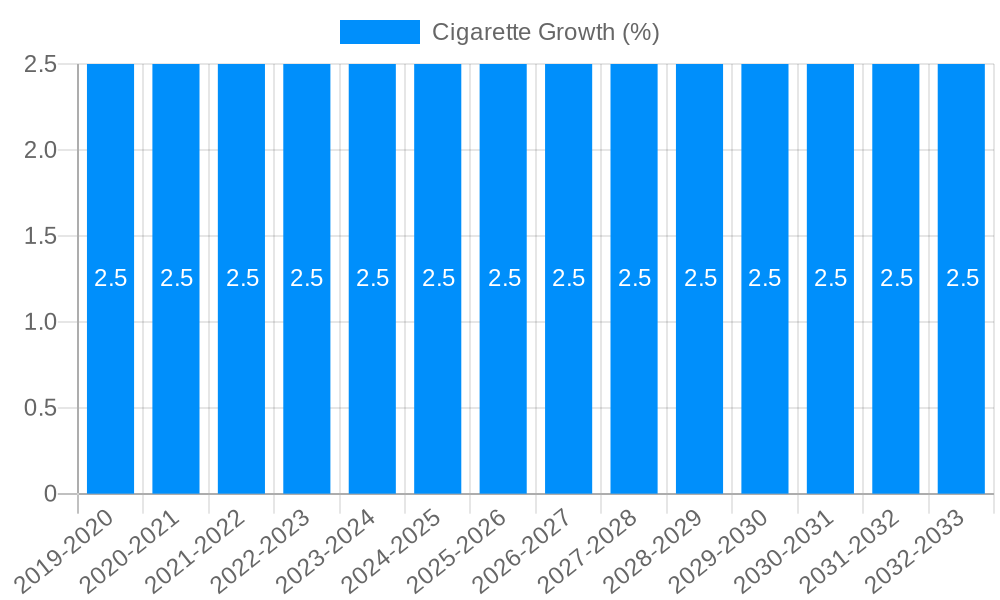

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cigarette?

The projected CAGR is approximately 2.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cigarette

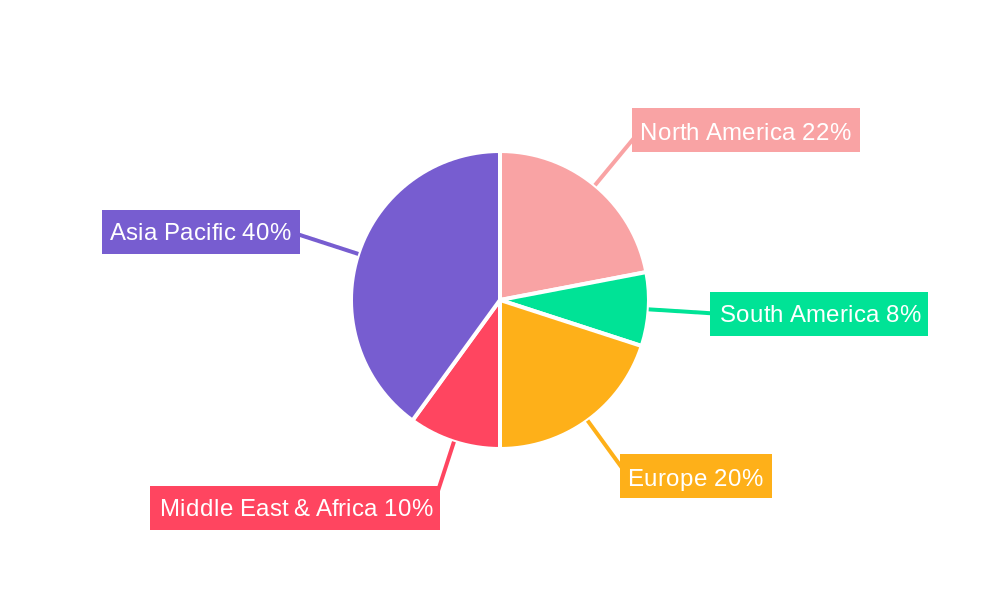

CigaretteCigarette by Type (Low Tar, High Tar, Male Smokers, Female Smokers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

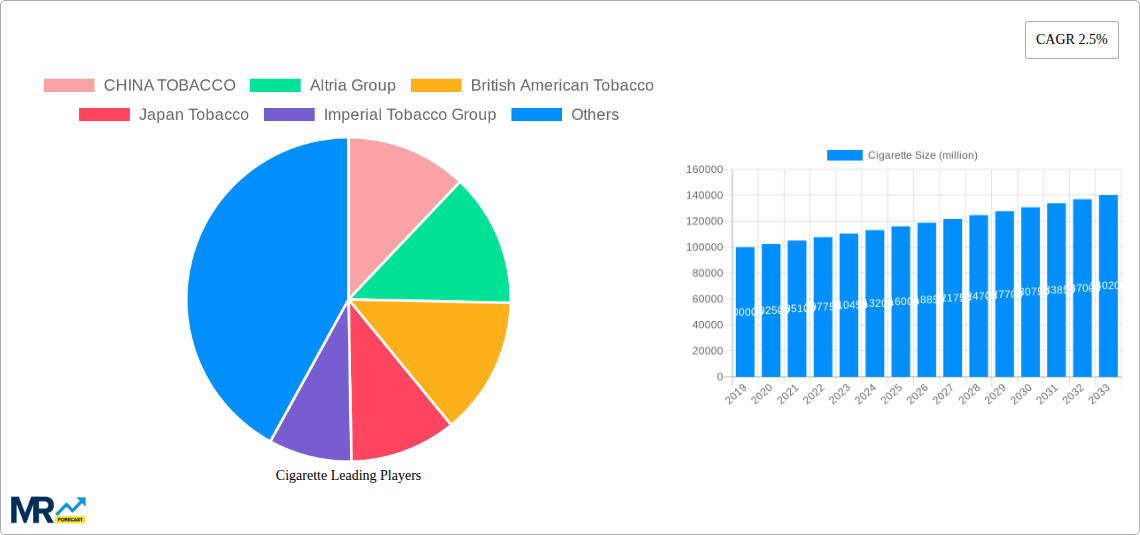

The global cigarette market, valued at $107.65 billion in 2025, is projected to experience a compound annual growth rate (CAGR) of 2.5% from 2025 to 2033. This moderate growth reflects a confluence of factors. While established players like China Tobacco, Altria Group, and British American Tobacco maintain significant market share, they face increasing pressure from stricter regulations globally, rising health concerns leading to decreased consumption in developed markets, and the growing popularity of alternative nicotine products like vaping. Emerging markets, however, are anticipated to contribute to market expansion, albeit at a slower rate than previously observed due to increasing awareness of the health risks associated with smoking. The market is segmented by various factors including product type (e.g., filtered, non-filtered), price point, and geographic location. Competition remains fierce, with companies continuously innovating to maintain market position, focusing strategies on brand loyalty, diversification into related products, and targeted marketing to specific consumer segments.

The market’s relatively low CAGR reflects a mature market grappling with evolving consumer preferences and increasing regulatory scrutiny. Profitability for major players remains under pressure due to rising taxes and excise duties in many countries. Strategies for future growth include exploring new markets, investing in brand building, and adapting to evolving consumer demands. The success of these strategies will depend on navigating evolving public health policies and the broader shift towards reduced-risk tobacco products. Furthermore, the influence of social and cultural trends, particularly among younger generations, will significantly shape market dynamics over the forecast period. The impact of economic fluctuations in different regions will also play a significant role in determining overall market growth.

The global cigarette market, valued at hundreds of billions of dollars annually, presents a complex picture characterized by declining sales in developed nations offset by growth in developing economies. Over the historical period (2019-2024), the industry witnessed a general decline in unit sales in many mature markets due to increasing health awareness, stringent regulations, and anti-smoking campaigns. This trend is expected to continue, albeit at a slower pace, during the forecast period (2025-2033). However, the market is far from stagnant. Significant growth is anticipated in certain developing regions with large populations and less stringent regulatory frameworks. The estimated year 2025 shows a fluctuating market share amongst major players, with some experiencing a slight increase while others face marginal decreases in volume. This reflects the shifting demographics of cigarette consumption and the adaptability of major tobacco companies to changing market conditions. The transition towards heated tobacco products and e-cigarettes is also influencing the overall market dynamics, creating a segment of alternative nicotine delivery systems that are impacting the traditional cigarette market. These alternatives, while offering a reduced perceived health risk, are nevertheless subject to increasing scrutiny and regulation. The future of the cigarette market is intrinsically linked to public health initiatives, governmental policies, and the evolving consumer preferences around nicotine consumption. Competition among major players remains fierce, with companies engaging in aggressive marketing strategies, product diversification, and acquisitions to maintain and expand their market share. Understanding these complexities is crucial for accurately predicting future market trends and understanding the overall health of the industry. The shift in consumption patterns, coupled with evolving regulations, makes precise forecasting challenging, yet the basic trend remains one of declining overall volume in developed economies and fluctuating growth in developing regions, with the emergence of alternative nicotine products continuously reshaping the landscape.

Several factors contribute to the continued, albeit moderated, demand for cigarettes globally. Firstly, the ingrained habit and addiction amongst existing smokers remains a significant driver. Despite awareness of health risks, breaking nicotine addiction proves challenging for many. Secondly, affordability, particularly in developing countries, plays a crucial role. Cigarettes often represent a relatively inexpensive form of escapism and stress relief for lower-income populations. Thirdly, cultural norms and social acceptance continue to impact consumption in certain regions. Smoking remains socially acceptable in some cultures, particularly amongst specific demographics. Moreover, the marketing strategies employed by major tobacco companies, while increasingly restricted, still manage to influence consumer behavior. Finally, the lack of effective and readily accessible cessation support in many regions contributes to sustained consumption levels. In contrast to the decline in sales seen in developed countries, the growing populations and increasing disposable incomes in several developing nations are contributing to the overall market size, albeit with significant regional variations. However, it's crucial to note that the influence of these factors is constantly being challenged by government regulations, public health campaigns, and the growing popularity of alternative nicotine products. The future will likely see a decline in overall cigarette consumption as health awareness increases globally.

The cigarette industry faces considerable challenges. Firstly, stringent government regulations, including taxation, advertising bans, and plain packaging mandates, significantly impact sales and profitability. These measures aim to discourage consumption and improve public health. Secondly, increasing public health awareness of the severe health consequences associated with smoking is leading to declining consumption rates in many countries, particularly amongst younger generations. Thirdly, the growing popularity of alternative nicotine products, such as e-cigarettes and heated tobacco products, presents a competitive threat, diverting consumers away from traditional cigarettes. Fourthly, the rising cost of tobacco leaf and manufacturing increases production costs, impacting profitability. Lastly, legal challenges and lawsuits related to health issues and marketing practices add further pressure on tobacco companies. The industry is adapting to these challenges through diversification into alternative nicotine products and exploring new markets in developing economies. However, the long-term sustainability of the industry is undoubtedly threatened by these combined forces. The industry needs to continually innovate and adapt to navigate these obstacles effectively, though its overall trajectory is one marked by considerable headwinds.

Asia: Countries like China and India, with their vast populations and significant smoking rates, are key contributors to cigarette consumption globally. The Chinese market, dominated by CHINA TOBACCO, is particularly significant. The sheer scale of these populations ensures continued, albeit potentially slower growth, in this region. However, increasing health awareness and government initiatives are gradually influencing consumption patterns.

Developed Markets (North America and Europe): While these regions historically accounted for a substantial share of cigarette consumption, the market is currently experiencing a decline due to stringent regulations, high taxes, and enhanced public health campaigns. Altria Group (in the US) and British American Tobacco (globally) maintain significant market shares, but their sales volumes are challenged by decreased demand and the rise of alternative products.

Developing Markets (Africa and South America): These markets offer potential for growth due to lower levels of regulation and potentially greater affordability. While this offers opportunities for tobacco companies, it also raises ethical concerns surrounding public health.

Segment Domination: The traditional cigarette segment, while facing decline in developed markets, remains the dominant segment due to its established market share and widespread availability. However, the heated tobacco and e-cigarette segments are rapidly growing, presenting strong competition for traditional cigarettes and potentially disrupting market dominance in future years.

The dominance of specific regions and segments will continue to evolve based on governmental policy, public health messaging, and the continued emergence and acceptance of alternative nicotine products. The shift in consumption patterns is multifaceted and highly dependent on local context, socio-economic factors and evolving regulatory landscapes.

Despite the challenges, several factors could potentially stimulate growth in the cigarette market. Expansion into developing markets with less stringent regulations offers potential for increased sales. Diversification into new products, such as heated tobacco and e-cigarettes, allows tobacco companies to adapt to changing consumer preferences. Innovative marketing strategies focusing on niche segments may help to counter the negative impact of public health campaigns. However, these catalysts are accompanied by ethical considerations and the uncertainty of future regulations that might curtail expansion or the marketing of such products.

This report provides a comprehensive analysis of the global cigarette market, encompassing historical data (2019-2024), an estimated year (2025), and future forecasts (2025-2033). It covers major players, key regions, and significant trends, providing invaluable insights into the dynamics of this complex and evolving industry. The report details challenges and opportunities within the industry, including growth catalysts, and offers a nuanced perspective on future market projections. This detailed information equips stakeholders with the knowledge needed for informed decision-making in this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.5%.

Key companies in the market include CHINA TOBACCO, Altria Group, British American Tobacco, Japan Tobacco, Imperial Tobacco Group, KT&G, Universal, Alliance One International, Tobacco Authority of Thailand (TAOT), PT Gudang Garam Tbk, China Taiwan Tobacco & Liquor, ITC Limited.

The market segments include Type.

The market size is estimated to be USD 107650 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cigarette," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cigarette, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.