1. What is the projected Compound Annual Growth Rate (CAGR) of the Clinical Peptide?

The projected CAGR is approximately 8.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Clinical Peptide

Clinical PeptideClinical Peptide by Type (Signaling Peptides, Carrier Peptides, Enzyme-Inhibiting Peptides, Neurotransmitter-Inhibiting Peptides, Antimicrobial Peptides), by Application (Preventive Medicine, Protein Production Services), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

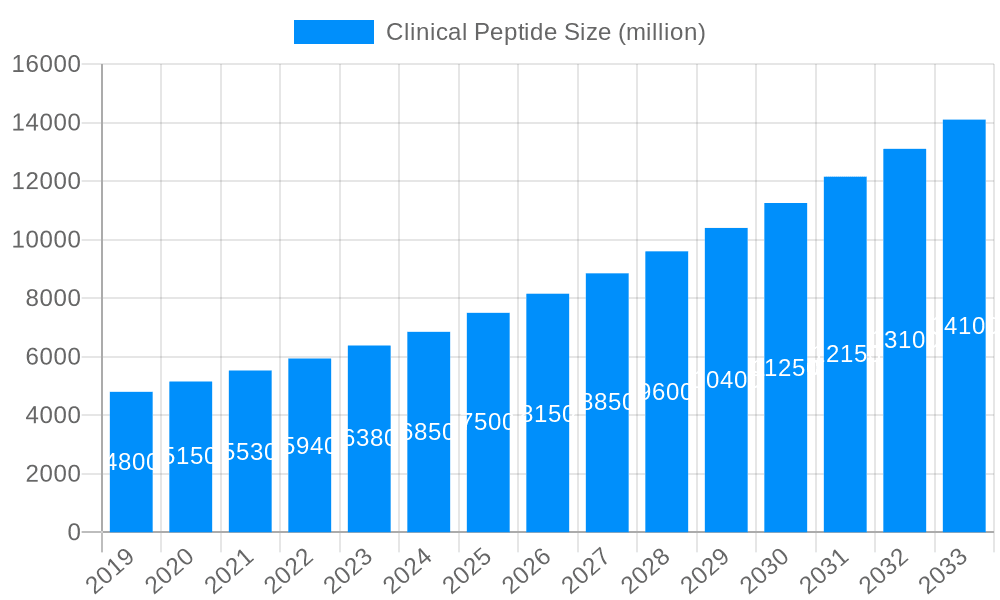

The global clinical peptide market is poised for significant expansion, driven by escalating chronic disease prevalence, the growing demand for personalized therapeutics, and continuous advancements in peptide synthesis and drug delivery systems. The market, valued at $49.7 billion in the base year 2025, is projected to achieve a compound annual growth rate (CAGR) of 8.1%, reaching substantial market size by 2033. This robust growth is primarily attributed to the extensive therapeutic applications of peptides in critical areas such as oncology, diabetes management, and cardiovascular disease treatment. Increased peptide utilization in clinical trials and heightened investments in peptide-centric research and development further underscore market momentum.

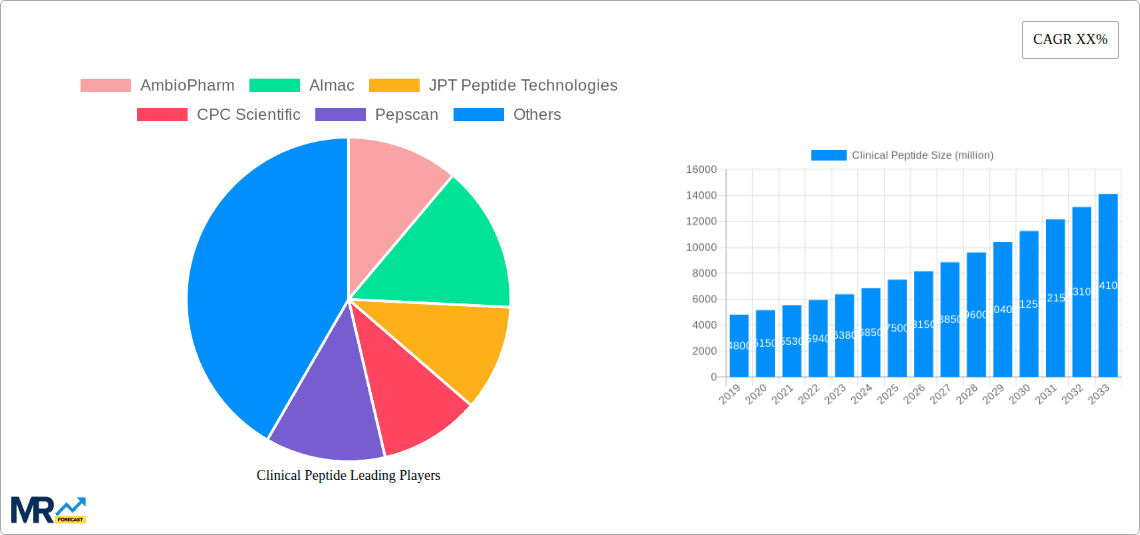

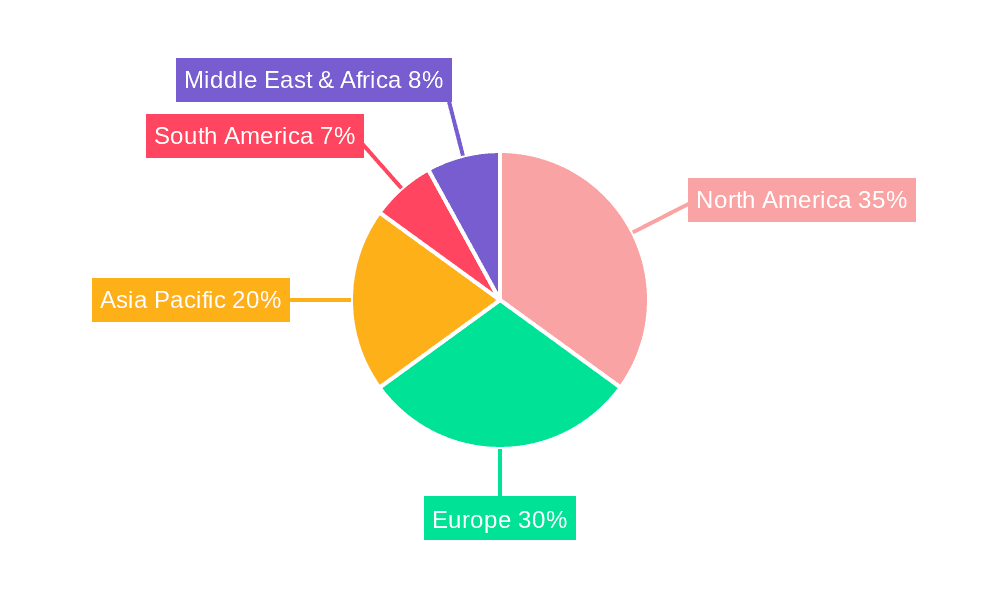

Key factors influencing market dynamics include the inherent cost of peptide synthesis and purification, challenges related to peptide stability and effective delivery, and comparatively extended development timelines. Nevertheless, ongoing innovations in peptide engineering and manufacturing are anticipated to address these hurdles, thereby unlocking broader market potential. The market is comprehensively segmented by peptide type (e.g., linear, cyclic), therapeutic application (e.g., oncology, immunology), and administration route (e.g., intravenous, subcutaneous). Leading market participants, including AmbioPharm, Almac, and JPT Peptide Technologies, are strategically focused on pioneering novel peptide-based therapies and enhancing their manufacturing capacities to address burgeoning demand. Regional market leadership is currently observed in North America and Europe, with Asia-Pacific projected for accelerated growth due to rising healthcare investments and an expanding patient demographic.

The clinical peptide market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. The study period from 2019 to 2033 reveals a consistently upward trajectory, driven by a confluence of factors. The estimated market value in 2025 serves as a significant benchmark, highlighting the accelerating pace of innovation and adoption within the pharmaceutical and biotechnology sectors. Key market insights include a burgeoning demand for novel therapeutics, particularly in the areas of oncology, endocrinology, and immunology. The increasing prevalence of chronic diseases and the limitations of traditional small molecule drugs are fueling the search for more targeted and effective peptide-based therapies. Furthermore, advancements in peptide synthesis and delivery technologies are significantly lowering production costs and improving efficacy, making clinical peptides a more attractive proposition for pharmaceutical companies. The historical period (2019-2024) demonstrates a steady rise in market share, indicating a solidified market position for clinical peptides, with the forecast period (2025-2033) expected to witness even more rapid expansion due to the increasing number of peptides entering clinical trials and gaining regulatory approvals. This trend is further amplified by substantial investments in research and development by both large pharmaceutical companies and smaller biotechnology firms, reflecting a widespread belief in the future potential of peptide therapeutics. The base year of 2025 represents a critical juncture, marking a significant shift towards greater market penetration and widespread acceptance of peptide-based treatment modalities.

Several key factors are driving the expansion of the clinical peptide market. The rising prevalence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, is creating an urgent need for innovative therapeutic solutions. Traditional small-molecule drugs often lack the target specificity and efficacy required to effectively address these complex conditions, opening the door for the superior precision and bioactivity offered by peptides. Simultaneously, significant advancements in peptide synthesis technologies, including solid-phase peptide synthesis (SPPS) and recombinant DNA technology, have reduced production costs and improved the efficiency of manufacturing clinical-grade peptides. This has made peptide-based therapies more economically viable for pharmaceutical companies and, consequently, more accessible to patients. Moreover, innovative delivery systems, such as liposomes and nanoparticles, are being developed to overcome challenges associated with peptide stability and bioavailability, enhancing their therapeutic potential. The increased investment in research and development by both pharmaceutical giants and emerging biotech firms further underscores the growing recognition of clinical peptides as a promising therapeutic modality, contributing to a robust pipeline of novel peptide drugs entering various stages of clinical development. Finally, the increasing number of successful clinical trials and regulatory approvals for peptide-based therapeutics are creating a positive feedback loop, encouraging further investment and development within this sector.

Despite its considerable promise, the clinical peptide market faces several challenges. The relatively short half-life of many peptides necessitates frequent administration, potentially impacting patient compliance and treatment outcomes. Furthermore, peptide synthesis can be complex and expensive, especially for longer or more complex peptide sequences, potentially limiting accessibility. Issues related to peptide stability and degradation, both during manufacturing and in vivo, remain significant obstacles. These challenges require innovative solutions, such as the development of more stable peptide analogs or sophisticated drug delivery systems. Regulatory hurdles associated with clinical development and approval of peptide-based therapies also present a substantial challenge. The stringent requirements for demonstrating efficacy and safety can be both time-consuming and costly, potentially delaying market entry for promising peptide therapeutics. Finally, competition from other therapeutic modalities, such as monoclonal antibodies and small molecule drugs, continues to pose a significant challenge, requiring differentiation based on superior efficacy, safety profiles, or specific target applications. Overcoming these challenges requires collaborative efforts between scientists, pharmaceutical companies, and regulatory bodies to advance the field of peptide therapeutics.

The North American and European markets currently hold significant shares of the clinical peptide market due to well-established research infrastructure, robust regulatory frameworks, and high healthcare expenditure. However, the Asia-Pacific region is experiencing rapid growth, driven by increasing healthcare spending, a rising prevalence of chronic diseases, and a growing pharmaceutical industry.

Segments: The oncology segment is currently a major driver of market growth, given the promising results of various peptide-based cancer therapies in clinical trials. However, the endocrinology and immunology segments are also exhibiting strong growth potential, reflecting a need for more targeted and effective treatment options for hormone-related disorders and immune-mediated diseases.

The market is also segmented by peptide type (linear, cyclic, modified), application (therapeutic, diagnostic), and by route of administration (oral, intravenous, subcutaneous). These subdivisions provide further granularity for market analysis and identify key opportunities for specific market segments. The anticipated growth in each segment offers significant investment potential for companies focused on peptide-based therapeutics. The overall market is likely to witness a shift towards specialized and personalized peptide-based therapies, driven by advances in genomics and proteomics.

Several factors are fueling the growth of the clinical peptide industry. Advances in peptide synthesis and delivery technologies are continuously lowering production costs and enhancing the efficacy of peptide therapeutics. The increasing prevalence of chronic diseases coupled with limitations of traditional drug therapies is further boosting demand for peptide-based alternatives. Significant investment in R&D from both large pharmaceutical companies and smaller biotech firms is fueling innovation and accelerating the pipeline of new peptide-based drugs entering clinical trials and receiving regulatory approvals. The rising acceptance of peptide therapies among healthcare professionals and patients further contributes to market expansion.

This report provides a thorough analysis of the clinical peptide market, including detailed insights into market trends, driving forces, challenges, key players, and future growth prospects. It covers the historical period from 2019 to 2024, provides estimated values for 2025, and offers a forecast for the period 2025-2033, offering a comprehensive overview of this rapidly evolving market sector. The report's analysis of segments and regions provides crucial information for both established industry players and new entrants seeking to understand the complexities and opportunities within this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.1%.

Key companies in the market include AmbioPharm, Almac, JPT Peptide Technologies, CPC Scientific, Pepscan, Enteris BioPharma, CordenPharma, Bachem, Polypeptide Group, Symbiosis Pharma, CS Bio, Quotient Sciences, CD BioSciences, Peptilogics, Alacrita.

The market segments include Type, Application.

The market size is estimated to be USD 49.7 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Clinical Peptide," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Clinical Peptide, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.