1. What is the projected Compound Annual Growth Rate (CAGR) of the Collectibles Auction?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Collectibles Auction

Collectibles AuctionCollectibles Auction by Type (Painting And Calligraphy, Jade, Wood, Coin, Others), by Application (Personal Identification, Individual Auction, Cultural Relic Identification), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

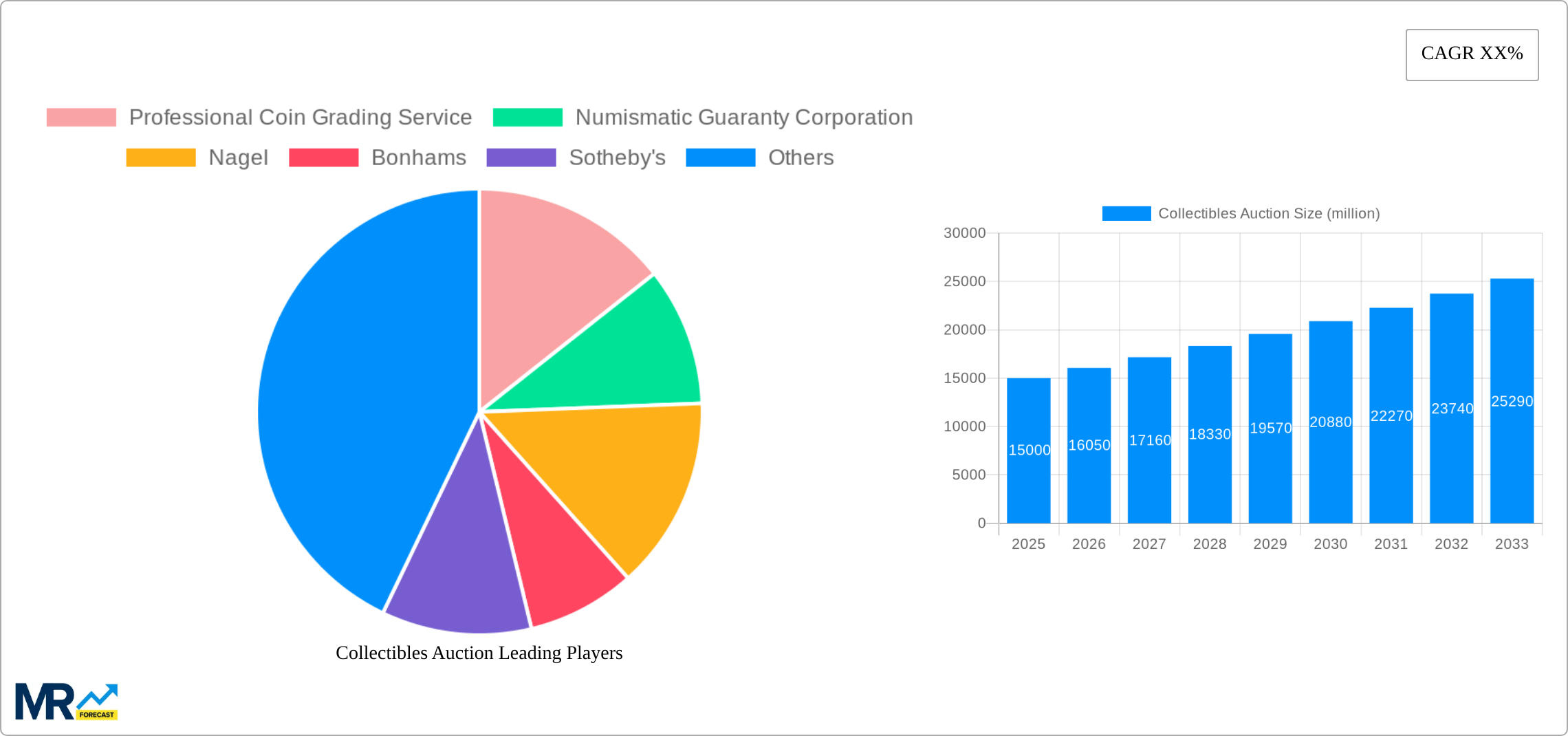

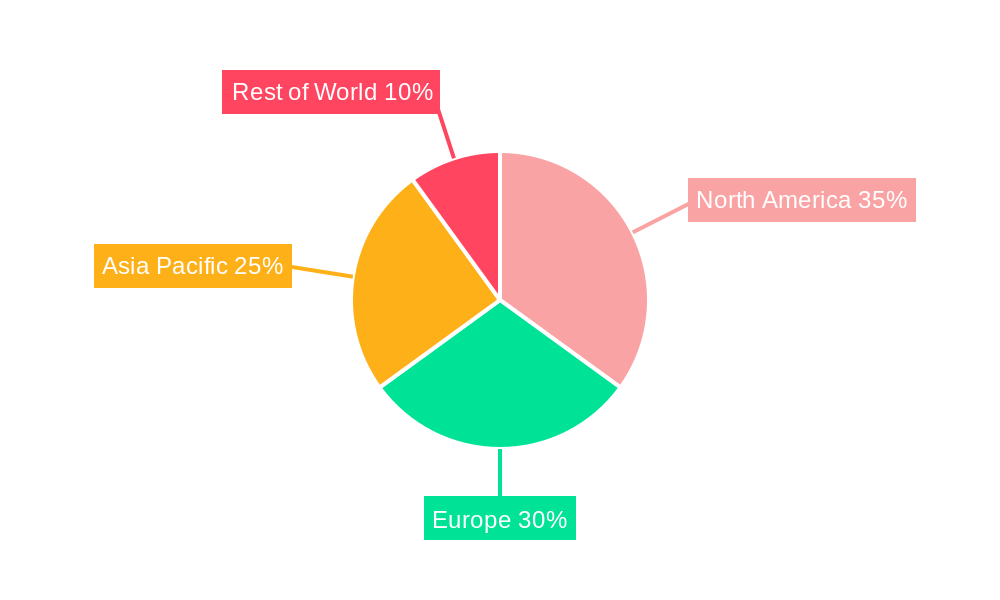

The global collectibles auction market is a dynamic and expanding sector, exhibiting significant growth potential driven by increasing disposable incomes, particularly in emerging economies, and a growing appreciation for art, history, and cultural heritage. The market's segmentation reveals strong demand across various collectible categories, including painting and calligraphy, jade, wood carvings, coins, and other unique items. Auction applications range from personal identification and individual auctions to the crucial field of cultural relic identification. The substantial presence of renowned auction houses such as Sotheby's, Christie's, and Bonhams, alongside numerous regional and specialized auctioneers, demonstrates a well-established market infrastructure. However, market growth is not without challenges; fluctuations in economic conditions and the inherent risks associated with high-value transactions can act as potential restraints. The market's geographical distribution shows a strong presence in North America and Europe, while Asia-Pacific, particularly China, is emerging as a key growth driver. The continued growth of online auction platforms and the increasing use of technology for authentication and verification are shaping the future of the industry, enhancing transparency and accessibility.

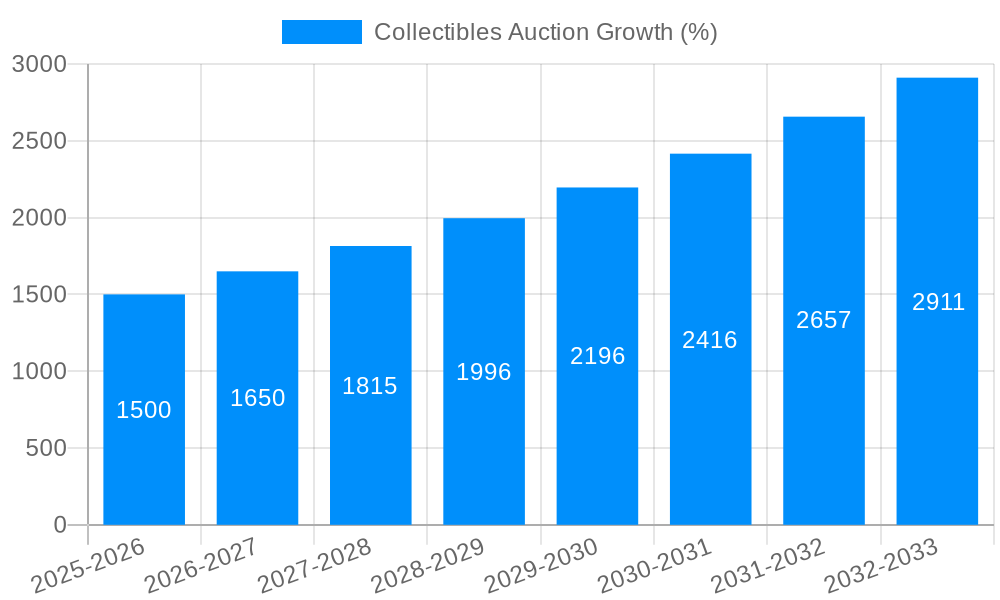

A Compound Annual Growth Rate (CAGR) indicative of healthy market expansion points to a consistently expanding market throughout the forecast period (2025-2033). This growth is fueled by rising affluence in developing nations, a surge in interest in both tangible and intangible assets as alternative investments, and a heightened emphasis on preserving cultural heritage. The diverse range of collectible items offers investment opportunities across varied price points and risk profiles, attracting a broadening base of both seasoned and new collectors. While economic downturns can temporarily impact sales, the long-term prospects for the collectibles auction market remain robust, supported by the enduring appeal of rare and valuable items and the continual evolution of the auction process itself. Geographic diversification is likely to continue, with regions experiencing economic growth witnessing a corresponding increase in auction activity.

The global collectibles auction market experienced remarkable growth during the historical period (2019-2024), exceeding several billion dollars in value. This surge was driven by a confluence of factors, including increased high-net-worth individual (HNWI) wealth, a growing appreciation for tangible assets as a hedge against inflation and market volatility, and the rise of online auction platforms expanding accessibility and global reach. The market saw particularly strong performance in segments like painting and calligraphy, with individual masterpieces fetching tens of millions of dollars. Similarly, rare coins graded by services like the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Corporation (NGC) commanded record prices, reflecting the increasing sophistication and transparency within the numismatic sector. The auction houses themselves, such as Sotheby's, Christie's, and Bonhams, have actively cultivated this growth by employing innovative marketing strategies, leveraging technology to enhance the bidding experience, and building relationships with high-profile collectors. The increasing interest in cultural relics further contributed to the market expansion, particularly in Asian markets where auctions of ancient jade and calligraphy pieces achieved astounding results, reaching into the hundreds of millions of dollars in single sales. This trend is anticipated to continue through the forecast period (2025-2033), though potentially at a moderated pace as the market matures and supply-demand dynamics shift. The overall market demonstrates a significant upward trajectory with the potential for reaching multi-billion dollar valuations in the coming years.

Several key forces are propelling the growth of the collectibles auction market. Firstly, the increasing wealth concentration among HNWIs fuels demand for high-value collectibles as investment vehicles and status symbols. Secondly, the rise of online auction platforms, such as those employed by Sotheby's and Christie's, has democratized access to the market, attracting a wider range of bidders globally. Thirdly, the growing appreciation for tangible assets as a safe haven investment in times of economic uncertainty is driving investment towards collectibles like rare coins and fine art. This is further intensified by concerns about inflation and the volatility of traditional financial markets. Furthermore, the authentication and grading services provided by organizations such as PCGS and NGC enhance transparency and build trust within the market, encouraging greater participation. Finally, the expanding interest in cultural heritage and the unique narratives surrounding specific artifacts contribute significantly to the rising demand, particularly in niche segments like ancient jade carvings or historical documents. These interwoven factors collectively contribute to the sustained and impressive growth trajectory of the collectibles auction market.

Despite the impressive growth, the collectibles auction market faces several challenges. The market is inherently susceptible to economic downturns; periods of recession often witness decreased bidding activity and lower sale prices as buyers become more risk-averse. Furthermore, the authentication and provenance of collectibles remain a critical concern. Counterfeit items can significantly undermine market confidence and trust, demanding robust verification and authentication processes. Geopolitical instability and regulatory changes can also impact cross-border trade, potentially restricting the flow of high-value collectibles. Finally, the concentration of market power within a relatively small number of major auction houses creates potential for price manipulation and market imbalances. The lack of liquidity in certain niche segments can also impact sales, particularly for less widely recognized types of collectibles. Addressing these challenges through greater transparency, improved authentication methods, and increased regulatory oversight is crucial for the sustainable and responsible growth of the collectibles auction market.

The Asian market, particularly China, is expected to significantly dominate the collectibles auction market throughout the forecast period. This is driven by the considerable rise in HNWIs within the region, a deeply rooted cultural appreciation for art, antiques, and cultural relics, and the increasing strength of the Chinese Yuan. Specific segments fueling this dominance include:

Within the application segment, the Individual Auction market is expected to witness the most significant growth. This is due to increased individual participation in auctions driven by online accessibility and the ability to acquire unique, high-value items as investment or personal enjoyment. While the Cultural Relic Identification segment is vital for market integrity and trust, its growth is often tied to the growth of the overall market. Conversely, segments such as Personal Identification utilizing collectibles are a relatively niche application.

The United States and Europe also maintain significant market presence, driven by established auction houses and a large collector base, but the pace of growth is projected to be outstripped by the Asian market in the coming years. The total market value from these segments is projected to increase to multiple billions of dollars by 2033.

The collectibles auction industry is poised for sustained growth, fueled by several key catalysts. Rising disposable incomes in emerging economies expand the pool of potential buyers. Improved authentication technologies and increased transparency build trust among buyers. Further, effective online marketing strategies expand market reach, and the continued popularity of collectibles as alternative investments drive demand, all contributing to substantial future expansion.

This report provides a detailed analysis of the collectibles auction market, covering historical performance, current trends, future projections, and key players. It offers valuable insights into market dynamics, driving forces, challenges, and growth opportunities, allowing stakeholders to make informed strategic decisions within this dynamic sector. The extensive data analysis and projections provide a comprehensive understanding of the market landscape, positioning this report as an essential resource for investors, auction houses, and collectors alike.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Professional Coin Grading Service, Numismatic Guaranty Corporation, Nagel, Bonhams, Sotheby's, Christie's Auction, Davids Auction, Skinners, Heritage Dallas, Susanina's Auctions, Bunte Auction, Tom Harris Marshall Town, Leslie Hindman Auctioneers, John Moran Auctioneers Inc, Poly, Guardian Auctions, Rongbaozhai, Duoyunxuan, Council International, Xiling Yinshe, Ningbo Hanhai, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Collectibles Auction," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Collectibles Auction, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.