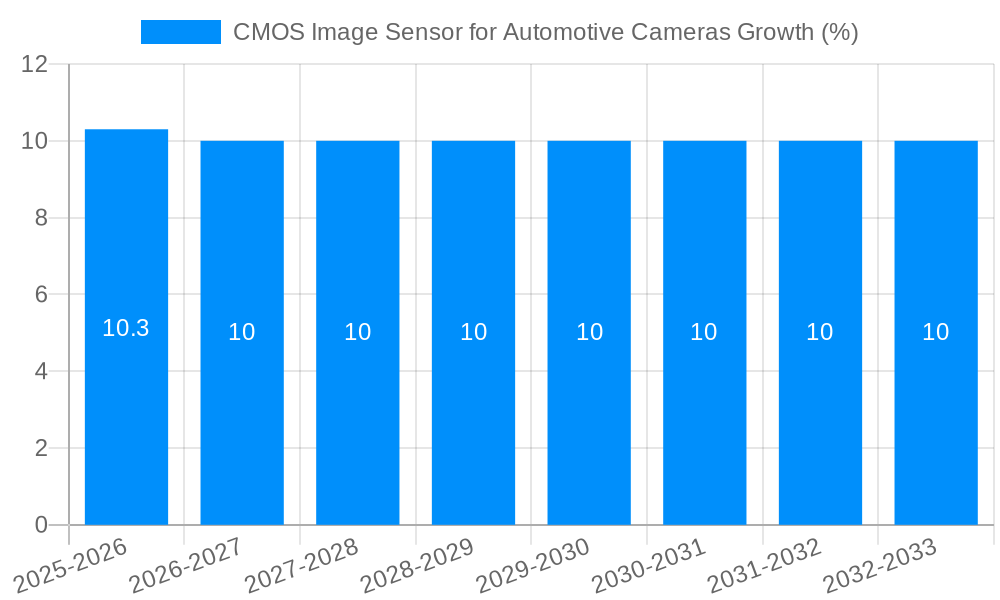

1. What is the projected Compound Annual Growth Rate (CAGR) of the CMOS Image Sensor for Automotive Cameras?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

CMOS Image Sensor for Automotive Cameras

CMOS Image Sensor for Automotive CamerasCMOS Image Sensor for Automotive Cameras by Type (Resolution ≤1.3MP, Resolution 1.3MP-3MP, Resolution >3MP, World CMOS Image Sensor for Automotive Cameras Production ), by Application (Autonomous Driving, Surround View Cameras, E-Mirrors, In-Cabin Monitoring, Others, World CMOS Image Sensor for Automotive Cameras Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

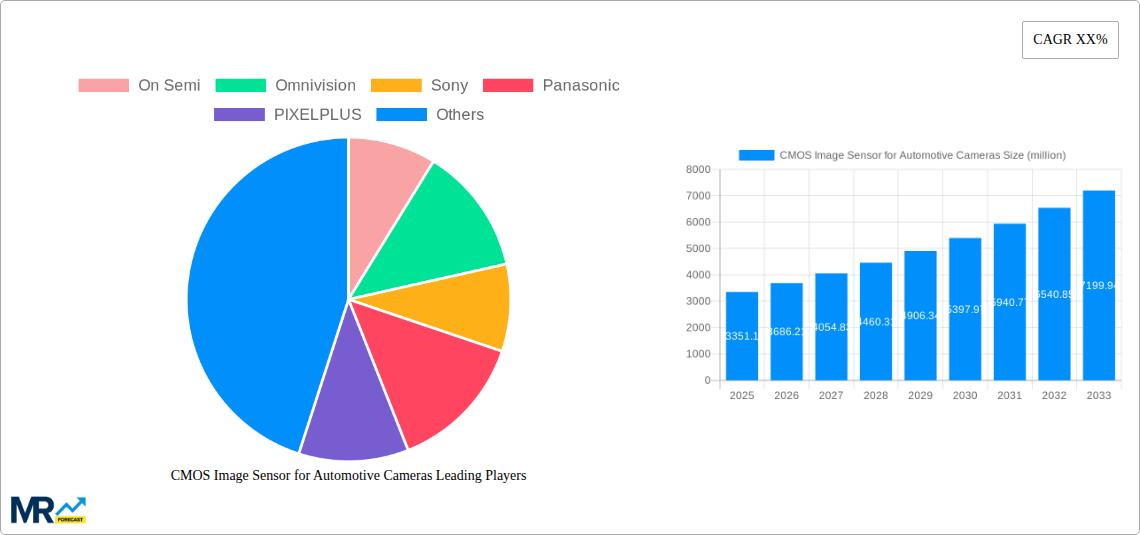

The global market for CMOS image sensors in automotive cameras is experiencing robust growth, projected to reach a substantial market size of approximately USD 3351.1 million by 2025. This expansion is primarily fueled by the escalating demand for advanced driver-assistance systems (ADAS) and the rapid evolution towards autonomous driving. Key growth drivers include increasing vehicle safety regulations worldwide, the integration of sophisticated sensing technologies for enhanced situational awareness, and the rising adoption of features like surround-view cameras, digital rearview mirrors (e-mirrors), and in-cabin monitoring systems. These applications necessitate high-performance image sensors capable of delivering exceptional image quality under diverse lighting conditions and environmental challenges. The market is further propelled by continuous technological advancements in sensor resolution, dynamic range, and low-light performance, enabling more precise object detection and recognition.

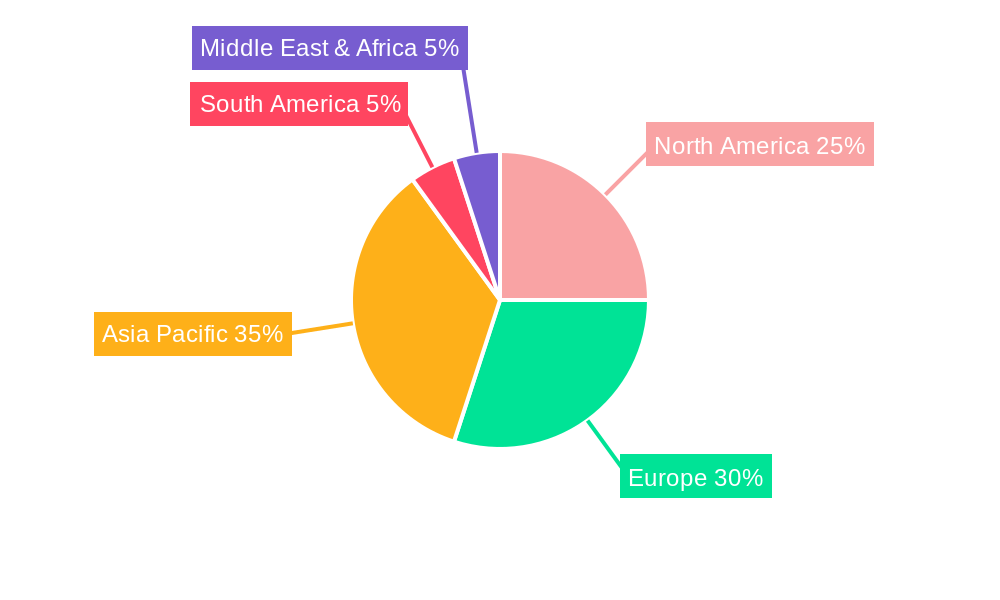

The market is segmented by resolution, with a significant concentration in the 1.3MP-3MP and >3MP categories, reflecting the need for detailed imaging in complex automotive scenarios. The type segment is characterized by a strong preference for higher resolution sensors to support advanced functionalities. Major players like Sony, Omnivision, On Semi, and Samsung are at the forefront of innovation, investing heavily in research and development to offer cutting-edge solutions. Geographically, Asia Pacific, particularly China and Japan, along with North America and Europe, are key markets due to the high concentration of automotive manufacturing and the early adoption of advanced automotive technologies. While the market is poised for significant growth, potential restraints include the high cost of implementation for some advanced sensor technologies, the need for standardization in certain areas, and the complex supply chain dynamics within the semiconductor industry. However, the overarching trend towards vehicle electrification and intelligent mobility ensures a positive trajectory for the CMOS image sensor automotive camera market throughout the forecast period.

This comprehensive report delves into the dynamic global market for CMOS image sensors specifically designed for automotive camera applications. The study encompasses a robust Study Period of 2019-2033, with a Base Year of 2025 serving as a crucial benchmark and an Estimated Year also in 2025 for immediate assessment. The detailed analysis extends through the Forecast Period of 2025-2033, building upon insights gathered from the Historical Period of 2019-2024.

The report meticulously analyzes the market landscape, examining key players, technological advancements, emerging trends, and the driving forces and challenges shaping the industry. It quantifies market opportunities by segmenting the analysis based on sensor resolution and application, providing granular insights into specific market niches. Furthermore, the report identifies pivotal regions and countries expected to dominate the market, offering strategic guidance for stakeholders.

The automotive industry's relentless pursuit of enhanced safety, advanced driver-assistance systems (ADAS), and eventually, fully autonomous driving, is the primary catalyst for the burgeoning CMOS image sensor market. The year 2025 stands as a critical inflection point, with the World CMOS Image Sensor for Automotive Cameras Production projected to reach unprecedented levels, potentially exceeding 500 million units. This surge is driven by an increasing camera proliferation per vehicle, with advanced models incorporating an average of 8-12 cameras for functions like surround-view, adaptive cruise control, lane keeping, and night vision. The transition from traditional CCD sensors to CMOS technology is nearly complete in automotive, owing to CMOS's superior speed, lower power consumption, and higher integration capabilities. The demand for higher resolution sensors, particularly those exceeding 3MP, is expected to witness substantial growth as vehicles are equipped with more sophisticated imaging systems capable of capturing finer details essential for object recognition and scene understanding. This trend is further amplified by regulatory mandates and consumer expectations for improved vehicle safety features. The increasing adoption of e-mirrors, replacing traditional rearview mirrors with digital displays powered by cameras, also contributes significantly to the demand for high-performance CMOS image sensors. The continuous innovation in sensor technology, focusing on improved low-light performance, wider dynamic range (WDR), and higher frame rates, is crucial for addressing the diverse environmental conditions encountered by vehicles, from bright daylight to nocturnal driving. The integration of artificial intelligence (AI) at the edge, directly within the sensor or image signal processor (ISP), is another significant trend, enabling real-time processing of visual data for faster decision-making in ADAS and autonomous systems. By 2025, the market is expected to see a robust interplay between established semiconductor giants and emerging specialized players, all vying for market share in this rapidly evolving and highly lucrative sector. The convergence of sensor technology with advanced algorithms will redefine automotive perception systems, leading to safer and more intelligent vehicles.

The automotive industry's monumental shift towards electrification and automation serves as the primary engine driving the demand for CMOS image sensors. As automakers integrate increasingly sophisticated ADAS and autonomous driving capabilities, the necessity for robust and high-performance imaging solutions becomes paramount. The integration of multiple cameras across various applications, from object detection for forward-facing cameras to surround-view systems for enhanced situational awareness, directly translates into a higher volume of CMOS image sensors per vehicle. For instance, the Application: Autonomous Driving segment alone is expected to witness exponential growth, requiring advanced sensors capable of perceiving complex traffic scenarios with exceptional clarity and reliability. Furthermore, the growing regulatory pressure globally to enhance vehicle safety standards, coupled with consumer demand for advanced safety features, acts as a significant propellant. Features like automatic emergency braking, pedestrian detection, and traffic sign recognition are heavily reliant on accurate visual data provided by CMOS image sensors. The continuous miniaturization and cost reduction of CMOS sensor technology, making them more accessible and cost-effective for integration into a wider range of vehicle models, including mid-range and entry-level segments, is also a crucial driver. The proliferation of e-mirrors, offering a wider field of view and reduced blind spots compared to traditional mirrors, is another emerging application that contributes to the escalating demand. By 2025, the synergy between advanced sensor capabilities, powerful image signal processors, and sophisticated AI algorithms will unlock new levels of vehicle autonomy and safety, making CMOS image sensors an indispensable component in the modern automobile.

Despite the robust growth trajectory, the CMOS image sensor market for automotive cameras faces several significant challenges and restraints that could temper its expansion. One of the most critical is the stringent automotive-grade qualification and reliability requirements. Sensors must withstand extreme temperature variations, vibration, humidity, and electromagnetic interference over the lifespan of a vehicle. Achieving these certifications is a complex and time-consuming process, often involving extensive testing and validation, which can limit the pace of innovation and market entry for new players. Supply chain disruptions, particularly those experienced in recent years, pose another significant hurdle. The automotive industry is highly sensitive to component shortages, and the reliance on specialized fabrication facilities for advanced CMOS image sensors can lead to production bottlenecks. Geopolitical tensions and trade policies can further exacerbate these supply chain vulnerabilities. The rapid pace of technological advancement itself can be a double-edged sword. While innovation drives demand for higher-performing sensors, it also leads to shorter product lifecycles and increased R&D investment requirements for manufacturers to stay competitive. Companies must constantly innovate to keep up with the demand for higher resolutions (e.g., Resolution >3MP), improved low-light performance, and enhanced dynamic range, which requires significant capital expenditure. Furthermore, cost pressures within the automotive industry, driven by the highly competitive nature of the market, can constrain the ASP (Average Selling Price) of image sensors. Automakers are constantly seeking cost-effective solutions, which puts pressure on sensor manufacturers to optimize their production processes and wafer costs. The integration of complex imaging systems also demands sophisticated image signal processors (ISPs) and robust software algorithms, requiring a holistic approach to system design, which can be a barrier to entry for some. Finally, data security and privacy concerns associated with cameras capturing internal and external vehicle data are emerging as a growing area of focus, which may necessitate additional security measures and protocols in sensor design and data handling.

The Asia-Pacific region, particularly China, is poised to be a dominant force in the global CMOS image sensor for automotive cameras market, driven by its massive automotive production capacity and the accelerating adoption of ADAS and autonomous driving technologies within its domestic market. By 2025, China's contribution to the World CMOS Image Sensor for Automotive Cameras Production is expected to be substantial, potentially accounting for over 40% of global output. This dominance is fueled by several factors:

Within the segment analysis, Application: Autonomous Driving is expected to be the most significant growth driver, followed closely by Surround View Cameras.

While other segments like E-Mirrors and In-Cabin Monitoring are also showing promising growth, the sheer volume and technological complexity demanded by autonomous driving and surround-view systems will make them the dominant forces shaping the market landscape in the coming years.

The relentless push for enhanced vehicle safety and the accelerating development of autonomous driving technologies are the primary growth catalysts for the CMOS image sensor industry. The increasing mandatory inclusion of ADAS features, driven by regulatory bodies and consumer demand for improved safety, directly fuels the need for more sophisticated and higher-resolution sensors. Furthermore, the automotive industry's rapid transition towards higher levels of autonomy necessitates the deployment of a greater number of cameras per vehicle, each equipped with advanced imaging capabilities to perceive and interpret complex driving environments. The continuous innovation in sensor technology, focusing on improved low-light performance, wider dynamic range, and higher frame rates, further catalyzes adoption by enabling a wider range of operational scenarios and enhanced reliability.

This comprehensive report offers an in-depth analysis of the global CMOS image sensor market for automotive cameras, providing critical insights for stakeholders across the value chain. The report meticulously examines market dynamics, including historical trends from 2019-2024, a detailed assessment of the Base Year 2025, and robust forecasts for the Forecast Period 2025-2033. It dissects the market by key segments, including resolution types (≤1.3MP, 1.3MP-3MP, >3MP) and critical applications such as Autonomous Driving, Surround View Cameras, E-Mirrors, and In-Cabin Monitoring, quantifying the World CMOS Image Sensor for Automotive Cameras Production. The report identifies the key driving forces, such as the increasing demand for ADAS and the pursuit of autonomy, alongside the inherent challenges like stringent automotive qualification and supply chain complexities. It further pinpoints dominant regions and countries, with a strong focus on the Asia-Pacific, and identifies the key growth catalysts that will shape the industry's future. Detailed company profiles of leading players and a timeline of significant technological developments are also included, offering a holistic and actionable view of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include On Semi, Omnivision, Sony, Panasonic, PIXELPLUS, STMicroelectronics, Samsung, Canon, BYD Semiconductor, SmartSens, GalaxyCore, .

The market segments include Type, Application.

The market size is estimated to be USD 3351.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "CMOS Image Sensor for Automotive Cameras," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the CMOS Image Sensor for Automotive Cameras, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.