1. What is the projected Compound Annual Growth Rate (CAGR) of the Cleanroom Tubing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cleanroom Tubing

Cleanroom TubingCleanroom Tubing by Type (/> HDPE Cleanroom Tubing, LDPE Cleanroom Tubing, Nylon Cleanroom Tubing, PTFE Cleanroom Tubing, PFA Cleanroom Tubing, Others), by Application (/> Electronics, Medical Devices, Pharmaceutical, Biopharmaceutical, Semiconductor, Aerospace, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

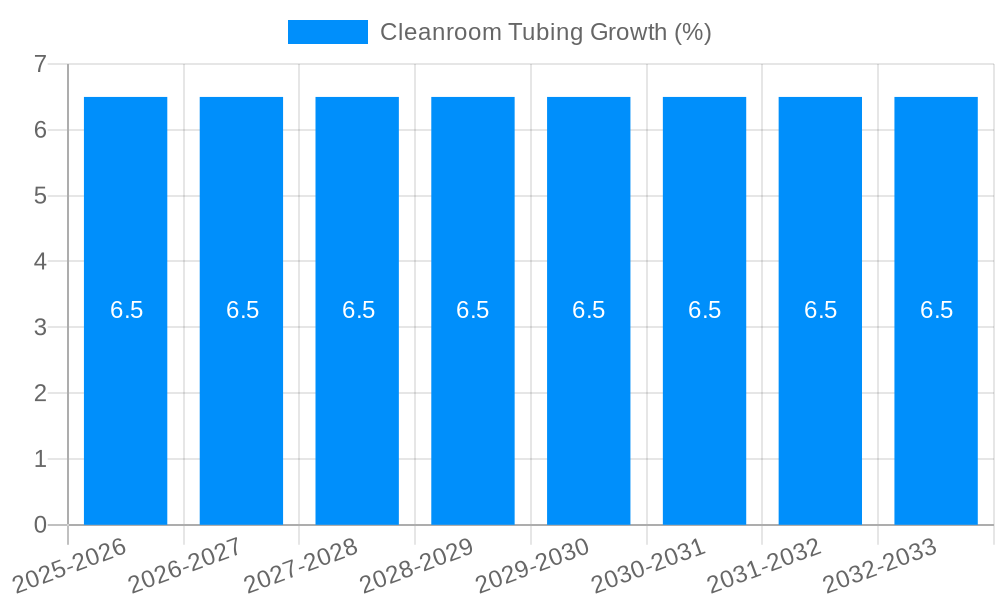

The global Cleanroom Tubing market is projected to witness robust growth, estimated to reach a substantial market size of approximately $750 million by 2025. This expansion is fueled by an increasing demand for ultra-pure and contamination-free environments across critical industries like pharmaceuticals, biopharmaceuticals, medical devices, and electronics. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of around 6.5% from 2025 to 2033, reflecting sustained innovation and adoption of advanced manufacturing processes. Key drivers include the stringent regulatory landscape demanding high purity standards, the growing complexity of sensitive electronic components, and the escalating production of biologics and advanced pharmaceuticals. Furthermore, the increasing focus on supply chain integrity and product safety within these sectors strongly underpins the market's upward trajectory.

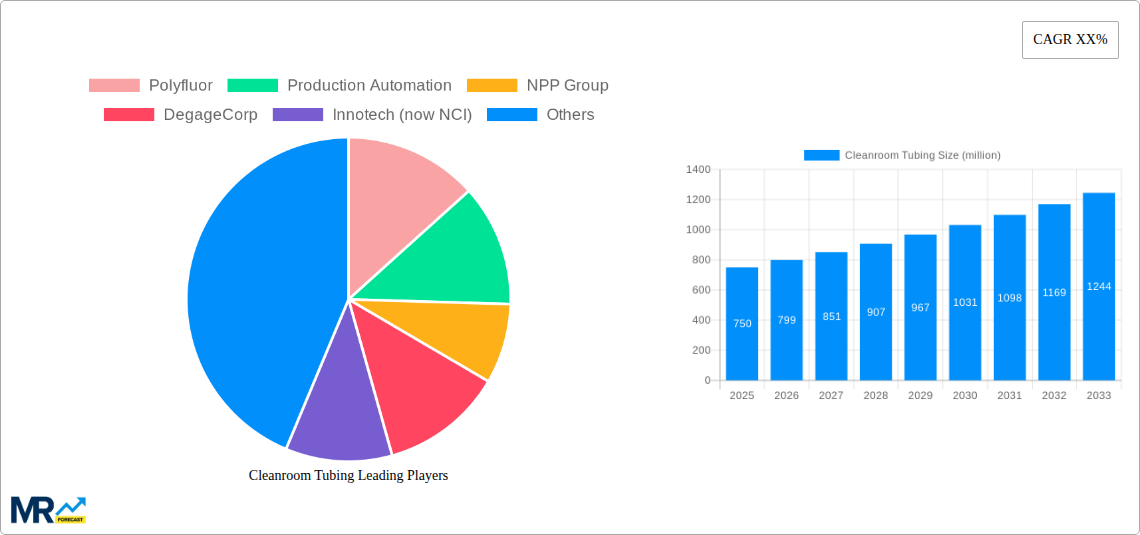

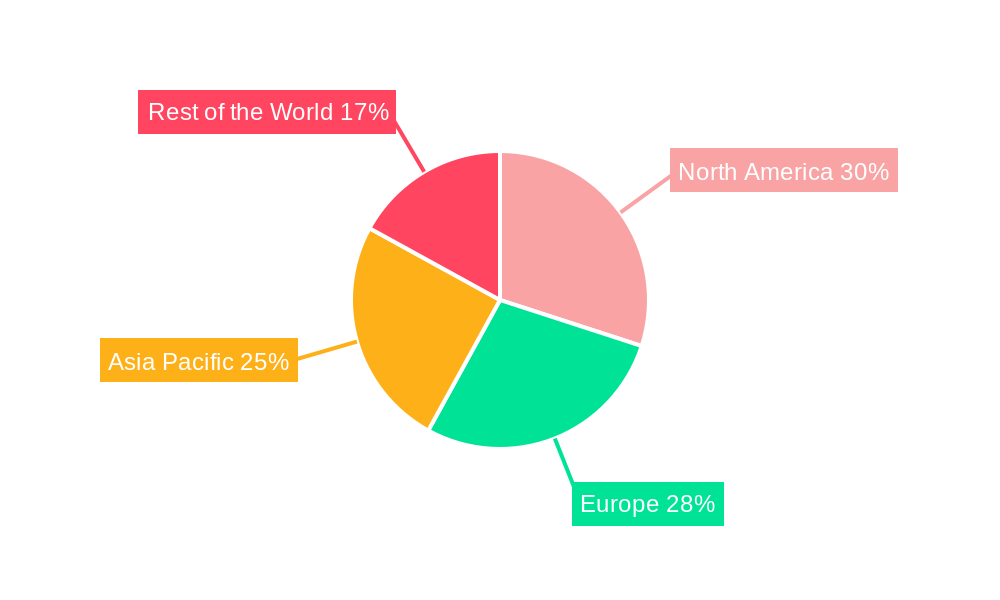

The market segmentation reveals a diverse landscape, with HDPE and LDPE cleanroom tubing holding significant shares due to their versatility and cost-effectiveness in various applications. However, specialized materials like PTFE and PFA cleanroom tubing are experiencing accelerated demand for highly corrosive or high-temperature environments, particularly in semiconductor manufacturing and advanced biopharmaceutical processes. Geographically, North America and Europe currently lead the market, driven by established industries and significant R&D investments. The Asia Pacific region is poised for the fastest growth, spurred by the expanding electronics and pharmaceutical manufacturing sectors in countries like China and India. Key restraints, such as the higher cost of specialized cleanroom tubing materials and the need for rigorous validation processes, are being addressed through material advancements and improved manufacturing techniques. The competitive landscape is characterized by a mix of established players and emerging companies focusing on product innovation and strategic collaborations.

Here's a unique report description for Cleanroom Tubing, incorporating your specified elements:

The global Cleanroom Tubing market is poised for robust expansion, projecting a valuation of $1,200 million by the end of the Forecast Period in 2033, a significant leap from its $800 million mark in the Base Year of 2025. This trajectory signifies a Compound Annual Growth Rate (CAGR) of approximately 4.1% during the Forecast Period of 2025-2033. The Historical Period of 2019-2024 laid a foundational growth, with the market reaching $750 million in 2024. Key insights reveal a growing demand driven by stringent purity requirements across high-stakes industries. The market is characterized by an increasing adoption of advanced materials like PTFE and PFA, favored for their inertness and resistance to chemical contamination, crucial for sensitive applications in pharmaceuticals and biopharmaceuticals. Furthermore, the burgeoning semiconductor industry's reliance on ultra-pure fluid transfer systems is a significant contributor to this upward trend. Innovations in extrusion technologies and material science are continually pushing the boundaries of what cleanroom tubing can achieve, offering enhanced flexibility, durability, and surface integrity. The market is also witnessing a rise in customized solutions, with manufacturers tailoring tubing specifications to meet the unique needs of diverse applications, from intricate medical device assemblies to large-scale pharmaceutical processing. The increasing global focus on health and safety, coupled with advancements in manufacturing processes demanding sterile environments, are fundamental drivers shaping the cleanroom tubing landscape. The intricate interplay of technological advancements, regulatory demands, and the ever-present pursuit of purity will continue to define the market's evolution.

The burgeoning demand for cleanroom tubing is predominantly fueled by the escalating stringency of regulatory standards and the unwavering commitment to product purity across critical sectors. The pharmaceutical and biopharmaceutical industries, in particular, are at the forefront, mandating the use of inert and biocompatible materials for drug manufacturing, research, and development, thereby necessitating the adoption of high-performance cleanroom tubing. This trend is further amplified by the rapid growth of the medical device sector, where the precise and sterile transfer of bodily fluids, reagents, and manufacturing media is paramount for patient safety and device efficacy. The increasing complexity and miniaturization of electronic components, especially within the semiconductor industry, also contribute significantly. These delicate processes require an environment free from particulate contamination, making advanced cleanroom tubing an indispensable element for maintaining operational integrity and preventing costly product defects. Moreover, the growing global emphasis on quality control and the prevention of cross-contamination in food and beverage processing, albeit a secondary segment, also adds to the overall market impetus.

Despite the promising growth trajectory, the Cleanroom Tubing market is not without its hurdles. A significant challenge lies in the high cost of specialized materials such as PTFE and PFA, which, while offering superior performance, can inflate the overall cost of cleanroom infrastructure and consumables. This cost factor can be a deterrent for smaller enterprises or those operating in budget-conscious segments. Furthermore, the complex manufacturing processes required to achieve the stringent purity levels and specific surface finishes demanded by cleanroom applications necessitate significant investment in advanced technology and highly skilled labor, further contributing to the elevated price point. The variability in regulatory compliance across different geographical regions can also present a challenge for global manufacturers. Staying abreast of and adhering to diverse national and international standards for particle shedding, leachables, and extractables requires continuous effort and investment. Moreover, the potential for contamination during installation and maintenance remains a persistent concern. Even the highest quality tubing can become compromised if not handled and installed correctly within a controlled environment, leading to product recalls or operational downtime, which can be extremely costly in millions of dollars.

The North America region is projected to emerge as a dominant force in the global Cleanroom Tubing market, largely driven by its robust and well-established pharmaceutical, biopharmaceutical, and semiconductor industries. The stringent regulatory framework championed by bodies like the Food and Drug Administration (FDA) mandates extremely high purity standards, directly fueling the demand for advanced cleanroom tubing solutions. For instance, the Pharmaceutical segment alone is expected to contribute over $350 million to the market by 2033, with a significant portion of this demand originating from North America.

Within this region, the Medical Devices segment is anticipated to witness substantial growth, driven by technological advancements in diagnostics, surgical equipment, and drug delivery systems. The need for biocompatible, kink-resistant, and ultra-clean tubing for fluid transfer in these intricate devices is paramount, leading to a projected market value in this segment alone exceeding $280 million by 2033. Companies like Production Automation and Elkay Plastics, with their established presence and product portfolios catering to these industries, are well-positioned to capitalize on this trend.

Another significant contributor to North America's dominance will be the Semiconductor industry, which demands unparalleled levels of cleanliness for the fabrication of microchips. The use of ultra-pure gases and chemicals necessitates tubing materials that exhibit exceptional inertness and minimal particle generation, with PTFE and PFA Cleanroom Tubing being the preferred choices. This segment is expected to account for a market share of around $220 million by 2033. The presence of leading semiconductor manufacturers in the US, coupled with ongoing investments in advanced manufacturing facilities, will further bolster demand.

Moreover, the Biopharmaceutical segment in North America is experiencing rapid expansion, fueled by innovation in biologics and gene therapies. These complex processes require tubing that can withstand rigorous sterilization protocols and maintain the integrity of sensitive biological materials, making specialized cleanroom tubing indispensable. This segment is forecasted to contribute approximately $200 million to the market by 2033.

Globally, among the Type segments, PTFE Cleanroom Tubing is expected to lead the market, projected to reach a valuation of over $300 million by 2033. Its exceptional chemical resistance, high-temperature tolerance, and inherent lubricity make it ideal for a wide range of critical applications. Following closely will be PFA Cleanroom Tubing, valued at an estimated over $250 million, due to its similar properties and enhanced flexibility, particularly favored in medical applications.

The growth in these segments and regions is underpinned by a continuous drive for innovation and adherence to the highest quality standards in industries where contamination is not an option and can lead to losses in the millions of dollars.

The Cleanroom Tubing industry is experiencing significant growth catalysts, primarily driven by the escalating global demand for sterile and contamination-free environments. Advancements in material science, leading to the development of tubing with enhanced inertness and reduced particle shedding, are crucial. Furthermore, the increasing stringency of regulatory requirements in the pharmaceutical, biopharmaceutical, and medical device sectors directly mandates the use of high-quality cleanroom tubing. The expansion of the semiconductor industry, with its ever-increasing need for ultra-pure fluid transfer, also acts as a major growth stimulant.

This comprehensive report delves into the intricate dynamics of the Cleanroom Tubing market, providing in-depth analysis across its historical trajectory (2019-2024) and future projections (2025-2033), with a base year of 2025. It meticulously examines key market insights, growth drivers, and the challenges that shape this vital industry. The report offers granular segmentation by tubing type (HDPE, LDPE, Nylon, PTFE, PFA, Others) and application (Electronics, Medical Devices, Pharmaceutical, Biopharmaceutical, Semiconductor, Aerospace, Others), providing a clear understanding of segment-specific demand and potential. With an estimated market valuation projected to reach $1,200 million by 2033, the report highlights the significant opportunities and strategic considerations for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Polyfluor, Production Automation, NPP Group, DegageCorp, Innotech (now NCI), American Plastics, PPC Flexible Packaging, Uline, AMS Printing, Elkay Plastics, AEROPACKAGING, Pristine Clean Bags by Jarrett.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Cleanroom Tubing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cleanroom Tubing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.