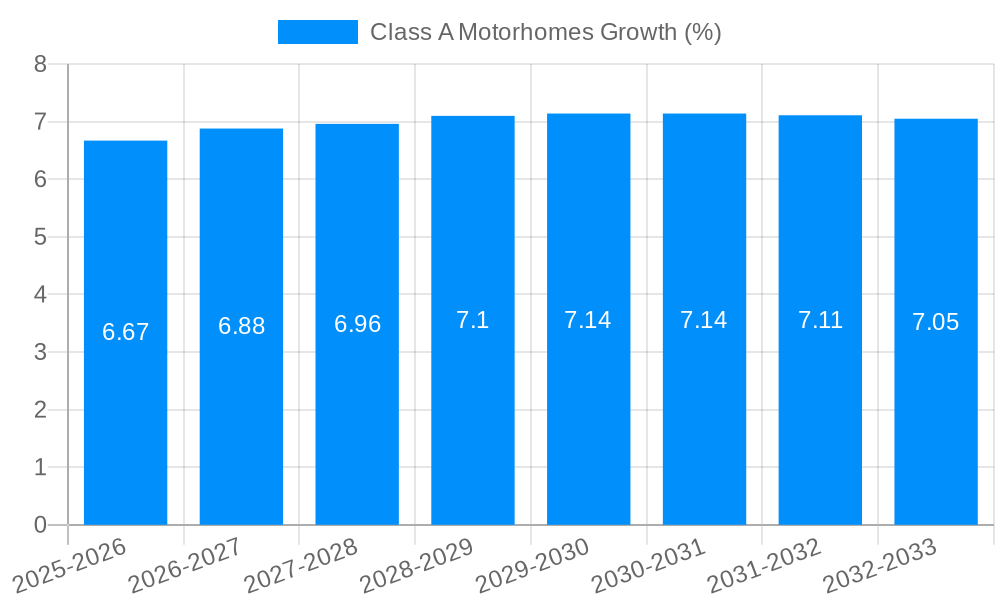

1. What is the projected Compound Annual Growth Rate (CAGR) of the Class A Motorhomes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Class A Motorhomes

Class A MotorhomesClass A Motorhomes by Type (Gas RVs, Diesel RVs), by Application (Residential, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

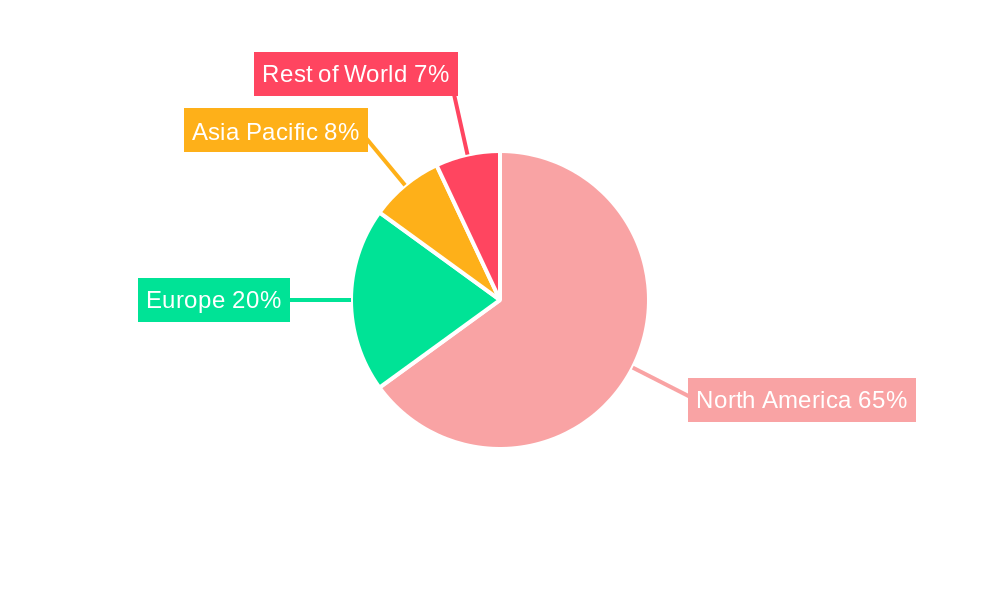

The Class A motorhome market, a segment within the broader RV industry, is experiencing robust growth driven by several key factors. Increasing disposable incomes, particularly among baby boomers and Gen X, coupled with a desire for experiential travel and outdoor recreation, are fueling demand. The rise of remote work and the "van life" movement also contribute significantly, as individuals seek greater flexibility and freedom in their lifestyle choices. Technological advancements within the RV sector, including improved fuel efficiency, enhanced amenities, and advanced safety features, further enhance the appeal of Class A motorhomes. While supply chain disruptions and increasing raw material costs presented challenges in recent years, the market has shown resilience, indicating strong underlying demand. The North American market, particularly the United States, remains the dominant region, benefiting from established infrastructure and a strong RV culture. However, Europe and other regions are exhibiting increasing growth, driven by rising tourism and a growing middle class with discretionary spending power. Competition within the Class A motorhome market is fierce, with established players like Thor Industries and Winnebago Industries vying for market share alongside newer entrants. Product differentiation, focusing on luxury features, customized designs, and sustainable technologies, is a key strategic element for manufacturers seeking a competitive edge. Future growth will likely be influenced by economic conditions, fuel prices, and evolving consumer preferences, particularly regarding sustainability and technological integration.

Looking ahead to 2033, the Class A motorhome market is poised for continued expansion, albeit at a potentially moderating pace compared to the recent past. The market's long-term trajectory will depend on factors such as macroeconomic stability, technological innovations, and evolving travel trends. Manufacturers will need to adapt to shifting consumer demands, emphasizing sustainability, connectivity, and personalized experiences. Furthermore, addressing concerns around environmental impact and responsible tourism will be crucial for maintaining positive growth. Expansion into emerging markets and strategic partnerships could also play a significant role in shaping the market landscape. Investment in research and development, particularly in areas such as alternative fuel technologies and lightweight materials, will be critical for long-term success within this dynamic and competitive market. The segment is likely to see continued fragmentation, with specialized niche products catering to distinct consumer preferences and needs.

The Class A motorhome market, valued at approximately $XX billion in 2024, is projected to experience significant growth, reaching an estimated $YY billion by 2033. This represents a Compound Annual Growth Rate (CAGR) of X%. This robust growth trajectory is fueled by several interconnected factors. The increasing disposable incomes of middle-aged and older demographics, coupled with a growing desire for experiential travel and outdoor recreation, significantly boosts demand. Consumers are increasingly seeking unique travel experiences beyond traditional vacations, with Class A motorhomes providing the ultimate in comfort, flexibility, and self-sufficient travel. The shift towards remote work arrangements also contributes, allowing individuals to work and travel simultaneously. Furthermore, advancements in motorhome technology, including improved fuel efficiency, enhanced amenities, and sophisticated safety features, are driving up market appeal. The market is witnessing a diversification of models, catering to a broader spectrum of consumer preferences and budgets, from luxurious high-end models to more affordable entry-level options. This trend extends beyond the traditional RV enthusiast, attracting new demographics looking for a unique blend of freedom and comfort. The rise of RV parks and campgrounds, coupled with the development of dedicated RV routes and amenities, also plays a significant role in market expansion. Finally, a surge in interest in sustainable travel contributes positively, with some manufacturers incorporating eco-friendly features into their designs. Overall, the Class A motorhome market is poised for sustained and impressive growth throughout the forecast period, driven by both economic and sociocultural trends. The market is witnessing increasing competition and innovation, which ultimately benefits the consumer with a wider selection of products and competitive pricing.

Several key factors propel the growth of the Class A motorhome market. Firstly, the burgeoning trend of "glamping" – glamorous camping – is attracting a new generation of consumers who appreciate the convenience and luxury of a fully equipped motorhome without compromising on the outdoor experience. This translates into a demand for high-end models featuring advanced technology, upscale interior finishes, and innovative features. Secondly, the rise in popularity of extended travel and adventure tourism caters directly to the Class A motorhome's strengths. Its ability to provide comfortable, self-sufficient travel for extended periods makes it ideal for exploring remote areas and experiencing diverse landscapes. Thirdly, the increasing affordability of financing options, including low interest rates and flexible loan terms, encourages consumers to make larger purchases such as Class A motorhomes. The expanding network of RV parks and campgrounds provides added convenience and security for motorhome users, enhancing their overall travel experience and alleviating concerns associated with finding overnight accommodation. This widespread availability of accommodation, combined with improvements in road infrastructure, makes motorhome travel increasingly accessible and attractive. Finally, effective marketing campaigns by manufacturers, highlighting the unique benefits of owning and traveling in a Class A motorhome, further stimulates market demand.

Despite the positive growth trajectory, several challenges and restraints impact the Class A motorhome market. The high initial purchase price remains a significant barrier to entry for many potential buyers. Furthermore, the ongoing costs associated with fuel, maintenance, insurance, and campground fees can be substantial, impacting affordability and long-term ownership. Fluctuations in the price of raw materials and components, particularly during periods of economic uncertainty, can impact production costs and ultimately retail pricing. Government regulations and emission standards can add to manufacturing costs and restrict the design and performance of motorhomes. The availability of skilled labor for manufacturing and servicing can also be a limiting factor, particularly during periods of high demand. Competition amongst manufacturers is fierce, necessitating continuous innovation and efficient cost management to remain competitive. Lastly, concerns surrounding environmental impact, including fuel consumption and waste disposal, are increasing, potentially impacting consumer purchasing decisions. Addressing these challenges requires collaborative efforts between manufacturers, suppliers, and regulatory bodies to improve sustainability and enhance the overall value proposition for consumers.

The North American market, specifically the United States and Canada, is expected to continue dominating the Class A motorhome market throughout the forecast period. This dominance stems from several factors including high levels of disposable income, a well-developed RV infrastructure, and a strong culture of outdoor recreation.

High disposable incomes: A significant portion of the population has the financial capacity to afford the purchase and maintenance of Class A motorhomes.

Established RV infrastructure: North America has a vast network of RV parks, campgrounds, and related services, providing ample opportunities for motorhome travel and enhancing the overall user experience.

Strong RV culture: RV travel is deeply ingrained in the North American culture, with a large and active community of RV enthusiasts.

Within the segments, the Residential application dominates the Class A motorhome market. This reflects the primary use of Class A motorhomes for personal leisure travel, extended vacations, and even temporary or permanent housing. The sheer volume of individuals choosing Class A motorhomes for recreational purposes significantly outpaces commercial and other applications.

High demand for leisure travel: Consumers prioritize comfort, space, and freedom when planning vacations, leading to a high demand for larger, more luxurious motorhomes.

Growing popularity of extended stays: Many consumers opt for extended periods of RV travel, using their motorhomes as temporary or seasonal residences.

Flexibility and convenience: The ability to easily customize travel routes and itineraries, combined with built-in living amenities, drives the popularity of Class A motorhomes for extended stays.

While the Diesel RV segment commands a premium price point, reflecting its greater fuel efficiency and increased power, the Gas RV segment maintains a strong market share due to its lower initial cost and wider accessibility. This balance reflects the diverse needs and budgets within the consumer base, showcasing the enduring appeal of gas-powered Class A motorhomes.

Several factors are poised to accelerate the growth of the Class A motorhome industry. Continued advancements in technology, encompassing improved fuel efficiency, enhanced safety features, and luxurious interior amenities, create a more compelling value proposition. Strategic partnerships between manufacturers and RV park operators to improve services and accessibility further fuel market expansion. The rise of RV rental services makes Class A motorhome ownership more accessible to a wider range of consumers, boosting market penetration. Finally, increasing marketing efforts that highlight the lifestyle benefits of RV travel enhance consumer awareness and interest.

This report provides a comprehensive analysis of the Class A motorhome market, offering valuable insights into market trends, growth drivers, challenges, and key players. It provides a detailed segmentation analysis, covering gas and diesel RVs and their residential and commercial applications. The report’s projections offer a reliable outlook for investors, manufacturers, and stakeholders seeking to navigate this dynamic sector. It meticulously analyzes the competitive landscape and pinpoints key growth catalysts and significant developments, empowering readers to make informed decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Thor Industries, Forest River, Winnebago Industries, REV Group, Erwin Hymer Group, Knaus Tabbert, Hobby Caravan, Dethleffs, Tiffin Motorhomes, Newmar, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Class A Motorhomes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Class A Motorhomes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.