1. What is the projected Compound Annual Growth Rate (CAGR) of the Collectibles Auction?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Collectibles Auction

Collectibles AuctionCollectibles Auction by Application (Personal Identification, Individual Auction, Cultural Relic Identification), by Type (Painting And Calligraphy, Jade, Wood, Coin, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

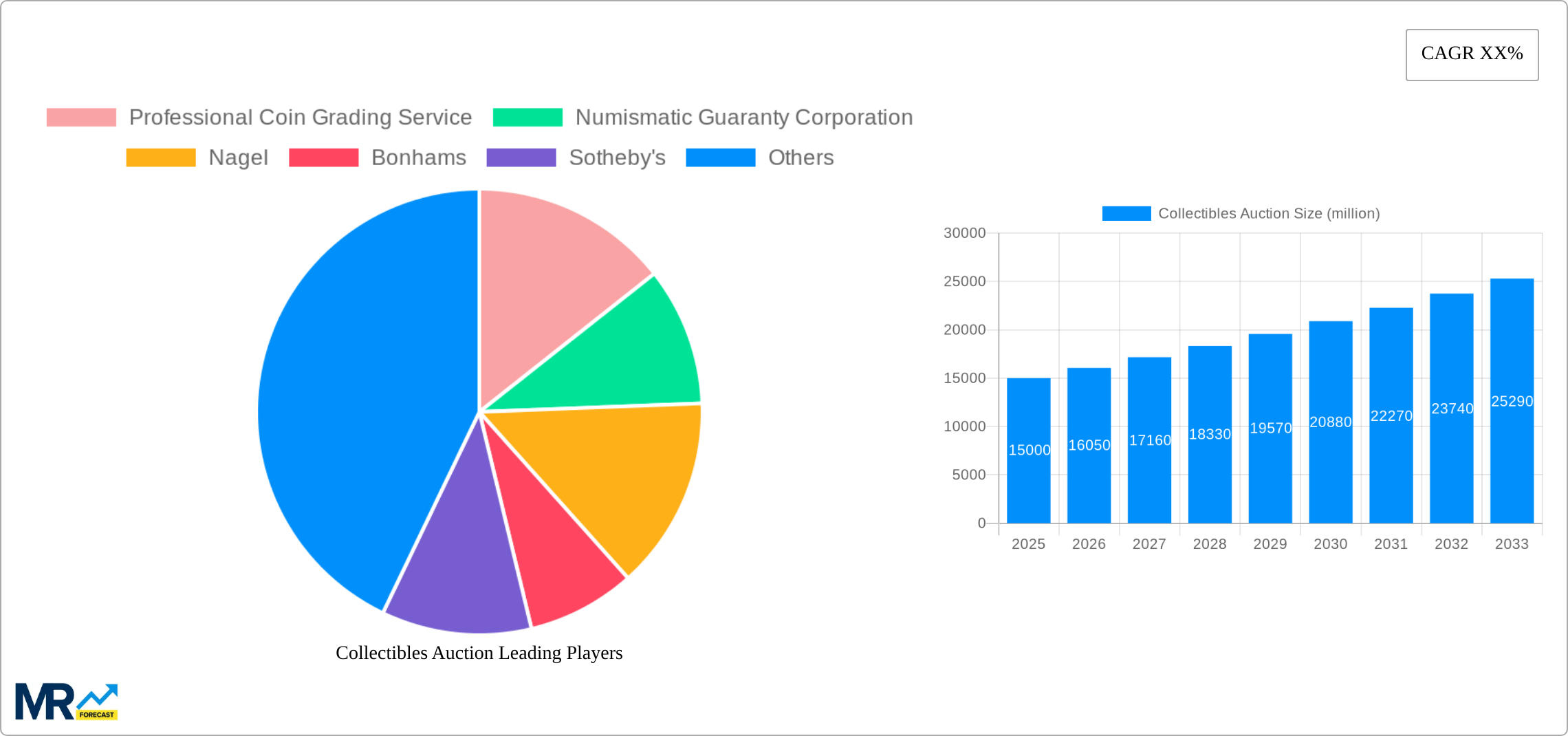

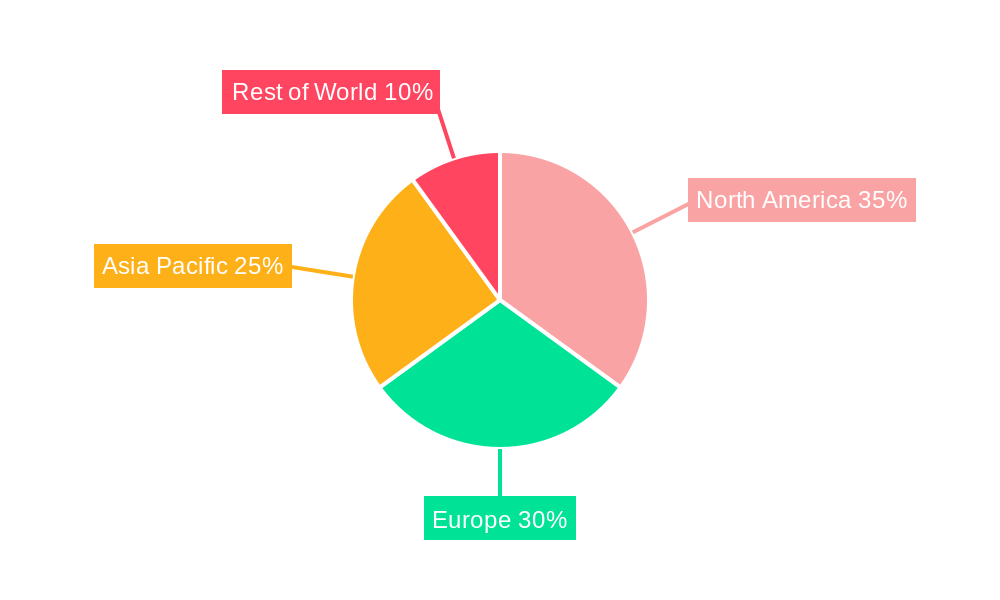

The global collectibles auction market is experiencing robust growth, driven by increasing disposable incomes in emerging economies, a rising appreciation for art and historical artifacts, and the expanding online auction platforms. The market's segmentation reveals strong demand across various applications, including personal identification, individual auctions, and the identification of cultural relics. Popular collectible types include paintings and calligraphy, jade, wood, coins, and other unique items. Key players like Sotheby's, Christie's, and Heritage Auctions dominate the market, leveraging their established reputations and extensive networks to attract high-value items and discerning buyers. The market's geographic distribution shows strong performance in North America and Europe, with Asia-Pacific emerging as a significant growth region fueled by China's expanding affluent class and its burgeoning interest in art and antiques. This region’s expanding collector base and increasing participation in online auctions are key drivers of this growth. While challenges such as market volatility and authentication concerns exist, the overall market outlook remains positive, projecting continued expansion driven by technological advancements, improved online security measures, and growing global interest in collectibles.

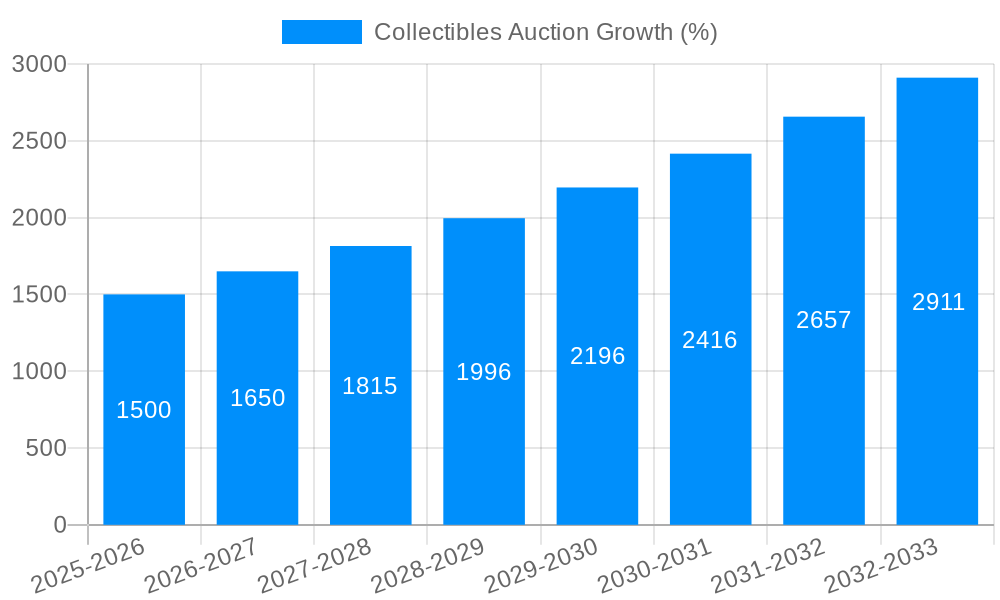

The forecast period of 2025-2033 indicates a sustained expansion in the collectibles auction market. The CAGR (let's assume a conservative estimate of 7% based on the general growth of the luxury goods market), coupled with the expanding market segments and regional penetration, points to a significant increase in market value. The continued development of specialized auction houses catering to specific niche collectibles, along with increased investments in authentication technologies, will further contribute to market growth. While regulatory hurdles and economic uncertainties could pose minor challenges, the long-term prospects for this market remain promising, driven by the enduring appeal of rare and valuable items and the increasing accessibility of auction platforms to global buyers.

The global collectibles auction market witnessed substantial growth during the historical period (2019-2024), exceeding several billion dollars in annual turnover. This surge is fueled by a confluence of factors, including increased disposable incomes in emerging economies, a growing appreciation for tangible assets as a hedge against inflation, and the rise of online auction platforms that broaden accessibility and reach. Key market insights reveal a significant shift towards digital platforms, facilitating global participation and driving up auction prices. High-value items, particularly rare coins graded by organizations like the Professional Coin Grading Service (Professional Coin Grading Service) and Numismatic Guaranty Corporation, consistently command millions of dollars, illustrating the market's robust appetite for exclusivity and provenance. Furthermore, the market showcases a clear preference for specific collectible types; for instance, Chinese painting and calligraphy auctions through houses like Rongbaozhai and Duoyunxuan consistently achieve record-breaking sales figures, reflecting a burgeoning interest in cultural heritage and investment opportunities within this niche. The increasing involvement of younger demographics, attracted by the allure of unique and historically significant items, further bolsters market expansion. The market demonstrates remarkable resilience even amidst economic fluctuations, highlighting the enduring appeal and value retention of high-quality collectibles. The forecast period (2025-2033) projects continued growth, with estimates pointing towards a market value exceeding tens of billions of dollars by 2033, driven by ongoing trends and strategic market expansions by auction houses.

Several key factors are driving the growth of the collectibles auction market. The rising global wealth, particularly in Asia and the Middle East, creates a larger pool of high-net-worth individuals willing to invest in luxury goods and collectibles as a form of wealth preservation and appreciation. Simultaneously, the growing awareness of collectibles as alternative investment assets, offering diversification beyond traditional financial markets, is attracting a broader investor base. Technological advancements, specifically the proliferation of online auction platforms, enhance market transparency, accessibility, and international reach, thereby fostering competition and driving up prices. Moreover, the increasing influence of social media and celebrity endorsements further fuel the demand for rare and coveted items. The burgeoning interest in cultural heritage and art collecting, as seen in the robust performance of Chinese art auctions, presents a significant growth opportunity. Finally, the limited supply of certain collectibles, coupled with increasing demand, creates a scarcity effect that significantly pushes up their value in the auction market. These combined elements contribute to a robust and continuously expanding collectibles auction sector.

Despite its robust growth, the collectibles auction market faces several challenges. The market's inherent volatility is a significant concern; prices are susceptible to shifts in economic conditions, market sentiment, and global events. Counterfeit items pose a considerable threat, requiring stringent authentication processes and expertise to ensure the legitimacy of traded goods. The lack of standardized valuation methods for certain collectibles presents difficulties in assessing their true worth, leading to potential pricing discrepancies and disputes. Regulatory uncertainties and varying tax policies across different jurisdictions can also hinder international trade and investment. Furthermore, securing and insuring high-value items against theft, damage, and loss requires significant investment, adding to operational costs. The concentration of the market in the hands of a few major auction houses can also raise concerns about market manipulation and transparency. Finally, the evolving tastes and preferences of collectors can shift demand, potentially impacting the market value of specific types of collectibles. Addressing these challenges is crucial for sustained and responsible growth within the sector.

The collectibles auction market is geographically diverse, with significant activity across several regions. However, Asia, particularly China and Hong Kong, consistently demonstrates exceptional market strength, driven by a robust domestic market and significant investment from wealthy collectors. Europe and North America also retain considerable market share, with established auction houses like Sotheby's (Sotheby's) and Christie's (Christie's Auction) playing a pivotal role.

Dominant Segment: Painting and Calligraphy: The segment of Painting and Calligraphy consistently demonstrates strong growth and high-value transactions. This is particularly evident in the Asian market, where works of renowned Chinese masters regularly achieve prices in the tens of millions. The cultural significance, historical importance, and investment potential of these artworks drive this segment's dominance. The exclusivity and limited supply further contribute to their high value. The auction houses specializing in this sector, such as Rongbaozhai and Duoyunxuan, play a crucial role in shaping market trends and valuations. Their expertise in authentication and provenance is vital for attracting high-net-worth buyers. The growing global interest in Asian art and culture contributes to the ongoing dominance of this segment within the broader collectibles market. The increasing number of international museums and private collectors seeking high-quality pieces further fuels demand, ensuring continuous growth for the foreseeable future. The segment is likely to experience robust expansion throughout the forecast period, with prices anticipated to continue their upward trajectory.

Supporting Segments: While painting and calligraphy take the lead, segments like rare coins, jade, and wood carvings also contribute significantly. The market for rare coins, facilitated by grading services like PCGS and NGC, continues to attract significant investment. Similarly, jade and wood carvings, particularly those with intricate designs and historical significance, command premium prices within dedicated auction segments.

The continued growth of the collectibles auction industry is fueled by several factors, including the rising global wealth, increasing disposable income among high-net-worth individuals, and the growing popularity of collectibles as alternative investments. Technological advancements, such as online auction platforms, enhance market accessibility and global reach, contributing to market expansion. The growing interest in cultural heritage and the increasing number of younger collectors contribute to sustained demand and drive growth within specific segments like Asian art and rare coins.

This report provides a comprehensive overview of the global collectibles auction market, analyzing historical trends, current market dynamics, and future growth projections. It examines key segments, influential players, and the factors driving market expansion while also addressing potential challenges and restraints. The report offers valuable insights for investors, collectors, auction houses, and other stakeholders interested in understanding and participating in this dynamic and lucrative market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Professional Coin Grading Service, Numismatic Guaranty Corporation, Nagel, Bonhams, Sotheby's, Christie's Auction, Davids Auction, Skinners, Heritage Dallas, Susanina's Auctions, Bunte Auction, Tom Harris Marshall Town, Leslie Hindman Auctioneers, John Moran Auctioneers Inc, Poly, Guardian Auctions, Rongbaozhai, Duoyunxuan, Council International, Xiling Yinshe, Ningbo Hanhai, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Collectibles Auction," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Collectibles Auction, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.