1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold Formed Metal Component?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cold Formed Metal Component

Cold Formed Metal ComponentCold Formed Metal Component by Application (Automobile Industry, Aerospace, Medical Industry, Electrical Industry, Others, World Cold Formed Metal Component Production ), by Type (Tube, Wire, Sheet Metal, Others, World Cold Formed Metal Component Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

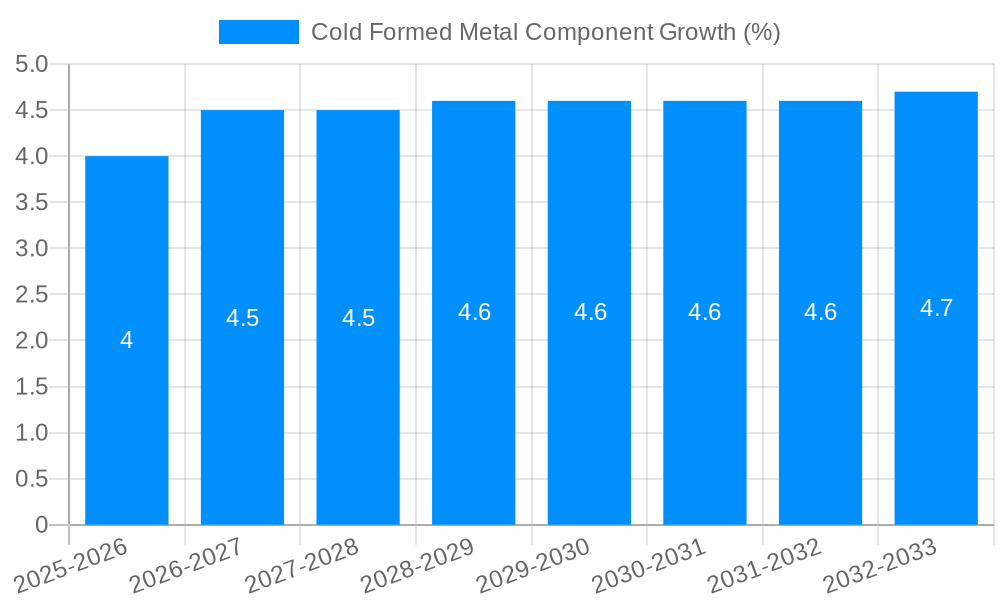

The global Cold Formed Metal Component market is poised for significant growth, projected to reach an estimated market size of approximately $XXX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% expected throughout the forecast period from 2025 to 2033. This expansion is primarily fueled by the burgeoning demand across key industries such as the automobile industry, aerospace, and the medical sector, all of which rely heavily on the precision, strength, and cost-effectiveness offered by cold-formed metal parts. The automotive sector, in particular, is a major consumer, driven by advancements in vehicle design and the increasing production of lightweight yet durable components. Similarly, the aerospace industry's stringent requirements for high-performance materials and components are contributing to market uplift. Furthermore, the medical industry's growing need for specialized, intricate metal parts for surgical instruments and implants is creating new avenues for growth. Emerging applications in electrical components and other diverse industrial sectors are also playing a crucial role in expanding the market's reach.

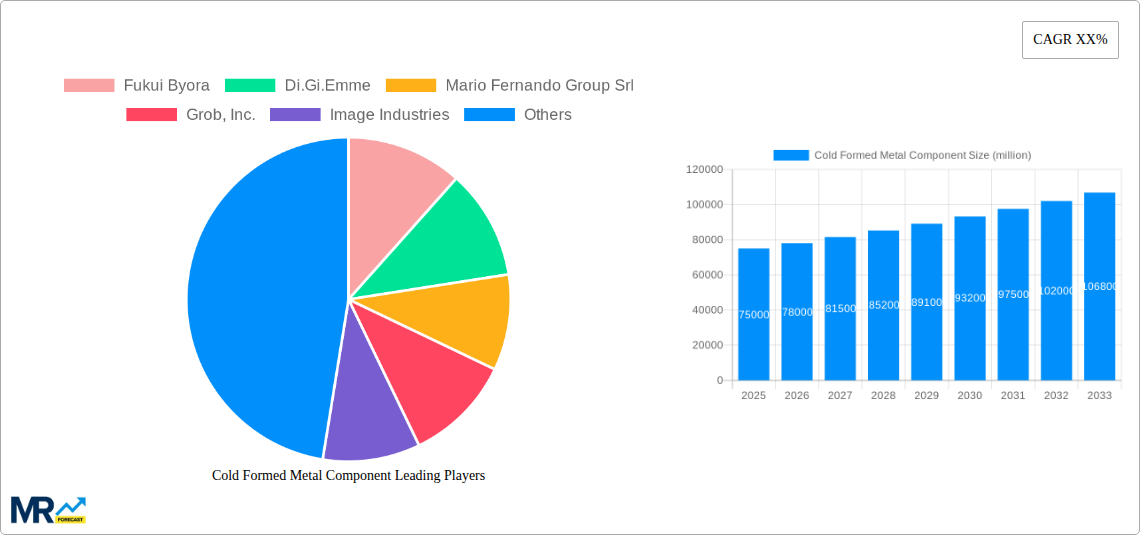

However, the market also faces certain restraints that could temper its growth trajectory. These include the initial capital investment required for advanced cold forming machinery and the potential fluctuations in raw material prices, particularly for specialized alloys. Skilled labor availability for operating and maintaining sophisticated cold forming equipment can also pose a challenge. Despite these hurdles, ongoing technological innovations, such as advancements in tooling, automation, and material science, are expected to mitigate these restraints. The development of new alloys with enhanced properties and improved manufacturing processes will further drive efficiency and broaden the application spectrum. The market is segmented by application, with the automobile industry holding a dominant share, followed by aerospace and medical industries. By type, tubes, wire, and sheet metal components constitute the primary product categories. Leading players like Fukui Byora, Grob, Inc., and The Federal Group are actively investing in research and development to enhance their product offerings and expand their global footprint.

Here is a unique report description for Cold Formed Metal Components, incorporating the requested elements and structure:

The global cold formed metal component market is poised for significant expansion and evolving dynamics throughout the study period of 2019-2033, with the base year of 2025 serving as a critical benchmark. XXX, a key metric indicating the sustained demand and adoption across various sectors, is projected to witness robust growth, underscoring the increasing reliance on these precision-engineered parts. The historical period (2019-2024) has laid a strong foundation, characterized by steady advancements in manufacturing techniques and a broadening application spectrum. As we move into the estimated year of 2025 and the subsequent forecast period (2025-2033), several overarching trends are expected to shape the market landscape. The increasing emphasis on lightweighting across industries like automotive and aerospace will continue to fuel the demand for high-strength, low-weight cold formed components, often replacing heavier, traditionally manufactured parts. Furthermore, the drive towards automation and Industry 4.0 principles within manufacturing facilities is leading to a demand for cold formed components that are designed for seamless integration into automated assembly lines, requiring tighter tolerances and consistent quality. The medical industry, with its stringent requirements for biocompatibility and precision, is also emerging as a significant growth avenue, with specialized cold formed implants and instruments witnessing escalating adoption. The electrical industry, driven by the expansion of renewable energy infrastructure and sophisticated electronic devices, will continue to be a substantial consumer of cold formed parts for connectors, housings, and internal structural elements. The "Others" segment, encompassing diverse applications such as construction, consumer goods, and industrial machinery, is expected to exhibit steady, albeit more fragmented, growth. The production of cold formed metal components, measured in millions of units, is anticipated to see a considerable uptick, driven by both increased volume from established applications and the penetration into new and emerging markets. Innovations in materials science, particularly the development of advanced alloys amenable to cold forming, will also play a crucial role in expanding the capabilities and applications of these components. The sustainability agenda is also influencing trends, with a growing preference for cold formed parts that contribute to energy efficiency in end-use products and are manufactured using processes that minimize waste and energy consumption.

The market for cold formed metal components is being propelled by a confluence of powerful driving forces that are fundamentally reshaping manufacturing and product design. A primary driver is the relentless pursuit of lightweighting across critical industries. In the automotive sector, stringent fuel efficiency regulations and the growing adoption of electric vehicles necessitate components that reduce overall vehicle weight without compromising structural integrity. Cold forming excels in producing strong, complex shapes from lighter gauge materials, making it an ideal solution. Similarly, the aerospace industry demands components that offer exceptional strength-to-weight ratios for aircraft structures and internal systems. The growing demand for high-precision and complex geometries is another significant impetus. Cold forming processes allow for the creation of intricate shapes and features with excellent dimensional accuracy and surface finish, often in a single operation, reducing the need for secondary machining and assembly. This precision is vital for applications in the medical industry, where implants and surgical instruments require exact specifications, and in the electronics sector, where miniaturization and tight tolerances are paramount. Furthermore, cost-effectiveness and manufacturing efficiency remain key attractions. Cold forming is a highly repeatable and high-speed process that minimizes material waste compared to subtractive manufacturing methods. This leads to lower production costs, making cold formed components a competitive choice for high-volume applications. The increasing adoption of advanced materials that are ductile enough for cold forming, such as specialized steel alloys, aluminum alloys, and even some exotic metals, is also expanding the application range and performance capabilities of these components. Finally, the trend towards automation and smart manufacturing in end-user industries means that components designed for automated assembly and integration are in high demand, a niche where cold formed parts often excel due to their consistent quality and designed-in features.

Despite the robust growth trajectory, the cold formed metal component market is not without its inherent challenges and restraints that can impede its full potential. A significant hurdle is the initial capital investment required for specialized tooling and machinery. The precision required for cold forming necessitates high-quality dies and punches, which can be expensive to design and manufacture, particularly for complex parts or for smaller production runs. This can be a barrier to entry for smaller manufacturers or for companies looking to produce highly customized components. Material limitations also pose a restraint. While the range of formable materials is expanding, certain high-strength or brittle alloys can be challenging or impossible to cold form without defects such as cracking or fracturing. This necessitates careful material selection and process optimization. The complexity of the forming process for extremely intricate designs can also be a limiting factor. While cold forming excels at producing many complex shapes, certain very deep draws, sharp undercuts, or extreme aspect ratios might still require secondary operations or alternative manufacturing methods, adding to cost and lead times. Energy consumption and environmental considerations related to the high pressures involved in cold forming, coupled with the lubrication requirements, can also be a point of concern for environmentally conscious manufacturers, although efforts are continuously being made to optimize these aspects. Fluctuations in raw material prices, particularly for metals like steel and aluminum, can impact the profitability and pricing strategies of cold formed component manufacturers, introducing an element of economic volatility. Finally, the availability of skilled labor with expertise in tool design, process engineering, and operating complex cold forming machinery can be a bottleneck, especially as the industry continues to innovate and adopt advanced technologies.

Within the global Cold Formed Metal Component market, the Automobile Industry stands out as a dominant application segment, with its insatiable demand for a vast array of components. This segment consistently accounts for a significant portion of the total market volume, measured in millions of units, due to the sheer scale of vehicle production worldwide. The automotive industry's reliance on cold formed parts spans from critical structural elements like chassis components, body-in-white reinforcements, and suspension parts to smaller yet vital items such as fasteners, bolts, nuts, and various brackets. The inherent advantages of cold forming – its ability to produce high-strength, lightweight, and cost-effective parts with excellent precision – directly align with the automotive sector's key objectives of improving fuel efficiency, enhancing safety, and reducing manufacturing costs. The push for electrification further amplifies this dominance, as electric vehicles, while different in their powertrain, still require a multitude of robust and precisely formed metal components for their chassis, battery enclosures, motor mounts, and interior fittings.

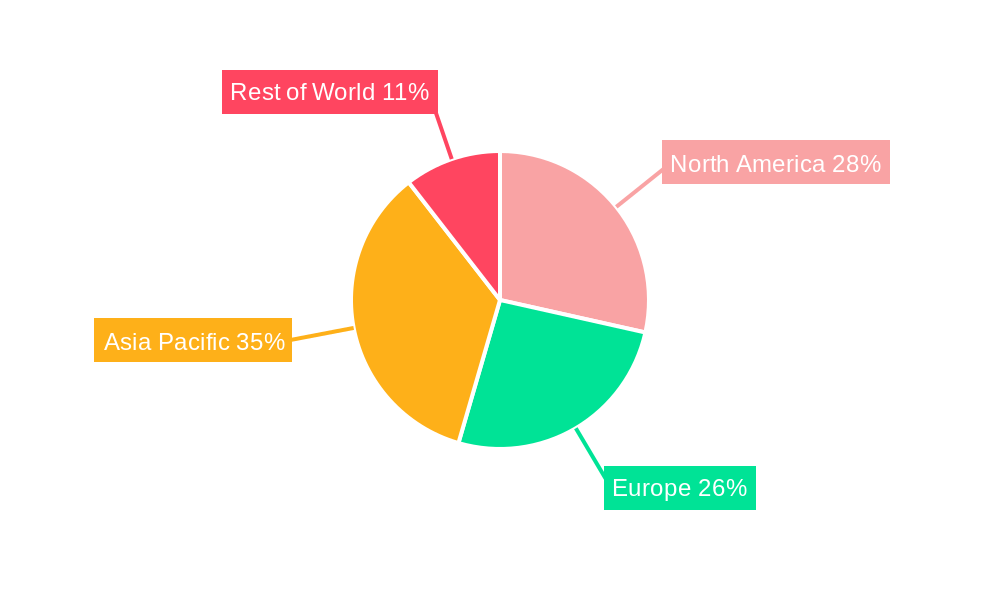

Geographically, Asia-Pacific is poised to be a dominant region in the cold formed metal component market. This dominance is largely driven by:

While Asia-Pacific takes the lead, North America and Europe remain crucial markets, driven by their established automotive and aerospace industries and a strong emphasis on technological innovation and high-value applications. The Type of cold formed metal component that is expected to dominate is Sheet Metal. This is due to its versatility and widespread application across multiple sectors, particularly in automotive body panels, appliance housings, construction materials, and electrical enclosures. The ability to form thin, yet strong, sheet metal into complex shapes with high precision makes it an indispensable material for modern manufacturing. However, Wire and Tube segments will also witness significant growth, driven by their specific applications in fasteners, springs, automotive tubing systems, and structural components. The "Others" category, encompassing a broad spectrum of specialized components, will also contribute to the overall market volume, reflecting the adaptability of cold forming to niche requirements.

The cold formed metal component industry is experiencing robust growth fueled by several key catalysts. The relentless global push for lightweighting in transportation and aerospace sectors is a primary driver, as cold forming enables the creation of high-strength, low-weight parts. Furthermore, the increasing demand for precision and complex geometries in industries like medical and electronics, which cold forming can efficiently deliver, is opening new avenues. The cost-effectiveness and high-volume production capabilities of cold forming make it an attractive option for mass-market applications. Finally, advances in materials science, leading to the development of more formable advanced alloys, are expanding the application scope and performance of cold formed components, further accelerating industry growth.

This report offers a comprehensive analysis of the global cold formed metal component market, providing invaluable insights for stakeholders. It delves into intricate market trends, exploring the nuanced shifts in demand and application from the historical period of 2019-2024 through the estimated year of 2025 and the extensive forecast period of 2025-2033. The report meticulously details the driving forces propelling market growth, such as the imperative for lightweighting and the pursuit of precision, while also critically examining the challenges and restraints that manufacturers may encounter. A significant portion of the report is dedicated to identifying and elaborating on the key regions and segments poised for dominance, with a particular focus on the pervasive influence of the Automobile Industry and the burgeoning potential of Sheet Metal as a primary component type. The report also highlights crucial growth catalysts that are expected to shape the industry's future trajectory. Furthermore, it presents a definitive list of leading players and chronicles significant developmental milestones and technological advancements within the sector, offering a forward-looking perspective on the evolution of cold formed metal components.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Fukui Byora, Di.Gi.Emme, Mario Fernando Group Srl, Grob, Inc., Image Industries, Norstan, National Machinery, MW Components, The Federal Group, McElroy Metal, Deringer Manufacturing Company, ARNOLD UMFORMTECHNIK GmbH, Protocase, Tri-State Cold-Formed Steel Components, Marcegaglia, CFS Profile, Construction Metal Forming, Bilstein & Siekermann, MOESCHTER, Simpson Strong-Tie, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cold Formed Metal Component," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cold Formed Metal Component, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.