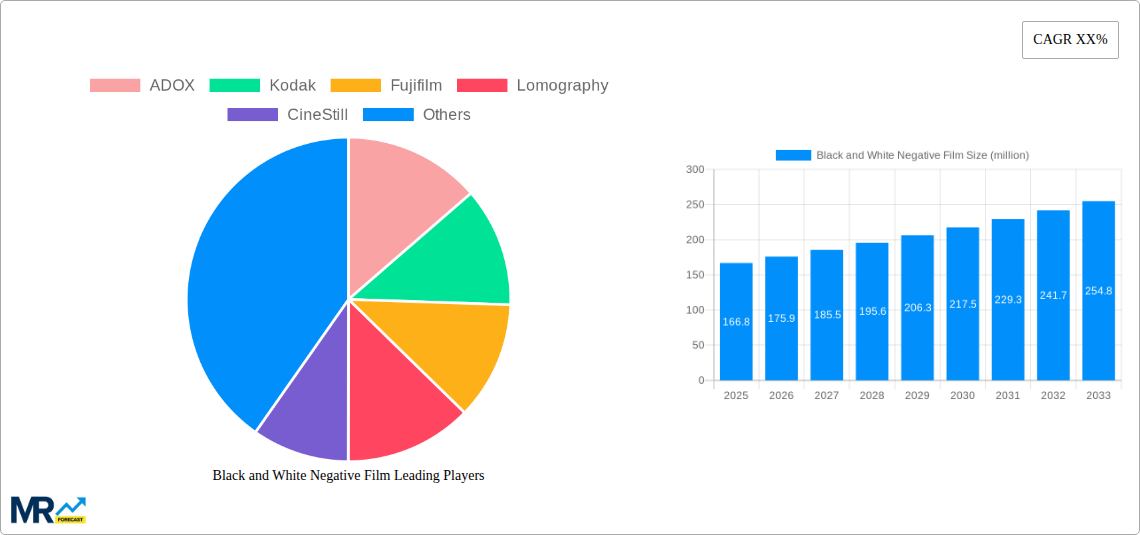

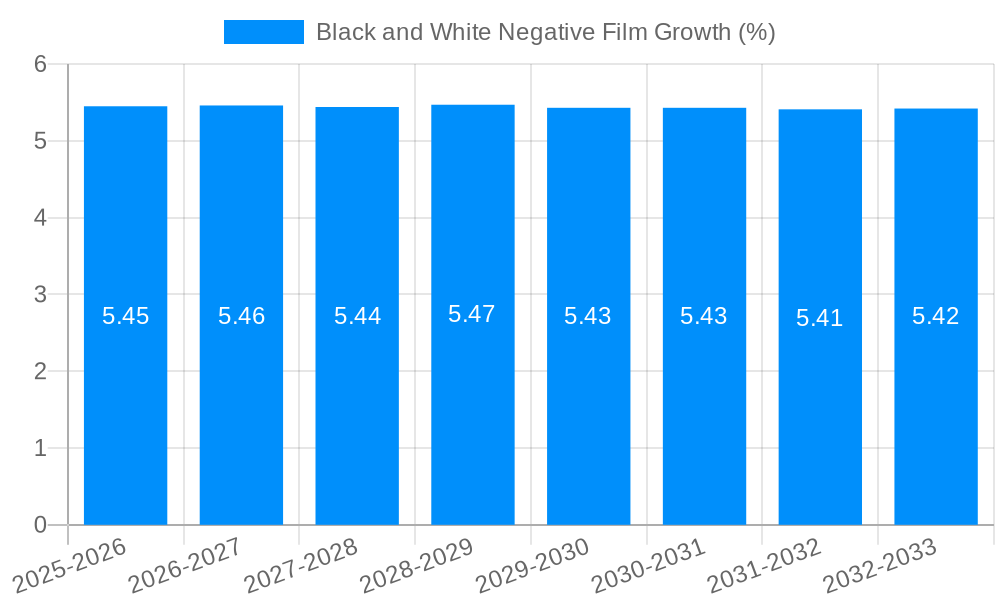

The black and white negative film market, valued at $126.6 million in 2025, is projected to experience steady growth with a compound annual growth rate (CAGR) of 4.0% from 2025 to 2033. This growth is fueled by several key drivers. A resurgence of interest in analog photography among younger generations, attracted by its unique aesthetic and tactile experience, is a significant factor. The growing popularity of film photography on social media platforms like Instagram further amplifies this trend, creating a community and inspiring others to experiment with this classic medium. Furthermore, a growing appreciation for the archival quality and longevity of film negatives, compared to digital formats, is driving demand, particularly among professional photographers and art enthusiasts. However, the market faces constraints, primarily the high cost of film and development compared to digital photography, along with the inconvenience of the process. Competition from readily available and inexpensive digital alternatives also poses a challenge. Despite these hurdles, the niche market's resilience is evident in its continued growth, driven by a passionate and dedicated community.

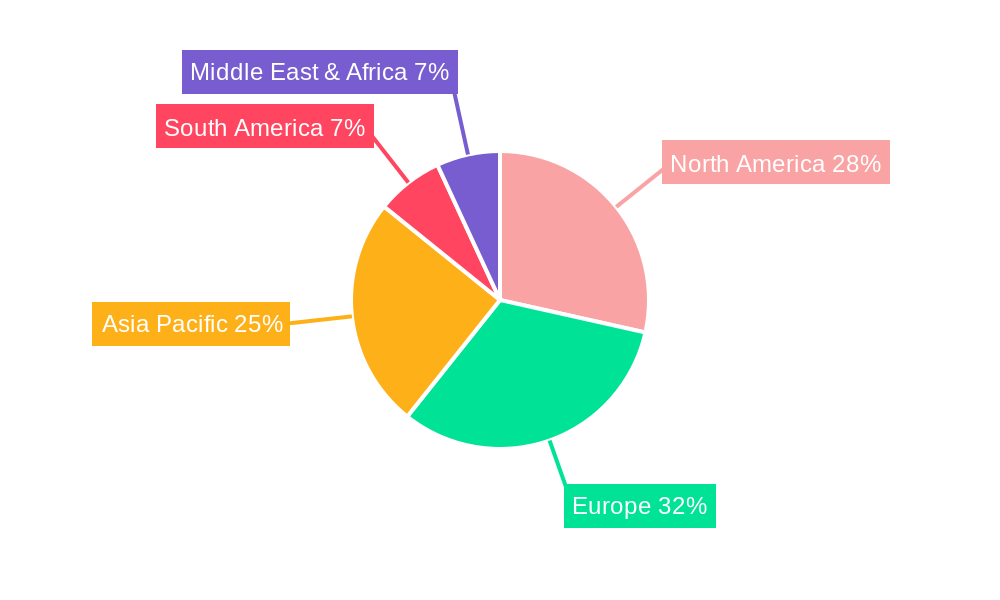

Segment analysis reveals a diverse range of players including established brands like Kodak and Fujifilm, alongside smaller, specialized companies catering to specific photographic styles, like Lomography and CineStill. These specialized brands cater to niche audiences with unique film characteristics and aesthetic preferences, fostering market dynamism. Regional market variations likely exist, with developed economies in North America and Europe potentially showing higher per-capita consumption due to higher disposable incomes and a stronger presence of photography enthusiasts. The historical period (2019-2024) likely exhibited fluctuating growth due to various economic and technological shifts, potentially experiencing a dip during the pandemic followed by a subsequent recovery. The forecast period (2025-2033) suggests a continuation of this growth trajectory, albeit at a moderate pace, as the market finds a balance between legacy and modern preferences in photography.

The black and white negative film market, while seemingly niche, exhibits surprising resilience and even growth in the face of digital photography's dominance. The study period from 2019 to 2033 reveals a complex narrative. While the historical period (2019-2024) saw a decline in overall sales, driven by the continued affordability and ease of use of digital alternatives, the market is demonstrating signs of stabilization and even modest resurgence, particularly within specific segments. This resurgence is not driven by mass-market appeal but rather by a passionate and growing community of photographers who value the unique aesthetic, tactile experience, and creative control offered by film photography. The estimated year 2025 shows a slight uptick in sales, projected to continue into the forecast period (2025-2033) fueled by several factors detailed below. Millions of units are sold annually, though the exact figure fluctuates significantly based on economic conditions and trends in the broader photography market. The base year of 2025 serves as a crucial benchmark for understanding the current market dynamics and projecting future growth. The market is far from saturated, with significant untapped potential in certain demographic groups and geographical regions. The unique grain structure, tonal range, and ability to create specific moods unattainable with digital processing are key factors driving the ongoing demand for black and white negative film. This report delves into the nuances of this market, providing insights into the factors driving its growth and the challenges it faces. The involvement of key players such as Kodak, Fujifilm, and independent film manufacturers like Lomography is integral to the market's continuing existence and evolution. This report reveals the factors supporting a continuation of this unique market niche and its potential for steady, albeit small, growth in the coming decade.

Several factors contribute to the sustained, if modest, growth of the black and white negative film market. Firstly, a significant resurgence of interest in analog photography among younger generations is occurring. This is fueled by a desire for a more tactile and deliberate creative process, a reaction against the instant gratification and often perceived artificiality of digital imagery. The unique aesthetic qualities of black and white film, including its grain and tonal range, are highly prized by artists and photographers seeking a specific look and feel in their work. Secondly, the rise of film photography communities and online forums fosters a vibrant culture of sharing, learning, and experimentation, attracting new enthusiasts. This community aspect is crucial in sustaining interest and providing support for a relatively niche market. Thirdly, the increasing availability of accessible and affordable developing and scanning services has lowered the barriers to entry for aspiring film photographers. Finally, a growing appreciation for the tangible and archival qualities of film photography, with its potential for lasting prints and negatives, contributes to its enduring appeal in an increasingly digital world. These factors together paint a picture of a niche market with significant staying power, propelled by passionate individuals and a thriving subculture.

Despite the positive trends, the black and white negative film market faces considerable challenges. The most significant is the persistent dominance of digital photography. Digital cameras and smartphones offer immediate results, effortless editing, and vastly reduced costs compared to film photography. The cost of film, developing, and scanning can be a significant barrier to entry, especially for beginners. The availability of developing services can also be limited in certain areas, hindering accessibility. Furthermore, the supply chain for raw materials and manufacturing can be susceptible to disruptions, potentially leading to price fluctuations and shortages. Competition from other analog photography options, such as instant film, also presents a challenge. Lastly, the increasing digitalization of the world, with its focus on instant access and ease of use, directly counters the slower, more deliberate nature of film photography. Overcoming these hurdles requires innovative approaches by manufacturers, continued support from the film photography community, and a sustained appreciation for the unique qualities of black and white negative film.

The black and white negative film market displays varying levels of demand across different regions and segments.

North America and Europe: These regions consistently demonstrate a stronger interest in film photography compared to others, driving a significant portion of the market demand. This is partly due to a well-established analog photography culture, greater disposable income, and access to specialist stores and services. Within these regions, urban centers often show higher adoption rates than rural areas.

Asia: While experiencing growth, the market share in Asia remains comparatively smaller than in North America and Europe. However, there's notable potential for expansion, particularly in countries with growing middle classes and an increasing appreciation for artistic and niche products.

Segments: The 35mm format generally holds the largest market share due to its widespread availability and affordability. However, other formats, such as medium format (120 roll film), are seeing a growth among professionals and enthusiasts who value higher image quality and resolution. The demand for specialty films, offering unique characteristics like increased contrast or specific grain structures, is also on the rise, catering to the diverse needs of artistic photographers. This specialization shows a more mature market driven by photographers who want to customize their final product and artistic output.

In summary, while North America and Europe currently dominate, the potential for growth in Asia and the diversification within film formats indicate a dynamic market with ongoing evolution.

The renewed interest in analog photography, driven by a desire for a more tactile and artistic process, is a key catalyst for growth. The vibrant community surrounding film photography, coupled with improved accessibility to developing and scanning services, significantly lowers the barriers to entry. Furthermore, the unique aesthetic properties of black and white film, including its distinct grain and tonal qualities, remain highly valued by artists and photographers, ensuring its continued relevance in the digital age.

This report provides a detailed analysis of the black and white negative film market, offering insights into market trends, driving forces, challenges, and key players. It provides a comprehensive overview of the market's current state and projects its future trajectory, highlighting growth opportunities and potential risks. The report offers valuable information for industry participants, investors, and anyone interested in understanding the dynamics of this unique and resilient market segment. The data presented provides a clear picture of the market's past performance, its current standing, and its likely future, aiding informed decision-making and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.0%.

Key companies in the market include ADOX, Kodak, Fujifilm, Lomography, CineStill, Street Candy Film, KONO, FOMA, .

The market segments include Type, Application.

The market size is estimated to be USD 126.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Black and White Negative Film," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Black and White Negative Film, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.