1. What is the projected Compound Annual Growth Rate (CAGR) of the Circulating Tumor Cells and Cancer Stem Cells?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Circulating Tumor Cells and Cancer Stem Cells

Circulating Tumor Cells and Cancer Stem CellsCirculating Tumor Cells and Cancer Stem Cells by Type (/> Cell Enrichment, Cell Detection, CTC Analysis), by Application (/> Hospital, NSC, Medical Research Institute), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

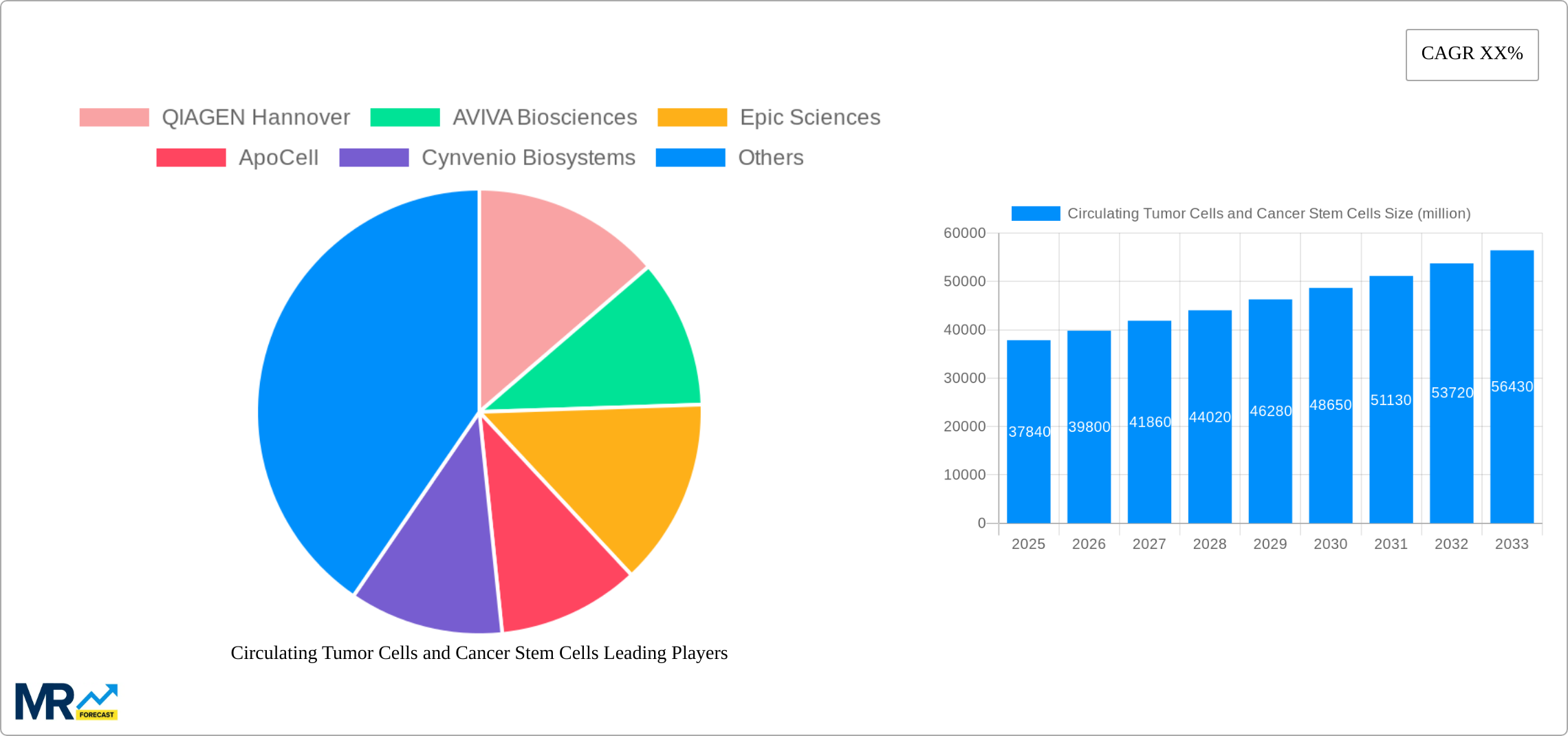

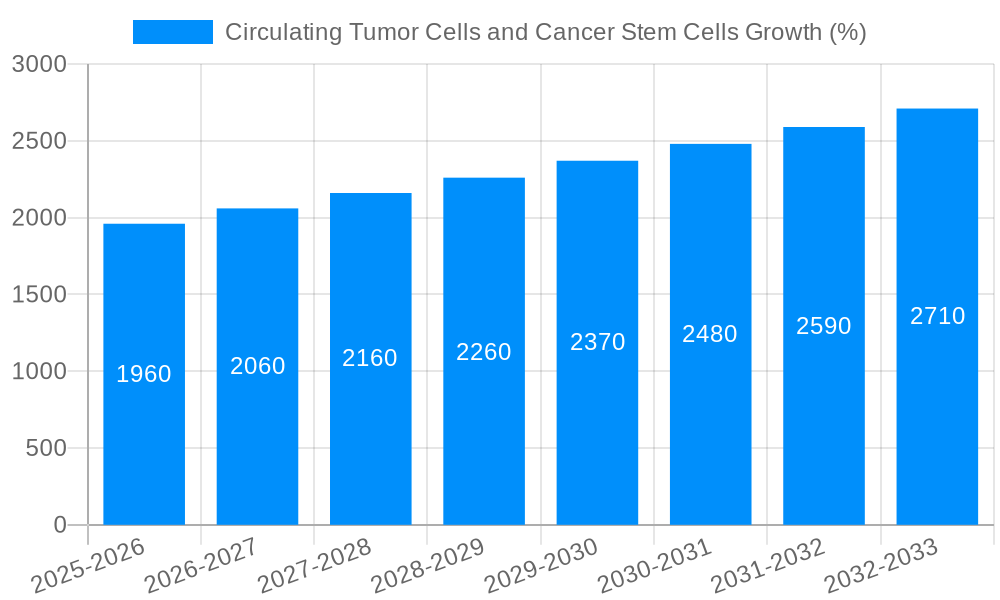

The Circulating Tumor Cells (CTCs) and Cancer Stem Cells (CSCs) market is experiencing significant growth, driven by advancements in detection and enrichment technologies, increasing cancer prevalence, and the rising adoption of personalized medicine approaches. The market, currently valued at approximately $37.84 billion in 2025, is projected to exhibit substantial growth throughout the forecast period (2025-2033). This expansion is fueled by several key factors. Firstly, the development of more sensitive and specific CTC and CSC detection technologies, such as microfluidic devices and next-generation sequencing, allows for earlier diagnosis and more effective treatment monitoring. Secondly, the increasing prevalence of cancer globally, particularly in aging populations, creates a larger addressable market. Thirdly, the shift towards personalized medicine, where treatment strategies are tailored to individual patient characteristics, relies heavily on CTC and CSC analysis to guide therapeutic decisions and monitor response. Finally, increasing research and development activities within the pharmaceutical and biotechnology industries are contributing to innovative product launches, further fueling market growth.

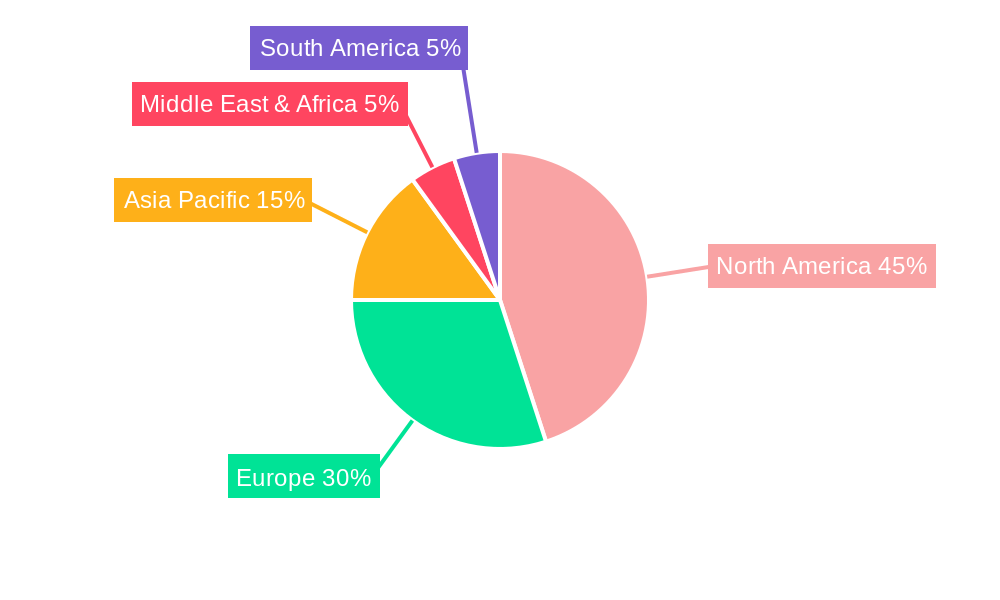

Despite the positive outlook, the market faces certain challenges. High costs associated with advanced technologies and specialized testing can limit accessibility, particularly in resource-constrained settings. Furthermore, standardization of testing protocols and data interpretation remains an ongoing hurdle for widespread adoption. The heterogeneity of CTCs and CSCs, coupled with their low numbers in circulation, makes detection and analysis complex, necessitating continuous technological advancements to improve sensitivity and specificity. Despite these restraints, the overall market trajectory remains positive, supported by ongoing innovations, increasing research investment, and the growing importance of personalized medicine in cancer care. The segmentation of the market by technology (Cell Enrichment, Cell Detection, CTC Analysis) and application (Hospital, NSC, Medical Research Institute) suggests avenues for targeted product development and market penetration. The geographical distribution, with North America and Europe currently holding larger market shares, also presents opportunities for expansion in emerging markets like Asia Pacific and the Middle East & Africa, driven by growing healthcare infrastructure and increasing awareness of advanced diagnostic techniques.

The global circulating tumor cells (CTCs) and cancer stem cells (CSCs) market is experiencing robust growth, projected to reach tens of billions of dollars by 2033. This surge is fueled by the increasing prevalence of cancer globally, coupled with advancements in detection and analysis technologies. The market, valued at approximately $X billion in 2025 (estimated year), is anticipated to demonstrate a Compound Annual Growth Rate (CAGR) of Y% during the forecast period (2025-2033). This growth is particularly evident in the areas of cell enrichment and detection technologies, driven by a significant increase in the number of clinical trials leveraging CTC and CSC analysis for early cancer diagnosis, prognosis prediction, and personalized therapy development. Hospitals and medical research institutes represent significant market segments, investing heavily in these technologies to improve patient care and advance cancer research. The historical period (2019-2024) saw steady market expansion, laying the groundwork for the explosive growth projected in the coming years. Key market insights reveal a shift towards minimally invasive procedures and liquid biopsies, underpinning the increasing demand for advanced CTC and CSC detection systems. Technological advancements, such as microfluidic devices and next-generation sequencing, are constantly improving the sensitivity and specificity of these assays, enhancing the market's overall appeal and clinical utility. The increasing availability of reimbursement policies and regulatory approvals for innovative CTC and CSC-based diagnostic tests further contributes to this market expansion. Millions of tests are projected to be conducted annually by the end of the forecast period, reflecting the growing recognition of the clinical value of CTC and CSC analysis across various cancer types. The market also sees a significant contribution from the non-clinical sector (NSC) with academic and research institutes driving innovation and expanding the knowledge base. By 2033, the global market is expected to be generating revenues in the tens of billions of dollars, signifying its enormous growth potential.

Several key factors are propelling the growth of the circulating tumor cells and cancer stem cells market. The rising global cancer burden is a primary driver, necessitating more effective diagnostic and therapeutic strategies. Liquid biopsies, utilizing CTC and CSC analysis, offer a less invasive alternative to traditional tissue biopsies, leading to increased patient acceptance and reduced procedural risks. Technological advancements, such as the development of more sensitive and specific detection and enrichment methods (e.g., microfluidics, advanced imaging techniques, and antibody-based enrichment), are expanding the capabilities of CTC and CSC analysis. This, in turn, is fostering the adoption of these techniques in both clinical and research settings. Furthermore, the growing focus on personalized medicine and targeted therapies is driving demand for these technologies, as CTC and CSC analysis provides valuable insights into tumor heterogeneity and drug resistance mechanisms. The expanding research and development efforts worldwide are continually improving the understanding of CTCs and CSCs and their role in cancer progression and metastasis, leading to the development of new diagnostic tools and therapeutic targets. Regulatory approvals and reimbursement policies are becoming more favorable, further supporting the market's expansion. Finally, the increasing collaborations between pharmaceutical companies, biotechnology firms, and academic institutions are accelerating innovation in this sector. This collaborative effort translates to a consistent stream of advancements in the technologies and therapies underpinning the CTC and CSC market's growth.

Despite its significant growth potential, the CTC and CSC market faces certain challenges and restraints. The inherent heterogeneity of CTCs and CSCs poses a significant analytical challenge, requiring advanced technologies to accurately isolate and characterize these rare cells from blood samples. The complexity and cost of the advanced technologies involved in CTC and CSC analysis remain a barrier to widespread adoption, particularly in resource-limited settings. Establishing standardized protocols and validation procedures for CTC and CSC assays is crucial for ensuring the reliability and reproducibility of the results, and the lack of universal standardization currently presents an obstacle to market expansion. The relatively small number of FDA-approved tests based on CTC and CSC analysis limits widespread clinical adoption. The need for extensive validation studies and regulatory approvals adds to the cost and time required for bringing new products to the market. Additionally, data interpretation and integration remain a significant hurdle, requiring sophisticated bioinformatics and data analysis capabilities for meaningful clinical interpretation. Finally, the lack of awareness and understanding of CTC and CSC analysis among healthcare professionals can hamper market growth.

Segments Dominating the Market:

Cell Enrichment: This segment is expected to hold a significant market share due to the critical role of efficient cell enrichment in isolating CTCs and CSCs from blood samples. Advancements in microfluidic devices and other cell separation technologies are driving growth in this area. The market for cell enrichment technologies is projected to exceed $X billion by 2033, representing a substantial portion of the overall CTC/CSC market.

CTC Analysis: This segment is poised for significant growth because of the increasing adoption of CTC analysis for early cancer detection, monitoring treatment response, and predicting prognosis. The continuous development of more sophisticated analytical techniques, such as next-generation sequencing and multiplex assays, fuels this growth. By 2033, the CTC analysis segment is expected to generate billions of dollars in revenue.

Hospital Application: Hospitals form a major segment due to their central role in cancer diagnosis and treatment. The increasing integration of CTC and CSC analysis into routine clinical practice, driven by the need for more precise and personalized cancer care, positions hospitals as a significant consumer of these technologies. Hospitals are projected to account for a substantial proportion of the overall market revenue by 2033.

Key Regions:

North America: This region is expected to dominate the market due to high healthcare expenditure, advanced technological infrastructure, and the presence of leading companies in the field. The US market, with its robust research base and proactive regulatory environment, will likely remain at the forefront. The projected market value for North America exceeds $X billion by 2033.

Europe: Europe is also predicted to experience substantial growth, driven by investments in healthcare research and the increasing adoption of advanced diagnostic techniques. Major European countries are expected to collectively contribute substantially to the overall market size. The projected market value for Europe is expected to reach $X billion by 2033.

Asia-Pacific: This region is showing promising growth potential due to rising healthcare awareness, increasing healthcare expenditure, and a growing prevalence of cancer. Rapid technological advancements and increasing investments in the biotechnology sector are fostering growth. The Asia-Pacific region is projected to achieve significant market expansion by 2033.

The combination of these rapidly advancing technologies and their increased clinical adoption across different regions suggests a promising and expanding market for CTC and CSC analysis. Millions of tests are expected to be conducted annually by the end of the forecast period.

The industry’s growth is catalyzed by several key factors, notably the rising prevalence of cancer globally, pushing for more effective early detection methods. Advancements in liquid biopsy technologies, enabling less invasive and more convenient sample collection, are also significant contributors. Increased investment in research and development is generating innovative techniques for CTC and CSC detection and characterization. Furthermore, growing acceptance of personalized medicine and targeted therapies requires enhanced diagnostic tools like CTC/CSC analysis to guide treatment decisions, further fueling market expansion.

This report offers a comprehensive analysis of the Circulating Tumor Cells and Cancer Stem Cells market, providing an in-depth examination of market trends, drivers, restraints, key players, and future growth prospects. The report covers detailed market segmentation by type of technology, application, and geography, offering valuable insights for companies operating in this dynamic field. The extensive market sizing and forecasting, combined with analysis of leading companies and their strategies, provides a clear view of the competitive landscape and future opportunities within the CTC and CSC market. The report aims to serve as a vital resource for investors, researchers, and industry professionals seeking to understand and navigate the rapidly expanding CTC and CSC market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include QIAGEN Hannover, AVIVA Biosciences, Epic Sciences, ApoCell, Cynvenio Biosystems, Fluxion Biosciences, Rarecells, Janssen Diagnostics, CellTraffix, Silicon Biosystems, Advanced Cell Diagnostics.

The market segments include Type, Application.

The market size is estimated to be USD 37840 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Circulating Tumor Cells and Cancer Stem Cells," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Circulating Tumor Cells and Cancer Stem Cells, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.