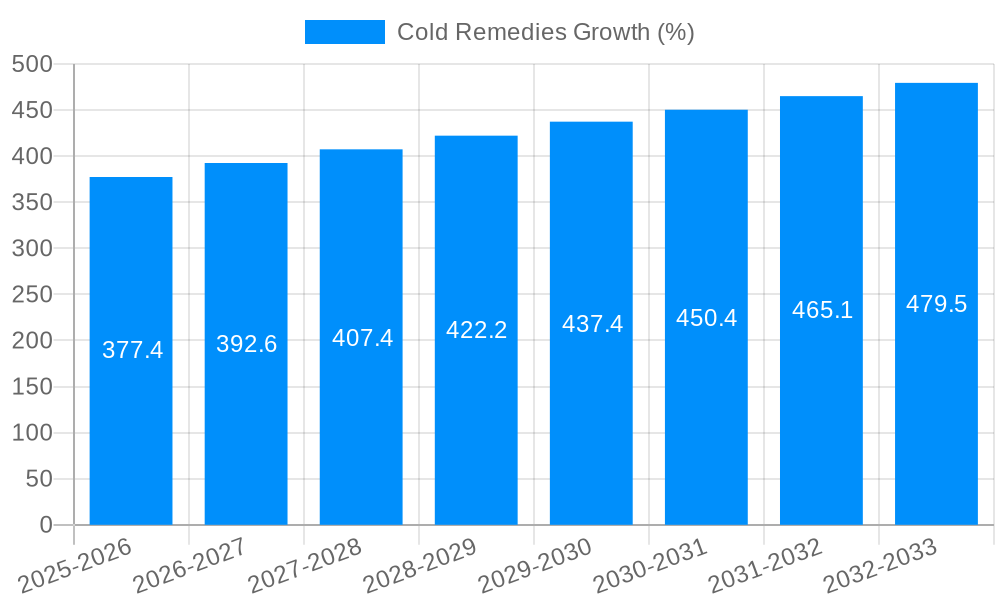

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold Remedies?

The projected CAGR is approximately 3.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cold Remedies

Cold RemediesCold Remedies by Type (Antihistamines, Expectorants, Bronchodilators, Decongestants, Antibiotics, Others), by Application (Hospital Pharmacies, Retail Pharmacies, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global cold remedies market, valued at $9,612.2 million in 2025, is projected to experience steady growth, driven by factors such as rising prevalence of respiratory infections, increasing healthcare expenditure, and growing self-medication practices. The Compound Annual Growth Rate (CAGR) of 3.8% from 2025 to 2033 indicates a consistent, albeit moderate, expansion. This growth is fueled by advancements in formulation technologies leading to more effective and convenient cold and flu treatments, a rising elderly population more susceptible to respiratory illnesses, and increased consumer awareness about preventive measures. However, the market faces restraints such as the increasing prevalence of antibiotic resistance (influencing the development of new formulations) and the potential for adverse effects from over-the-counter medications. The market is segmented across various product types (e.g., decongestants, analgesics, cough suppressants), distribution channels (pharmacies, online retailers), and geographic regions. Key players, including Reckitt Benckiser, Johnson & Johnson, GlaxoSmithKline, and Pfizer, are actively engaged in research and development, product innovation, and strategic collaborations to maintain their market share and capitalize on growth opportunities. The competitive landscape is characterized by both brand-name and generic products, with pricing strategies playing a significant role.

The historical period (2019-2024) likely witnessed similar growth patterns, albeit possibly influenced by fluctuations related to seasonal illnesses and global health events. Looking ahead, the forecast period (2025-2033) anticipates continued market expansion, primarily driven by the aforementioned factors. However, successful navigation of regulatory hurdles and addressing consumer concerns regarding ingredient safety will be crucial for sustained growth. Emerging markets in Asia-Pacific and Latin America present significant opportunities for expansion, driven by rising disposable incomes and increased access to healthcare services. Companies are likely to focus on product diversification, geographic expansion, and targeted marketing campaigns to capture these opportunities.

The global cold remedies market, valued at approximately $XX billion in 2024, is projected to reach $YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X% during the forecast period (2025-2033). This robust growth is fueled by several converging factors, including rising incidences of respiratory illnesses, an aging global population with increased susceptibility to colds, and the growing self-medication trend. The market’s historical period (2019-2024) saw significant fluctuations, influenced by seasonal variations in cold occurrences and the impact of the COVID-19 pandemic. While the pandemic initially disrupted supply chains and consumer behavior, it simultaneously highlighted the importance of readily available over-the-counter (OTC) cold remedies. The market has shown resilience and is poised for sustained expansion, driven by the ongoing need for effective and convenient cold symptom relief. Innovation in formulation, particularly the development of more targeted and efficacious products with fewer side effects, is also shaping market trends. Consumers are increasingly seeking natural remedies and products with enhanced convenience, such as single-dose packaging and convenient delivery systems. This preference is driving manufacturers to adapt their product portfolios and marketing strategies to cater to these evolving consumer preferences. Moreover, the rise of e-commerce and online pharmacies has expanded market accessibility, contributing significantly to the overall growth trajectory. The competitive landscape is dynamic, with established pharmaceutical giants and emerging players vying for market share through product differentiation, strategic alliances, and aggressive marketing campaigns. The increasing awareness of preventive measures and self-care, coupled with the readily available information regarding cold remedies, is also a key driver for the growing market. However, pricing pressures and the potential for generic competition remain significant factors to consider in the overall market outlook.

Several key factors are driving the expansion of the cold remedies market. Firstly, the global prevalence of common colds and other upper respiratory tract infections remains consistently high, creating a substantial and persistent demand for effective treatment options. This is exacerbated by factors like changing climate patterns, increased urbanization, and air pollution, all of which can contribute to weakening immune systems and increased susceptibility to illness. Secondly, the aging global population represents a significant market segment, as older adults are more prone to experiencing more severe cold symptoms and requiring longer recovery periods. Thirdly, the growing acceptance and practice of self-medication for minor ailments contributes significantly to the demand for OTC cold remedies. Consumers are increasingly comfortable managing mild cold symptoms without immediate medical intervention, opting for readily available products from pharmacies and retail outlets. Furthermore, the increasing disposable income in many developing economies is leading to greater affordability and accessibility of cold remedies. Finally, ongoing research and development efforts focused on creating improved formulations, enhanced delivery systems, and novel active ingredients are fueling innovation within the market, attracting consumers seeking more effective and convenient solutions.

Despite its positive growth trajectory, the cold remedies market faces several challenges. Regulatory hurdles and stringent approval processes for new drug formulations can delay product launches and limit market entry for innovative solutions. The rise of generic competition puts pressure on pricing strategies of established brands, affecting profitability. Fluctuations in raw material costs and supply chain disruptions can impact production efficiency and overall market stability. Concerns regarding the potential for adverse effects associated with long-term use of certain cold remedies, particularly those containing decongestants or pain relievers, can lead to consumer hesitation and preference for alternative treatments. Increasing awareness of potential side effects and interactions between different cold remedies necessitates clearer and more comprehensive labeling and consumer education initiatives. Furthermore, the growing popularity of natural and herbal remedies presents a challenge to traditional pharmaceutical cold remedies, forcing manufacturers to adapt and innovate to maintain competitiveness. Lastly, public health campaigns promoting preventive measures, such as vaccination and hygiene practices, can indirectly impact the market demand for cold remedies by reducing the overall incidence of illness.

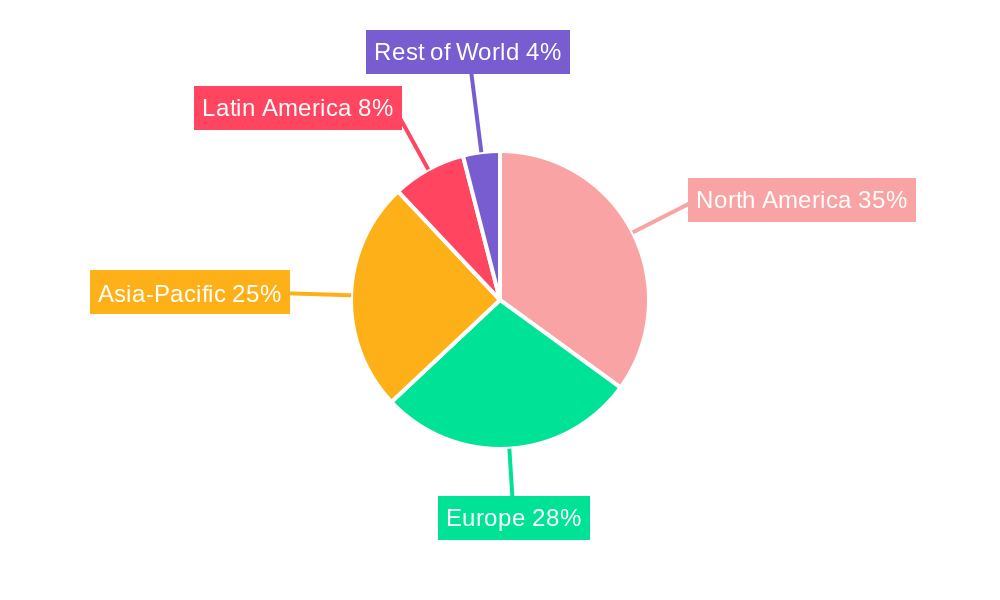

North America: This region is expected to maintain a dominant position, driven by high healthcare expenditure, widespread self-medication practices, and a substantial elderly population. The US, in particular, represents a significant market due to its mature healthcare infrastructure and high per capita consumption of OTC medications.

Europe: The European market is characterized by a diverse range of regulatory frameworks and consumer preferences. Western European countries generally exhibit higher per capita consumption than Eastern European nations, reflecting differences in healthcare access and purchasing power.

Asia-Pacific: This region is experiencing rapid growth, driven by a burgeoning middle class, increasing awareness of healthcare, and rising prevalence of respiratory illnesses. China and India are key growth drivers within this region.

Dominant Segments:

Decongestants: This segment remains a cornerstone of the market, driven by the persistent need for relief from nasal congestion, a common symptom of the common cold.

Cough suppressants: These products are widely used to alleviate coughing associated with colds and other respiratory illnesses.

Analgesics/Pain Relievers: Products offering pain relief are essential components of many cold remedy formulations, addressing symptoms such as headache, muscle aches, and fever.

Combination Products: Many consumers prefer combination products that offer multiple symptom relief in a single formulation, driving growth in this segment.

In summary, while North America currently leads in terms of market size, the Asia-Pacific region is projected to experience the fastest growth rate during the forecast period due to the expanding middle class and rising healthcare expenditure. The combination product segment is likely to continue its strong performance as consumers seek comprehensive relief from multiple cold symptoms.

The cold remedies market's growth is propelled by several key factors. The rising prevalence of respiratory illnesses, coupled with an aging global population more susceptible to colds, fuels consistent demand. The growing acceptance of self-medication and increasing disposable incomes in developing economies further boost market accessibility and affordability. Innovative product development, focusing on more effective and convenient formulations, caters to evolving consumer preferences and enhances market appeal. These combined factors create a fertile ground for continued expansion in the years to come.

This report provides a thorough analysis of the global cold remedies market, covering historical data (2019-2024), the estimated year (2025), and a detailed forecast up to 2033. It incorporates market sizing, segmentation analysis, competitive landscape assessment, and trend identification to deliver a comprehensive understanding of this dynamic market. The report also identifies key growth drivers and challenges, providing valuable insights for stakeholders looking to navigate this evolving landscape successfully. The inclusion of detailed company profiles, significant developments, and regional analyses provides a complete picture of this essential sector within the healthcare industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.8%.

Key companies in the market include Reckitt Benckiser, Johnson & Johnson, GlaxoSmithKline, Novartis, Bayer, AstraZeneca, Sun Pharmaceutical Industries, Pfizer, Prestige Brands, .

The market segments include Type, Application.

The market size is estimated to be USD 9612.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cold Remedies," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cold Remedies, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.